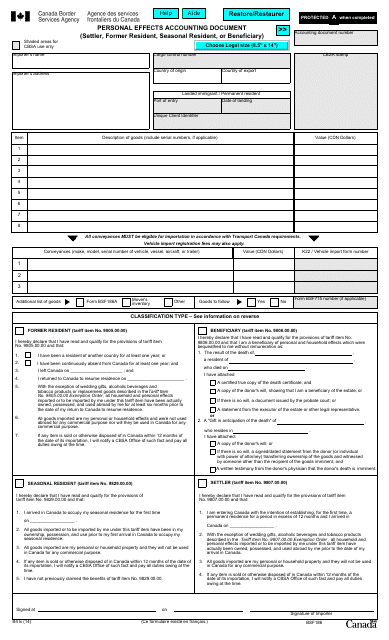

Form BSF186 Personal Effects Accounting Document (Settler, Former Resident, Seasonal Resident, or Beneficiary) - Canada

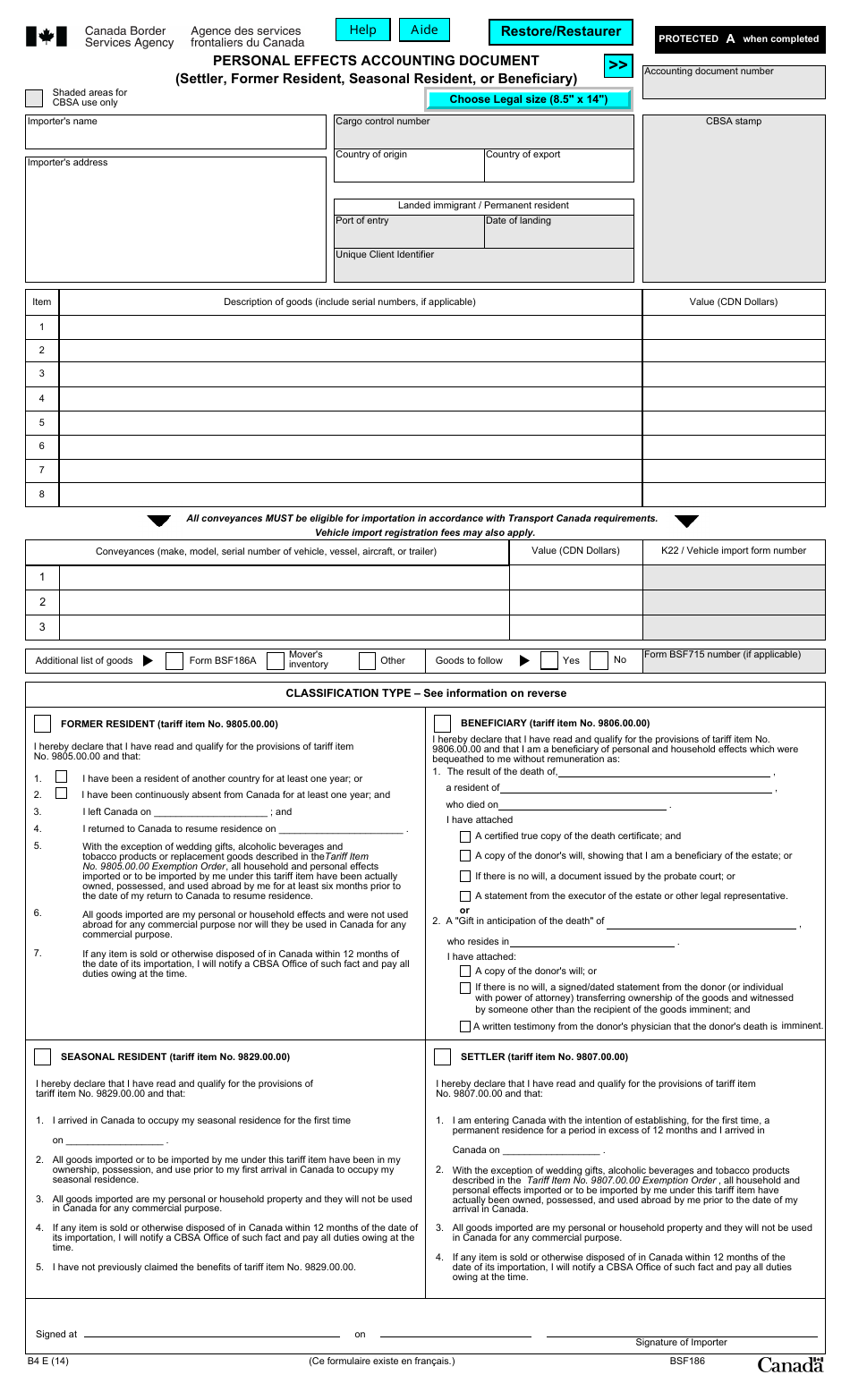

Form BSF186 Personal Effects Accounting Document (Settler, Former Resident, Seasonal Resident, or Beneficiary) in Canada is used for individuals who are settling in, returning to, or temporarily residing in Canada, and wish to bring their personal effects with them. This form helps to account for the personal belongings being imported and ensures compliance with customs regulations. It is used by individuals who are Canadian residents, former residents, seasonal residents, or beneficiaries.

The Form BSF186 Personal Effects Accounting Document is filed by settlers, former residents, seasonal residents, or beneficiaries entering or returning to Canada.

FAQ

Q: What is the BSF186 Personal Effects Accounting Document?

A: The BSF186 Personal Effects Accounting Document is a form used by individuals who are settling, former residents, seasonal residents, or beneficiaries in Canada to declare their personal effects when entering the country.

Q: Who needs to fill out the BSF186 Personal Effects Accounting Document?

A: Individuals who are settling in Canada, former residents returning to Canada, seasonal residents, or beneficiaries receiving personal effects, need to fill out the BSF186 form.

Q: What is the purpose of the BSF186 Personal Effects Accounting Document?

A: The purpose of the BSF186 form is to declare and account for personal effects being brought into Canada by settlers, former residents, seasonal residents, or beneficiaries.

Q: What information do I need to provide on the BSF186 Personal Effects Accounting Document?

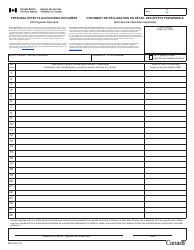

A: You will need to provide information about yourself, your personal effects, and any applicable exemptions or privileges you are claiming on the BSF186 form.

Q: Are there any fees associated with the BSF186 Personal Effects Accounting Document?

A: There are no fees associated with the BSF186 Personal Effects Accounting Document.

Q: Do I need to keep a copy of the BSF186 Personal Effects Accounting Document?

A: Yes, it is recommended to keep a copy of the completed BSF186 Personal Effects Accounting Document for your records and for future reference if needed.

Q: Is the BSF186 Personal Effects Accounting Document required for all personal effects brought into Canada?

A: Yes, the BSF186 Personal Effects Accounting Document is required for all personal effects being brought into Canada by settlers, former residents, seasonal residents, or beneficiaries.