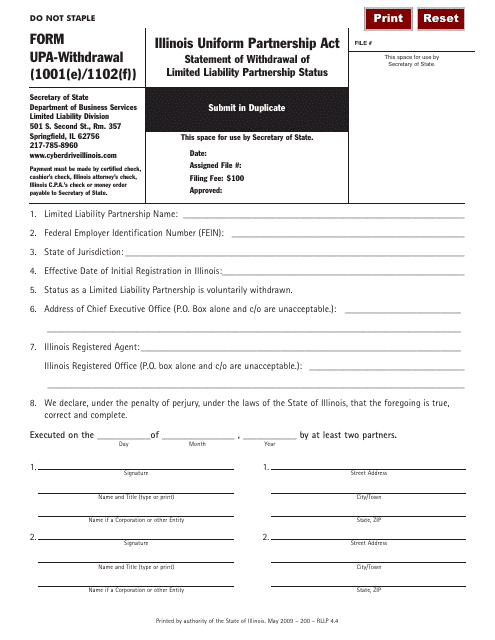

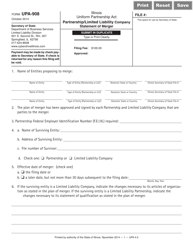

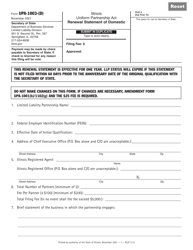

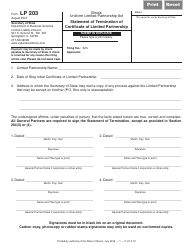

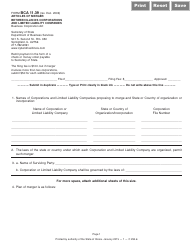

Form UPA1001(E) / 1102(F) Statement of Withdrawal of Limited Liability Partnership Status - Illinois

What Is Form UPA1001(E)/ 1102(F)?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UPA1001(E)/ 1102(F)?

A: Form UPA1001(E)/ 1102(F) is the form used to withdraw the limited liability partnership status in Illinois.

Q: What is limited liability partnership status?

A: Limited liability partnership status is a legal designation that offers liability protection to partners in a business.

Q: How can I withdraw the limited liability partnership status in Illinois?

A: To withdraw the limited liability partnership status in Illinois, you need to complete and submit Form UPA1001(E)/ 1102(F).

Q: Are there any specific requirements or information needed to complete the form?

A: Yes, the form requires certain information, such as the name of the limited liability partnership, the reason for withdrawal, and the signature of an authorized person.

Q: Can I withdraw the limited liability partnership status at any time?

A: Yes, you can withdraw the limited liability partnership status at any time by filing the withdrawal form.

Q: Is it necessary to withdraw the limited liability partnership status if the business is no longer operating?

A: Yes, it is advisable to withdraw the limited liability partnership status if the business is no longer operating to avoid any potential liabilities or obligations.

Q: What happens after submitting the withdrawal form?

A: After submitting the withdrawal form, the Illinois Secretary of State will process the request and update the status of the limited liability partnership.

Q: Can I be held personally liable for the partnership's obligations after withdrawal?

A: No, once the limited liability partnership status is withdrawn, the partners are generally not personally liable for the partnership's obligations.

Form Details:

- Released on May 1, 2009;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UPA1001(E)/ 1102(F) by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.