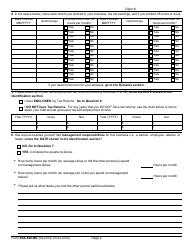

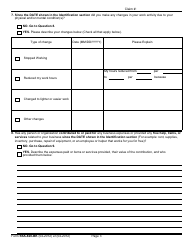

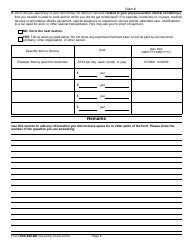

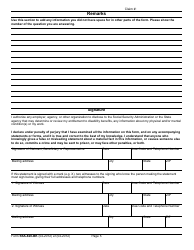

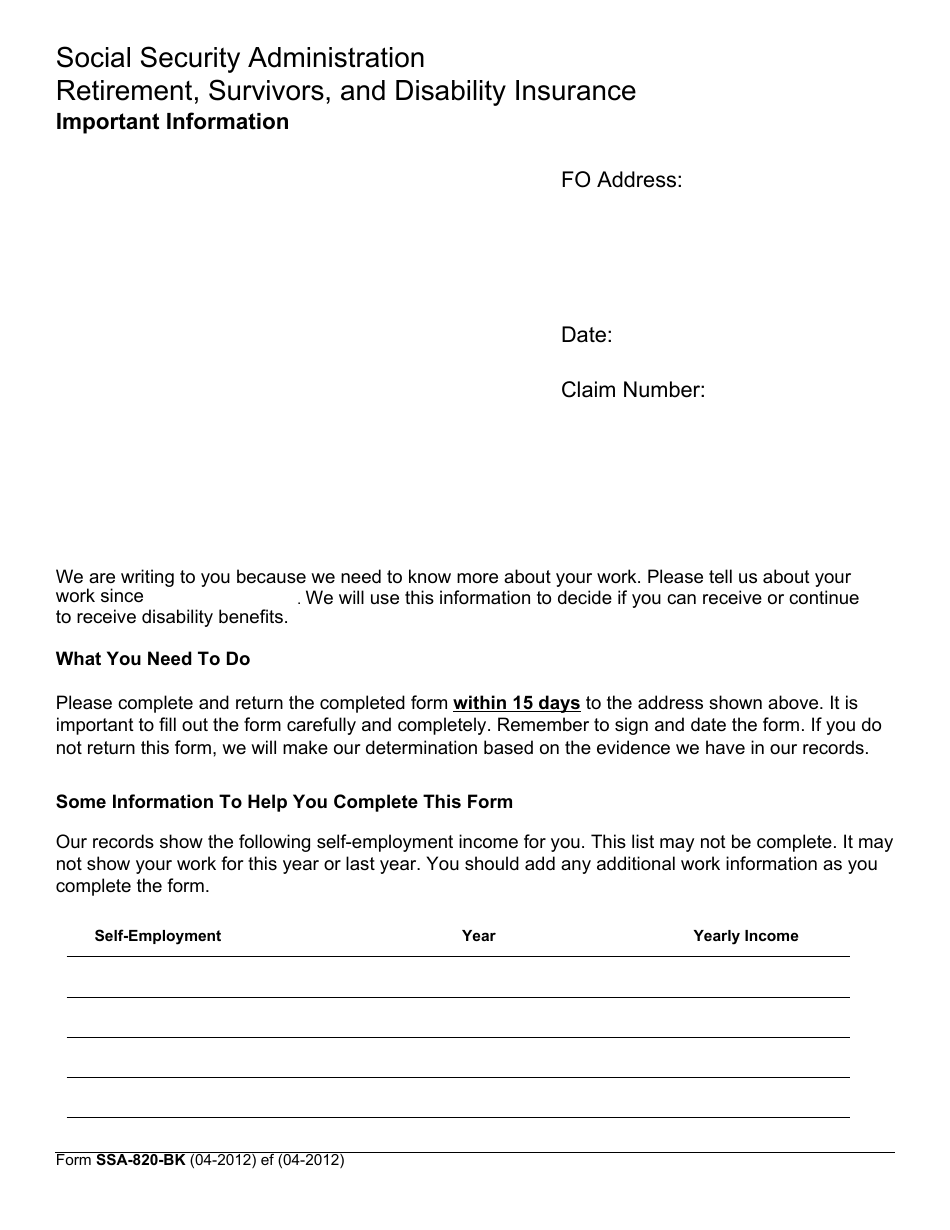

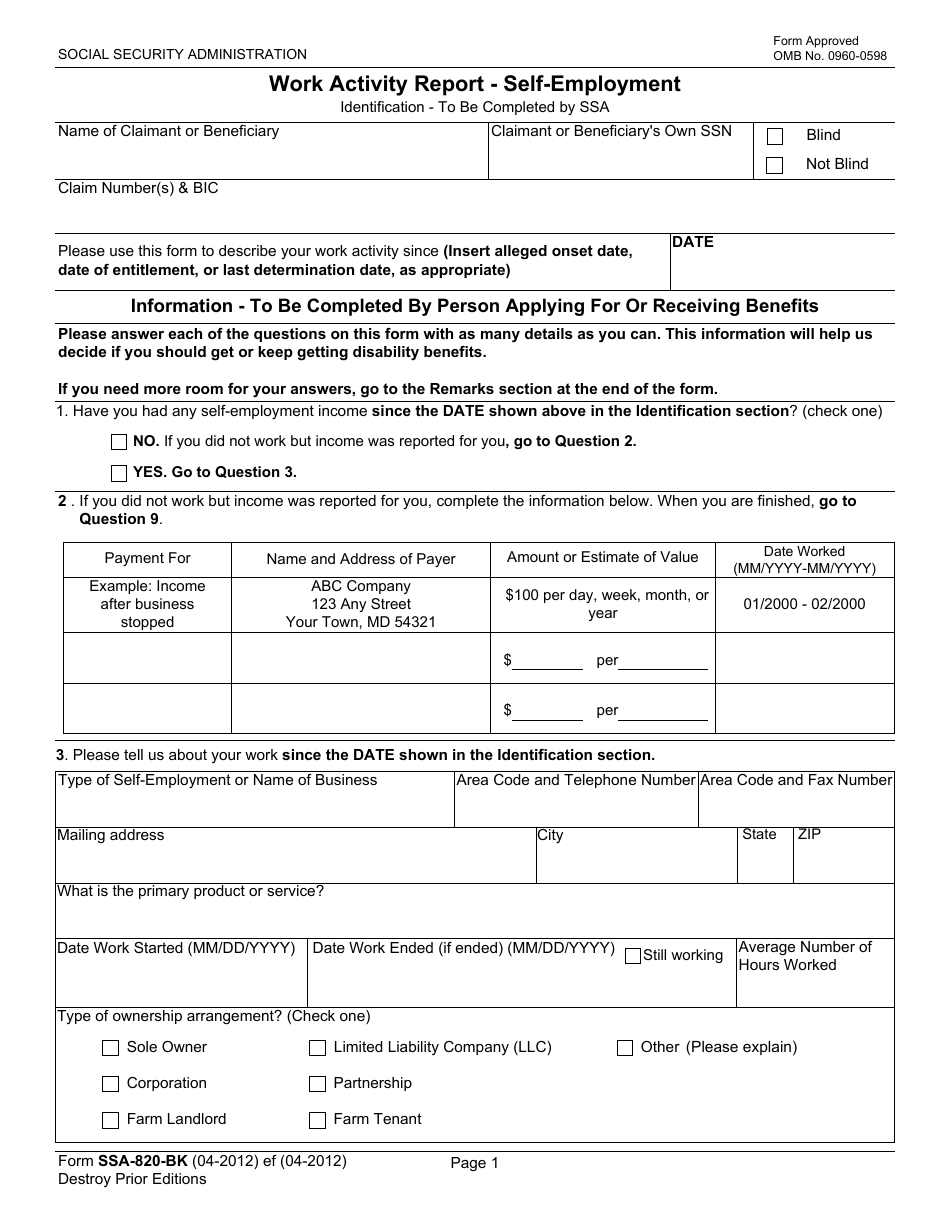

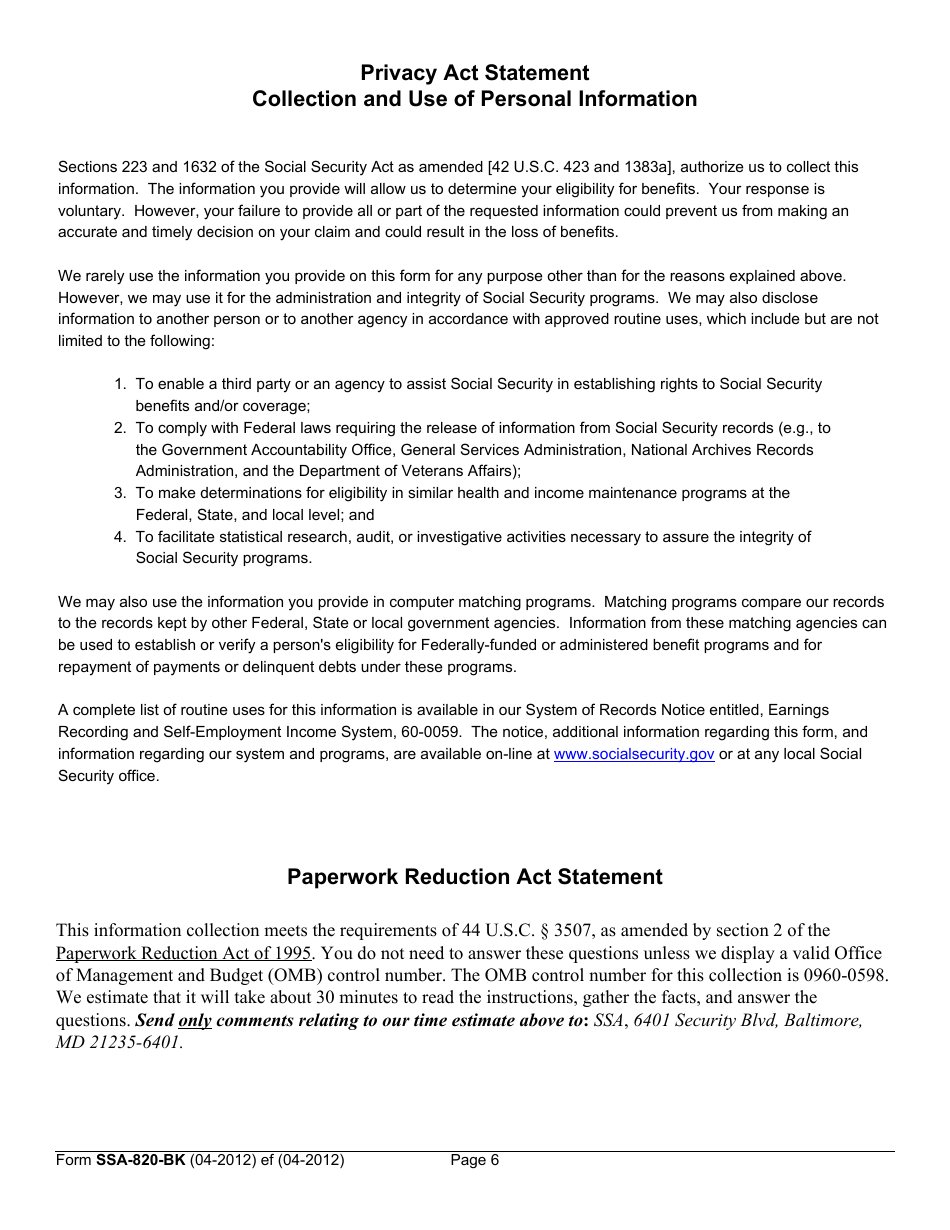

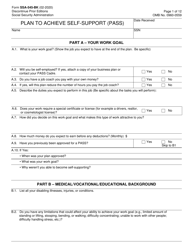

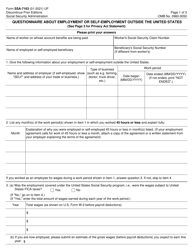

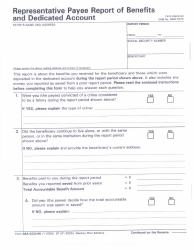

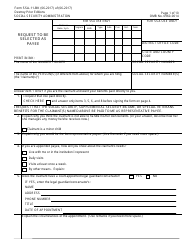

Form SSA-B20-BK Work Activity Report - Self-employment

What Is Form SSA-B20-BK?

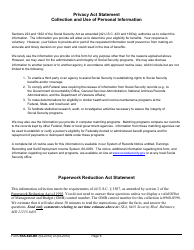

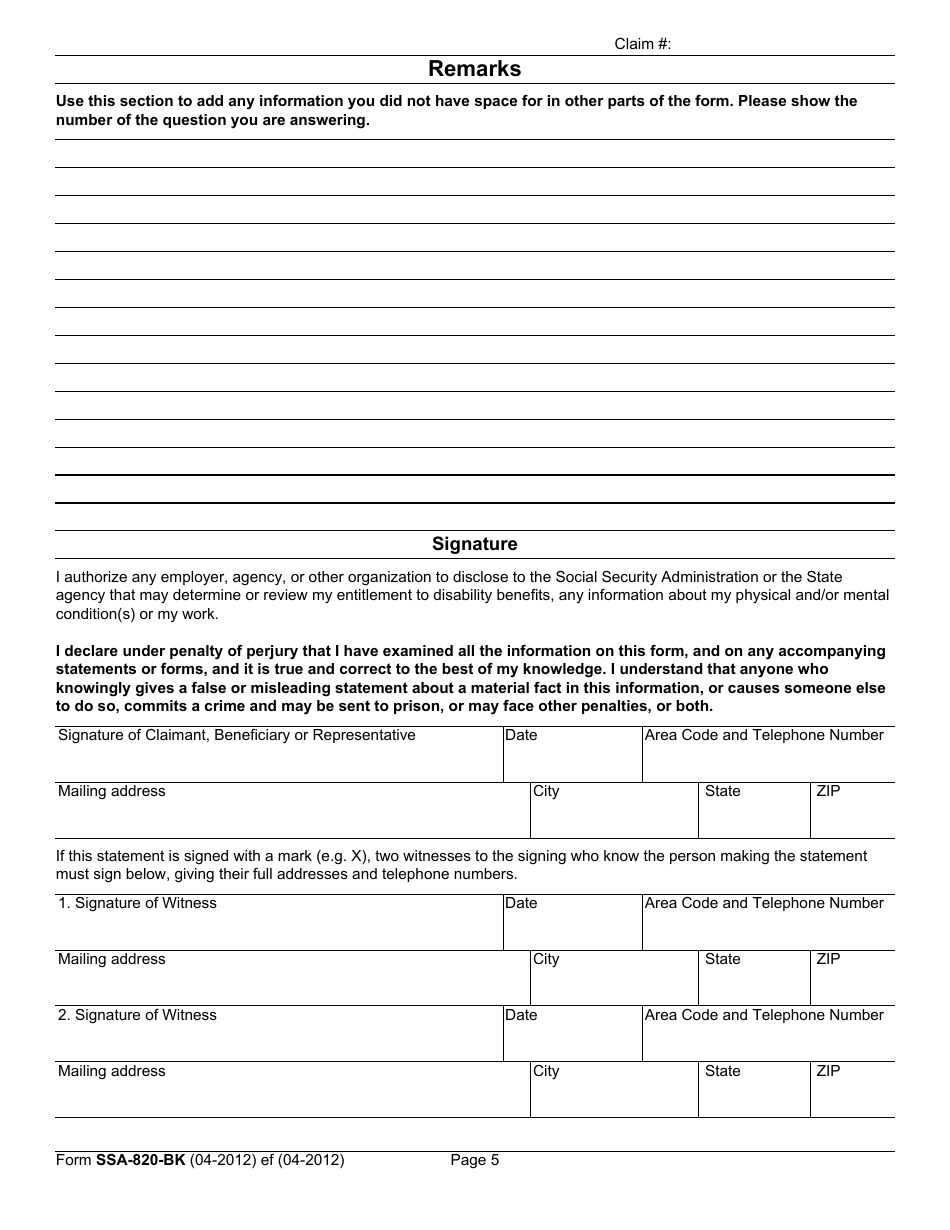

This is a legal form that was released by the U.S. Social Security Administration on April 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-B20-BK?

A: Form SSA-B20-BK is the Work Activity Report - Self-employment form.

Q: Who needs to fill out Form SSA-B20-BK?

A: Anyone who is self-employed and receiving Social Security benefits needs to fill out Form SSA-B20-BK.

Q: What is the purpose of Form SSA-B20-BK?

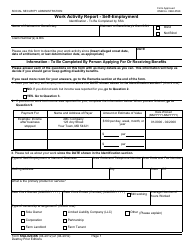

A: The purpose of Form SSA-B20-BK is to report any work activity and earnings from self-employment while receiving Social Security benefits.

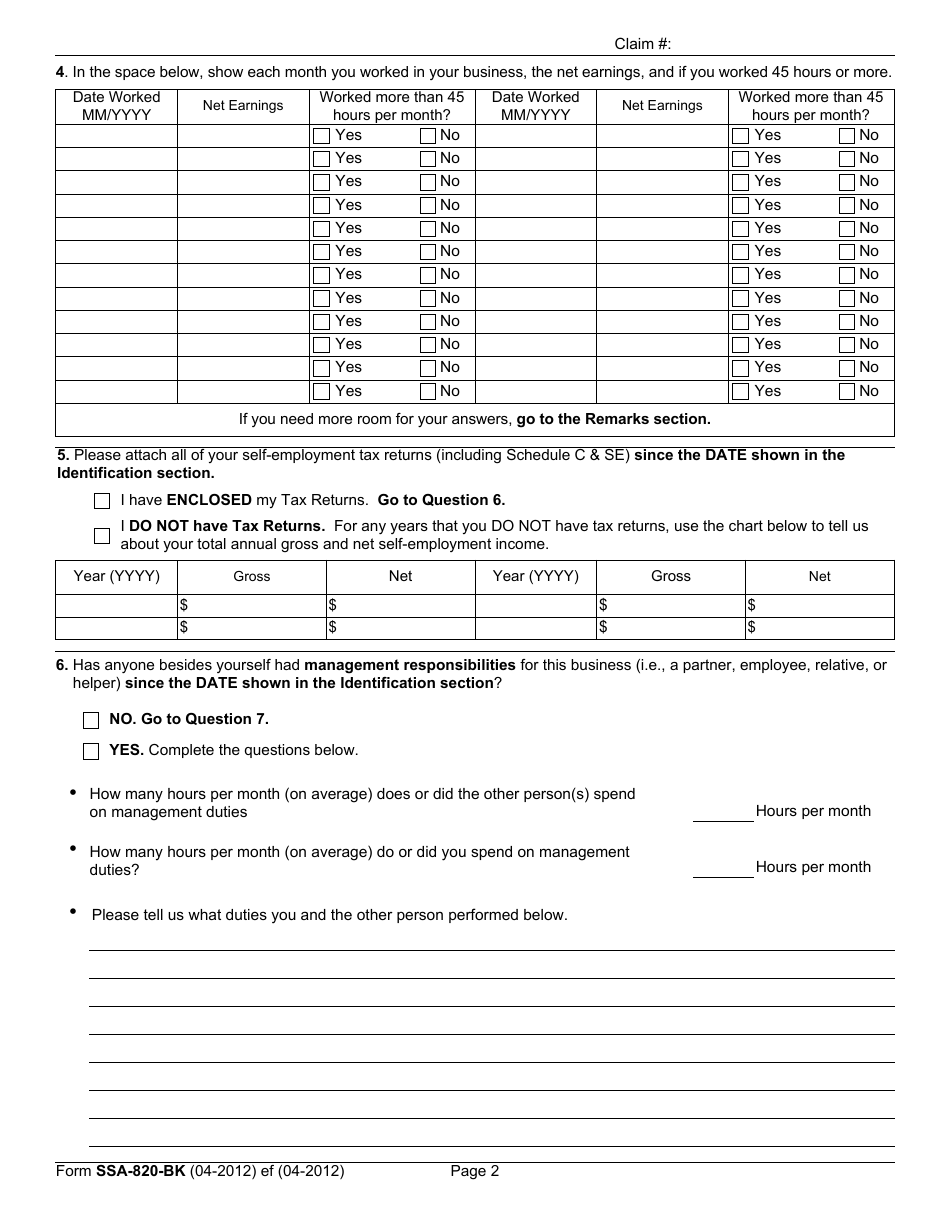

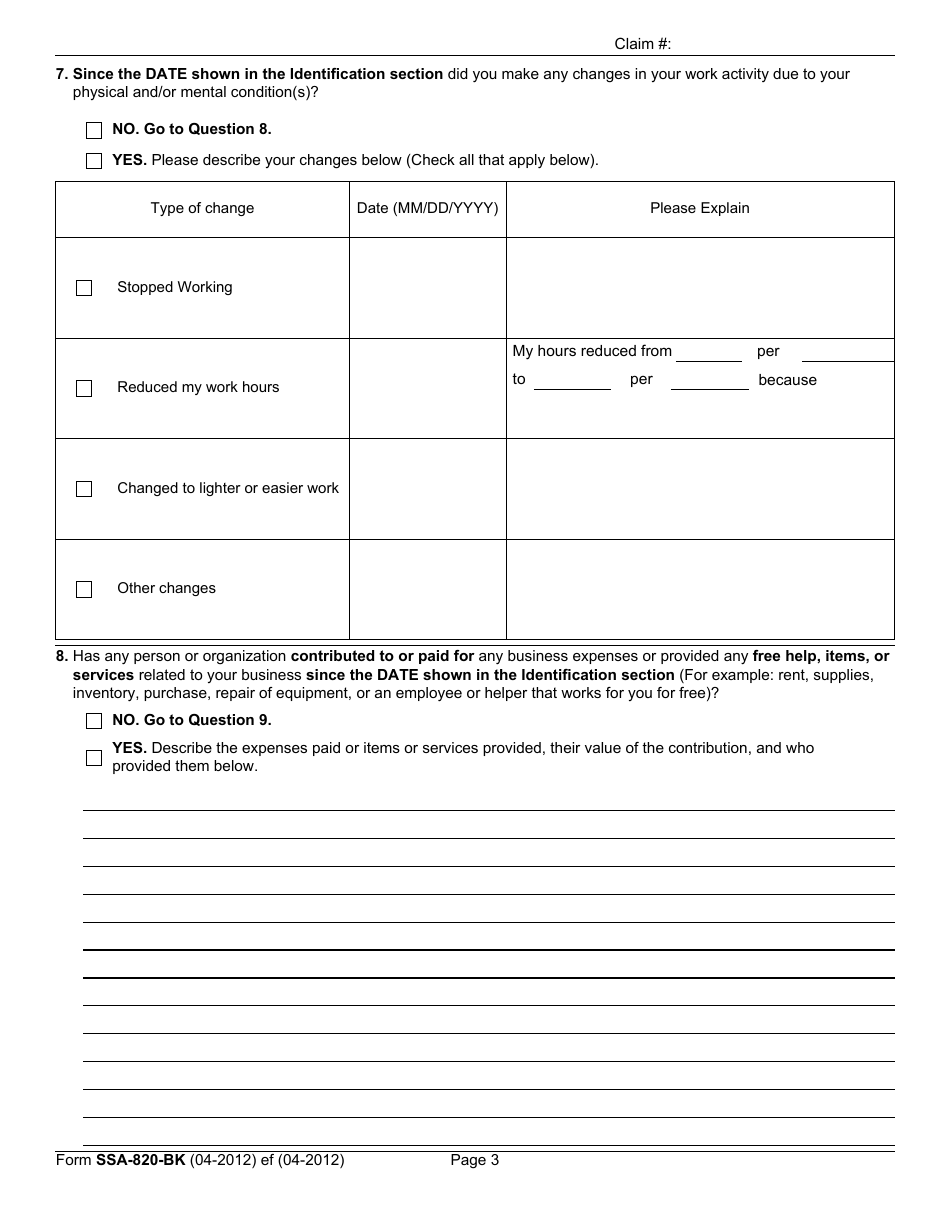

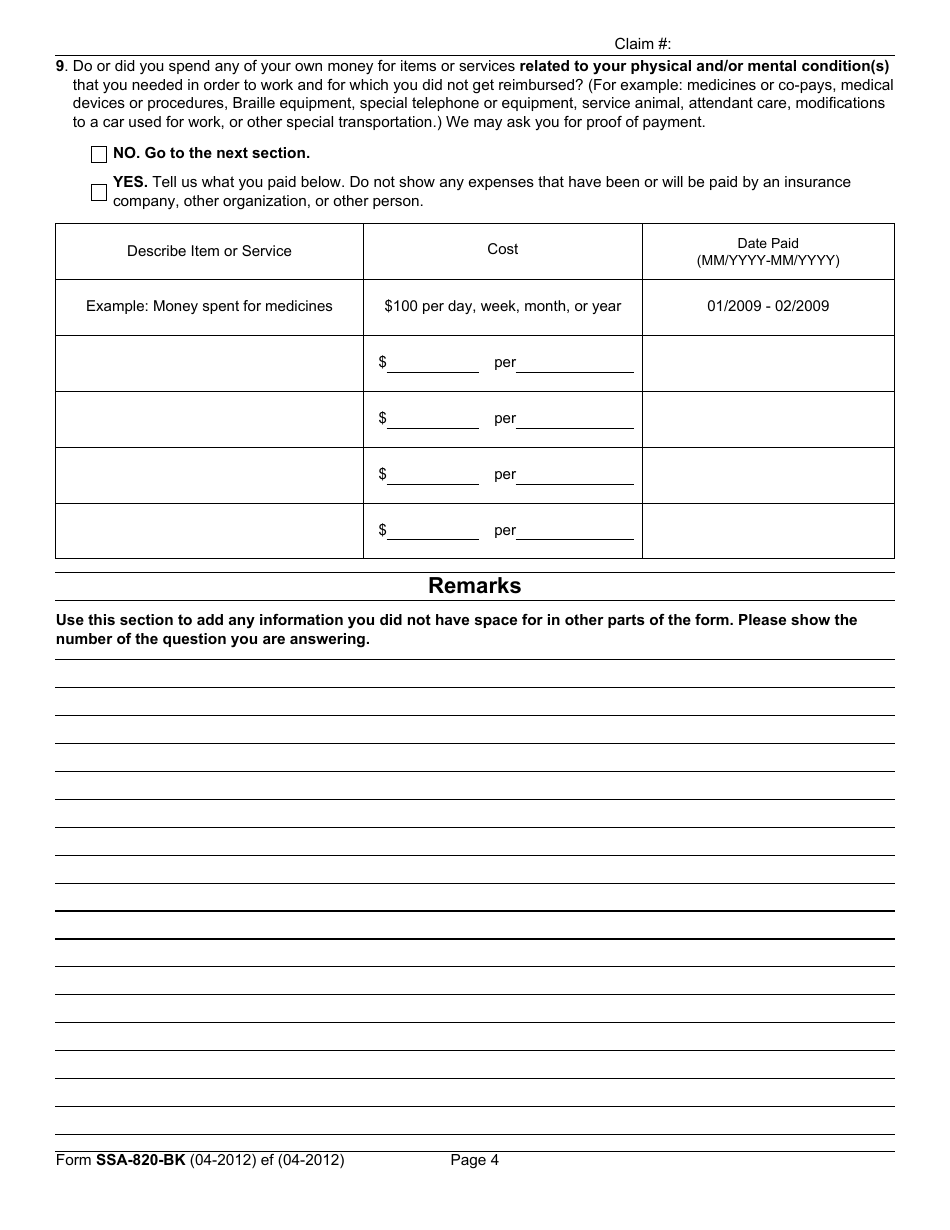

Q: What information is required on Form SSA-B20-BK?

A: Form SSA-B20-BK requires information about the nature of your self-employment, monthly earnings, and expenses related to your self-employment.

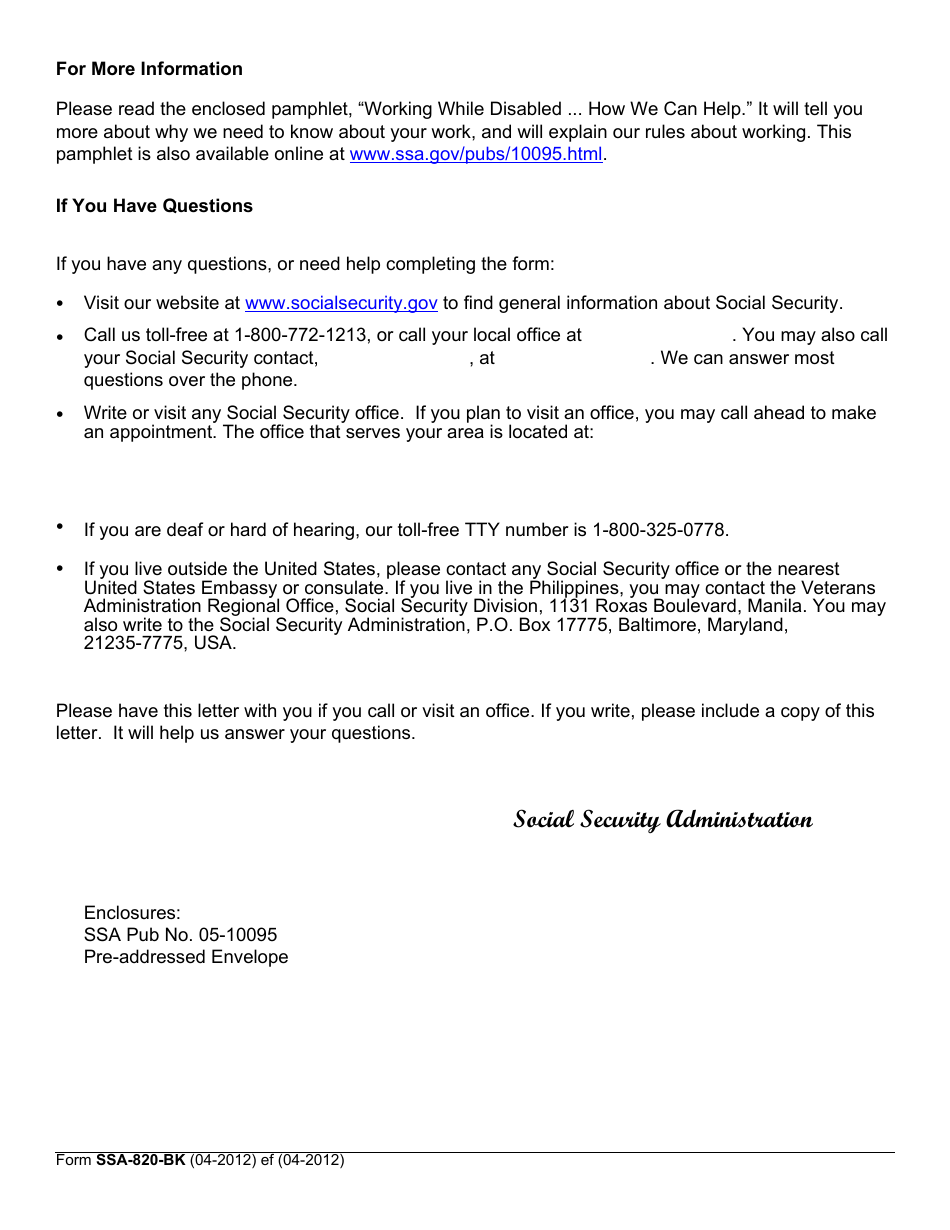

Q: How do I submit Form SSA-B20-BK?

A: You can submit Form SSA-B20-BK by mail or in person at your local Social Security office.

Q: Is Form SSA-B20-BK mandatory?

A: Yes, if you are self-employed and receiving Social Security benefits, filling out Form SSA-B20-BK is mandatory to report your work and earnings.

Form Details:

- Released on April 1, 2012;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-B20-BK by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.