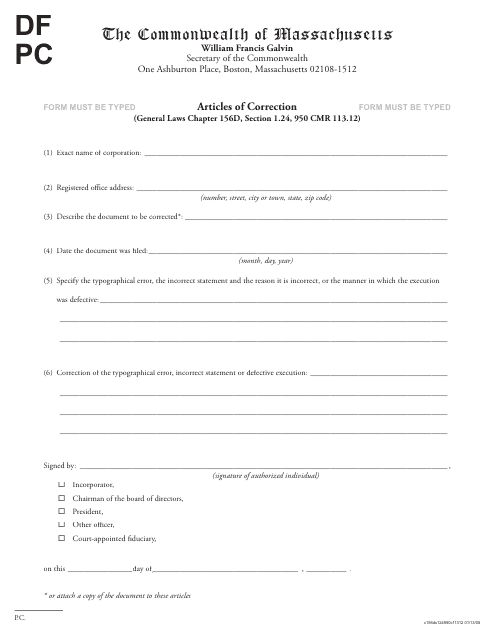

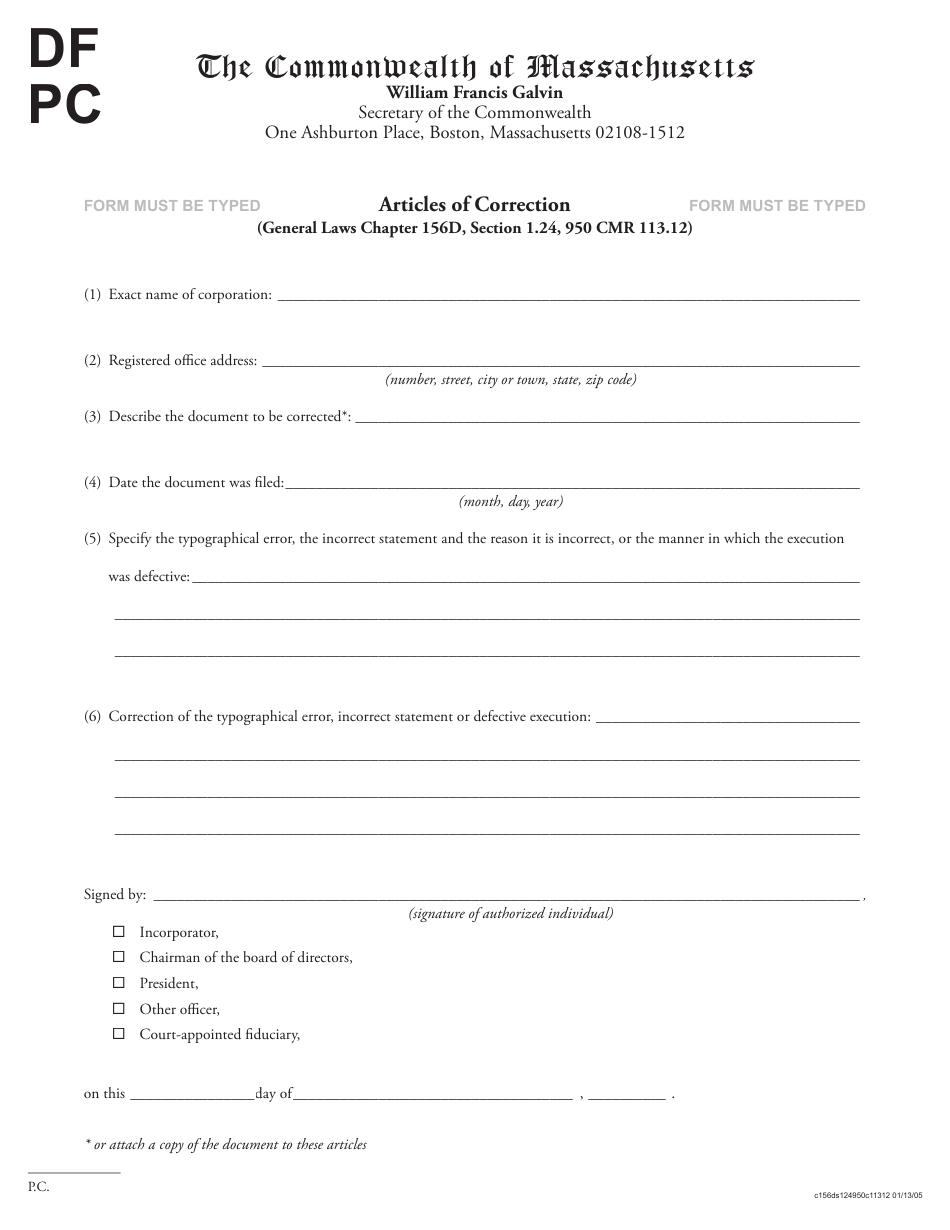

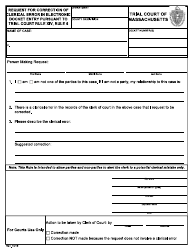

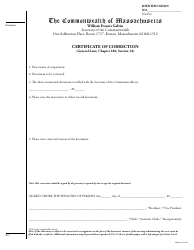

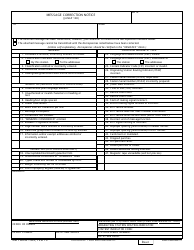

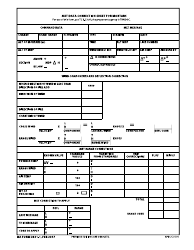

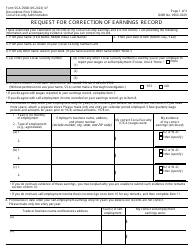

Articles of Correction - Massachusetts

Articles of Correction is a legal document that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What are Articles of Correction?

A: Articles of Correction are legal documents filed by a corporation or limited liability company to correct any errors or omissions in previously filed documents.

Q: Can any type of business file Articles of Correction?

A: Yes, both corporations and limited liability companies can file Articles of Correction.

Q: Why would a business need to file Articles of Correction?

A: A business may need to file Articles of Correction to correct any mistakes or omissions in previously filed documents, such as articles of organization or articles of incorporation.

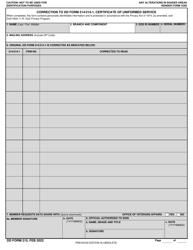

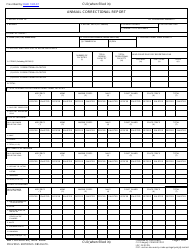

Q: What types of errors or omissions can be corrected with Articles of Correction?

A: Articles of Correction can be used to correct errors or omissions related to the name of the business, the address, the membership or shareholder information, or any other information that was incorrectly stated in the original filing.

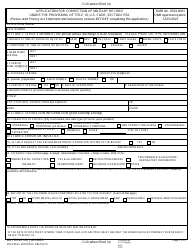

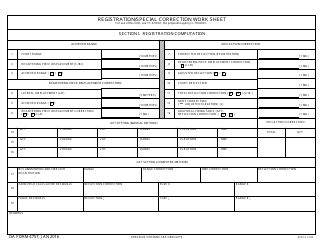

Q: How can a business file Articles of Correction?

A: To file Articles of Correction, the business must complete the appropriate form provided by the Secretary of the Commonwealth of Massachusetts and submit it along with the required filing fee.

Q: What is the filing fee for Articles of Correction in Massachusetts?

A: As of 2021, the filing fee for Articles of Correction is $100 for corporations and $50 for limited liability companies, payable to the Secretary of the Commonwealth.

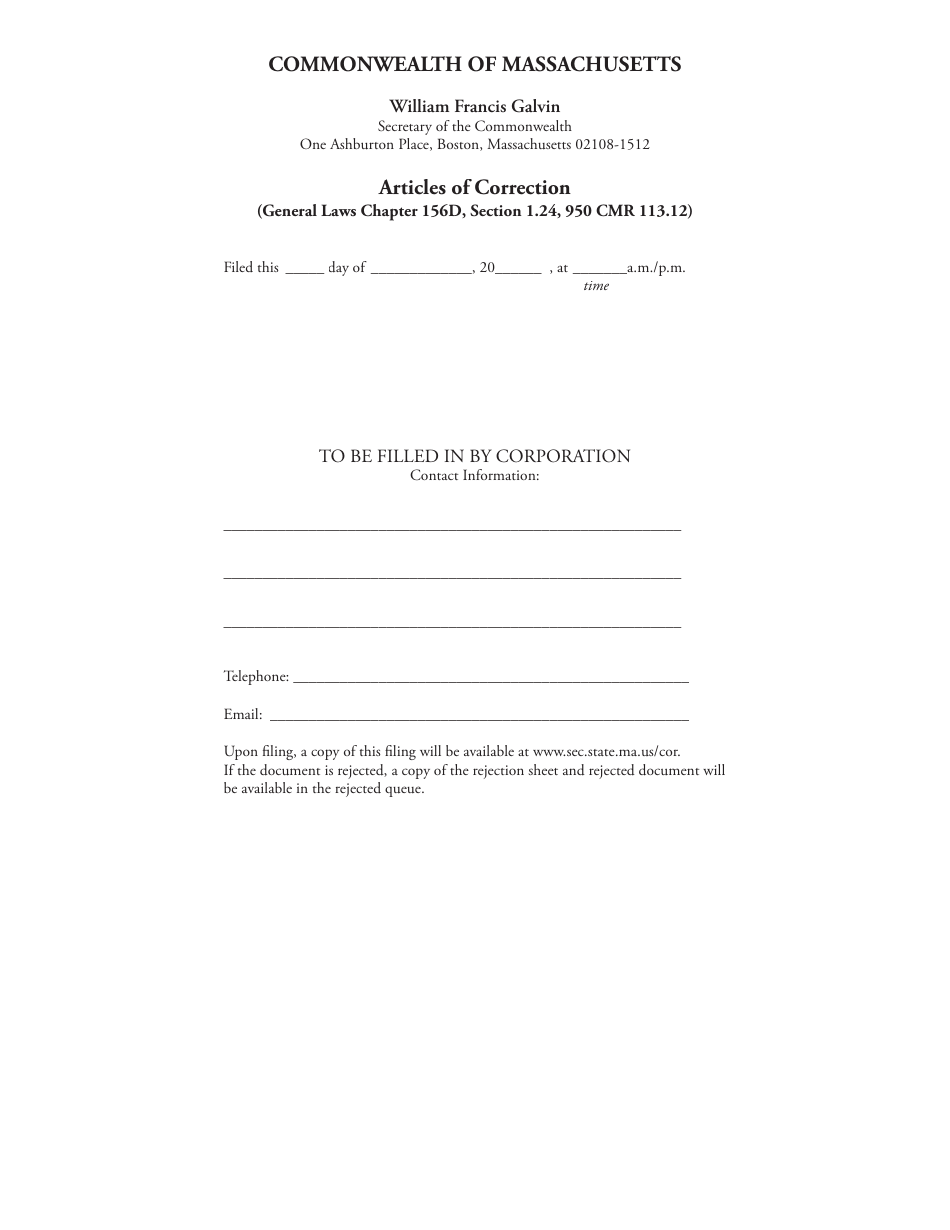

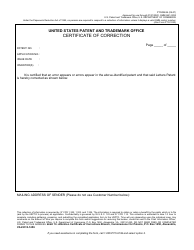

Q: What happens after the Articles of Correction are filed?

A: Once the Articles of Correction are filed and processed, the corrected information will be reflected in the business's official records.

Q: Is there a deadline for filing Articles of Correction?

A: There is no specific deadline for filing Articles of Correction, but it is recommended to file them as soon as the error or omission is discovered.

Q: Can Articles of Correction be used to change other information about the business?

A: No, Articles of Correction are specifically used to correct errors or omissions in previously filed documents. If a business needs to make other changes, such as changing its name or address, it would need to file a different document, such as an amendment or restated articles.

Q: Are Articles of Correction public record?

A: Yes, once filed, Articles of Correction become part of the public record and can be accessed by anyone who wishes to review the business's official records.

Form Details:

- Released on January 13, 2005;

- The latest edition currently provided by the Secretary of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.