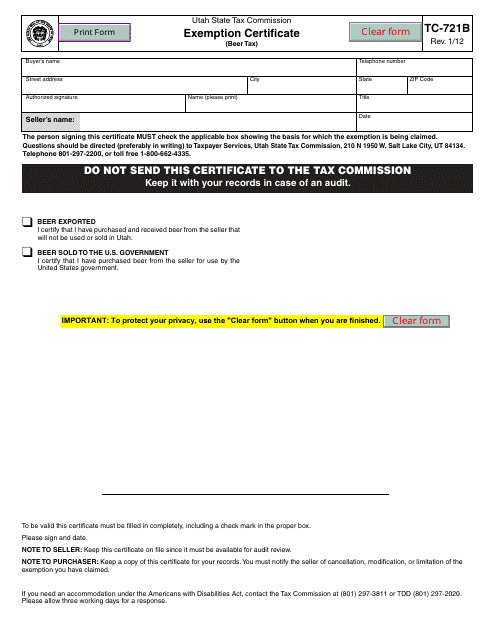

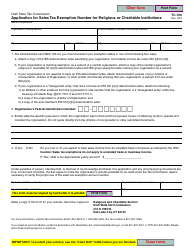

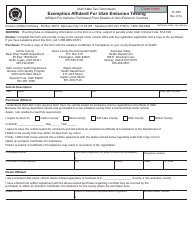

Form TC-721B Exemption Certificate (Beer Tax) - Utah

What Is Form TC-721B?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-721B?

A: Form TC-721B is an Exemption Certificate for Beer Tax in Utah.

Q: Who needs to fill out Form TC-721B?

A: Wholesalers and retailers of beer in Utah need to fill out Form TC-721B.

Q: What is the purpose of Form TC-721B?

A: The purpose of Form TC-721B is to claim an exemption from beer taxes.

Q: How do I fill out Form TC-721B?

A: You need to provide your business information, purchase details, and reason for exemption.

Q: Is there a deadline for submitting Form TC-721B?

A: Yes, Form TC-721B must be submitted monthly by the 15th day of the following month.

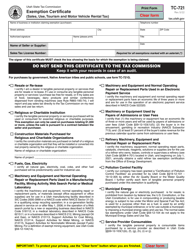

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-721B by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.