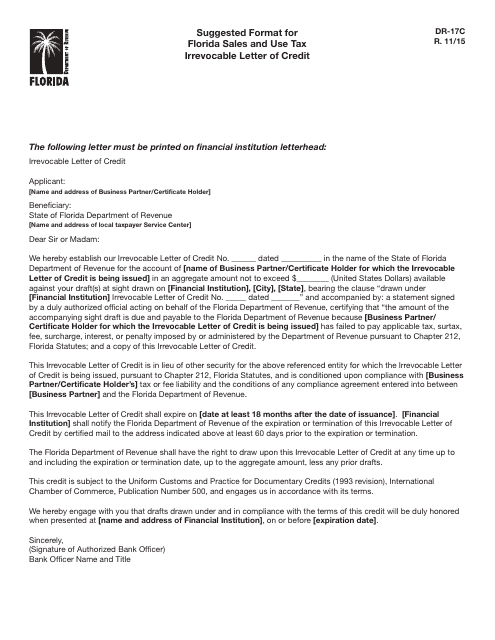

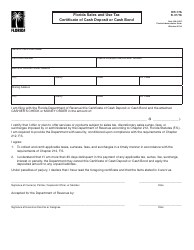

Form DR-17C Suggested Format for Florida Sales and Use Tax Irrevocable Letter of Credit - Florida

What Is Form DR-17C?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form DR-17C?

A: Form DR-17C is a suggested format for creating an irrevocable letter of credit for Florida Sales and Use Tax.

Q: What is an irrevocable letter of credit?

A: An irrevocable letter of credit is a financial instrument issued by a bank that guarantees payment to a specified party.

Q: What is the purpose of Form DR-17C?

A: Form DR-17C provides a suggested format for creating an irrevocable letter of credit specifically for Florida Sales and Use Tax purposes.

Q: Who can use Form DR-17C?

A: Businesses registered for Florida Sales and Use Tax can use Form DR-17C to create an irrevocable letter of credit.

Q: What is the significance of an irrevocable letter of credit in relation to Florida Sales and Use Tax?

A: An irrevocable letter of credit can be used by businesses as an alternative means of providing security for unpaid sales and use tax liabilities in Florida.

Q: Is Form DR-17C mandatory?

A: Form DR-17C is not mandatory. It is provided as a suggested format, but businesses have the option to use their own format for creating an irrevocable letter of credit.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-17C by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.