This version of the form is not currently in use and is provided for reference only. Download this version of

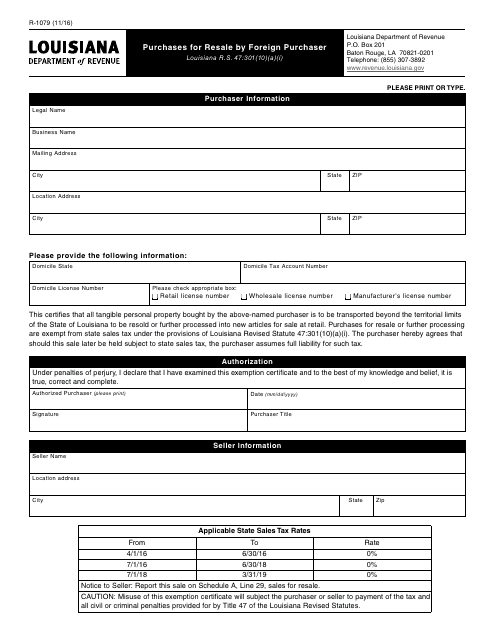

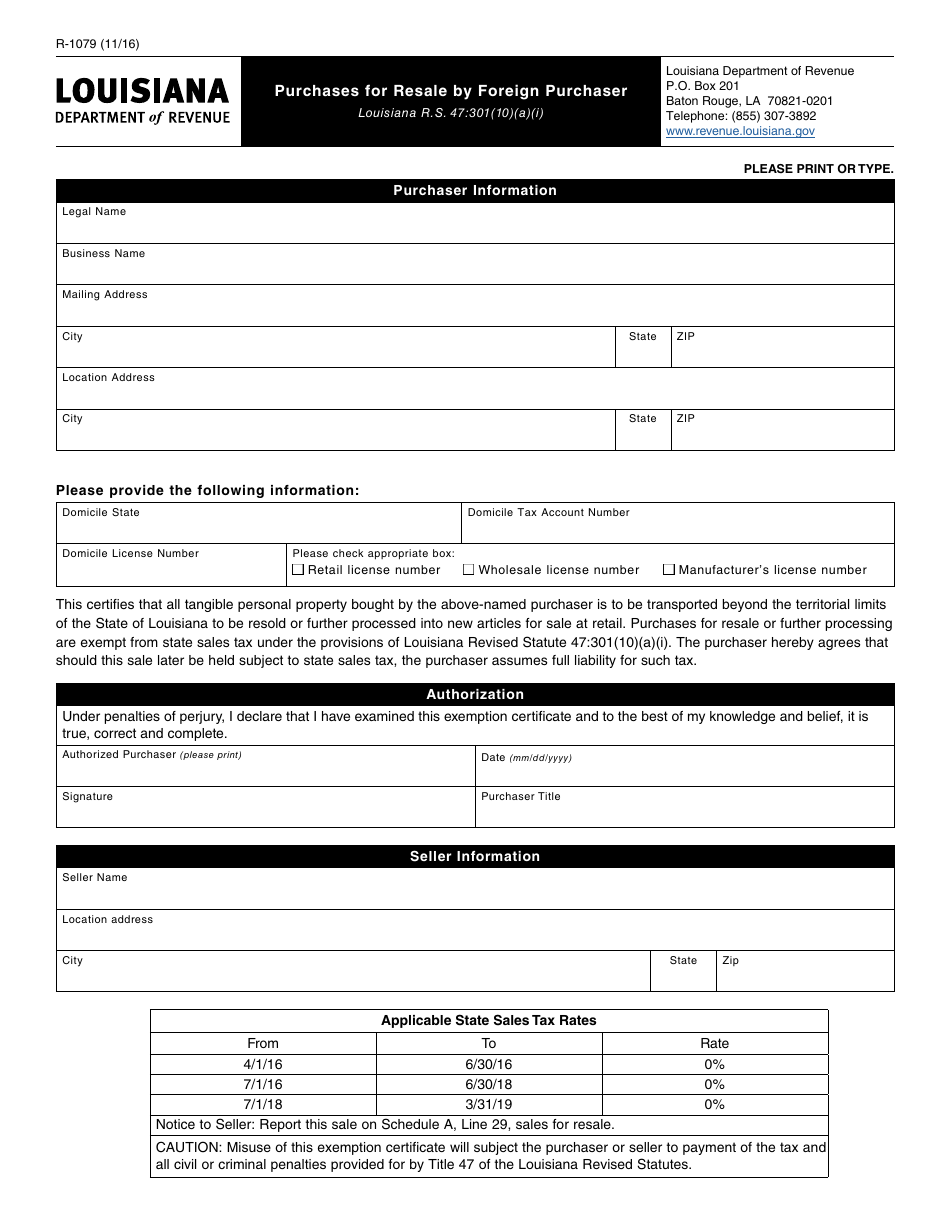

Form R-1079

for the current year.

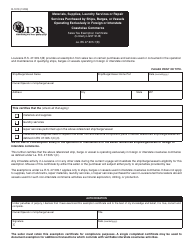

Form R-1079 Purchases for Resale by Foreign Purchaser - Louisiana

What Is Form R-1079?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1079?

A: Form R-1079 is a form used in Louisiana for purchases for resale by foreign purchasers.

Q: Who is required to use Form R-1079?

A: Foreign purchasers who are buying goods in Louisiana for resale are required to use Form R-1079.

Q: What is the purpose of Form R-1079?

A: The purpose of Form R-1079 is to exempt foreign purchasers from paying sales tax on goods that will be resold.

Q: When should Form R-1079 be filed?

A: Form R-1079 should be filed at the time of purchase, or within 60 days after the close of the month in which the purchase was made.

Q: What information is required on Form R-1079?

A: Form R-1079 requires information such as the name and address of the foreign purchaser, details of the purchase, and a statement of intent to resell the goods.

Q: Are there any penalties for not filing Form R-1079?

A: Yes, failure to file Form R-1079 or filing a false or fraudulent form can result in penalties and interest.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1079 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.