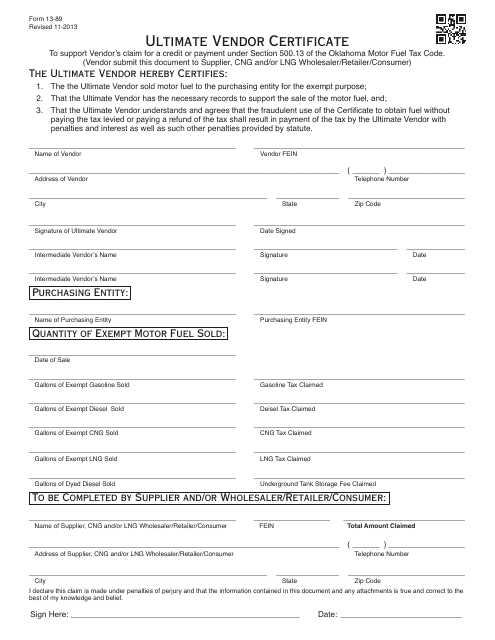

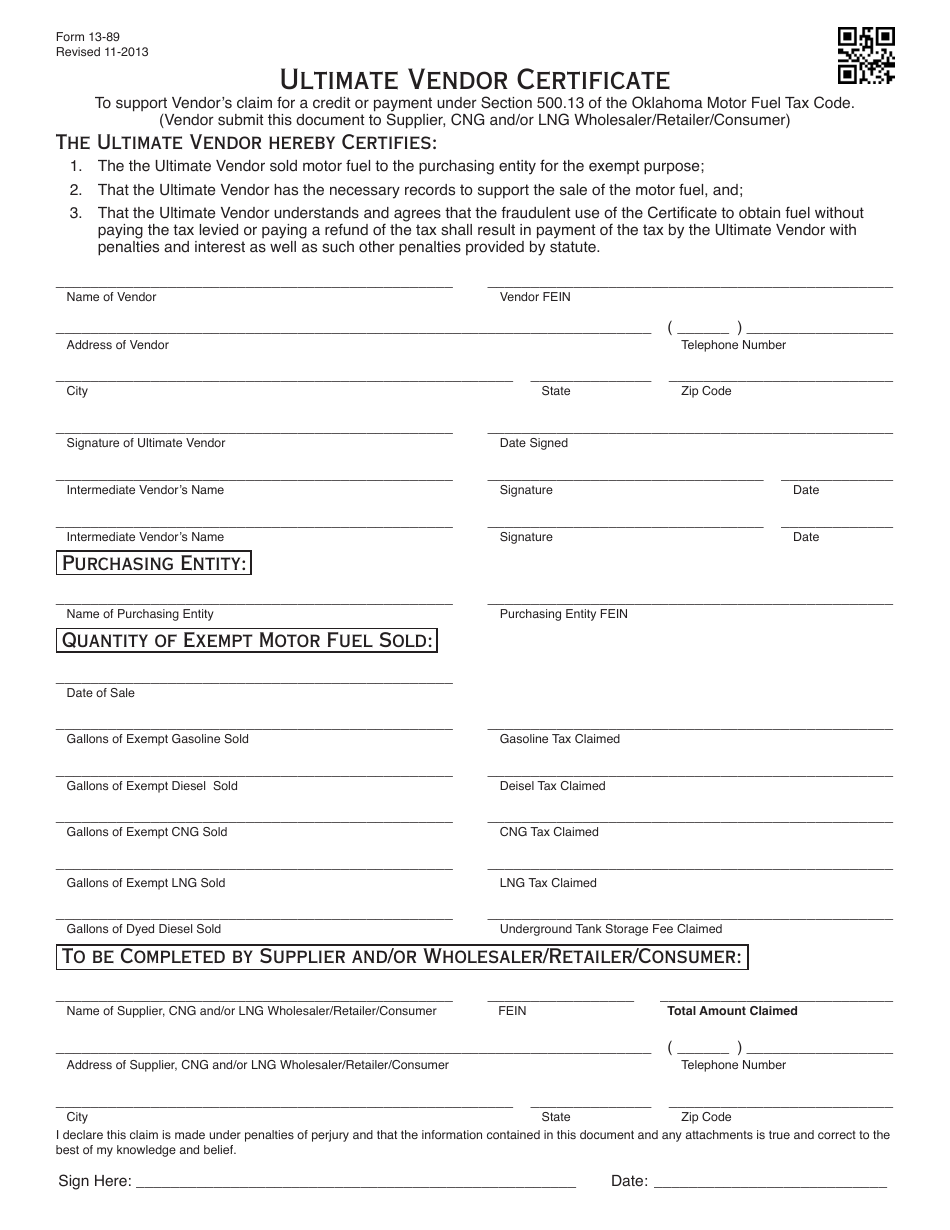

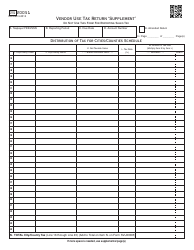

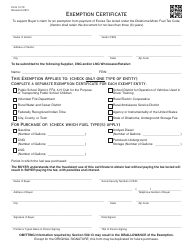

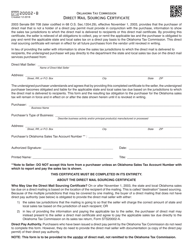

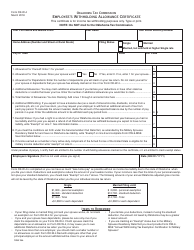

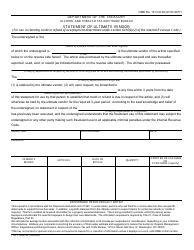

OTC Form 13-89 Ultimate Vendor Certificate - Oklahoma

What Is OTC Form 13-89?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 13-89?

A: OTC Form 13-89 is the Ultimate Vendor Certificate for the state of Oklahoma.

Q: What is the purpose of OTC Form 13-89?

A: The purpose of OTC Form 13-89 is to certify that a vendor has met all the requirements for ultimate vendor status in Oklahoma.

Q: Who needs to fill out OTC Form 13-89?

A: Vendors who wish to obtain or maintain ultimate vendor status in Oklahoma need to fill out OTC Form 13-89.

Q: What information is required on OTC Form 13-89?

A: OTC Form 13-89 requires information such as the vendor's name, address, tax identification number, and a signature.

Q: When should OTC Form 13-89 be submitted?

A: OTC Form 13-89 should be submitted by the deadline specified by the Oklahoma Tax Commission.

Q: What happens after I submit OTC Form 13-89?

A: After submitting OTC Form 13-89, the Oklahoma Tax Commission will review the application and determine if the vendor qualifies for ultimate vendor status.

Q: Is there a fee for filing OTC Form 13-89?

A: No, there is no fee for filing OTC Form 13-89.

Q: How long is OTC Form 13-89 valid for?

A: OTC Form 13-89 is valid until it is revoked by the Oklahoma Tax Commission or the vendor's ultimate vendor status is no longer valid.

Q: What should I do if there are changes to the information on OTC Form 13-89?

A: If there are changes to the information on OTC Form 13-89, the vendor should notify the Oklahoma Tax Commission in writing.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 13-89 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.