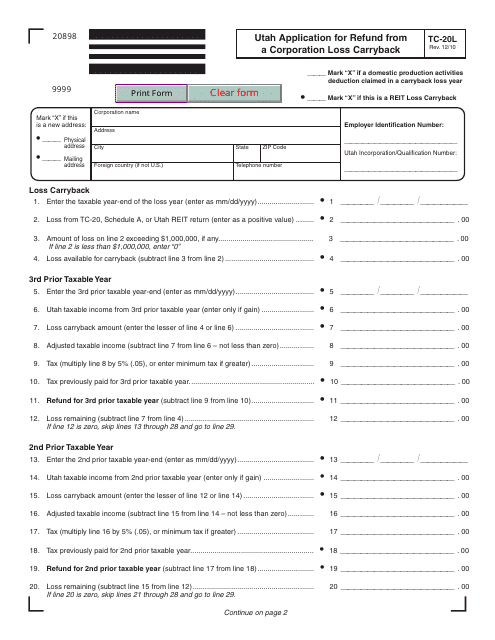

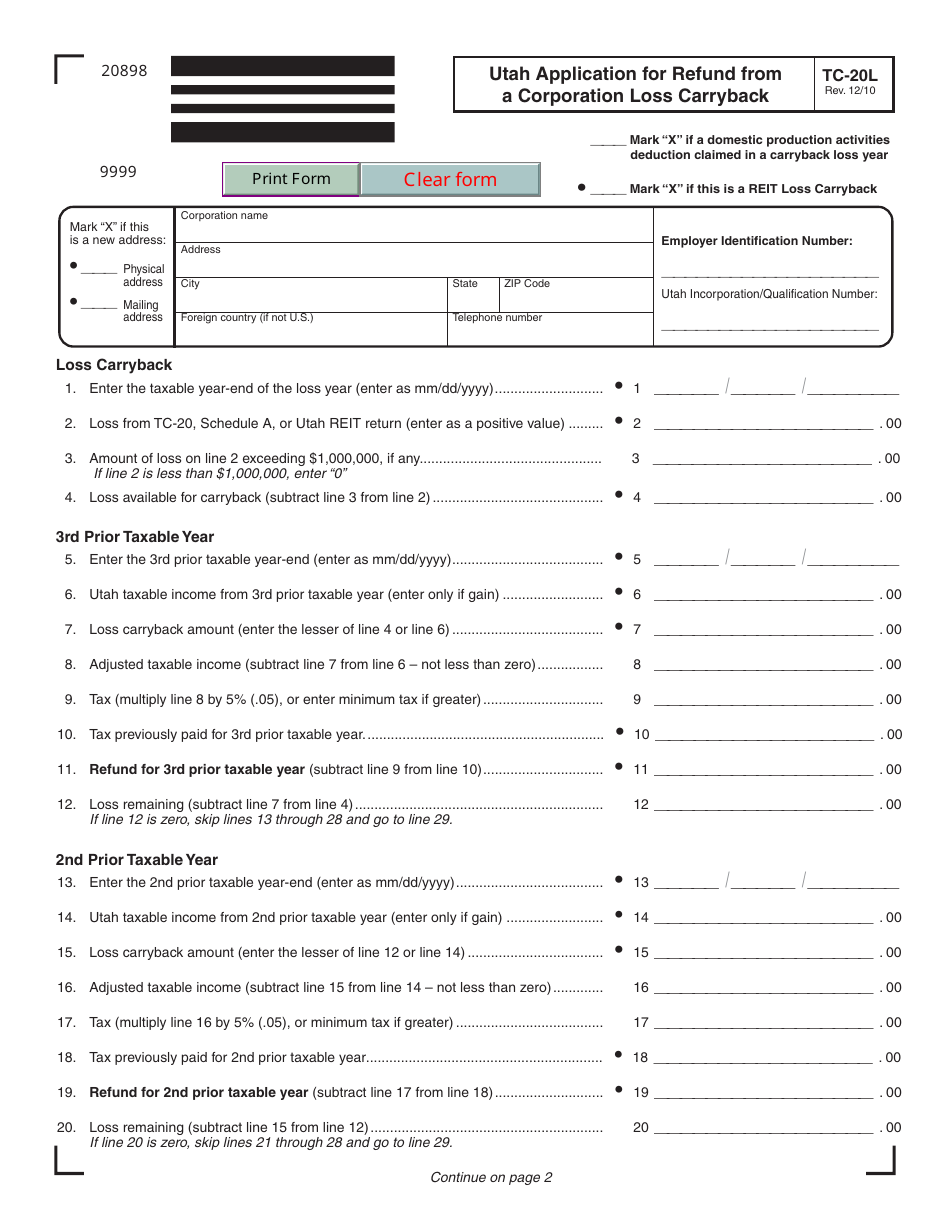

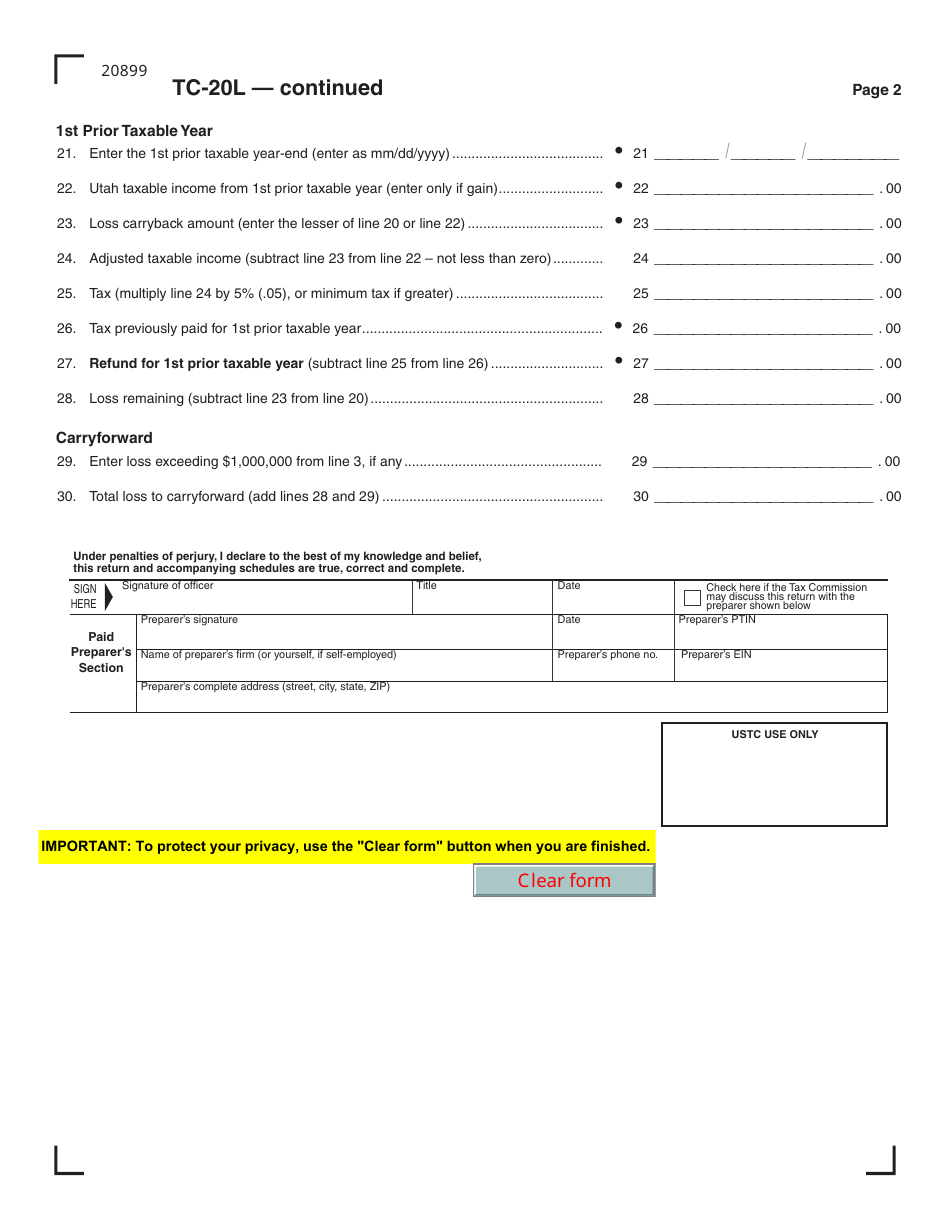

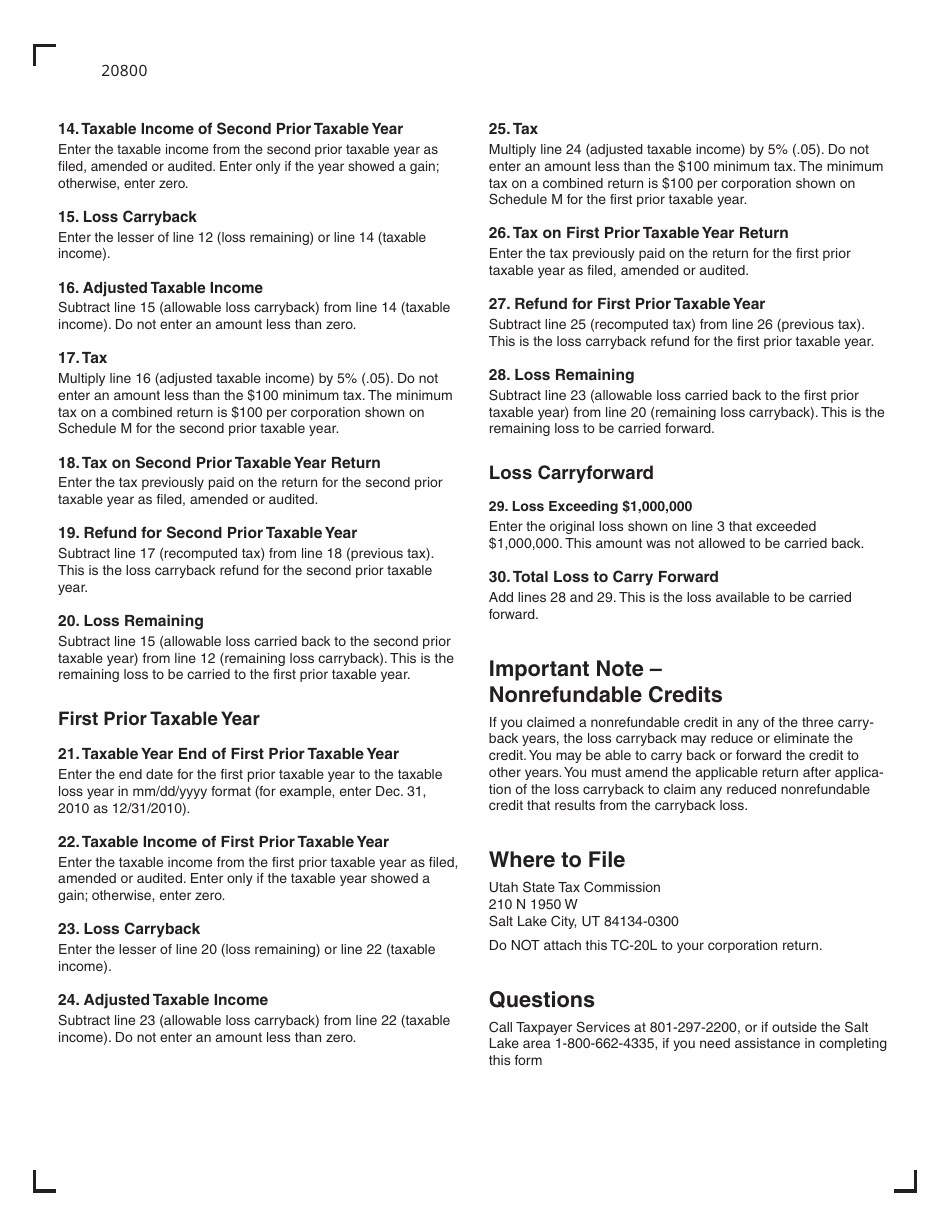

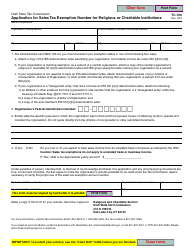

Form TC-20L Utah Application for Refund From a Corporation Loss Carryback - Utah

What Is Form TC-20L?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-20L?

A: Form TC-20L is an application for refund from a corporation loss carryback in Utah.

Q: Who can use Form TC-20L?

A: Form TC-20L can be used by corporations in Utah who want to apply for a refund by carrying back a loss.

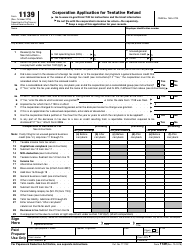

Q: What is a corporation loss carryback?

A: A corporation loss carryback refers to applying a loss from one year to offset income from a previous year, which can result in a refund of taxes paid.

Q: What information is required on Form TC-20L?

A: Form TC-20L requires information such as the corporation's name, federal employer identification number, tax year, and details of the loss being carried back.

Q: Is there a deadline to file Form TC-20L?

A: Yes, Form TC-20L must be filed within three years from the original due date of the return or within one year from the date the tax was paid, whichever is later.

Q: Are there any fees associated with filing Form TC-20L?

A: There are no filing fees associated with Form TC-20L.

Q: How long does it take to receive a refund after filing Form TC-20L?

A: The processing time for a refund after filing Form TC-20L can vary, but it generally takes several weeks to several months.

Q: Can I file Form TC-20L electronically?

A: No, at the time of writing this document, Form TC-20L can only be filed by mail.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-20L by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.