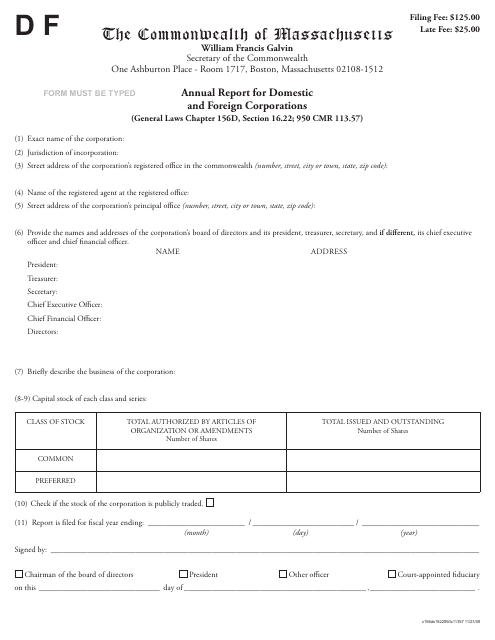

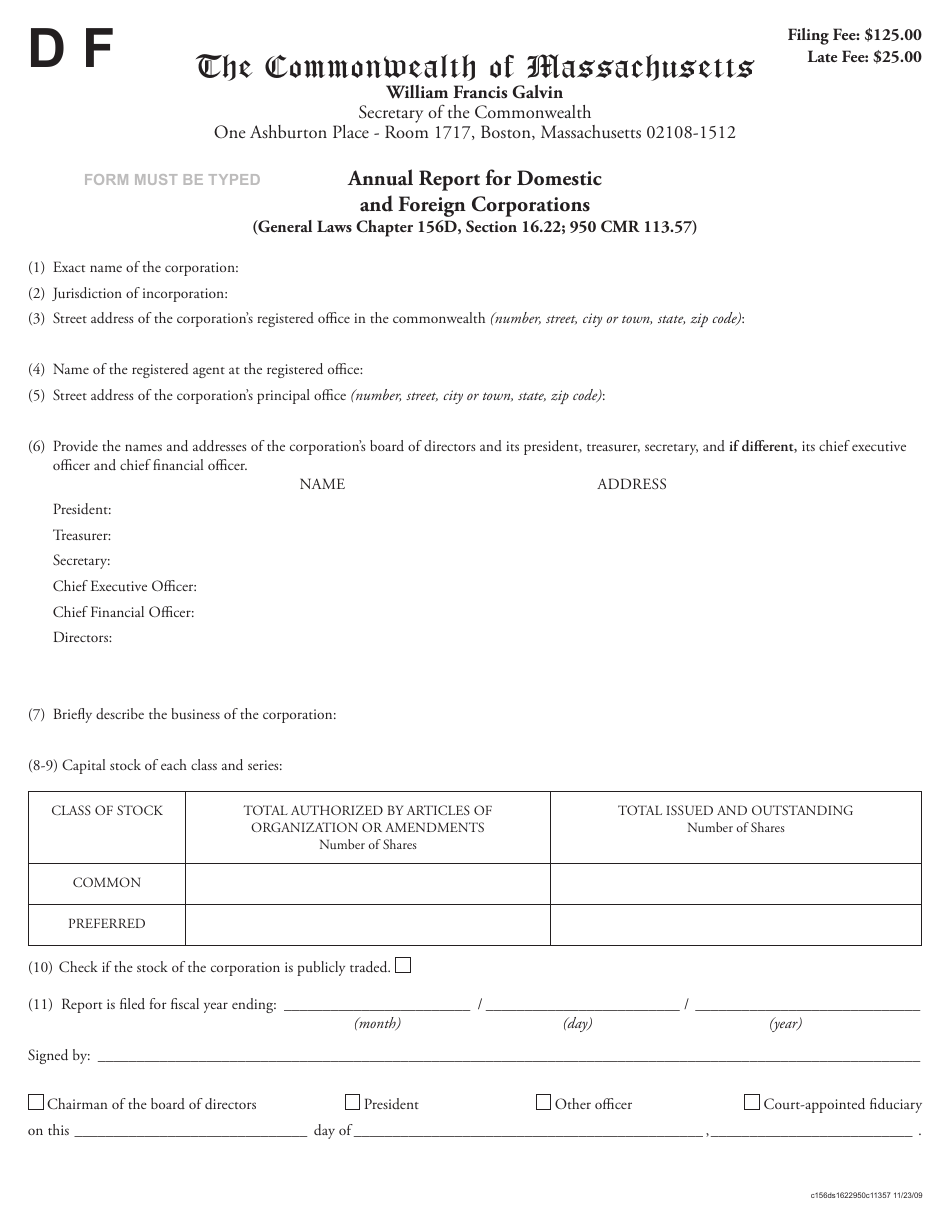

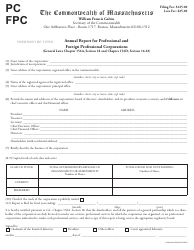

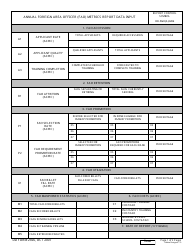

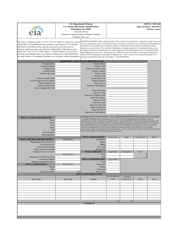

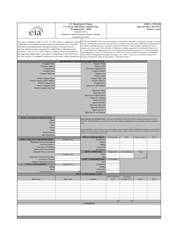

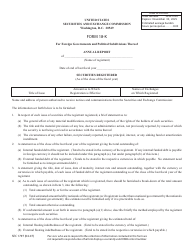

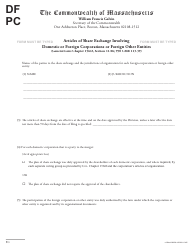

Annual Report for Domestic and Foreign Corporations - Massachusetts

Annual Report for Domestic and Foreign Corporations is a legal document that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is the Annual Report for Domestic and Foreign Corporations?

A: The Annual Report is a required filing for both domestic and foreign corporations in Massachusetts.

Q: Who needs to file an Annual Report?

A: Both domestic and foreign corporations registered in Massachusetts need to file an Annual Report.

Q: When is the Annual Report due?

A: The Annual Report is due by the anniversary date of the corporation's formation or registration in Massachusetts.

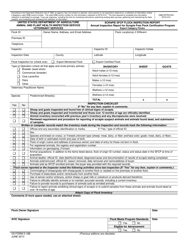

Q: What information is included in the Annual Report?

A: The Annual Report includes details about the corporation's officers, directors, and registered agent, as well as its principal office address.

Q: Is there a fee for filing the Annual Report?

A: Yes, there is a fee associated with filing the Annual Report. The fee amount varies depending on the corporation's authorized shares or par value.

Q: What happens if I don't file the Annual Report?

A: Failure to file the Annual Report can result in late fees, penalties, and potential administrative dissolution of the corporation.

Q: Can I request an extension for filing the Annual Report?

A: No, extensions are not granted for filing the Annual Report. It must be filed by the due date.

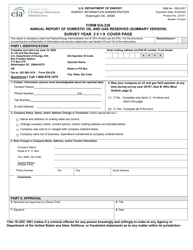

Form Details:

- Released on November 23, 2009;

- The latest edition currently provided by the Secretary of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.