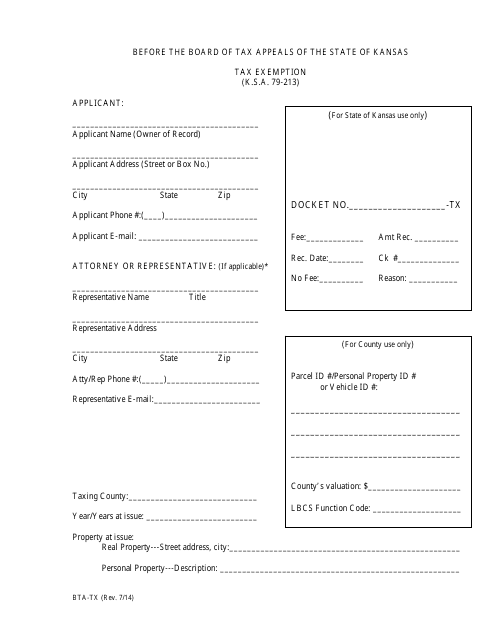

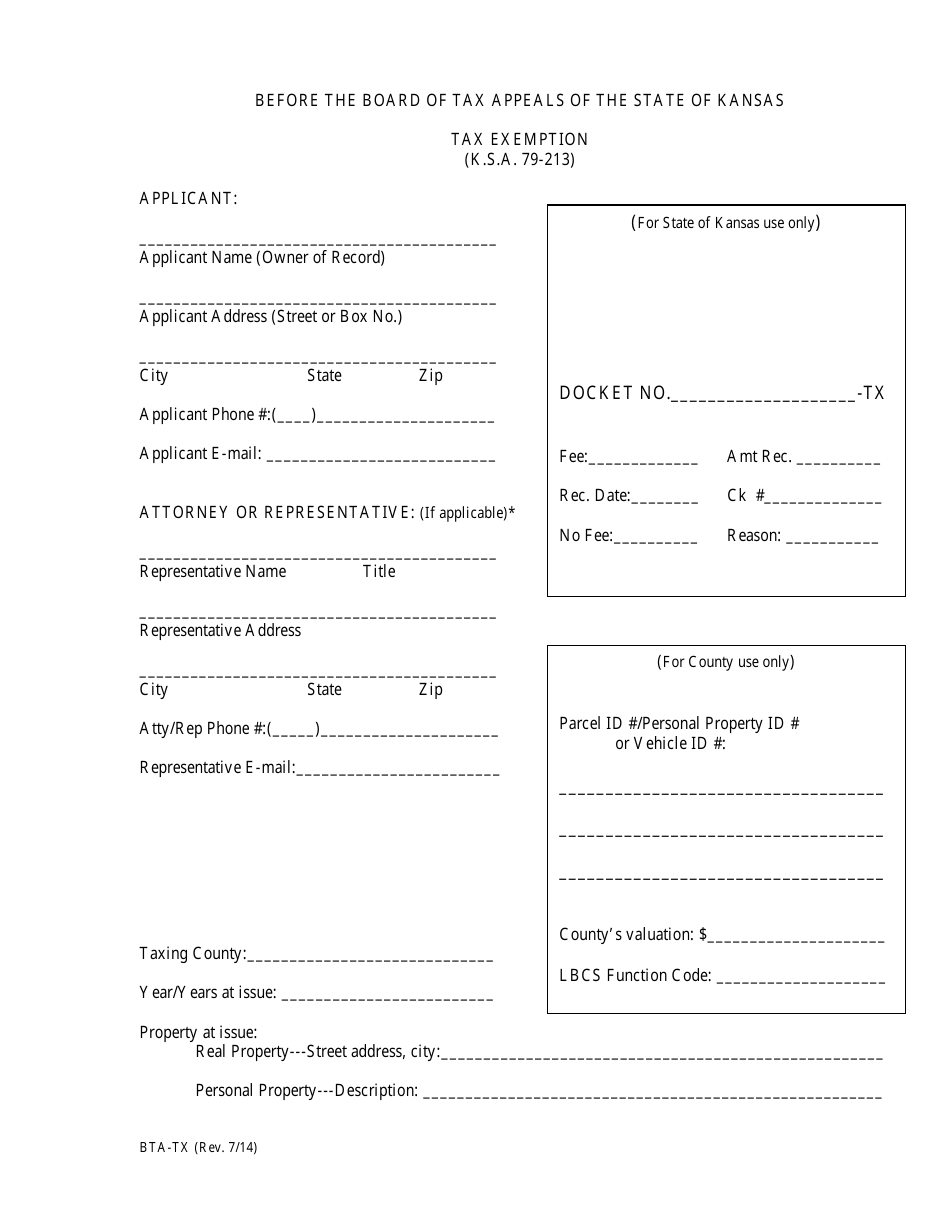

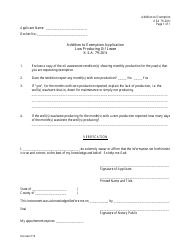

Form BTA-TX Tax Exemption Application - Kansas

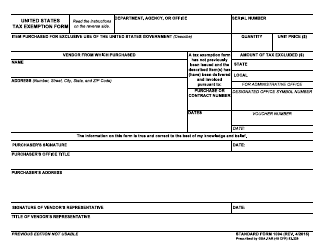

What Is Form BTA-TX?

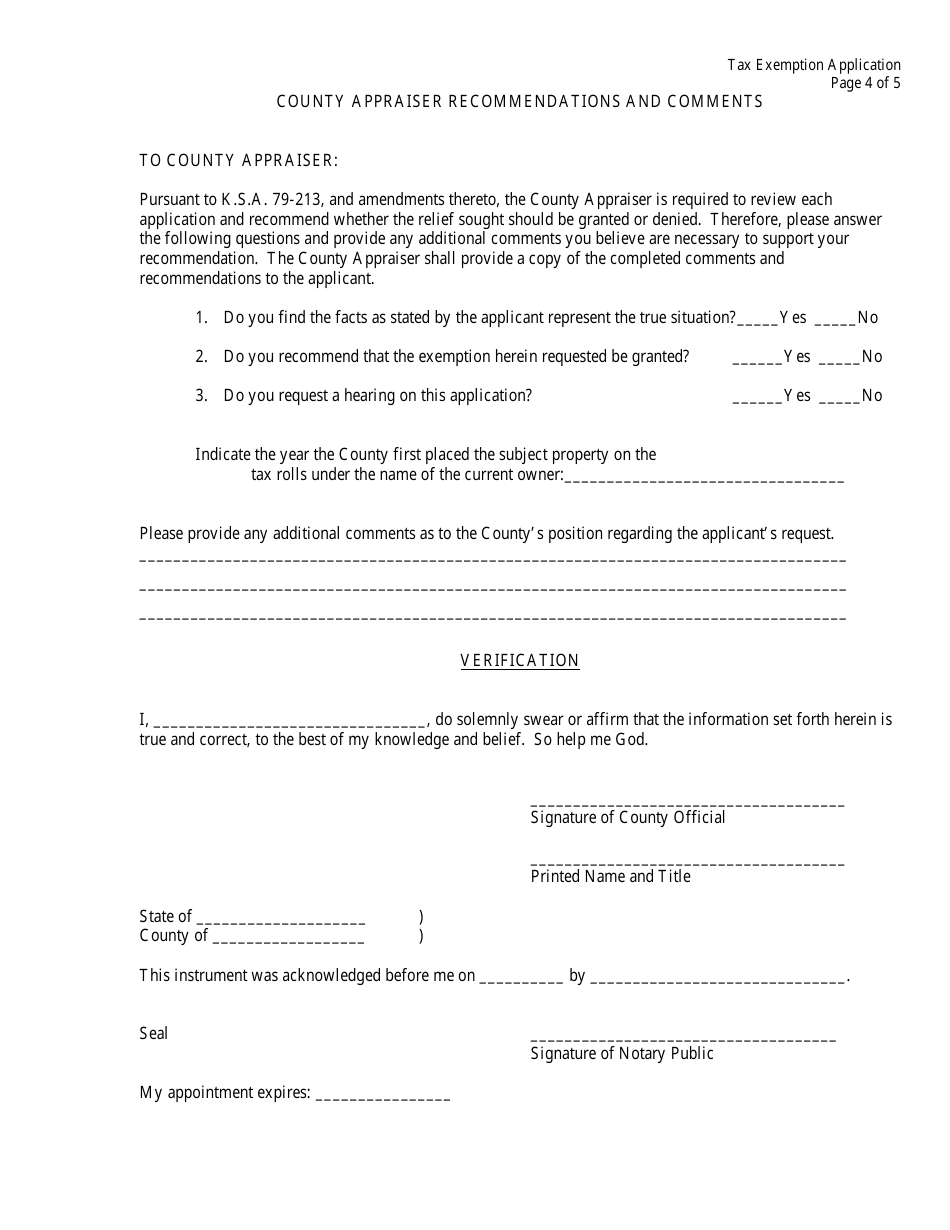

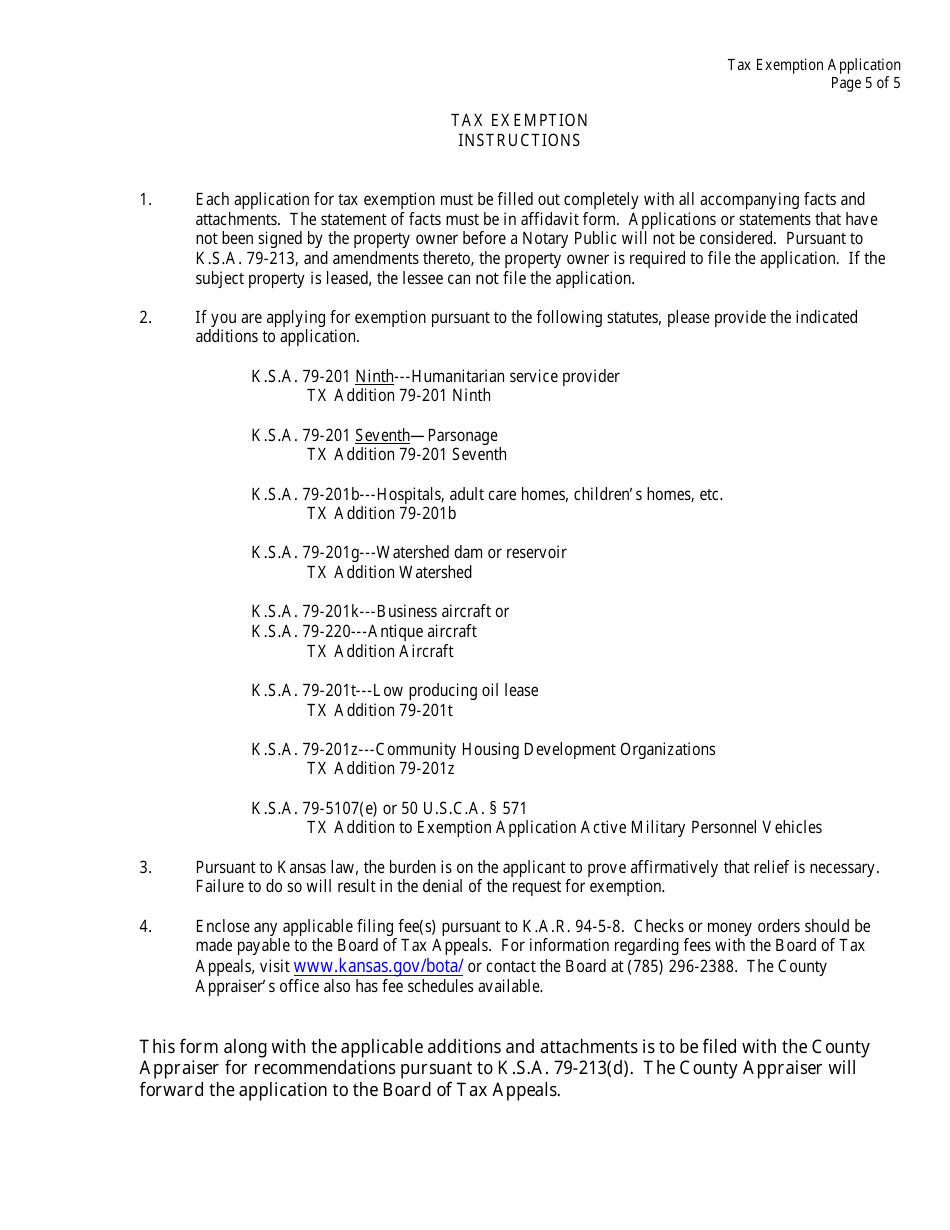

This is a legal form that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the BTA-TX Tax Exemption Application?

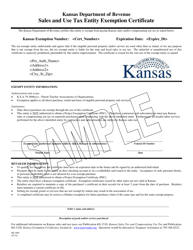

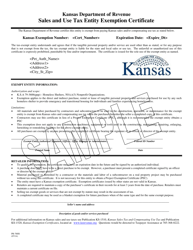

A: The BTA-TX Tax Exemption Application is a form used to apply for a tax exemption in the state of Kansas.

Q: Who needs to fill out this form?

A: Individuals and organizations seeking a tax exemption in Kansas need to fill out this form.

Q: What is the purpose of the tax exemption?

A: The tax exemption is meant to provide relief from certain taxes for eligible individuals and organizations in Kansas.

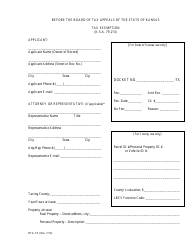

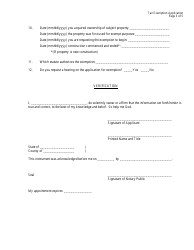

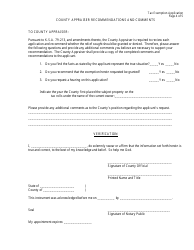

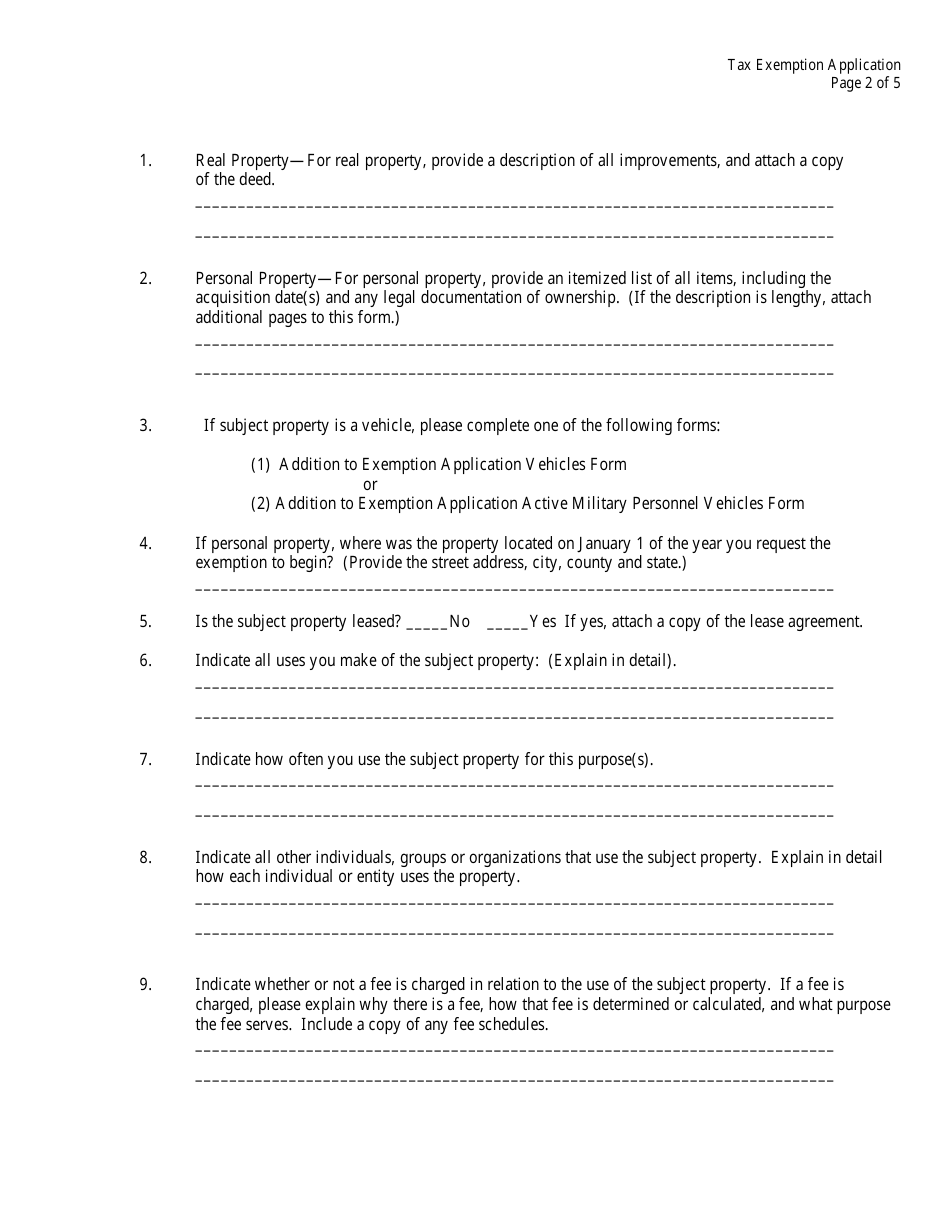

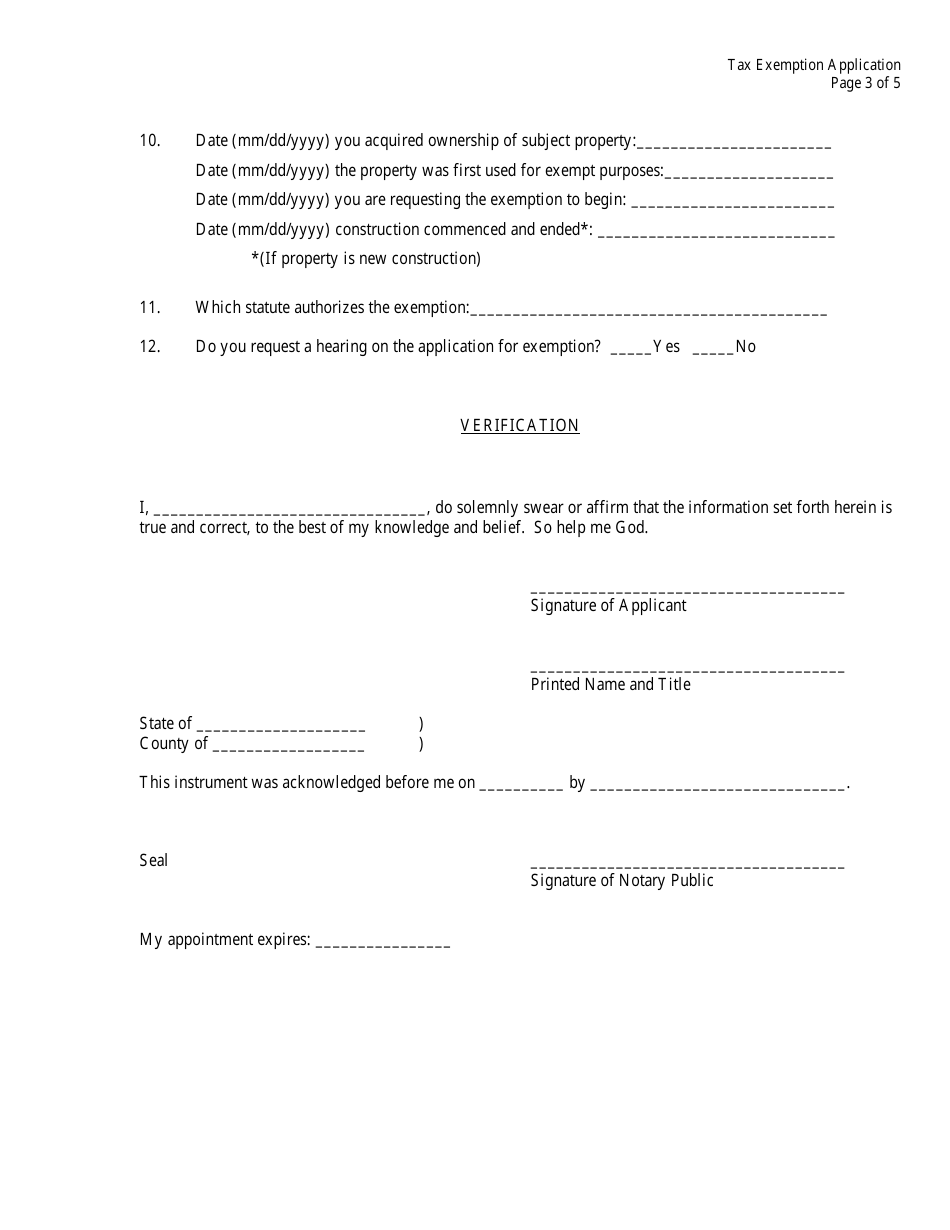

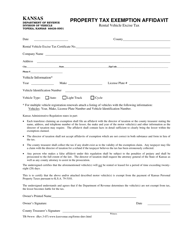

Q: What information do I need to provide on the form?

A: The form requires you to provide information about yourself or your organization, as well as details about the nature of your tax exemption request.

Q: Are there any fees associated with the application?

A: There may be fees associated with the application. You should check the instructions on the form or contact the Kansas Department of Revenue for more information.

Q: How long does it take to process the application?

A: The processing time for the application will vary. It is recommended to submit the application well in advance of any deadlines or tax due dates.

Q: What should I do if my application is denied?

A: If your application is denied, you may have the option to appeal the decision. Contact the Kansas Department of Revenue for guidance on the appeals process.

Q: Is the tax exemption permanent?

A: The tax exemption may be granted for a specific period of time or may be permanent, depending on the nature of your request and the decision of the Kansas Department of Revenue.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Kansas Board of Tax Appeals;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BTA-TX by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.