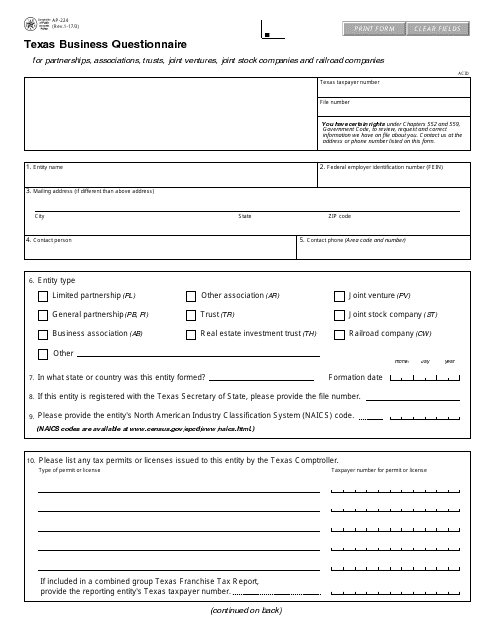

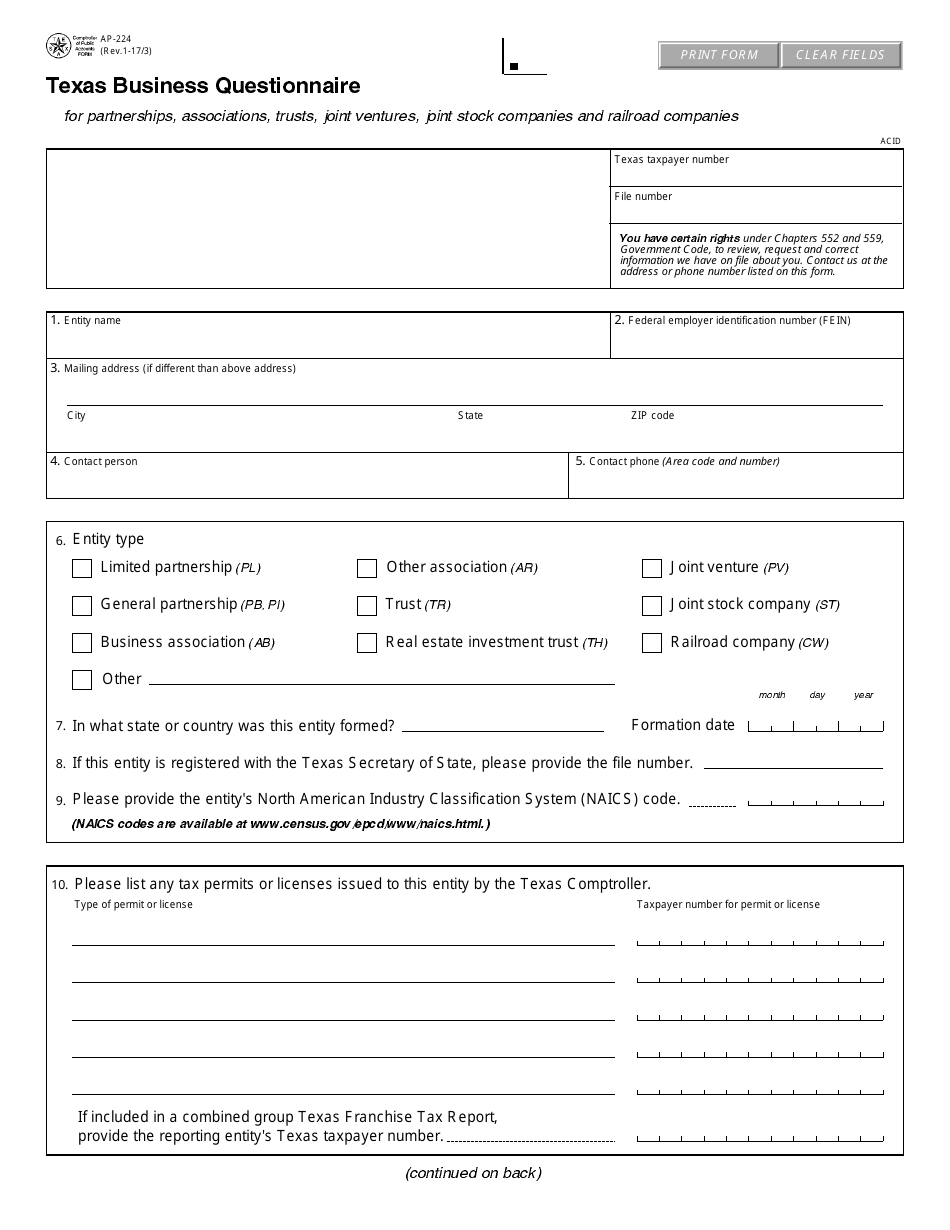

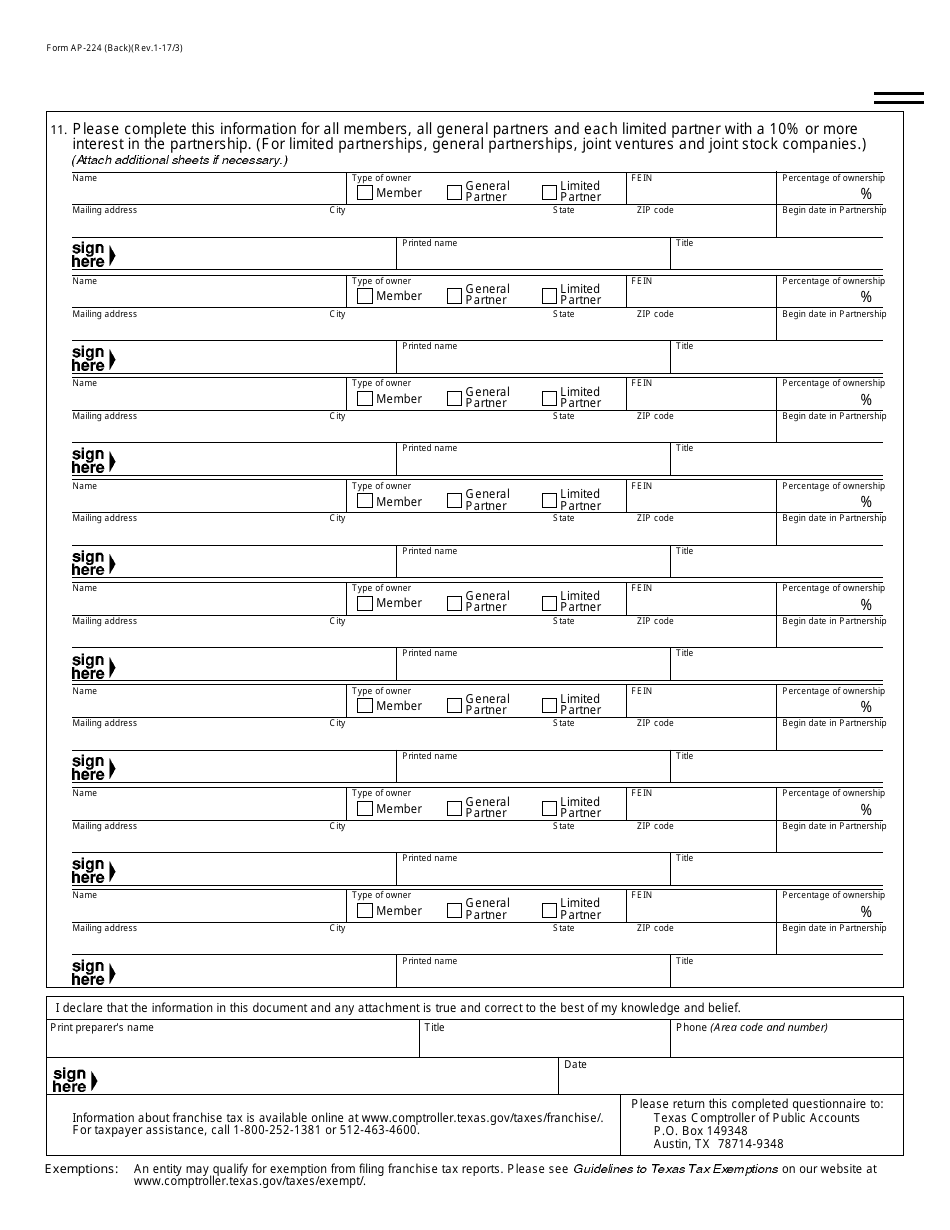

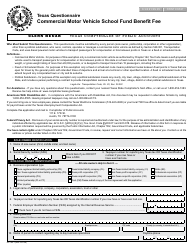

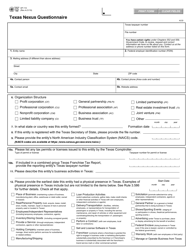

Form AP-224 Texas Business Questionnaire - Texas

What Is Form AP-224?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-224?

A: Form AP-224 is the Texas Business Questionnaire.

Q: Who needs to fill out Form AP-224?

A: Anyone starting or doing business in Texas.

Q: What is the purpose of Form AP-224?

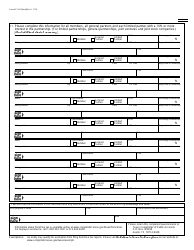

A: The form provides information necessary for the Texas Comptroller to determine the appropriate tax accounts for a business.

Q: Do I need to fill out Form AP-224 if I am just starting a business in Texas?

A: Yes, the form is required for all new businesses.

Q: Are there any fees associated with filing Form AP-224?

A: No, there are no fees for filing the form.

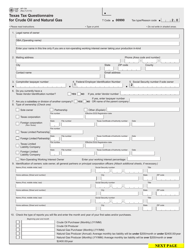

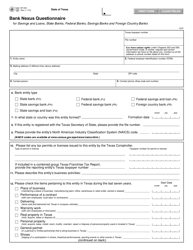

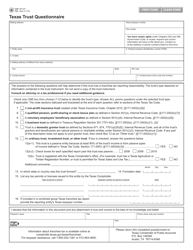

Q: What information do I need to provide on Form AP-224?

A: You will need to provide basic information about your business, such as the business name, address, and NAICS code.

Q: Is Form AP-224 required for all types of businesses?

A: Yes, the form is required for all types of businesses operating in Texas.

Q: When do I need to submit Form AP-224?

A: You should submit the form before you begin doing business in Texas.

Q: What happens after I submit Form AP-224?

A: The Texas Comptroller will use the information provided on the form to determine your tax responsibilities and assign you the appropriate tax accounts.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-224 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.