This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-6642

for the current year.

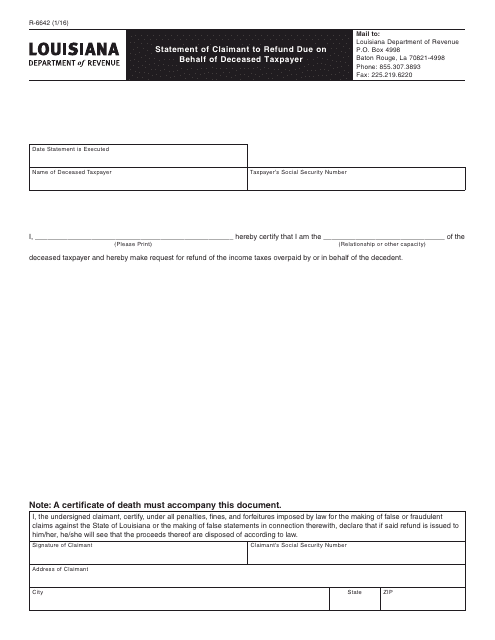

Form R-6642 Statement of Claimant to Refund Due on Behalf of Deceased Taxpayer - Louisiana

What Is Form R-6642?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6642?

A: Form R-6642 is the Statement of Claimant to Refund Due on Behalf of Deceased Taxpayer.

Q: What is the purpose of Form R-6642?

A: The purpose of Form R-6642 is to claim a refund on behalf of a deceased taxpayer in Louisiana.

Q: Who can file Form R-6642?

A: Form R-6642 can be filed by the claimant who is entitled to the refund on behalf of the deceased taxpayer.

Q: Is there a deadline to file Form R-6642?

A: Yes, there is a deadline to file Form R-6642. It must be filed within three years from the date the original return was due or within one year from the date of the deceased taxpayer's death, whichever is later.

Q: What supporting documents are required with Form R-6642?

A: Supporting documents required with Form R-6642 may include a certified copy of the taxpayer's death certificate, a copy of the taxpayer's final tax return, and any additional documentation to support the claim for refund.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6642 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.