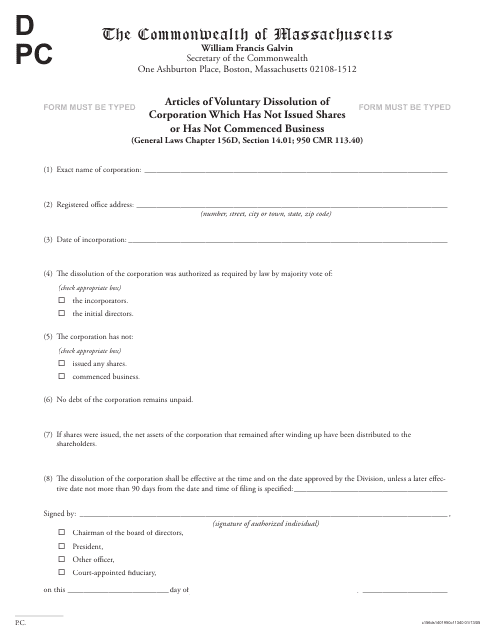

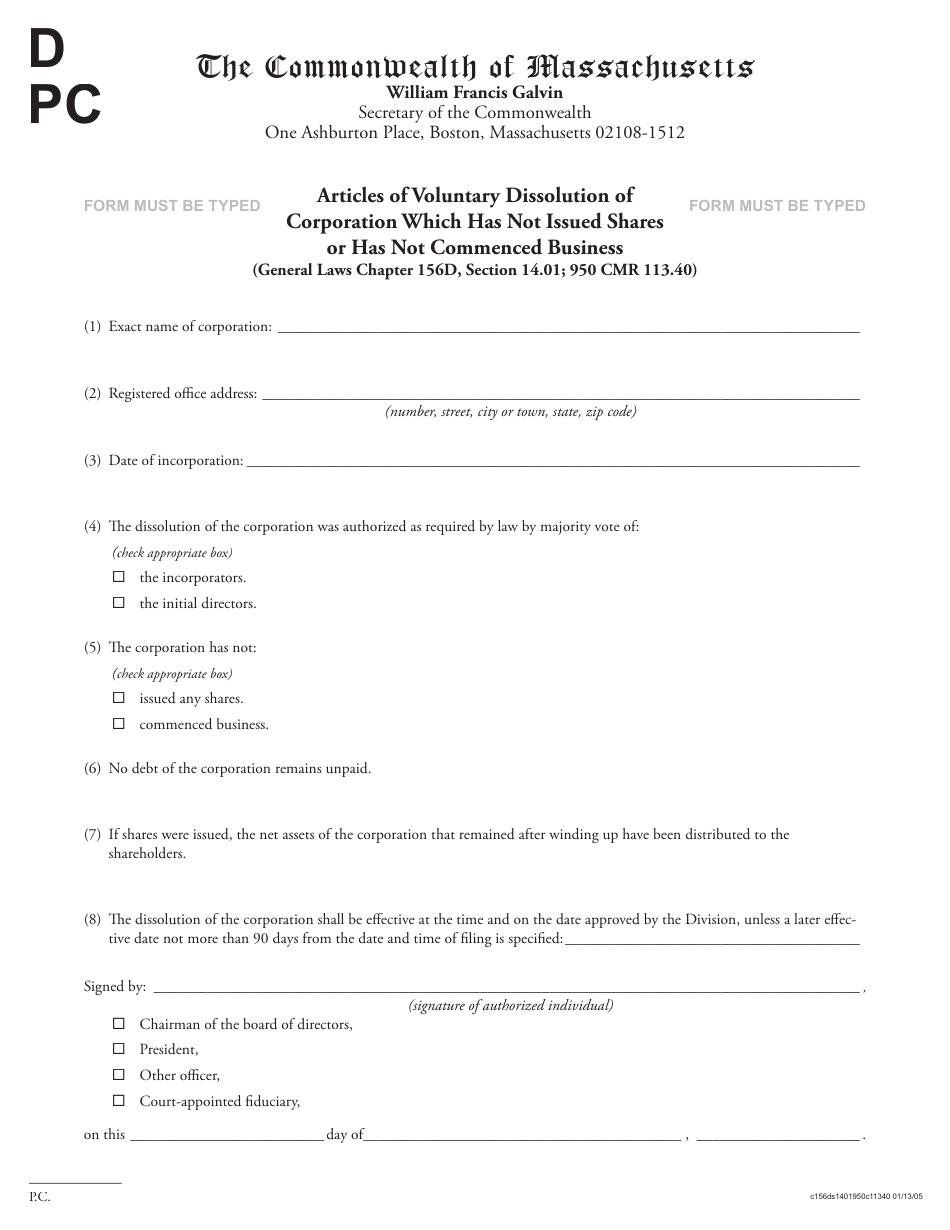

Articles of Voluntary Dissolution of Corporation Which Has Not Issued Shares or Has Not Commenced Business - Massachusetts

Articles of Voluntary Dissolution of Corporation Which Has Not Issued Shares or Has Not Commenced Business is a legal document that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts.

FAQ

Q: What is a voluntary dissolution of a corporation?

A: Voluntary dissolution of a corporation refers to the process of formally ending the existence of a corporation by the decision of its owners or shareholders.

Q: What does it mean for a corporation to not have issued shares?

A: If a corporation has not issued shares, it means that there are no owners or shareholders who have received ownership or stock in the company.

Q: What does it mean for a corporation to not have commenced business?

A: If a corporation has not commenced business, it means that the company has not started its operations or generated any revenue.

Q: What is the purpose of filing articles of voluntary dissolution?

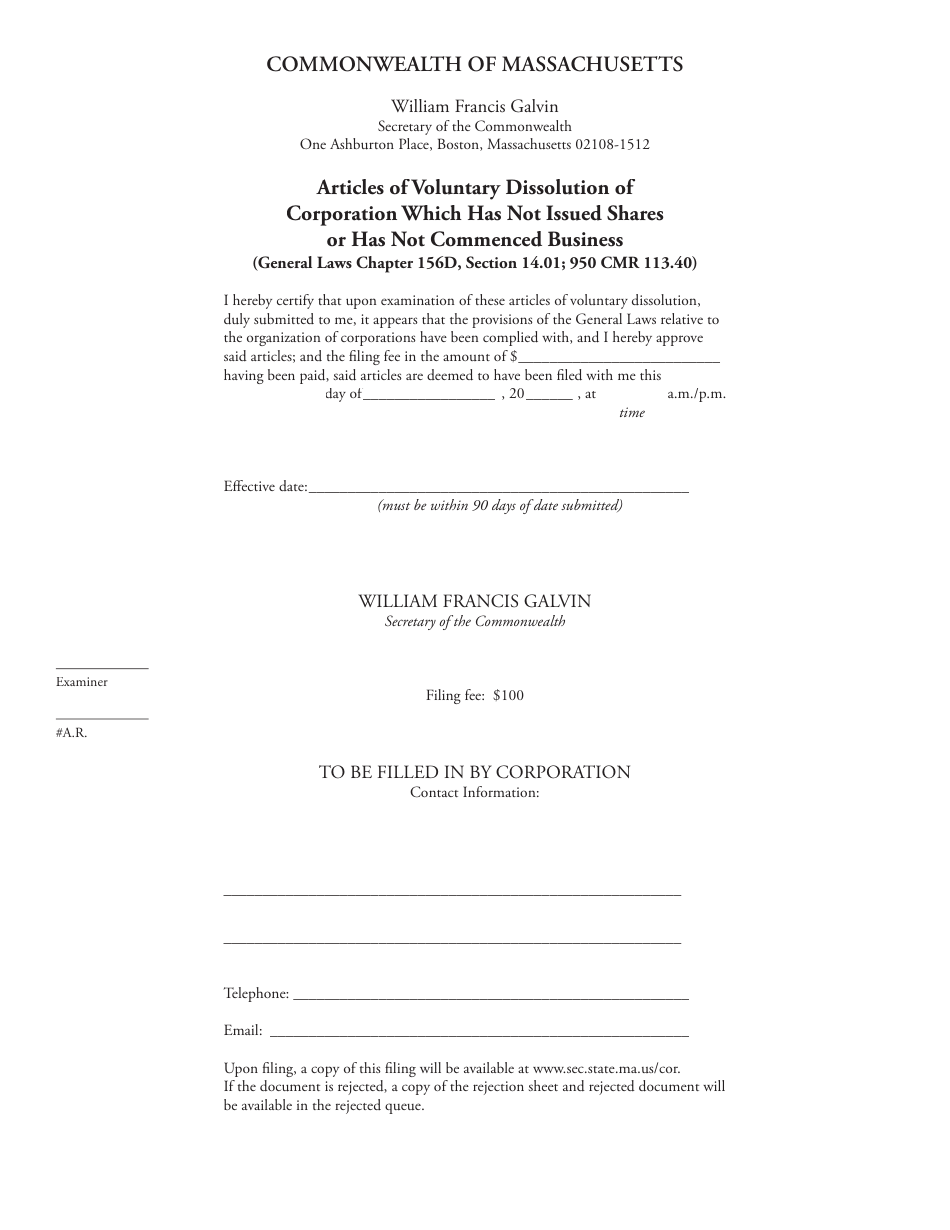

A: Filing articles of voluntary dissolution serves as an official declaration to the state that the corporation has decided to dissolve and terminate its existence.

Q: What are the requirements for filing articles of voluntary dissolution in Massachusetts?

A: The requirements may vary, but typically include completing a specific form provided by the state, paying the applicable fees, and fulfilling any necessary legal obligations.

Q: Are there any specific benefits or advantages to filing articles of voluntary dissolution?

A: Filing articles of voluntary dissolution allows the corporation to officially terminate its existence and avoid ongoing compliance requirements and potential liabilities.

Q: What happens after filing articles of voluntary dissolution?

A: After filing articles of voluntary dissolution, the corporation will go through a winding-down process which involves settling its affairs, distributing assets, and satisfying any outstanding obligations.

Q: Can a corporation be revived after filing articles of voluntary dissolution?

A: In some cases, it may be possible to revive a corporation after filing articles of voluntary dissolution, but the process and requirements will depend on the specific laws and regulations of the state.

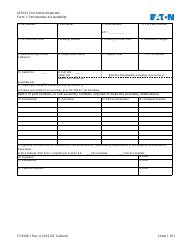

Form Details:

- Released on January 13, 2005;

- The latest edition currently provided by the Massachusetts Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.