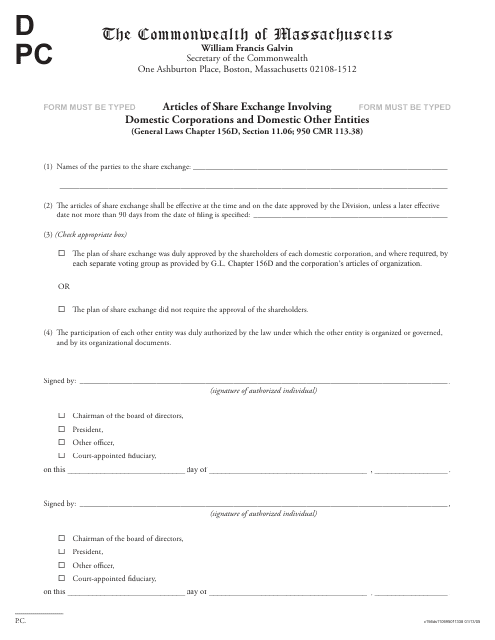

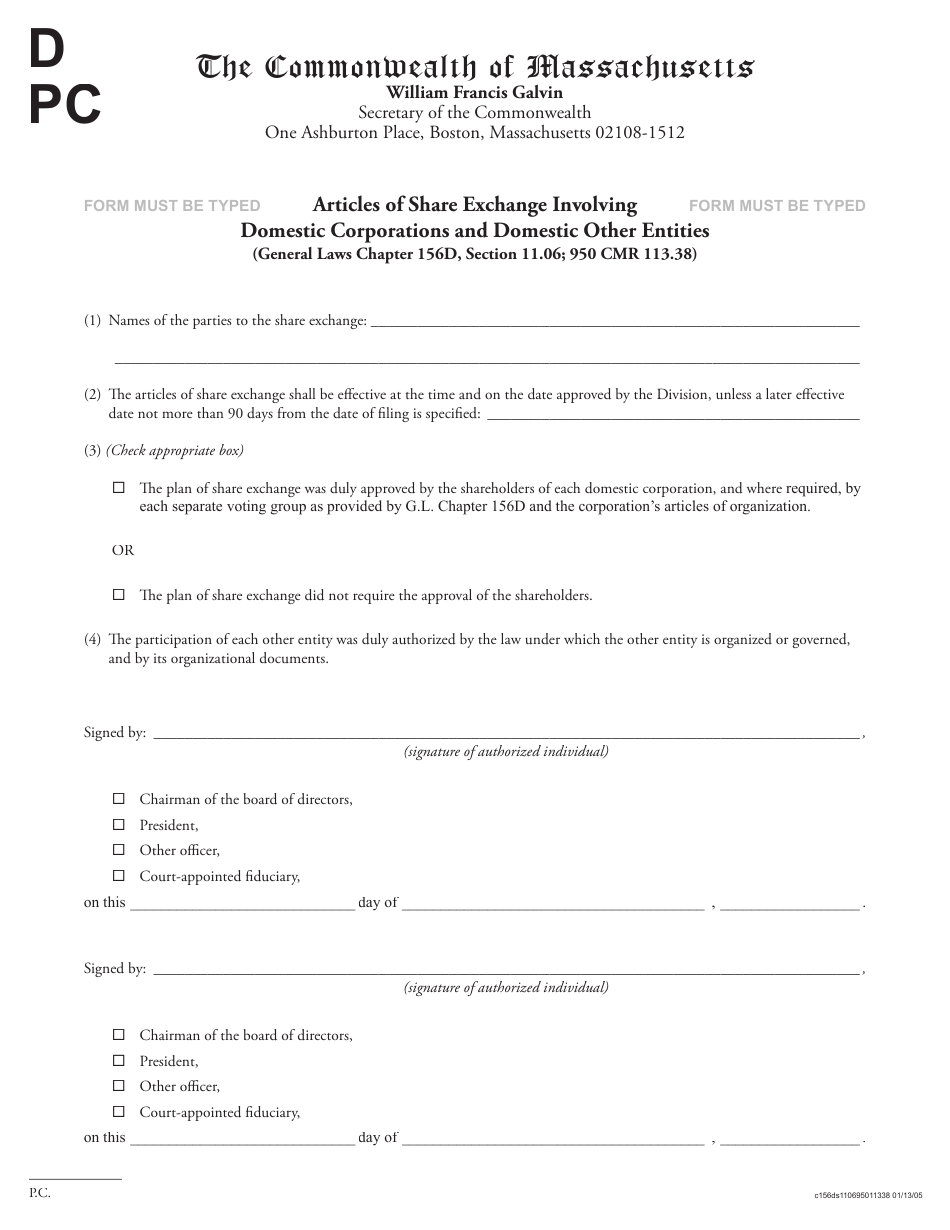

Articles of Share Exchange Involving Domestic Corporations and Domestic Other Entities - Massachusetts

Articles of Domestic Corporations and Domestic Other Entities is a legal document that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is a share exchange?

A: A share exchange is a transaction where one corporation or entity acquires the shares of another corporation or entity.

Q: What is the purpose of a share exchange?

A: The purpose of a share exchange is to facilitate the combination of two corporations or entities into one.

Q: What are the requirements for a share exchange in Massachusetts?

A: In Massachusetts, the shareholders of each corporation or entity involved in the share exchange must approve the transaction.

Q: Do both corporations involved in a share exchange have to be based in Massachusetts?

A: Yes, both corporations or entities involved in a share exchange in Massachusetts must be domestic, meaning they are formed under Massachusetts law.

Q: Is there any limitation on the types of entities that can engage in a share exchange in Massachusetts?

A: In Massachusetts, both corporations and other entities, such as partnerships or limited liability companies, can engage in a share exchange.

Q: Can a share exchange be used for mergers between corporations?

A: Yes, a share exchange can be used as a method of merging two corporations.

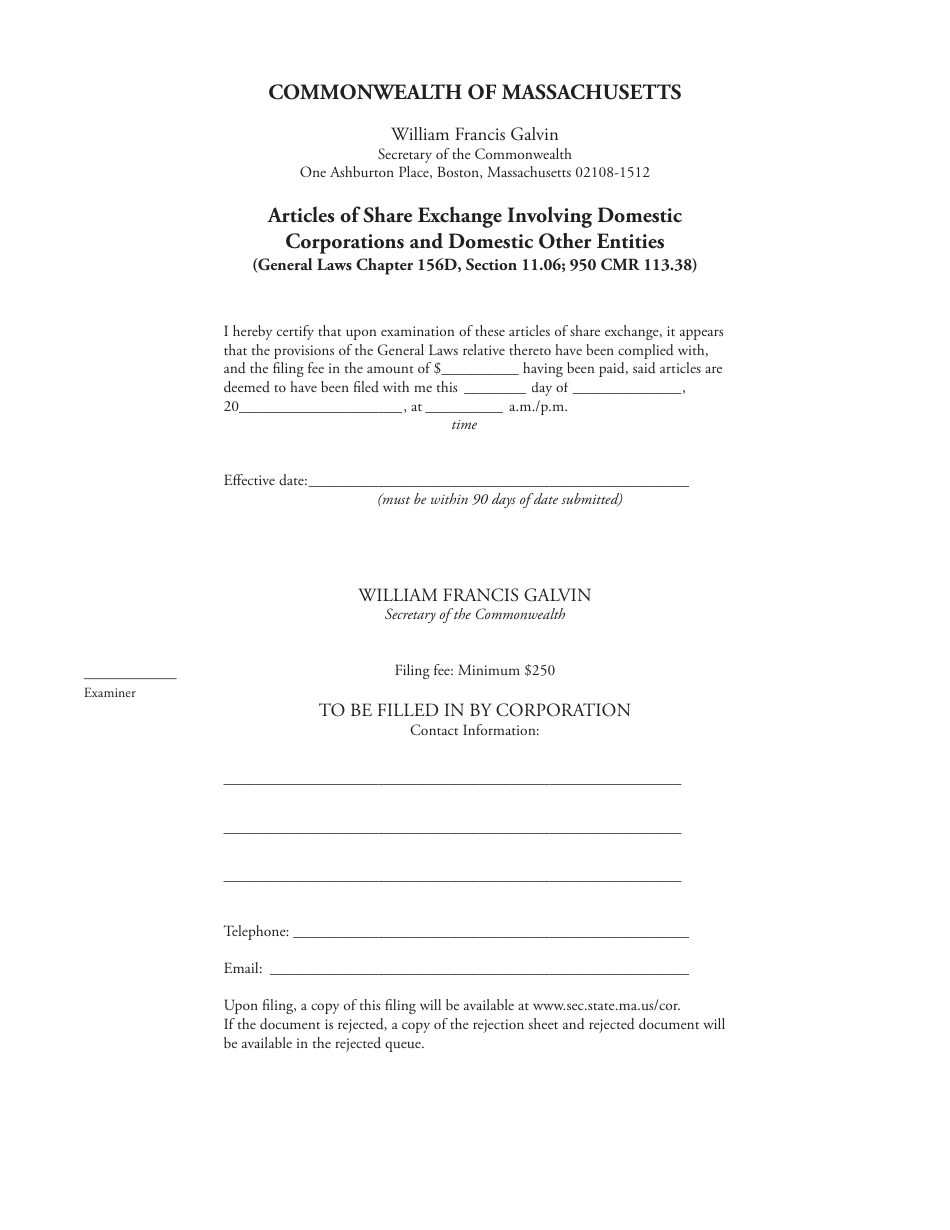

Q: Are there any filing requirements for a share exchange in Massachusetts?

A: Yes, both corporations involved in a share exchange in Massachusetts must file certain documents with the Secretary of the Commonwealth.

Q: Can the shareholders of a corporation involved in a share exchange dissent from the transaction?

A: Yes, shareholders of a corporation involved in a share exchange have the right to dissent from the transaction and demand payment for their shares.

Q: What happens to the shares of the acquired corporation in a share exchange?

A: In a share exchange, the shares of the acquired corporation are generally cancelled or converted into shares of the acquiring corporation.

Q: Can a share exchange result in tax consequences for the shareholders?

A: Yes, a share exchange can have tax consequences for the shareholders of the corporations involved, and it is recommended to seek professional tax advice.

Form Details:

- Released on January 13, 2005;

- The latest edition currently provided by the Secretary of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.