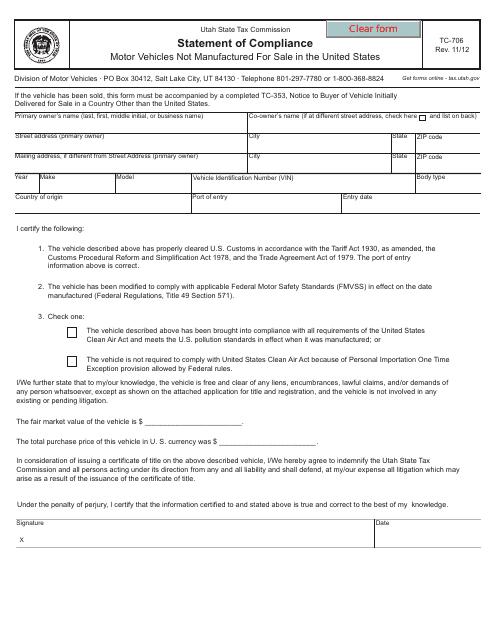

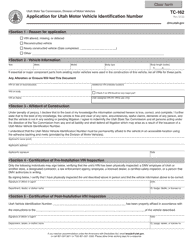

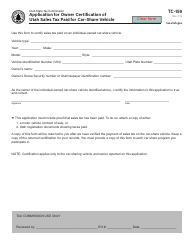

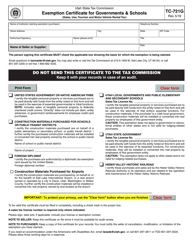

Form TC-706 Statement of Compliance, Motor Vehicles Not Manufactured for Sale in the United States - Utah

What Is Form TC-706?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TC-706?

A: Form TC-706 is a statement of compliance for motor vehicles not manufactured for sale in the United States.

Q: What is the purpose of Form TC-706?

A: The purpose of Form TC-706 is to provide information about motor vehicles that were not manufactured for sale in the United States.

Q: Who needs to file Form TC-706?

A: Anyone who owns or operates a motor vehicle that was not manufactured for sale in the United States and is currently registered in Utah needs to file Form TC-706.

Q: How often do I need to file Form TC-706?

A: Form TC-706 needs to be filed annually with the Utah State Tax Commission.

Q: Is there a fee to file Form TC-706?

A: Yes, there is a fee associated with filing Form TC-706. The fee amount depends on the age and weight of the vehicle.

Q: What information do I need to provide on Form TC-706?

A: You need to provide information about the motor vehicle, including make, model, VIN, and the country where it was manufactured.

Q: Are there any penalties for not filing Form TC-706?

A: Yes, there are penalties for not filing Form TC-706, including monetary fines and suspension of vehicle registration.

Q: Who can I contact for more information about Form TC-706?

A: For more information about Form TC-706, you can contact the Taxpayer Services Division of the Utah State Tax Commission.

Form Details:

- Released on November 1, 2012;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-706 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.