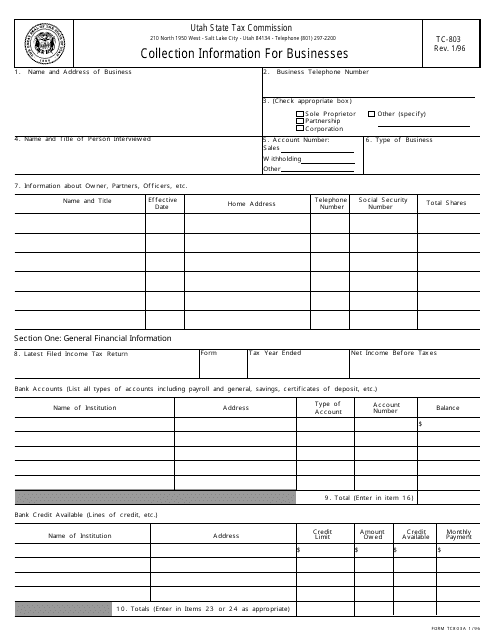

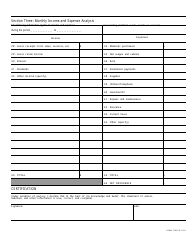

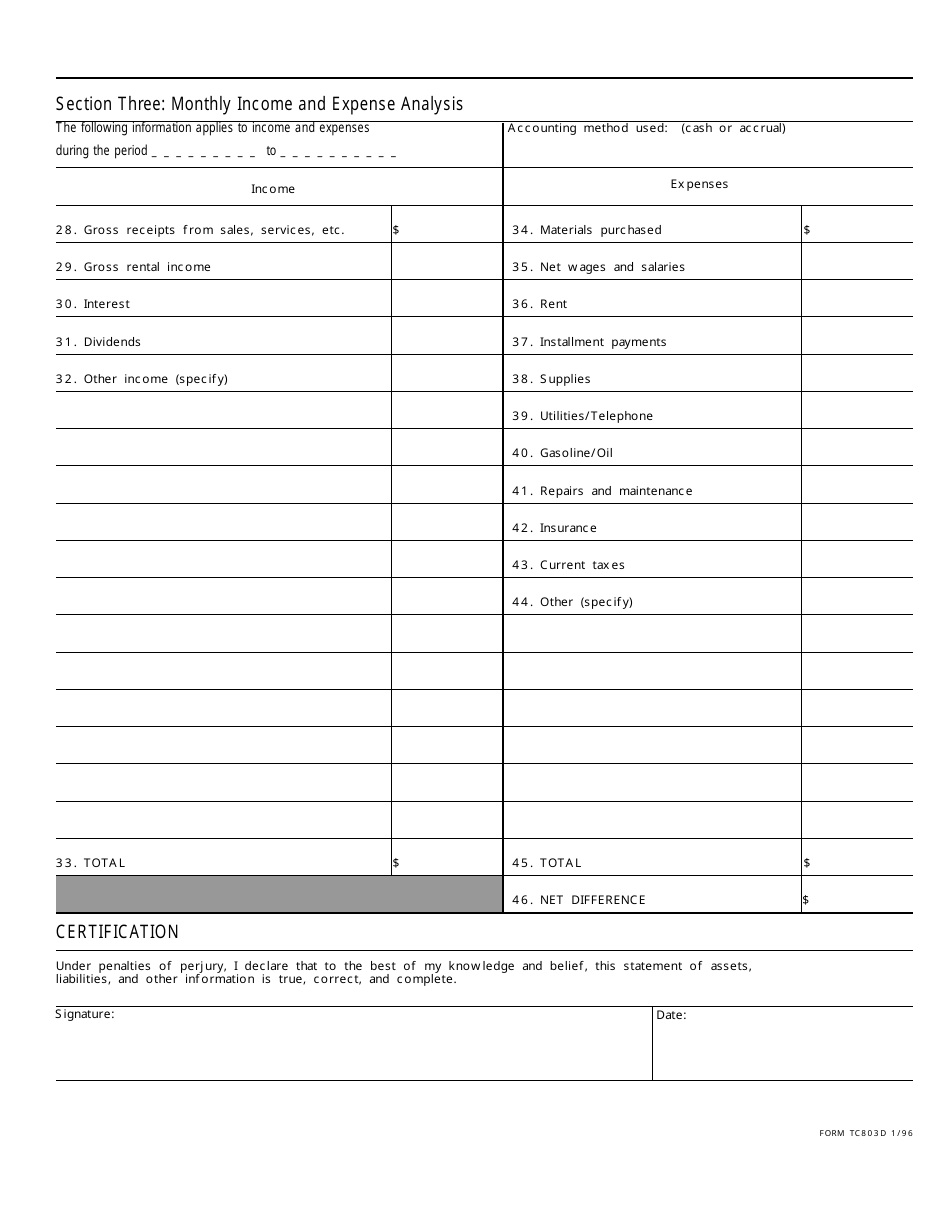

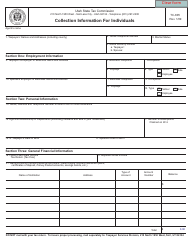

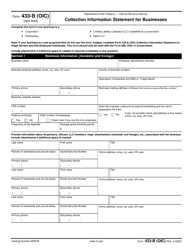

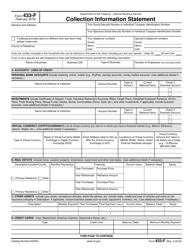

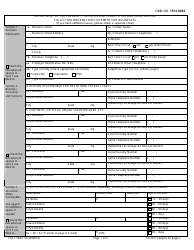

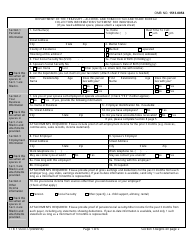

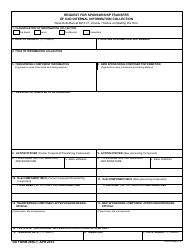

Form TC-803 Collection Information for Businesses - Utah

What Is Form TC-803?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-803?

A: Form TC-803 is the Collection Information for Businesses form in Utah.

Q: Who needs to file Form TC-803?

A: Businesses in Utah that owe taxes and need to provide collection information to the Utah State Tax Commission.

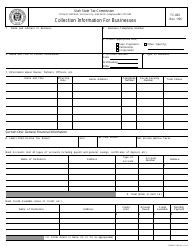

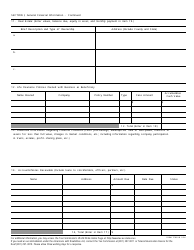

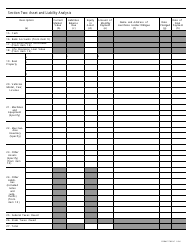

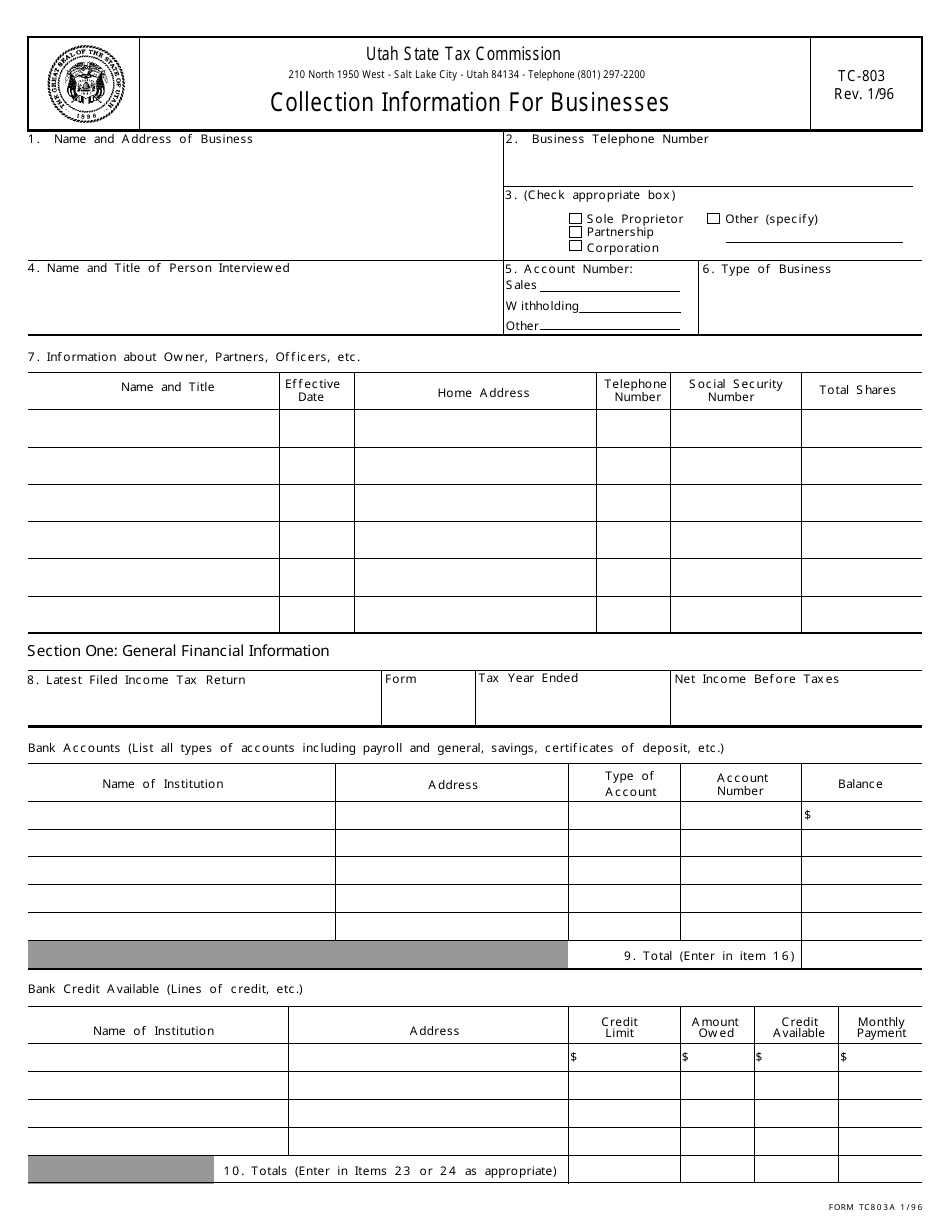

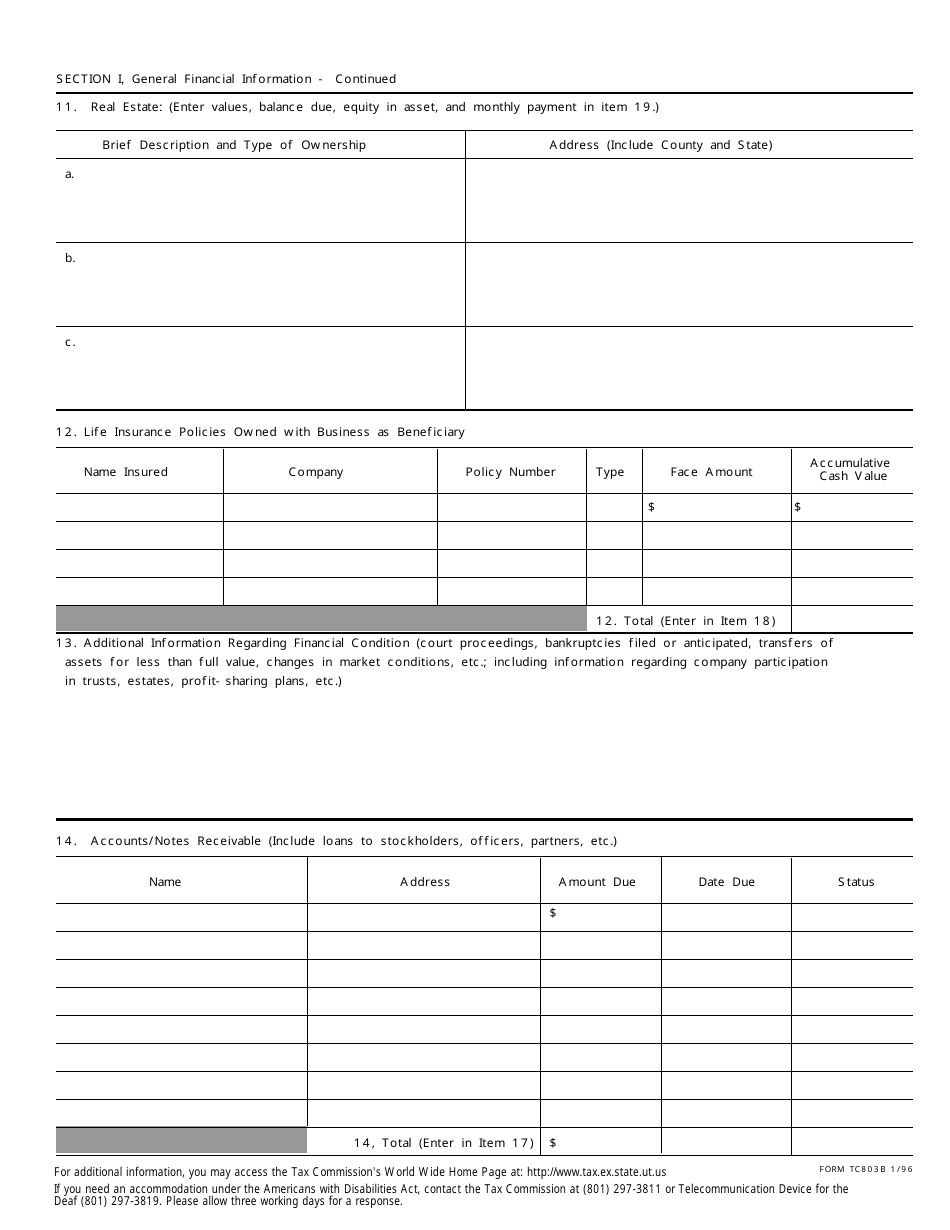

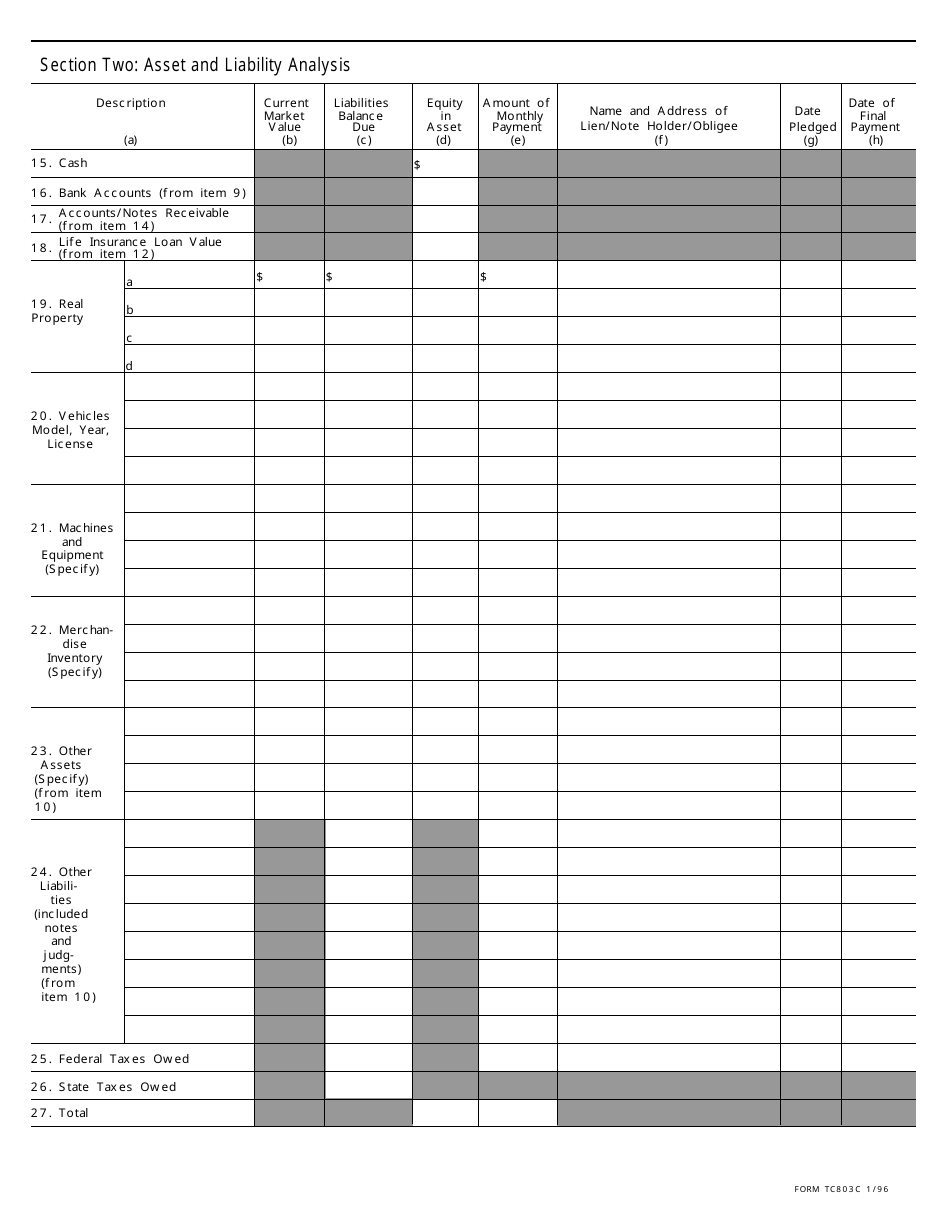

Q: What information is required on Form TC-803?

A: Form TC-803 requires businesses to provide information about their assets, income, and liabilities.

Q: Is Form TC-803 required every year?

A: Form TC-803 is generally required to be filed annually by businesses that owe taxes to the Utah State Tax Commission.

Q: Is there a deadline for filing Form TC-803?

A: Yes, the deadline for filing Form TC-803 is usually the same as the deadline for filing your annual tax return.

Q: What happens if I don't file Form TC-803?

A: Failure to file Form TC-803 may result in penalties and interest being assessed on the tax debt owed by the business.

Q: Can I request an extension to file Form TC-803?

A: Yes, you can request an extension to file Form TC-803 by contacting the Utah State Tax Commission.

Form Details:

- Released on January 1, 1996;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TC-803 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.