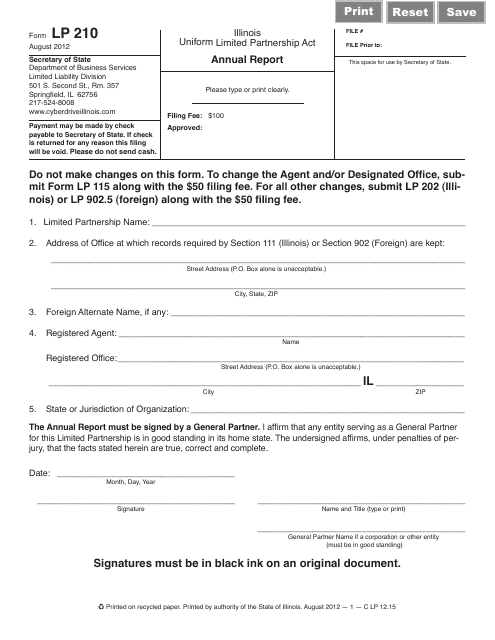

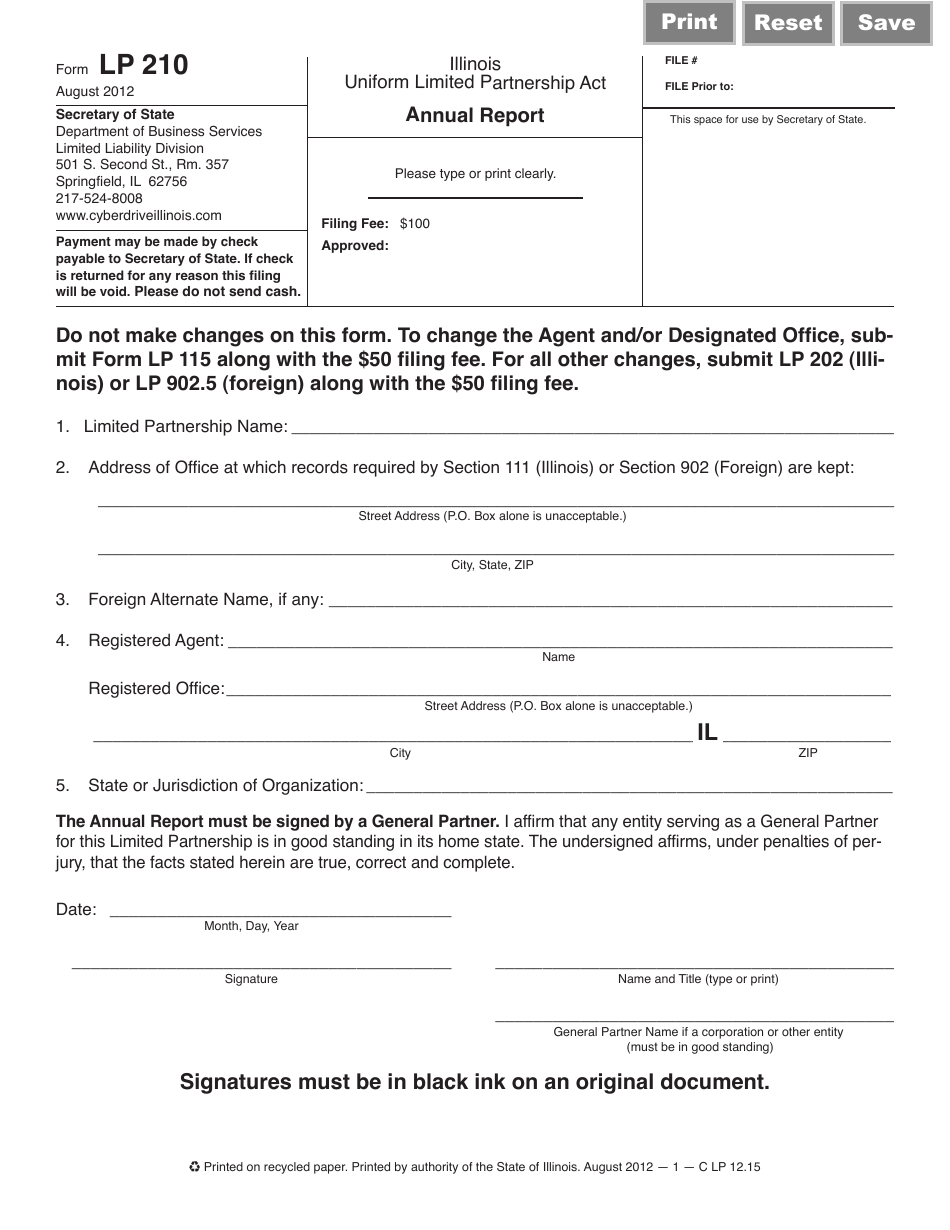

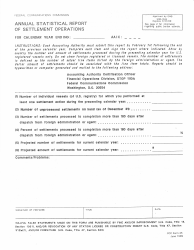

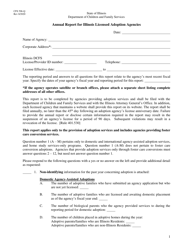

Form LP210 Annual Report - Illinois

What Is Form LP210?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the LP210 Annual Report?

A: The LP210 Annual Report is a form filed by Limited Partnerships in Illinois.

Q: Who needs to file the LP210 Annual Report?

A: Limited Partnerships registered in Illinois are required to file the LP210 Annual Report.

Q: When is the LP210 Annual Report due?

A: The LP210 Annual Report is due by the first day of the anniversary month of the Limited Partnership's formation.

Q: What information is required for the LP210 Annual Report?

A: The LP210 Annual Report requires information such as the Limited Partnership's name, address, registered agent, and the names and addresses of the partners.

Q: Is there a fee to file the LP210 Annual Report?

A: Yes, there is a filing fee associated with the LP210 Annual Report. The fee amount may vary.

Q: What happens if I don't file the LP210 Annual Report?

A: Failure to file the LP210 Annual Report can result in penalties, such as the loss of good standing status or dissolution of the Limited Partnership.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LP210 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.