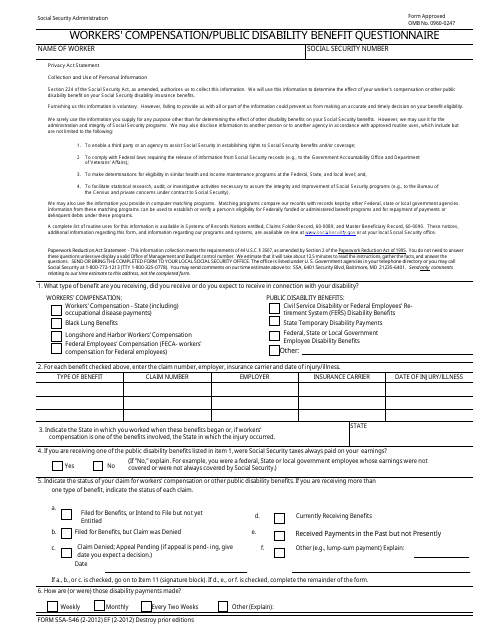

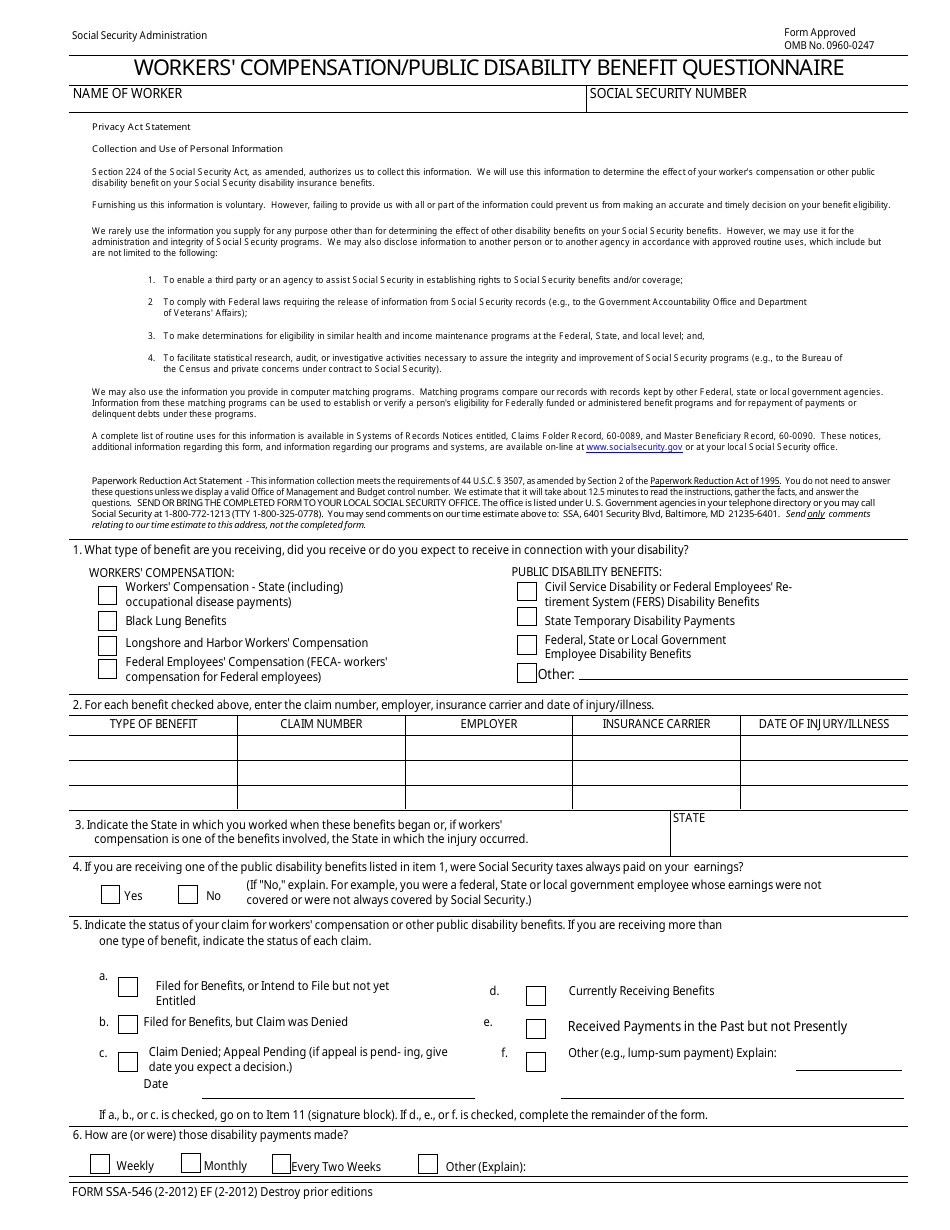

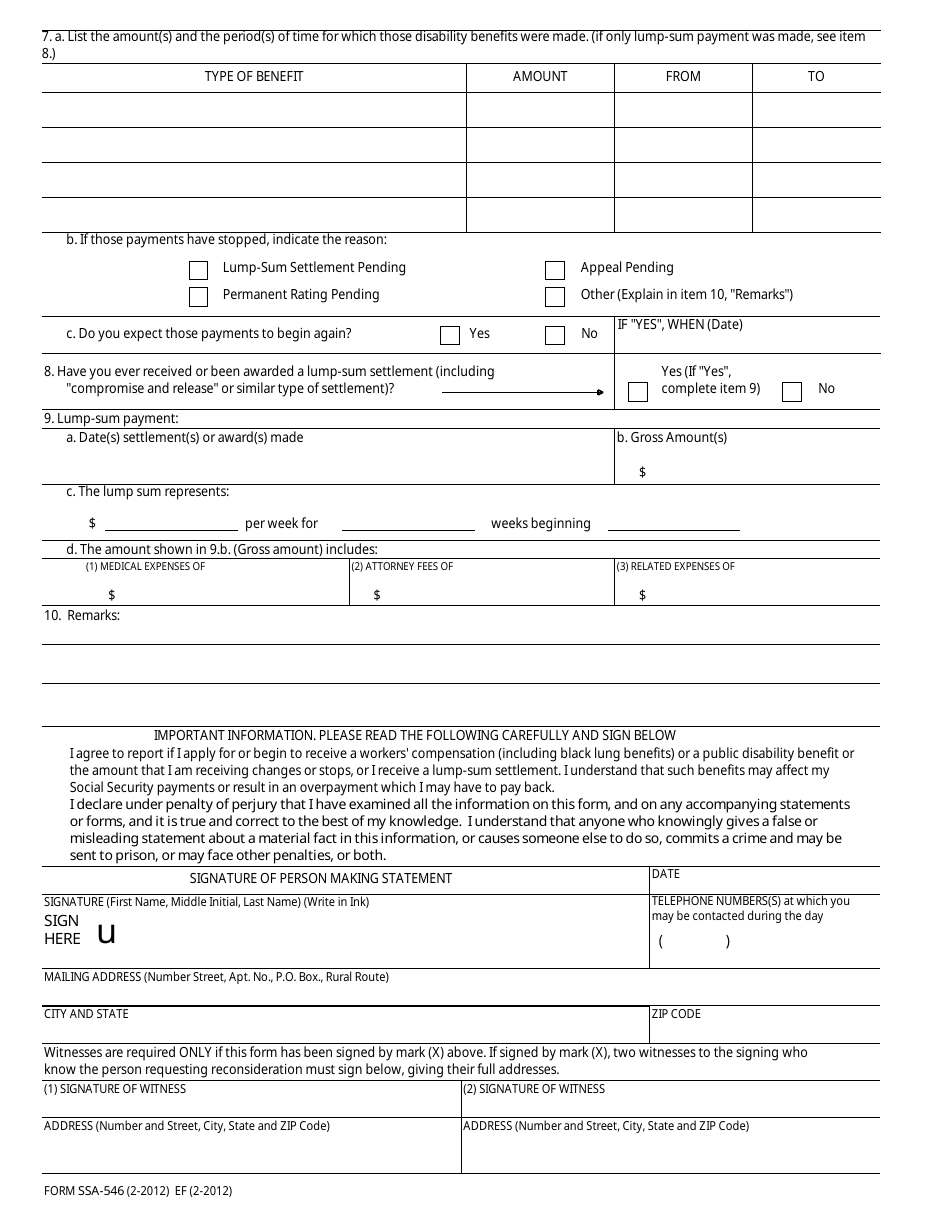

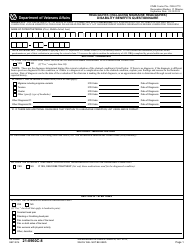

Form SSA-546 Workers Compensation / Public Disability Benefit Questionnaire

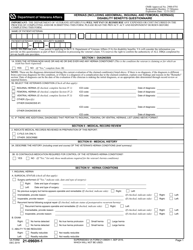

What Is Form SSA-546?

This is a legal form that was released by the U.S. Social Security Administration on February 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form SSA-546?

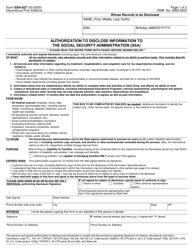

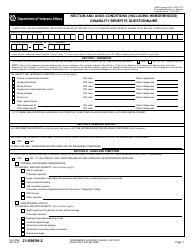

A: Form SSA-546 is used to gather information about any workers' compensation or public disability benefits an individual is receiving.

Q: Who needs to complete Form SSA-546?

A: Individuals who are currently receiving workers' compensation or public disability benefits need to complete Form SSA-546.

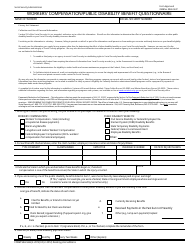

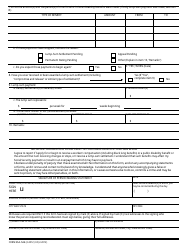

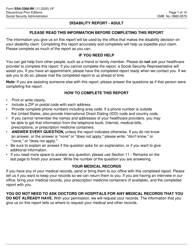

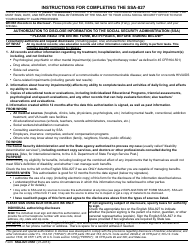

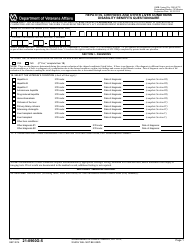

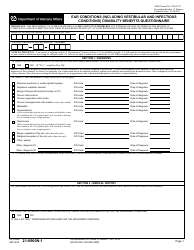

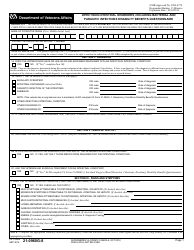

Q: What information is required on Form SSA-546?

A: Form SSA-546 asks for details regarding the type of benefits received, the amount of benefits, and the dates the benefits were paid.

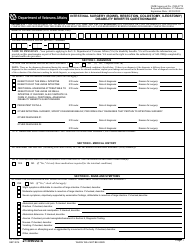

Q: Will my workers' compensation or public disability benefits affect my Social Security benefits?

A: Yes, your workers' compensation or public disability benefits may potentially reduce the amount of Social Security benefits you receive.

Q: How often do I need to complete Form SSA-546?

A: Form SSA-546 needs to be completed whenever there is a change in your workers' compensation or public disability benefits, or as requested by the SSA.

Q: What happens after I submit Form SSA-546?

A: The SSA will review the information provided on Form SSA-546 to determine if any adjustments need to be made to your Social Security benefits.

Q: What should I do if I have questions or need assistance with Form SSA-546?

A: If you have any questions or need assistance with Form SSA-546, you can contact your local SSA office or speak with a representative from the SSA helpline.

Form Details:

- Released on February 1, 2012;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-546 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.