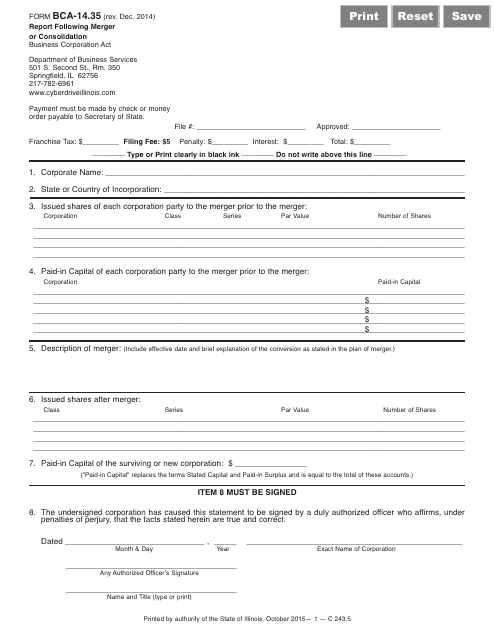

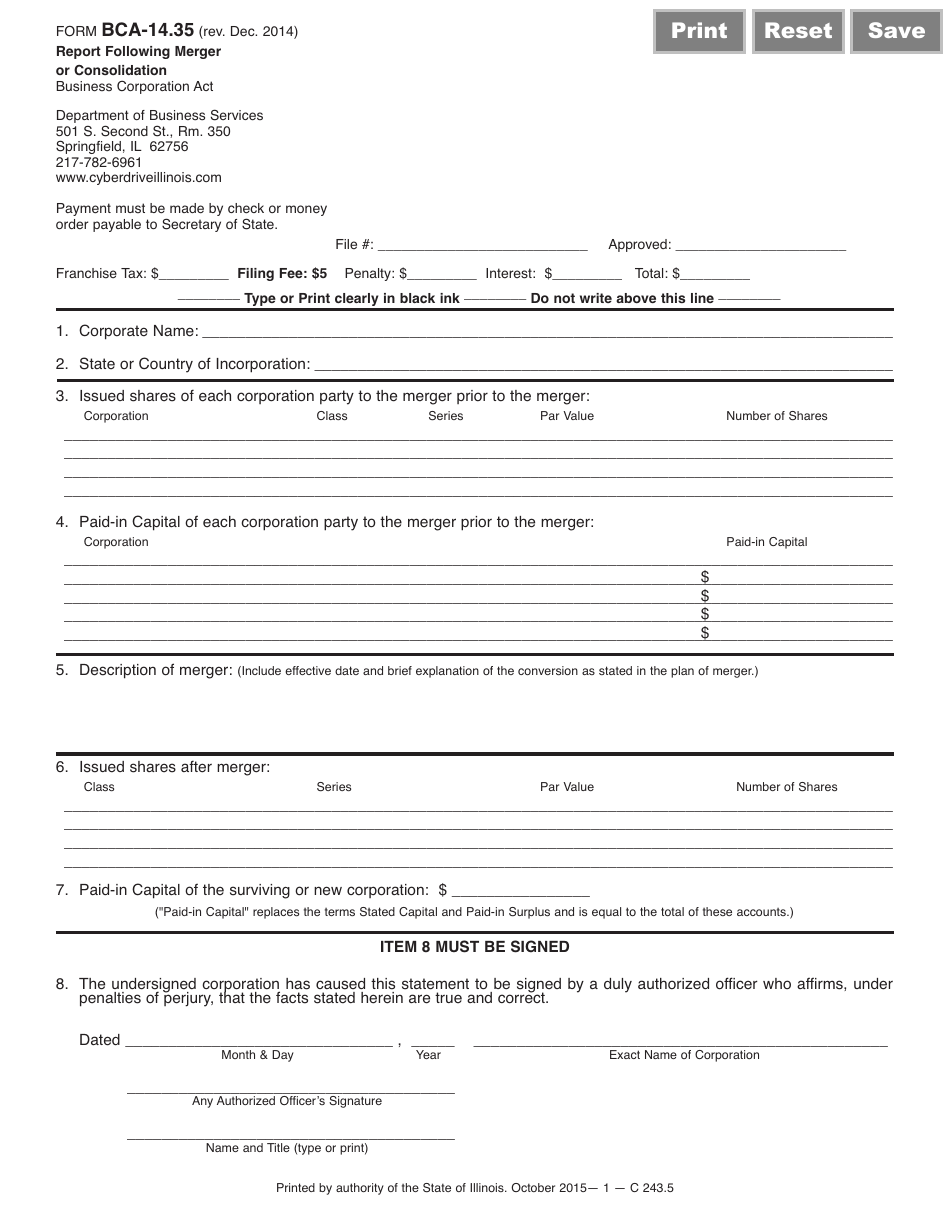

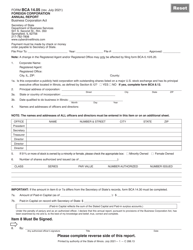

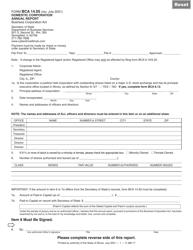

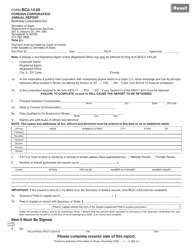

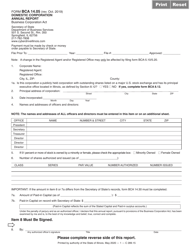

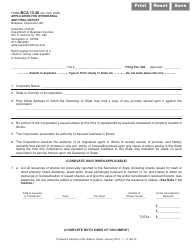

Form BCA-14.35 Report Following Merger or Consolidation - Illinois

What Is Form BCA-14.35?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BCA-14.35?

A: Form BCA-14.35 is a report that needs to be filed following a merger or consolidation in the state of Illinois.

Q: When do I need to file Form BCA-14.35?

A: You need to file Form BCA-14.35 after completing a merger or consolidation in Illinois.

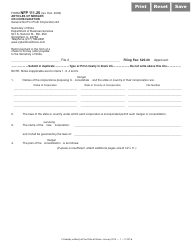

Q: What information is required on Form BCA-14.35?

A: Form BCA-14.35 requires information about the merging or consolidating entities, the effective date of the merger or consolidation, and other details.

Q: Are there any penalties for not filing Form BCA-14.35?

A: Yes, there may be penalties for not filing Form BCA-14.35, such as late fees or other consequences.

Q: Do I need to file Form BCA-14.35 if the merger or consolidation took place in another state?

A: No, Form BCA-14.35 is specific to mergers or consolidations in the state of Illinois. You should consult the relevant state's requirements for filing after a merger or consolidation.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BCA-14.35 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.