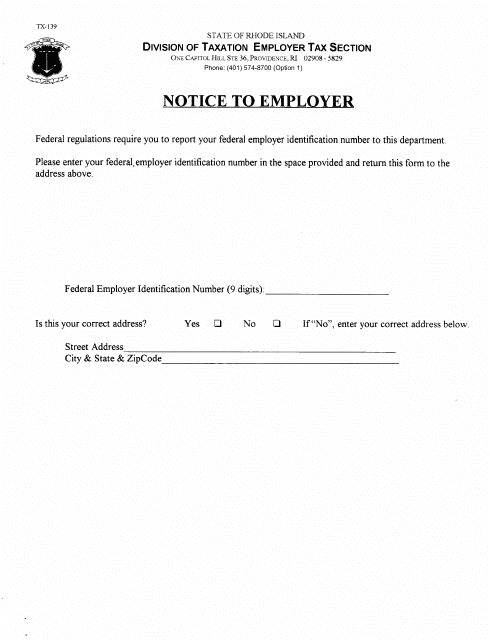

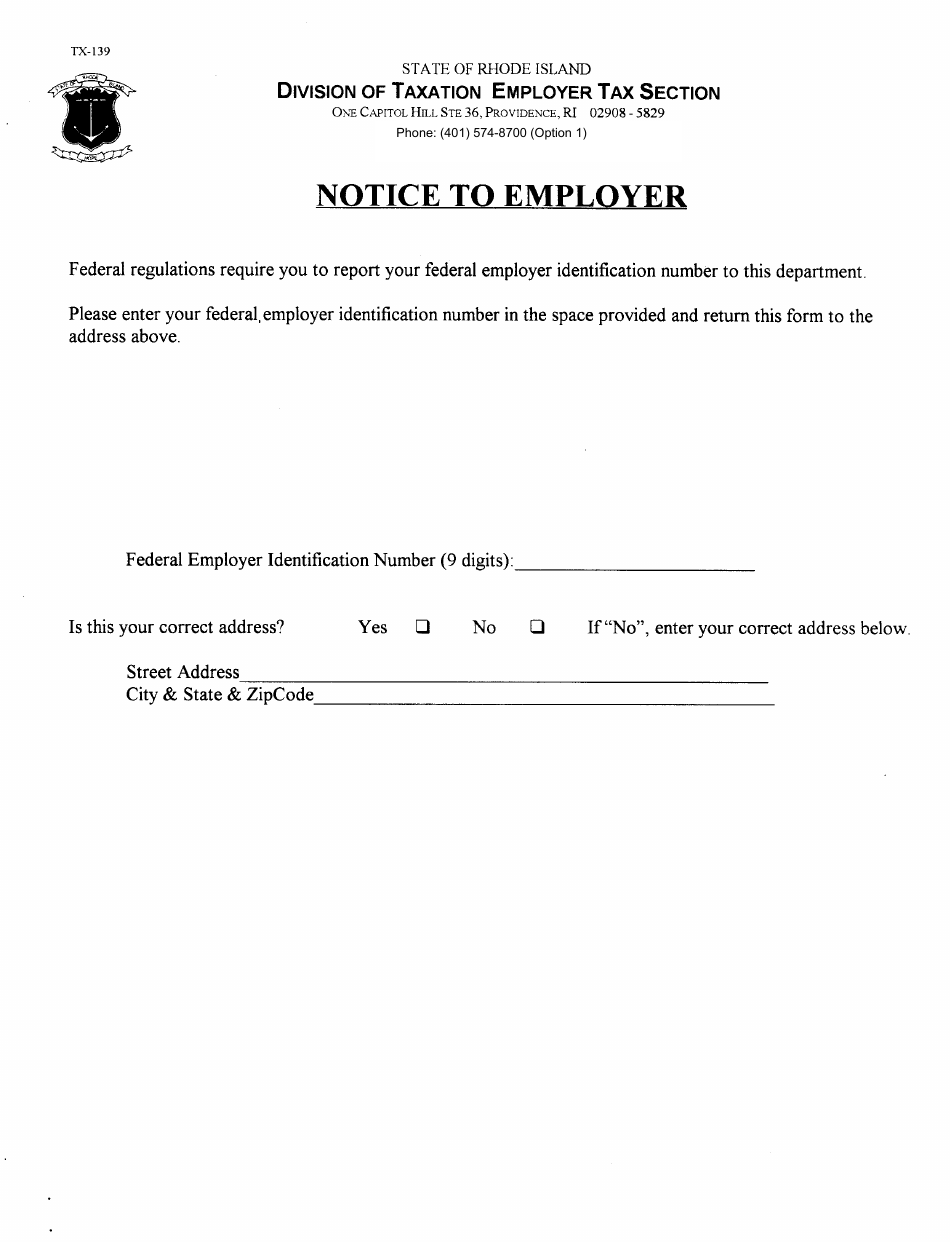

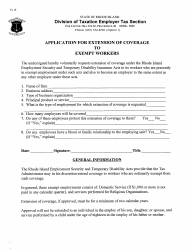

Form TX-139 Notice to Employer - Rhode Island

What Is Form TX-139?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

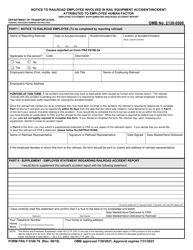

Q: What is Form TX-139?

A: Form TX-139 is the Notice to Employer form for Rhode Island.

Q: When should Form TX-139 be used?

A: Form TX-139 should be used to give notice to an employer about a child support case in Rhode Island.

Q: What information is required on Form TX-139?

A: Form TX-139 requires information about the case, including the names of the parties and the court involved.

Q: Who should complete Form TX-139?

A: The party initiating the child support case should complete Form TX-139.

Q: Is there a fee to submit Form TX-139?

A: No, there is no fee to submit Form TX-139.

Q: What should I do after completing Form TX-139?

A: After completing Form TX-139, you should submit it to the employer along with any additional required documents.

Q: Is Form TX-139 confidential?

A: Yes, the information provided on Form TX-139 is confidential and protected by privacy laws.

Q: What happens after the employer receives Form TX-139?

A: After receiving Form TX-139, the employer is required to comply with the child support order and withhold the appropriate amount from the employee's wages.

Q: What if the employer fails to comply with the child support order?

A: If the employer fails to comply with the child support order, they may face penalties and legal consequences.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TX-139 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.