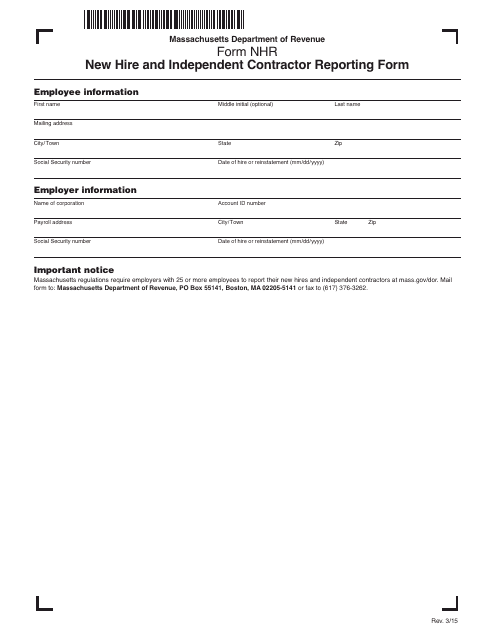

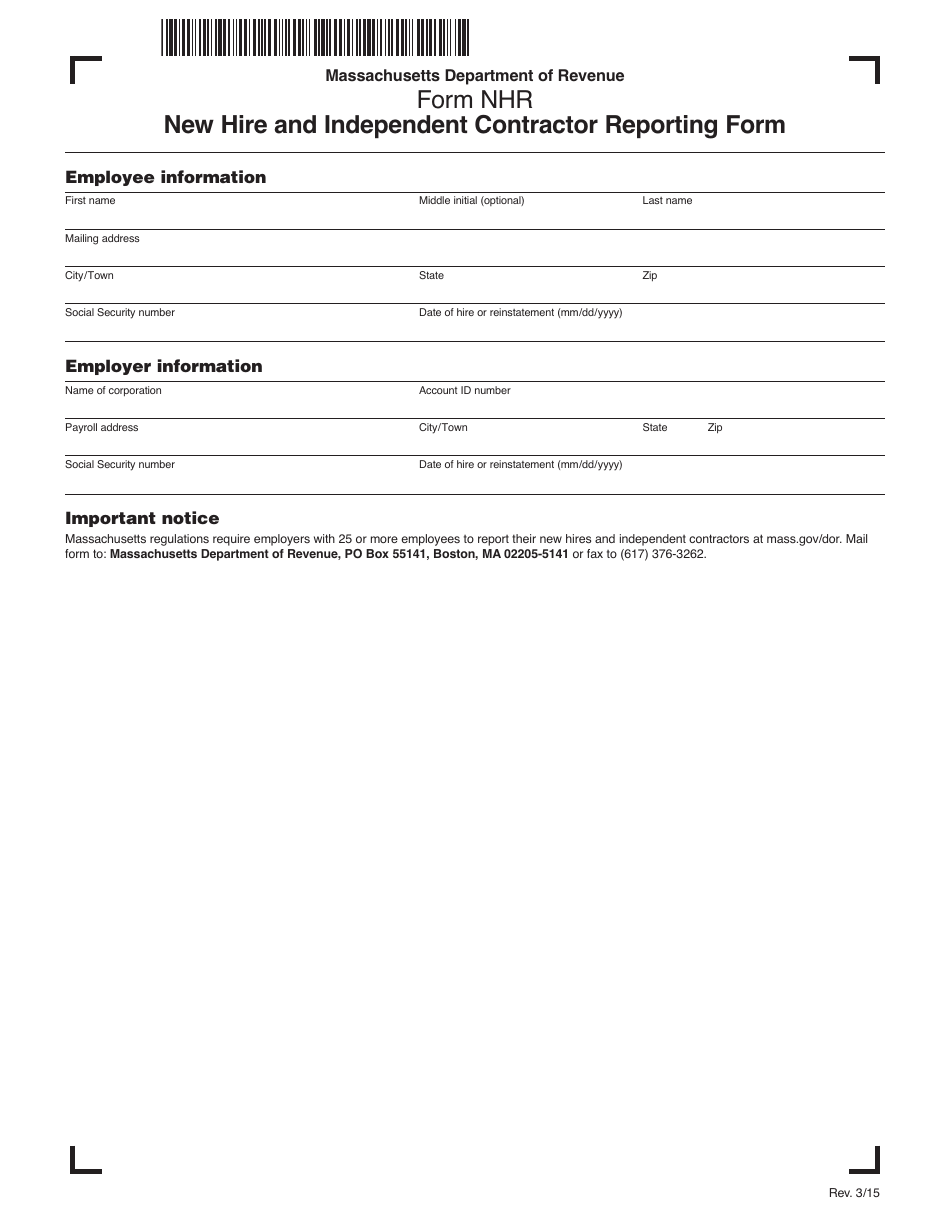

Form NHR New Hire and Independent Contractor Reporting Form - Massachusetts

What Is Form NHR?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NHR?

A: Form NHR is the New Hire and Independent Contractor Reporting Form in Massachusetts.

Q: Who needs to file Form NHR?

A: Employers in Massachusetts need to file Form NHR if they hire new employees or engage independent contractors.

Q: What information is required on Form NHR?

A: Form NHR requires the employer to provide information about the newly hired employees or independent contractors, such as their names, addresses, and social security numbers.

Q: When should Form NHR be filed?

A: Employers must file Form NHR within 14 days of hiring a new employee or engaging an independent contractor.

Q: Is there a penalty for not filing Form NHR?

A: Yes, there is a penalty for not filing Form NHR. Employers may be subject to fines for noncompliance.

Q: Are there any exemptions to filing Form NHR?

A: Yes, certain categories of employees and independent contractors are exempt from the reporting requirements. Employers should consult the official guidelines for a complete list of exemptions.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NHR by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.