This version of the form is not currently in use and is provided for reference only. Download this version of

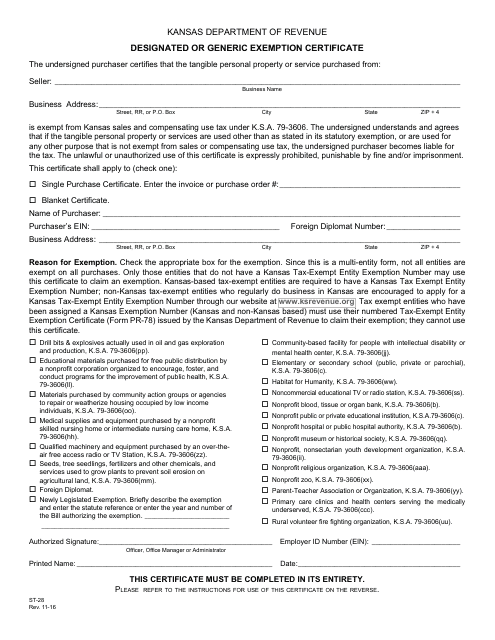

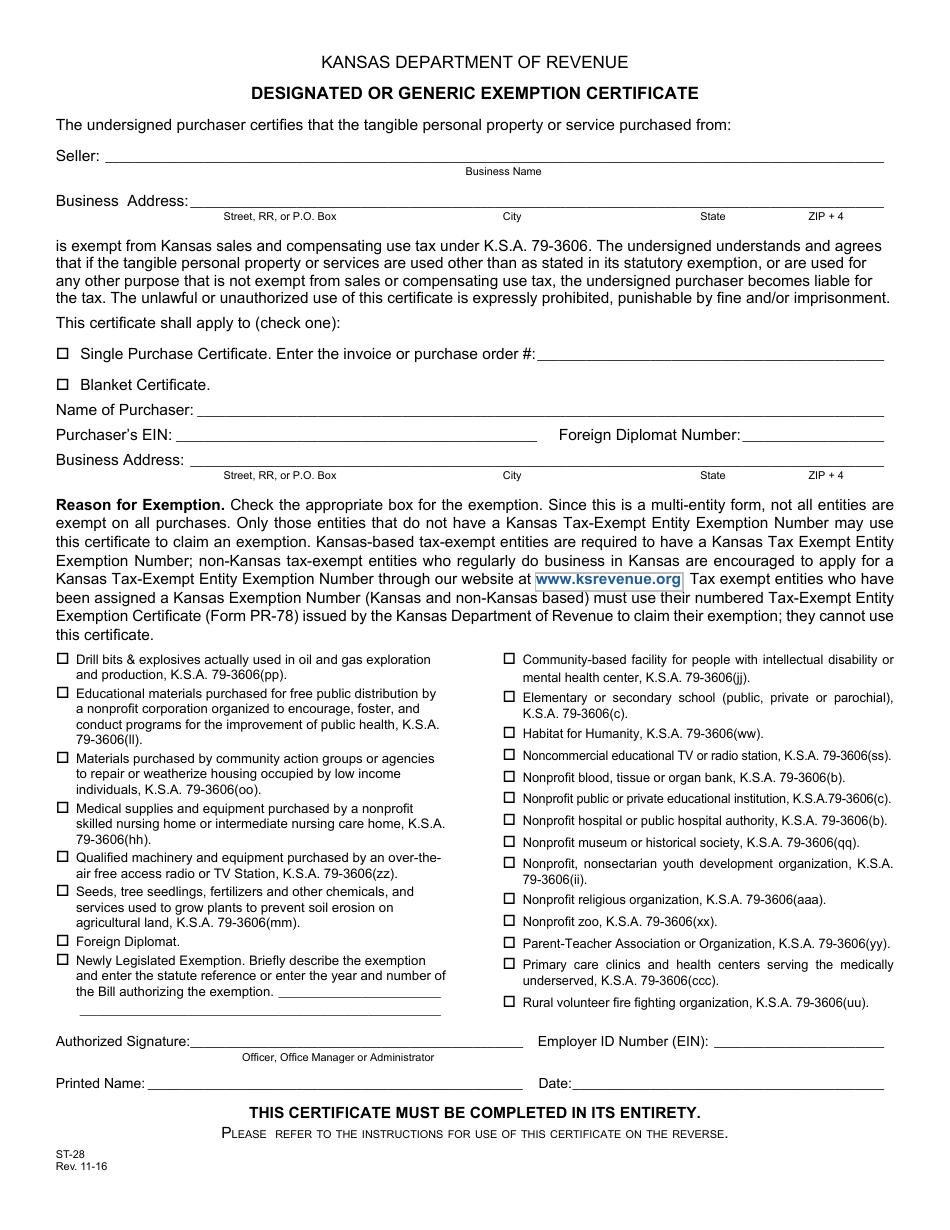

Form ST-28

for the current year.

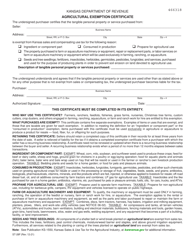

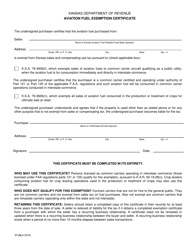

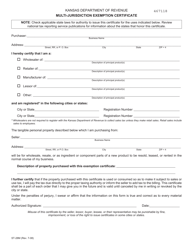

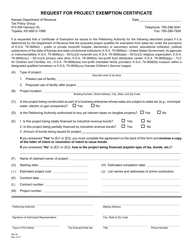

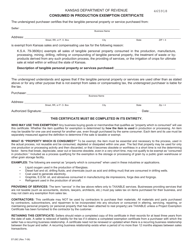

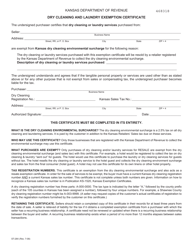

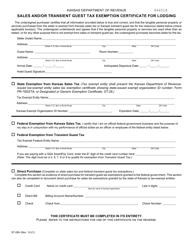

Form ST-28 Designated or Generic Exemption Certificate - Kansas

What Is Form ST-28?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-28 Designated or Generic Exemption Certificate?

A: The Form ST-28 Designated or Generic Exemption Certificate is a document used in Kansas to claim exemptions from sales and use tax.

Q: Who uses the Form ST-28 Designated or Generic Exemption Certificate?

A: Businesses or individuals who qualify for exemptions from sales and use tax in Kansas use this form.

Q: What is the purpose of the Form ST-28 Designated or Generic Exemption Certificate?

A: The purpose of this form is to provide proof to sellers that the buyer is eligible for an exemption from sales and use tax.

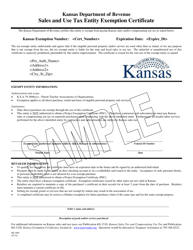

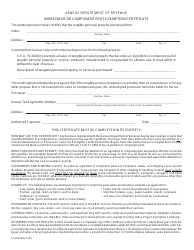

Q: Are there any specific requirements for filling out this form?

A: Yes, you must provide accurate and complete information, including your name, address, exemption reason, and other relevant details.

Q: How long is the Form ST-28 Designated or Generic Exemption Certificate valid for?

A: The certificate is generally valid until it is revoked or canceled, or until there is a change in circumstances that would make the exemption no longer applicable.

Q: What should I do if my Form ST-28 Designated or Generic Exemption Certificate is lost or stolen?

A: If your certificate is lost or stolen, you should notify the Kansas Department of Revenue and request a replacement.

Q: Can I use the Form ST-28 Designated or Generic Exemption Certificate for all types of purchases?

A: No, this form is specifically for claiming exemptions from sales and use tax in Kansas. There may be different forms or requirements for other types of exemptions.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-28 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.