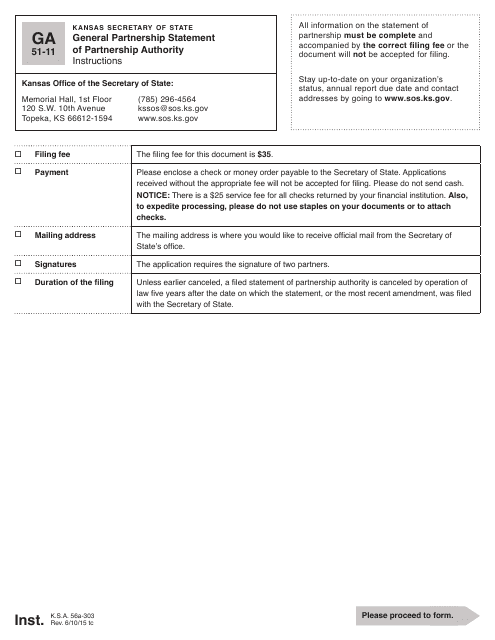

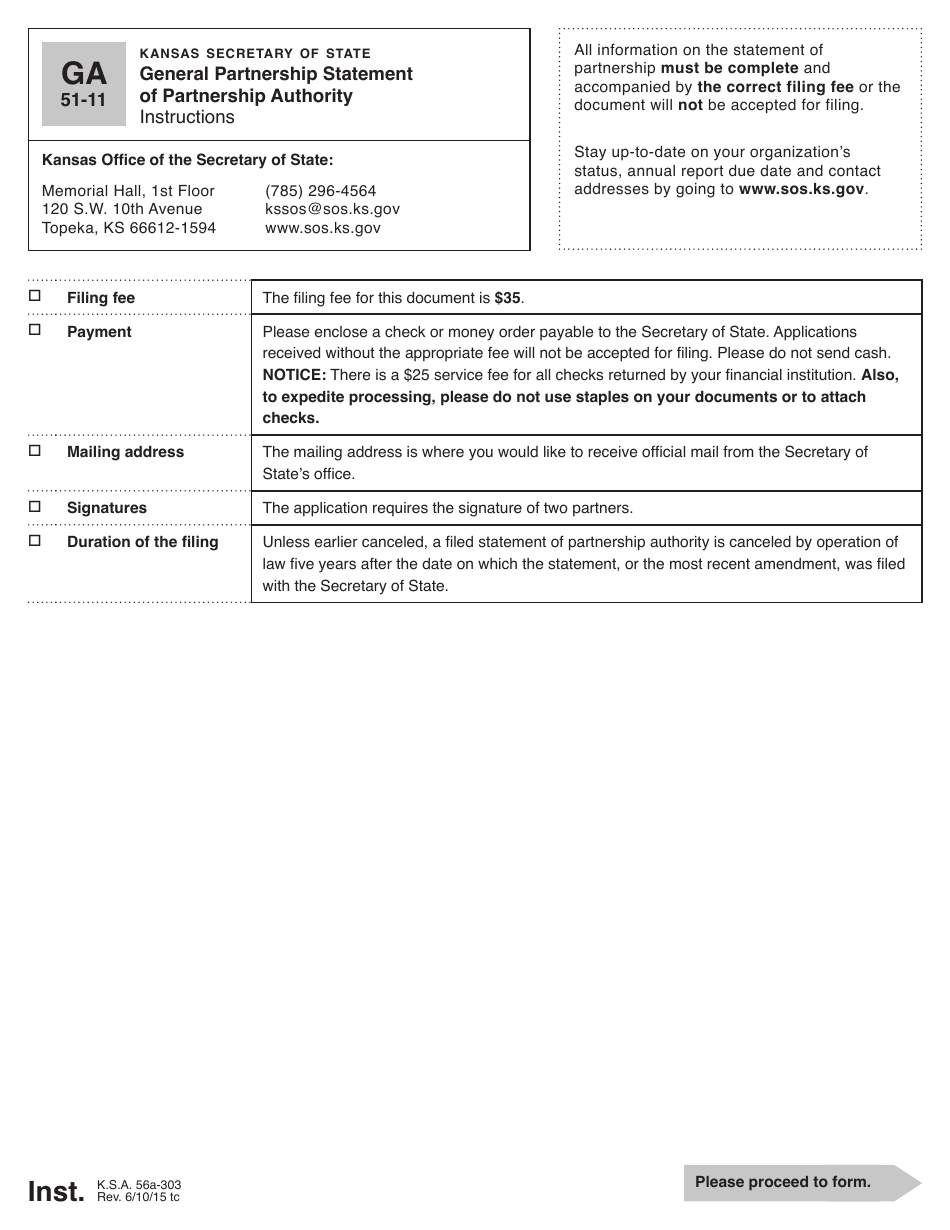

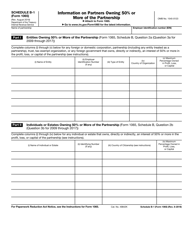

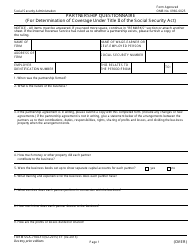

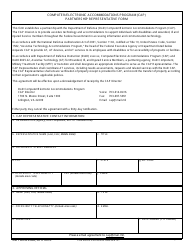

Form GA51-11 General Partnership Statement of Partnership Authority - Kansas

What Is Form GA51-11?

This is a legal form that was released by the Kansas Secretary of State - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GA51-11?

A: Form GA51-11 is the General Partnership Statement of Partnership Authority specifically for the state of Kansas.

Q: What is the purpose of Form GA51-11?

A: The purpose of Form GA51-11 is to provide information about a general partnership's authority to act on behalf of the partnership.

Q: Who needs to file Form GA51-11?

A: All general partnerships operating in Kansas need to file Form GA51-11.

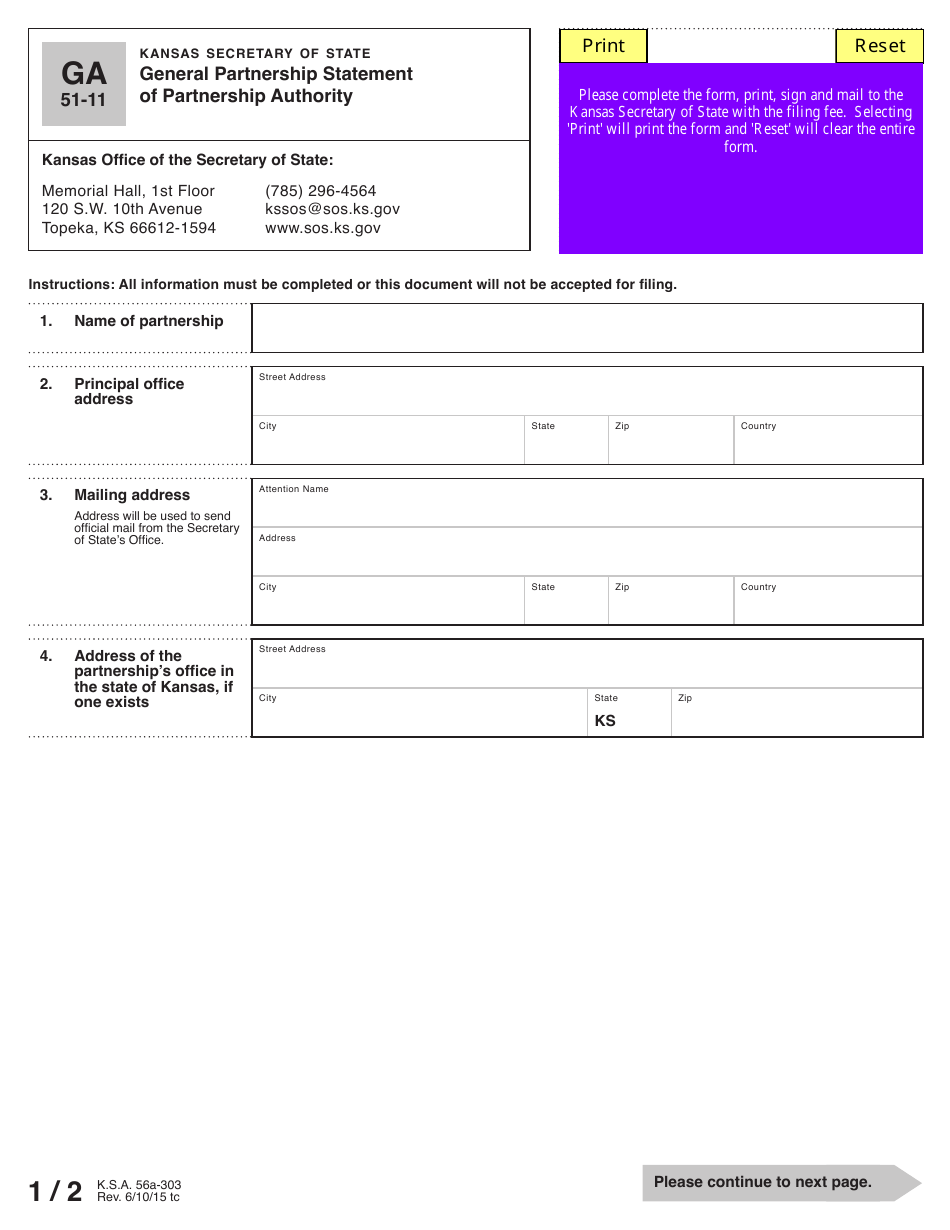

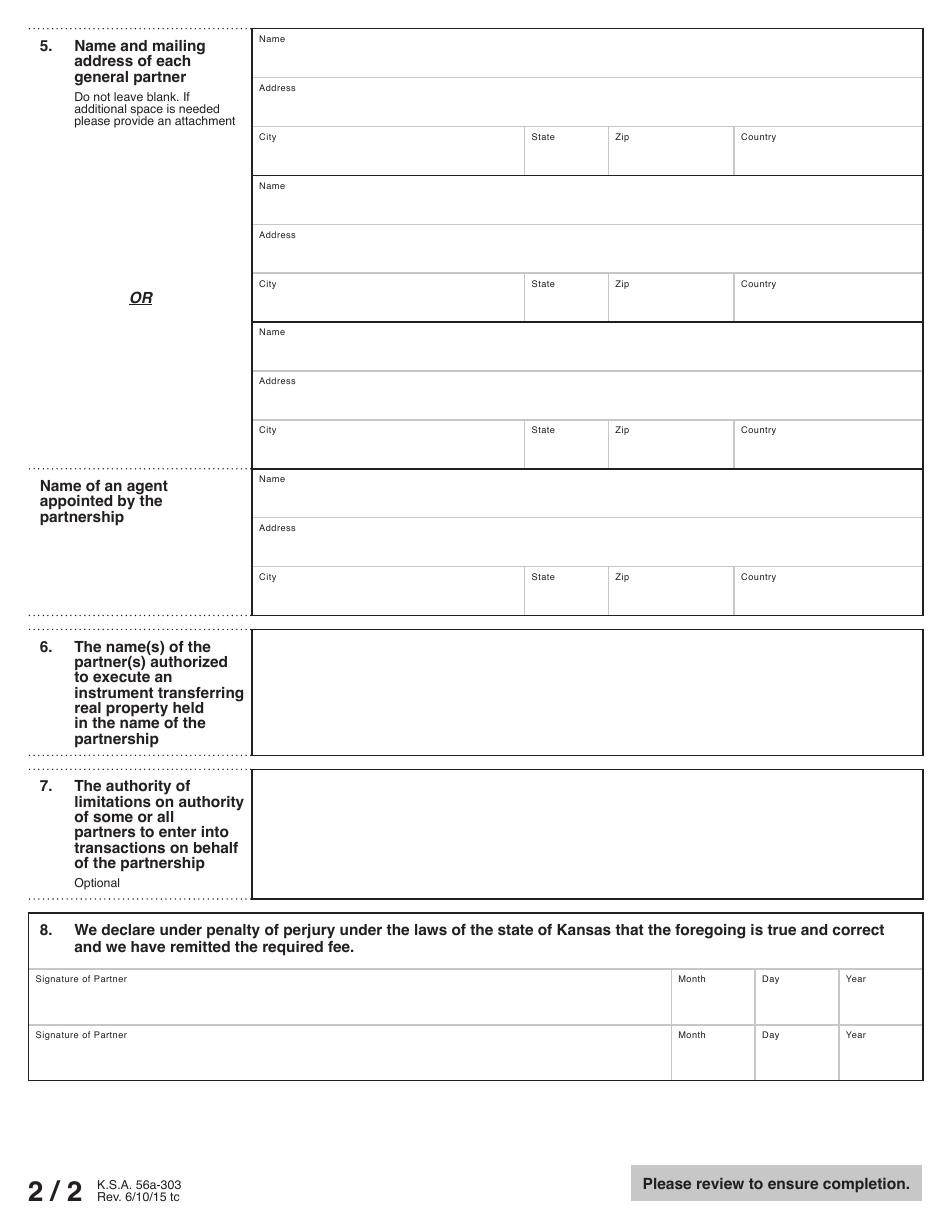

Q: What information is required on Form GA51-11?

A: Form GA51-11 requires information about the general partnership's name, address, and details about the partners.

Q: When is the deadline for filing Form GA51-11?

A: Form GA51-11 must be filed within 30 days of the partnership's formation or when there is a change in the authority of the partnership.

Q: Are there any additional requirements after filing Form GA51-11?

A: After filing Form GA51-11, the partnership may need to meet other tax or regulatory requirements depending on its business activities.

Q: What happens if I don't file Form GA51-11?

A: Failure to file Form GA51-11 can result in penalties and may limit the partnership's ability to act on behalf of the partnership in Kansas.

Form Details:

- Released on June 10, 2015;

- The latest edition provided by the Kansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GA51-11 by clicking the link below or browse more documents and templates provided by the Kansas Secretary of State.