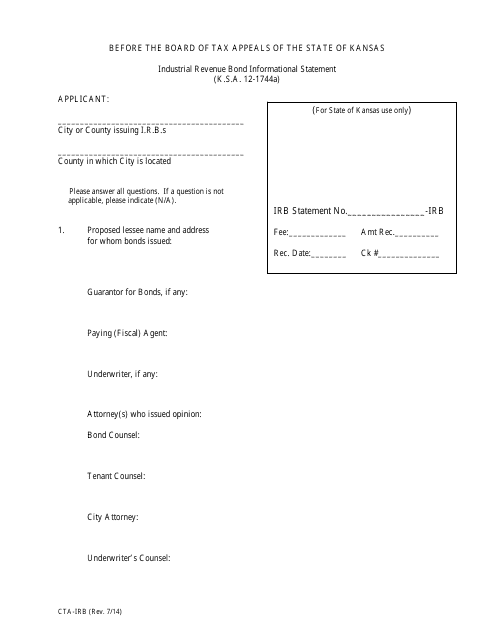

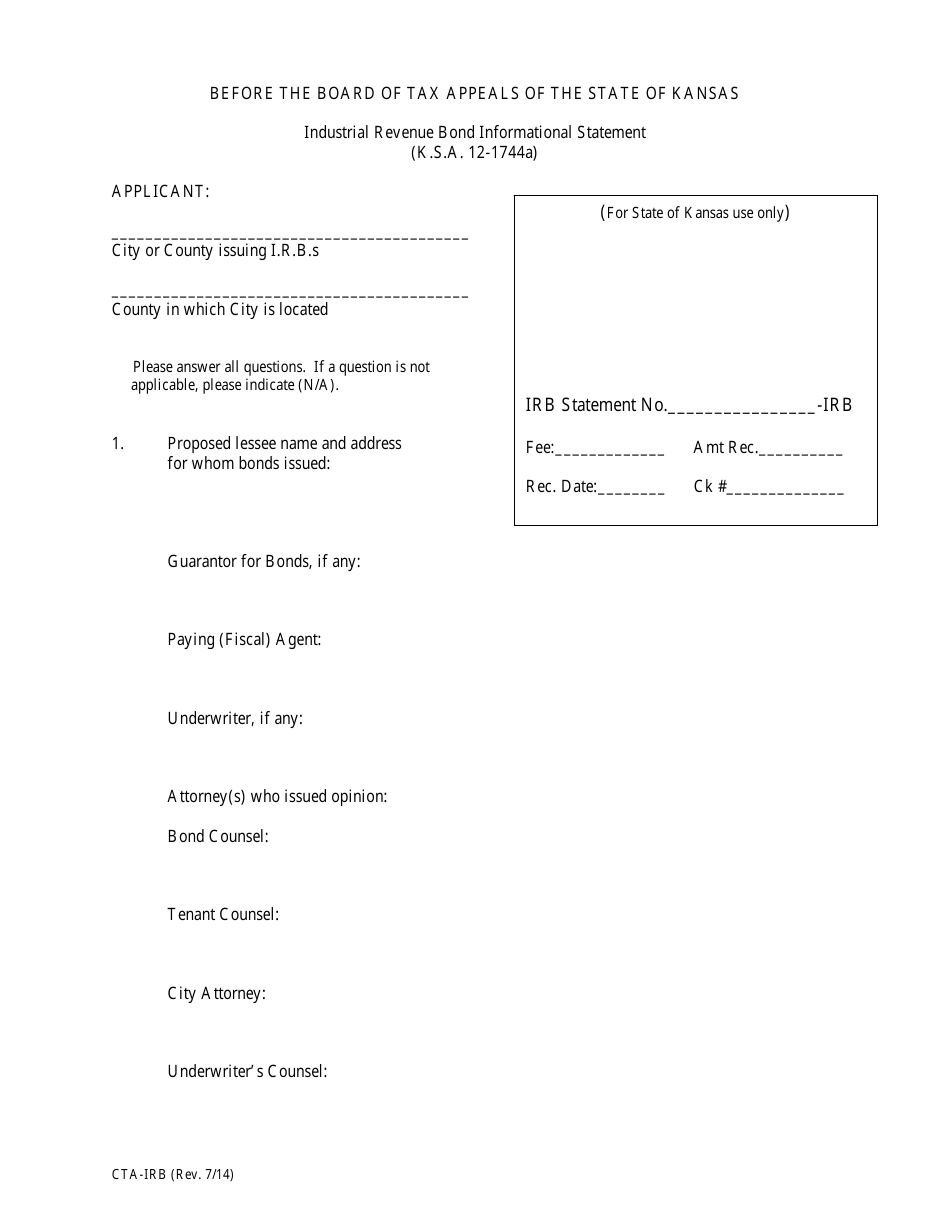

Form CTA-IRB Industrial Revenue Bond Informational Statement - Kansas

What Is Form CTA-IRB?

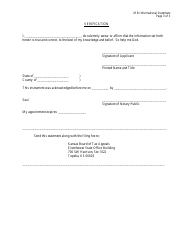

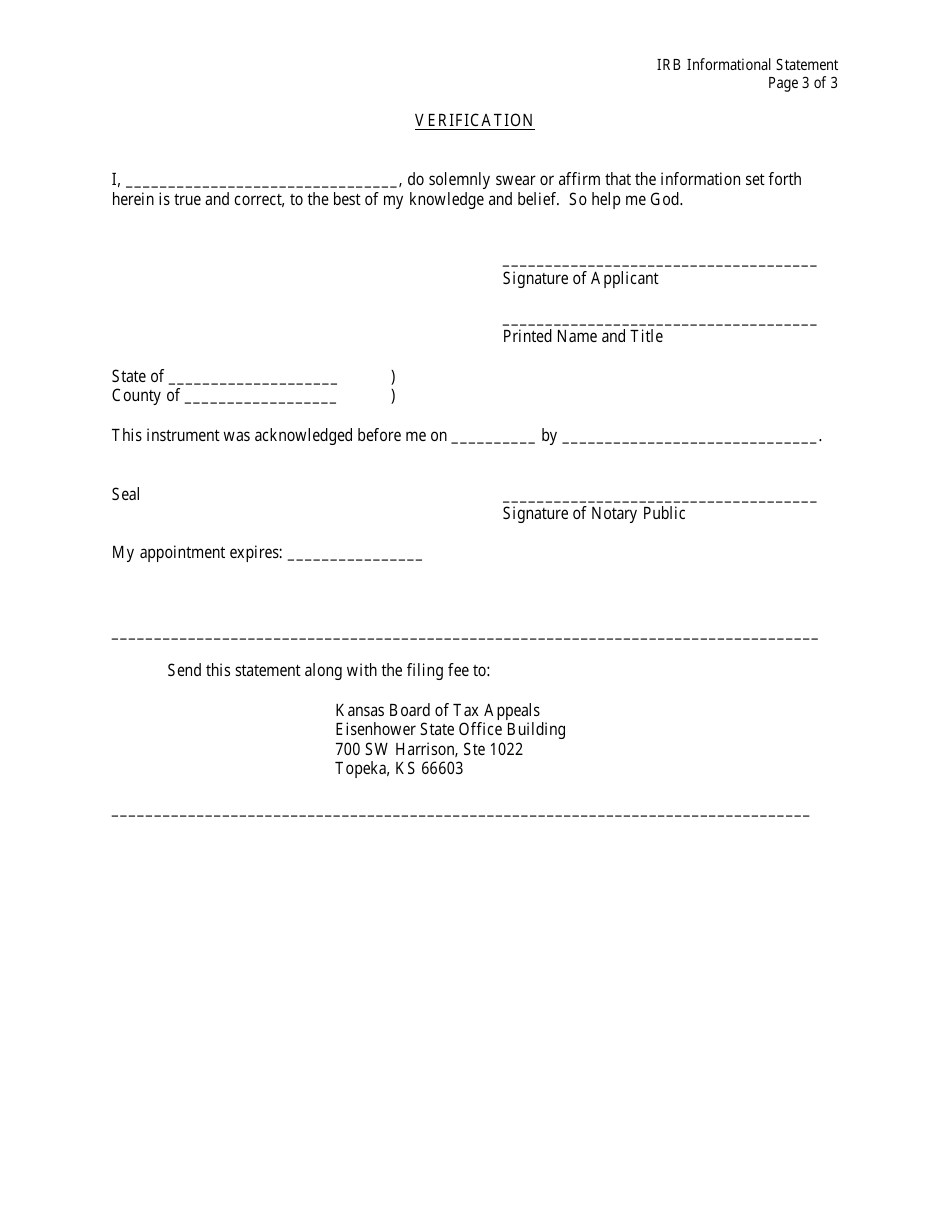

This is a legal form that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CTA-IRB?

A: CTA-IRB stands for Industrial Revenue Bond, which is a type of financing tool used by municipalities to stimulate economic development.

Q: What is the purpose of the CTA-IRB Industrial Revenue Bond Informational Statement?

A: The purpose of this statement is to provide information about the industrial revenue bond and its potential impact on the community.

Q: Who is required to file the CTA-IRB Industrial Revenue Bond Informational Statement?

A: The entity proposing the issuance of the industrial revenue bond is required to file this statement.

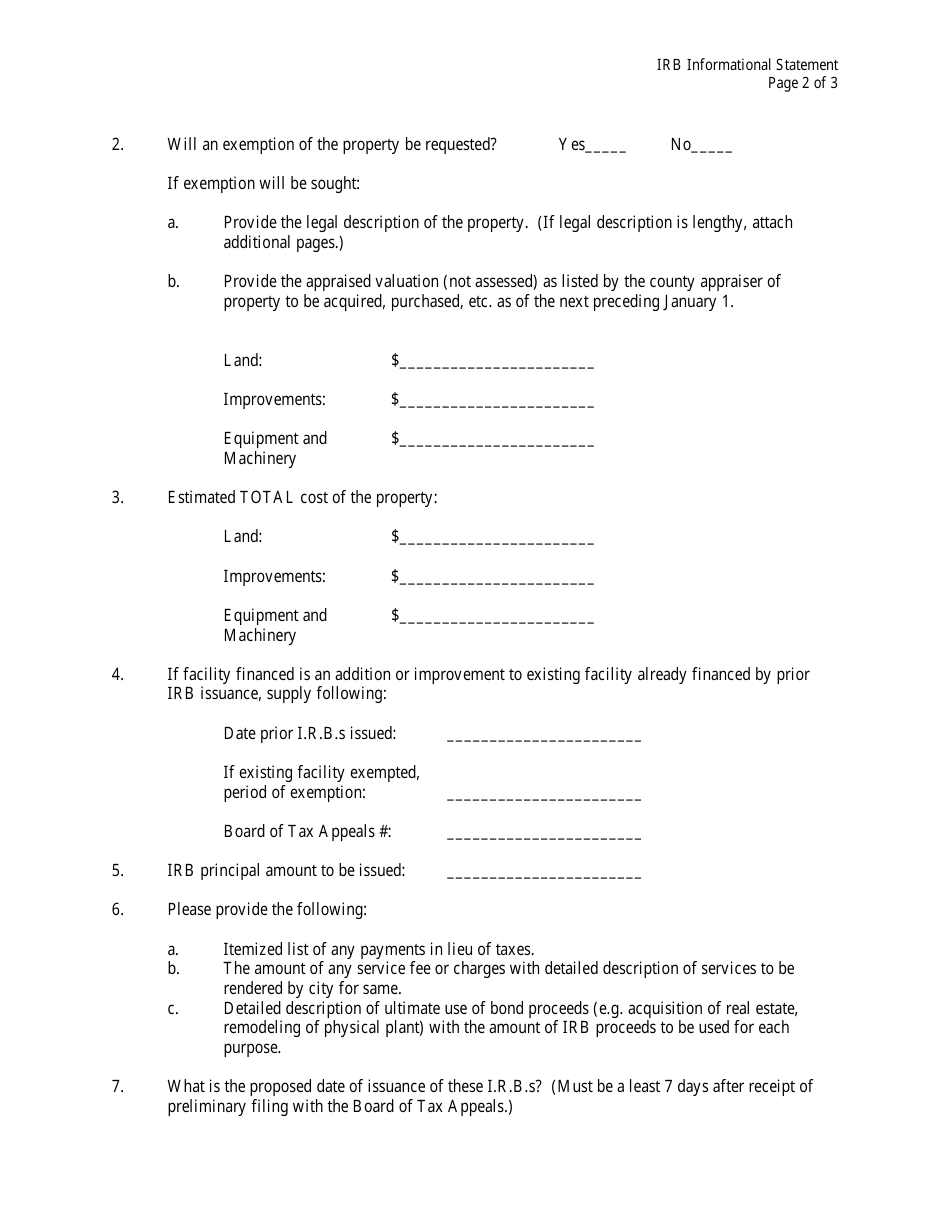

Q: What information should be included in the CTA-IRB Industrial Revenue Bond Informational Statement?

A: The statement should include details about the proposed project, its economic impact, benefits to the community, and any potential risks or issues.

Q: Is there a deadline for filing the CTA-IRB Industrial Revenue Bond Informational Statement?

A: Yes, the statement must be filed at least ten days before the governing body considers the issuance of the industrial revenue bond.

Q: Are there any fees associated with filing the CTA-IRB Industrial Revenue Bond Informational Statement?

A: Yes, there is a filing fee that must be paid at the time of submission.

Q: What is the role of the governing body in reviewing the CTA-IRB Industrial Revenue Bond Informational Statement?

A: The governing body will review the statement to assess the potential economic impact, benefits, and risks of the proposed project.

Q: Can the governing body approve or deny the issuance of the CTA-IRB based on the information provided in the statement?

A: Yes, the governing body can approve or deny the issuance based on its assessment of the information provided in the statement.

Q: Are there any requirements for public notice and hearing regarding the CTA-IRB Industrial Revenue Bond?

A: Yes, public notice must be given at least ten days before the hearing, and a public hearing must be held to allow input from the community.

Q: Are there any limitations on the issuance of CTA-IRB Industrial Revenue Bonds?

A: Yes, there are certain limitations, such as the maximum amount of bonds that can be issued, the purpose for which the proceeds can be used, and the repayment terms of the bonds.

Q: What happens if the CTA-IRB Industrial Revenue Bond is approved?

A: If approved, the bond will be issued, and the proceeds can be used to fund the proposed project.

Q: Is there an appeals process if the CTA-IRB Industrial Revenue Bond is denied?

A: Yes, if the bond is denied, the entity proposing the bond can appeal the decision to the district court.

Q: Is the information provided in the CTA-IRB Industrial Revenue Bond Informational Statement public record?

A: Yes, the information provided in the statement is considered public record and can be accessed by the public.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Kansas Board of Tax Appeals;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CTA-IRB by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.