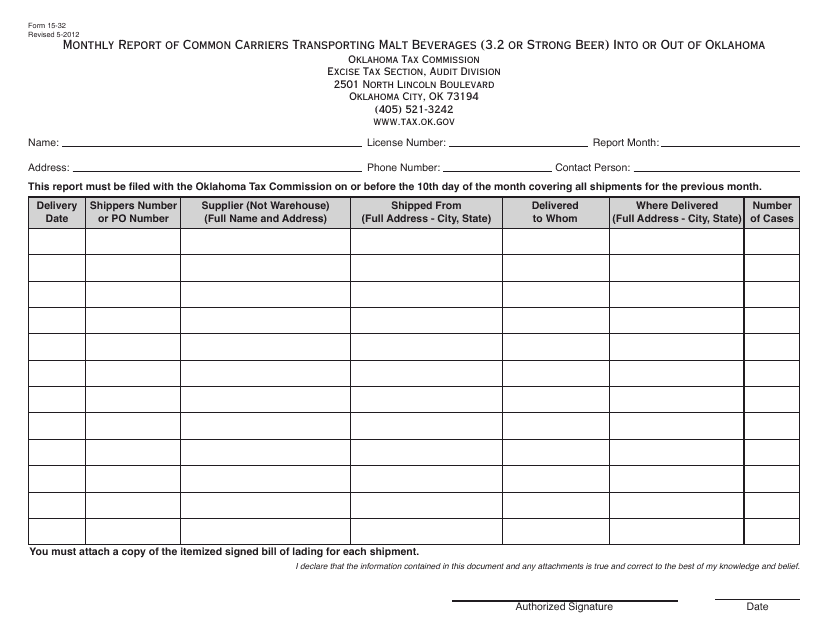

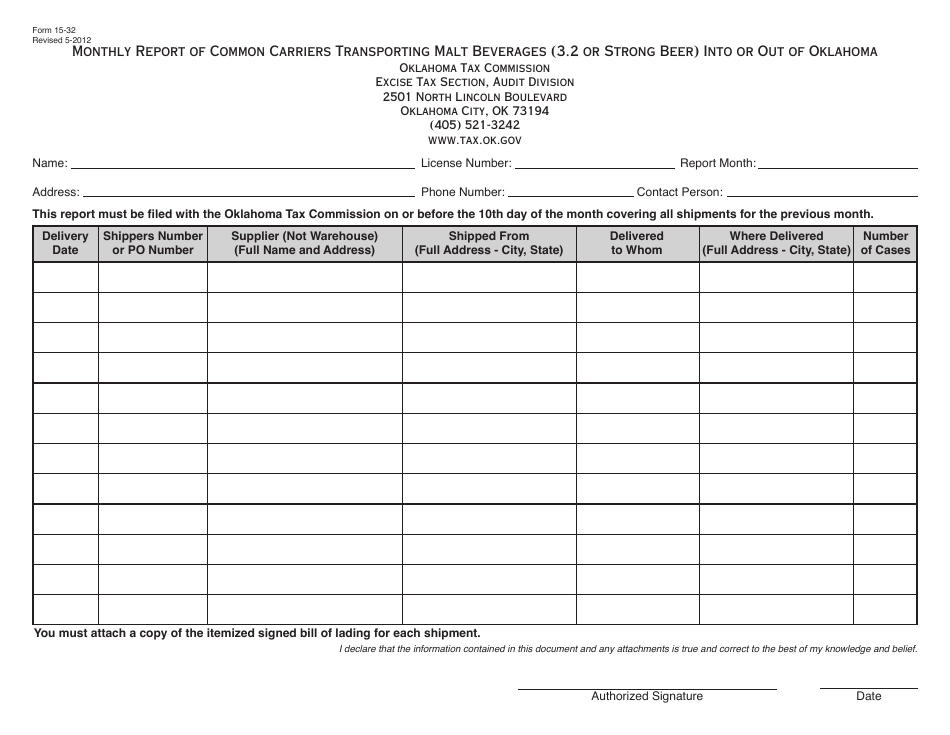

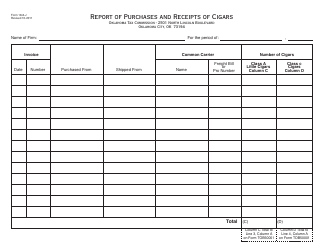

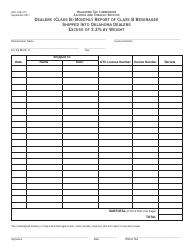

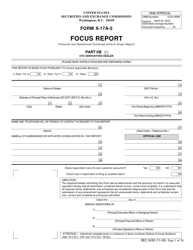

OTC Form 15-32 Monthly Report of Common Carriers Transporting Malt Beverages (3.2 or Strong Beer) Into or out of Oklahoma - Oklahoma

What Is OTC Form 15-32?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 15-32?

A: OTC Form 15-32 is a monthly report required from common carriers transporting malt beverages (3.2 or strong beer) into or out of Oklahoma.

Q: Who needs to file OTC Form 15-32?

A: Common carriers transporting malt beverages (3.2 or strong beer) into or out of Oklahoma need to file OTC Form 15-32.

Q: What does OTC Form 15-32 report?

A: OTC Form 15-32 reports the monthly volume of malt beverages (3.2 or strong beer) transported by common carriers into or out of Oklahoma.

Q: When is OTC Form 15-32 due?

A: OTC Form 15-32 is due on the 20th day of the following month.

Q: Are there any penalties for late filing of OTC Form 15-32?

A: Yes, there are penalties for late filing of OTC Form 15-32. It is important to submit the report on time to avoid penalties.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 15-32 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.