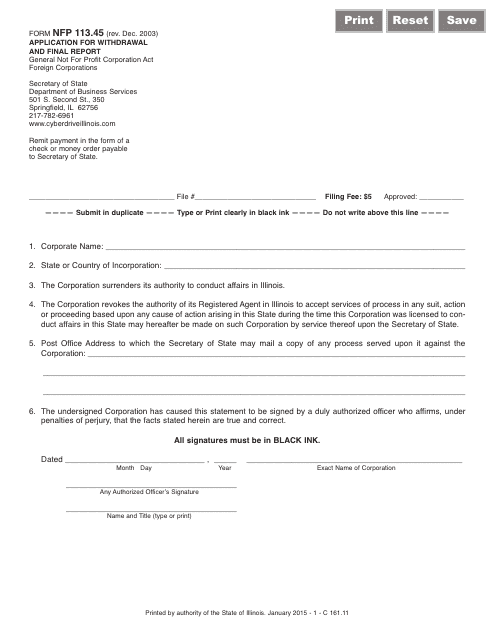

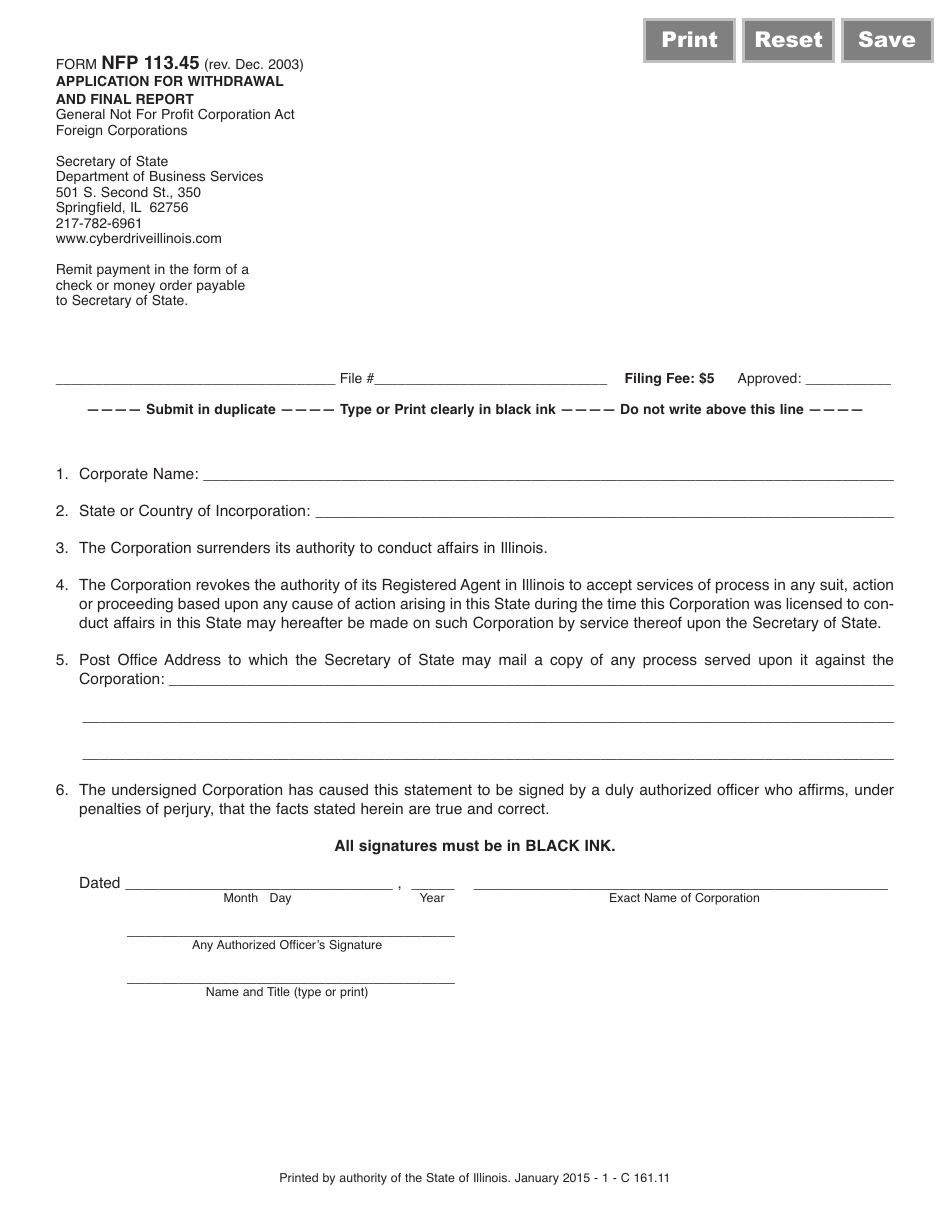

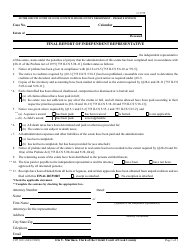

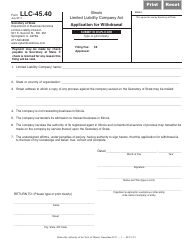

Form NFP113.45 Application for Withdrawal and Final Report - Illinois

What Is Form NFP113.45?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NFP113.45?

A: Form NFP113.45 is an application for withdrawal and final report.

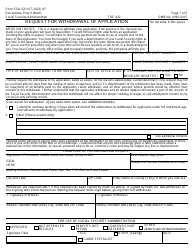

Q: What is the purpose of Form NFP113.45?

A: The purpose of Form NFP113.45 is to apply for withdrawal and submit a final report for a non-profit organization in Illinois.

Q: Who needs to file Form NFP113.45?

A: Non-profit organizations in Illinois that wish to withdraw and submit a final report must file Form NFP113.45.

Q: What information is required on Form NFP113.45?

A: Form NFP113.45 requires information such as the organization's name, address, reason for withdrawal, and financial information.

Q: Are there any fees for filing Form NFP113.45?

A: Yes, there is a filing fee for Form NFP113.45. The amount of the fee depends on the organization's assets.

Q: What is the deadline for filing Form NFP113.45?

A: The deadline for filing Form NFP113.45 is within 60 days of the organization's decision to withdraw.

Q: What happens after I file Form NFP113.45?

A: After you file Form NFP113.45, the Secretary of State will review your application and issue a certificate of withdrawal if approved.

Q: Is there any additional documentation required with Form NFP113.45?

A: Yes, along with Form NFP113.45, you must also submit a final report detailing the organization's activities and financial status.

Form Details:

- Released on December 1, 2003;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NFP113.45 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.