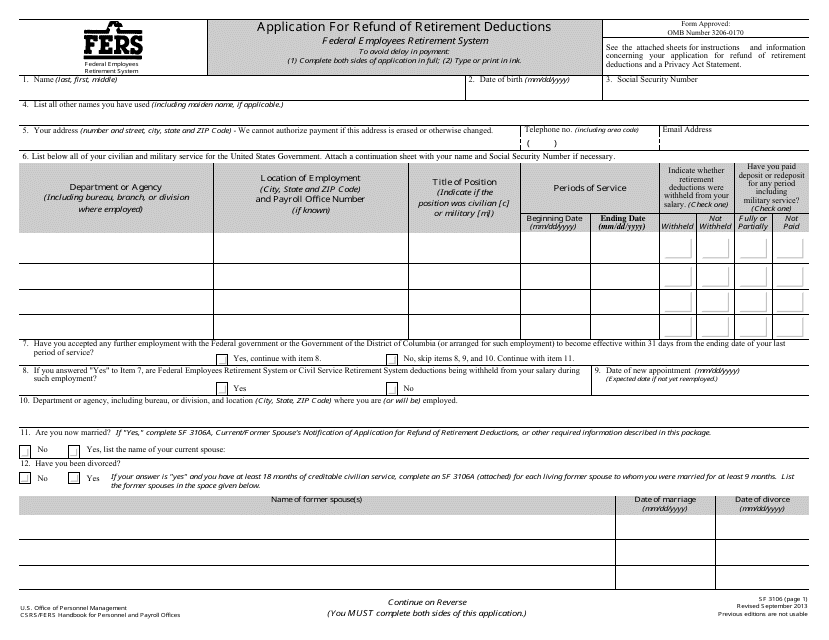

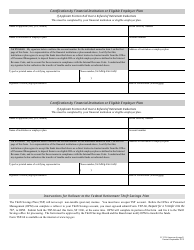

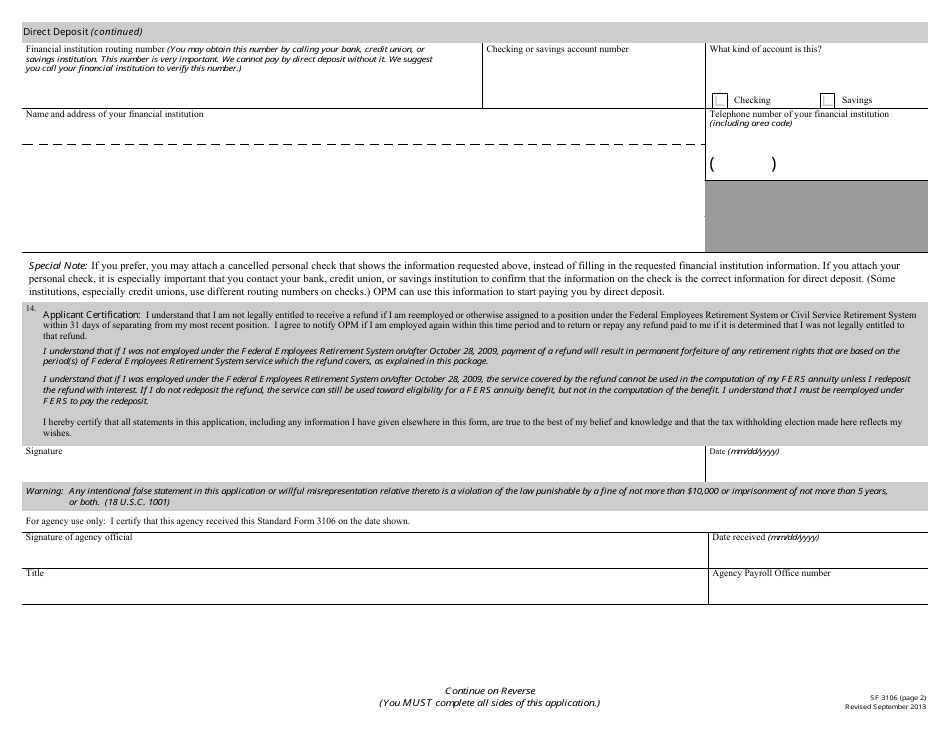

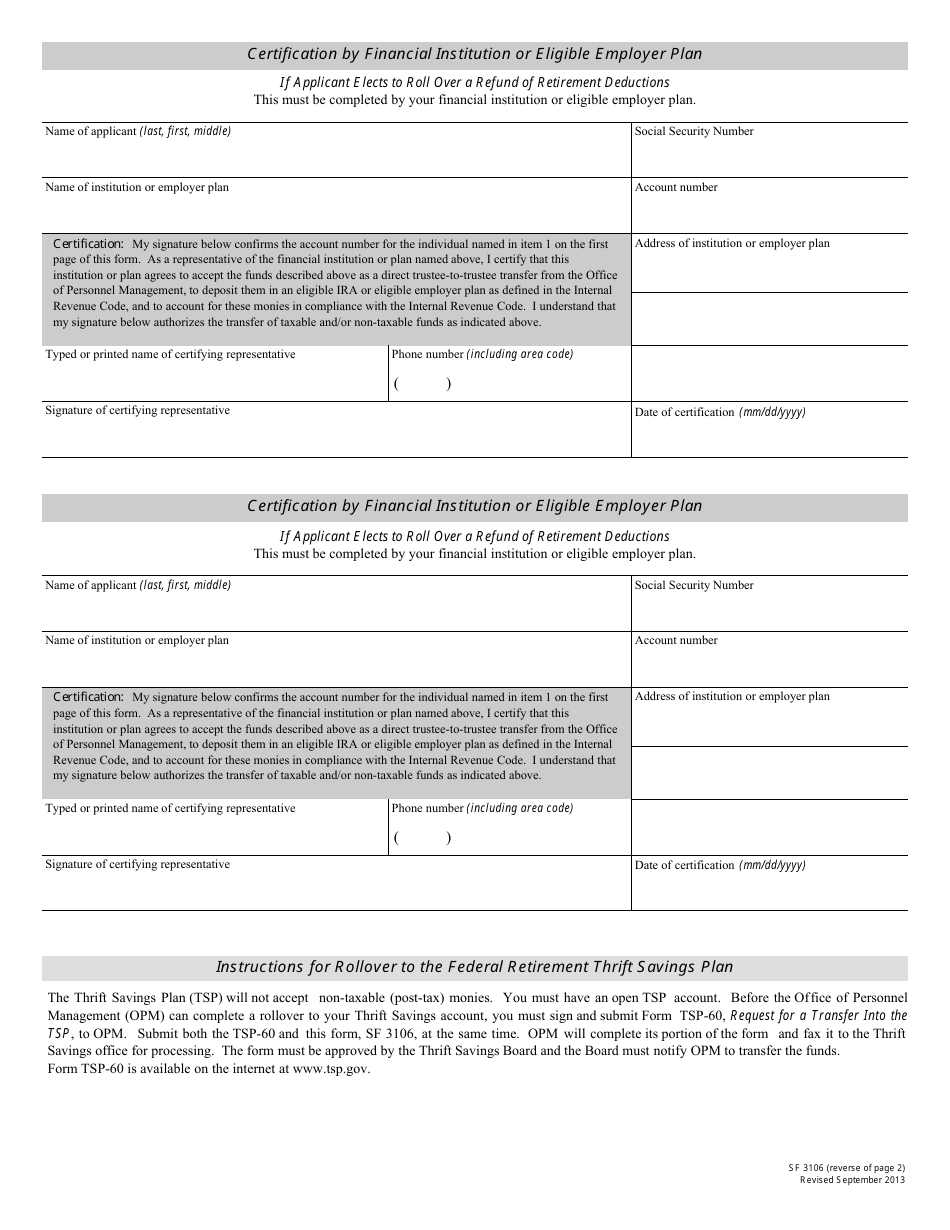

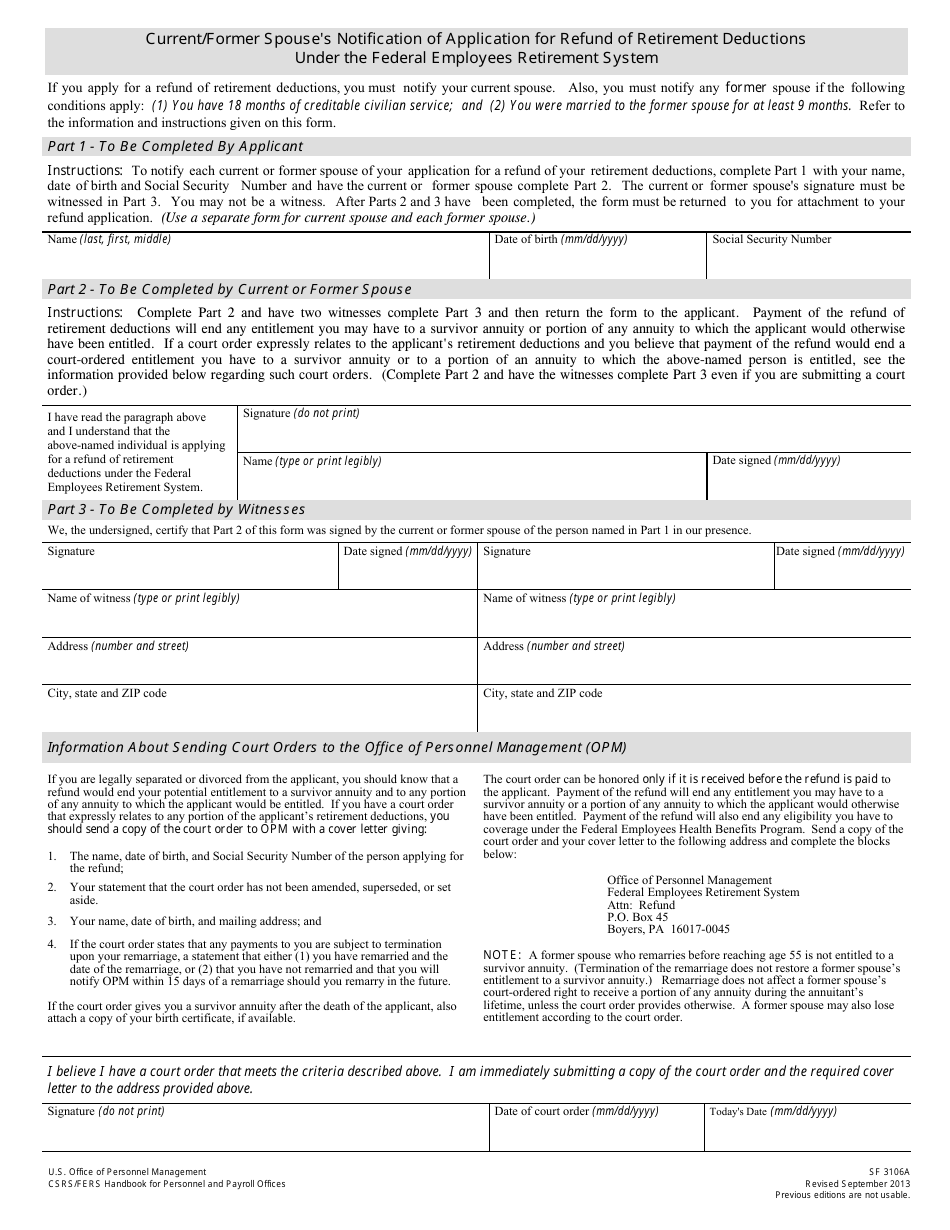

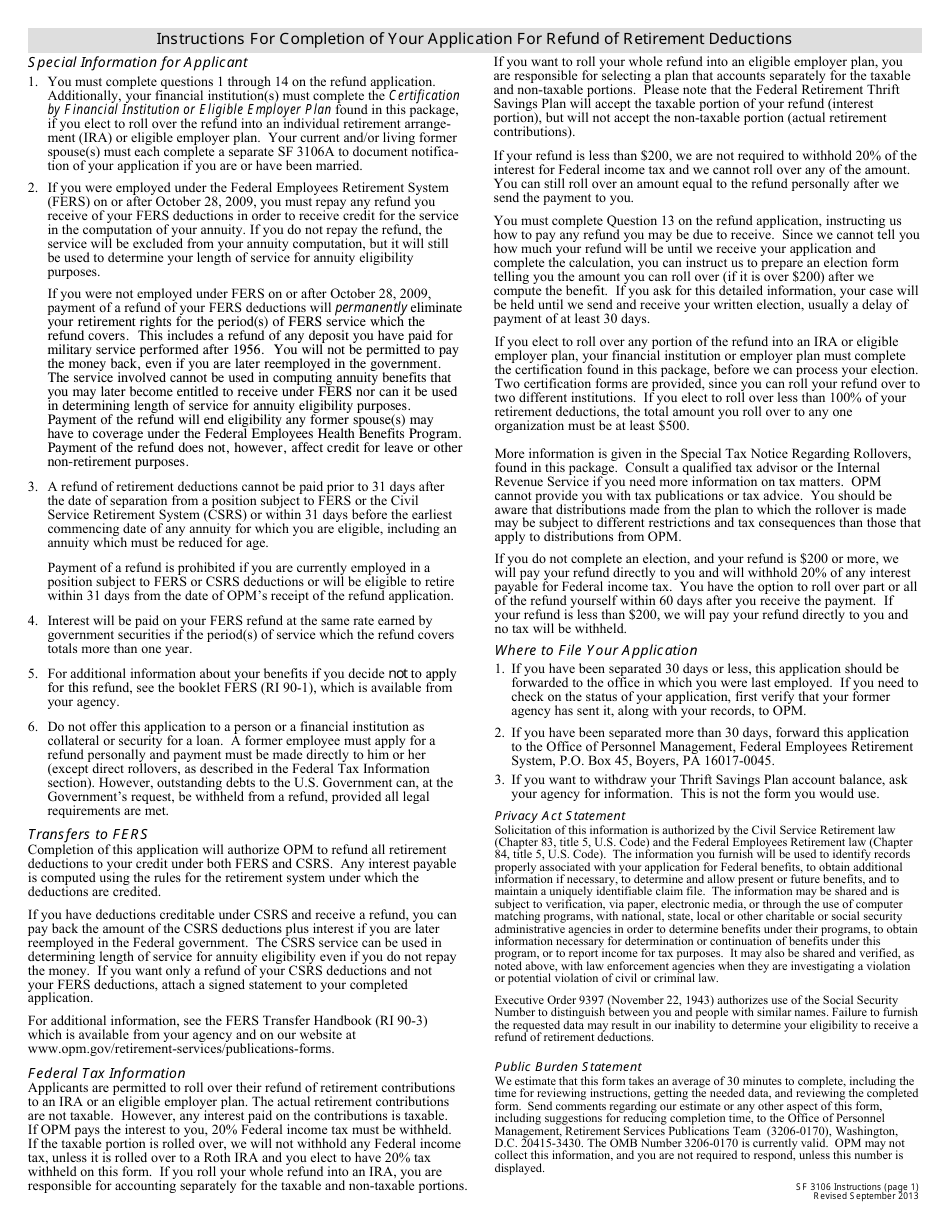

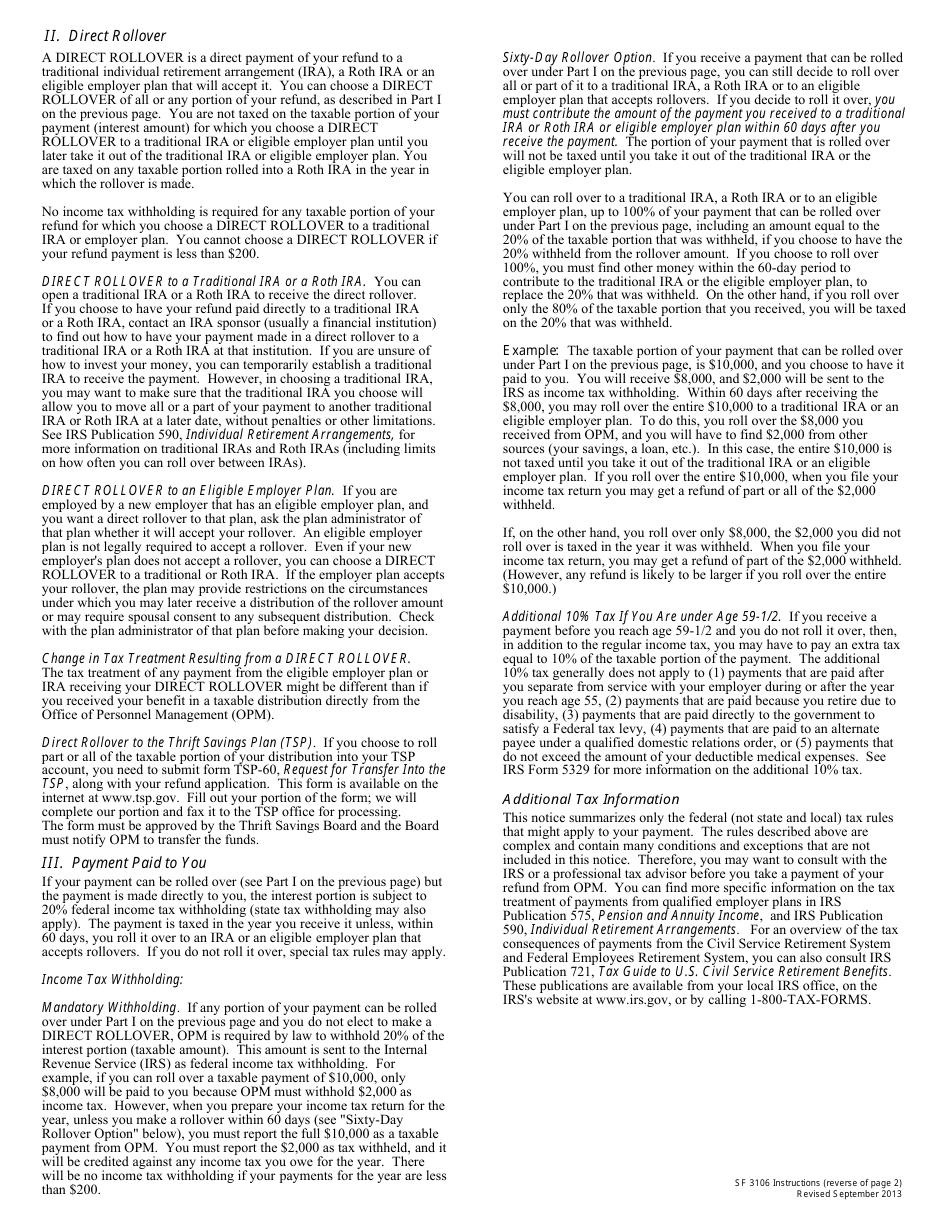

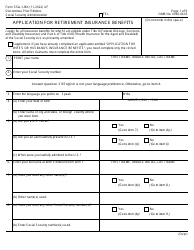

OPM Form SF3106 Application for Refund of Retirement Deductions

What Is OPM Form SF3106?

This is a legal form that was released by the U.S. Office of Personnel Management on September 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OPM Form SF3106?

A: OPM Form SF3106 is an application for refund of retirement deductions.

Q: Who can use OPM Form SF3106?

A: Federal employees who are eligible for a refund of their retirement deductions can use OPM Form SF3106.

Q: What is the purpose of OPM Form SF3106?

A: The purpose of OPM Form SF3106 is to apply for a refund of retirement deductions made by federal employees.

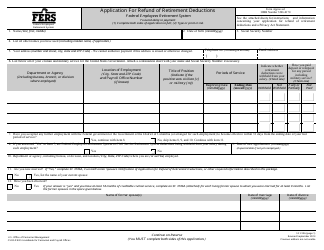

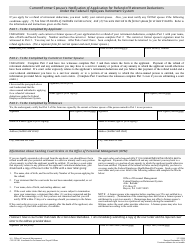

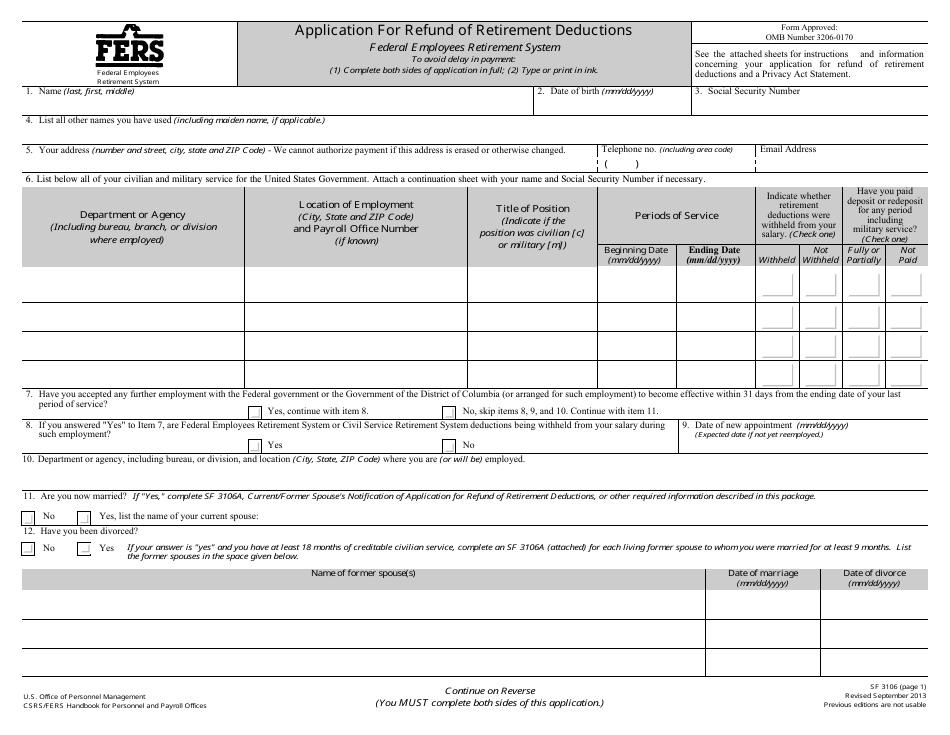

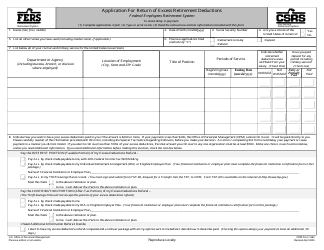

Q: What information is required on OPM Form SF3106?

A: OPM Form SF3106 requires information such as your personal details, employment history, and retirement plan information.

Q: How long does it take to process OPM Form SF3106?

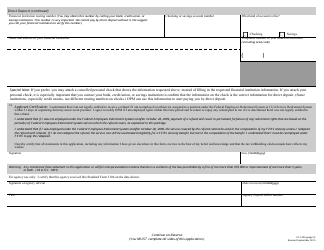

A: The processing time for OPM Form SF3106 can vary, but it typically takes several weeks to several months.

Q: What happens after I submit OPM Form SF3106?

A: After you submit OPM Form SF3106, the Office of Personnel Management (OPM) will review your application and process your refund if you are eligible.

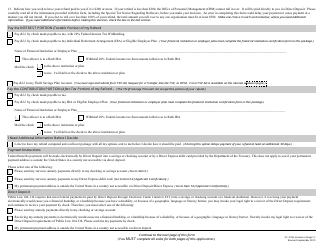

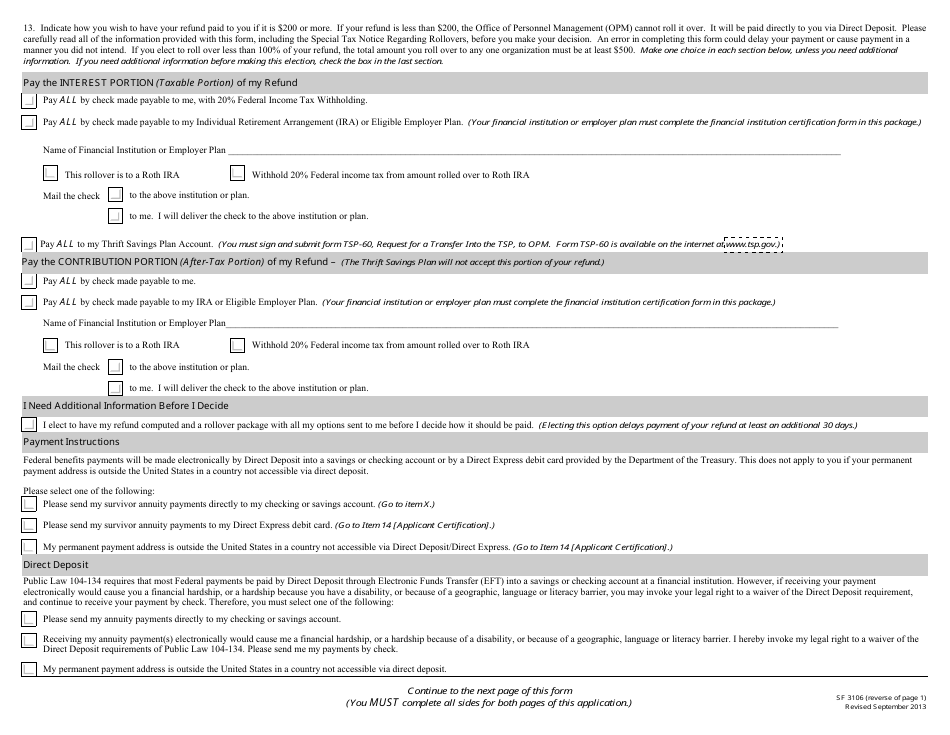

Q: Can I request a direct deposit for my refund?

A: Yes, you can request a direct deposit for your refund by providing your bank account information on OPM Form SF3106.

Q: Can I still receive a refund if I am eligible for retirement benefits?

A: If you are eligible for retirement benefits, you may still be able to receive a refund of your retirement deductions, but it may affect your future retirement benefits.

Form Details:

- Released on September 1, 2013;

- The latest available edition released by the U.S. Office of Personnel Management;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OPM Form SF3106 by clicking the link below or browse more documents and templates provided by the U.S. Office of Personnel Management.