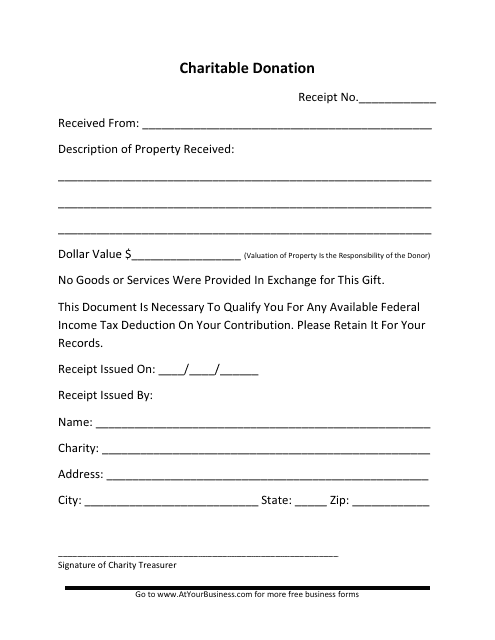

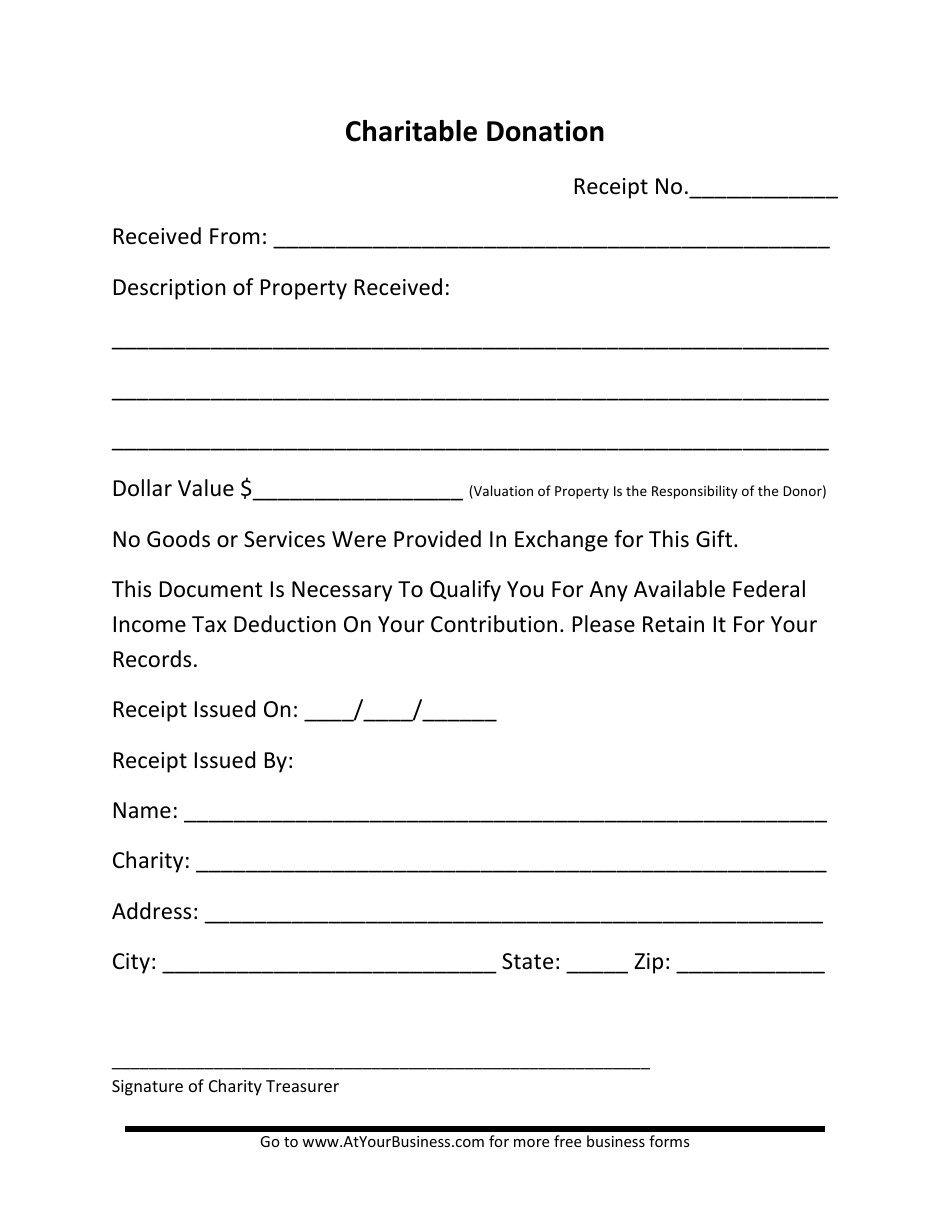

Charitable Donation Form

A Charitable Donation Form is used to document and record donations made to a charitable organization. It helps individuals or businesses claim tax deductions for their charitable contributions.

The donor or taxpayer typically files the charitable donation form. However, the specific form to be filed may vary depending on the country or jurisdiction.

FAQ

Q: What is a charitable donation form?

A: A charitable donation form is a document used to record and track donations made to a non-profit organization.

Q: Why is a charitable donation form important?

A: A charitable donation form is important for individuals and organizations who want to claim tax deductions for their charitable contributions. It provides proof of the donation and can be used as supporting documentation.

Q: What information is typically included in a charitable donation form?

A: A charitable donation form usually includes the donor's name, contact information, donation amount, date of donation, and details about the recipient non-profit organization.

Q: Can I use a charitable donation form for donations to any type of non-profit organization?

A: Yes, a charitable donation form can be used for donations to any qualified non-profit organization, as long as they have the necessary tax-exempt status to issue donation receipts.