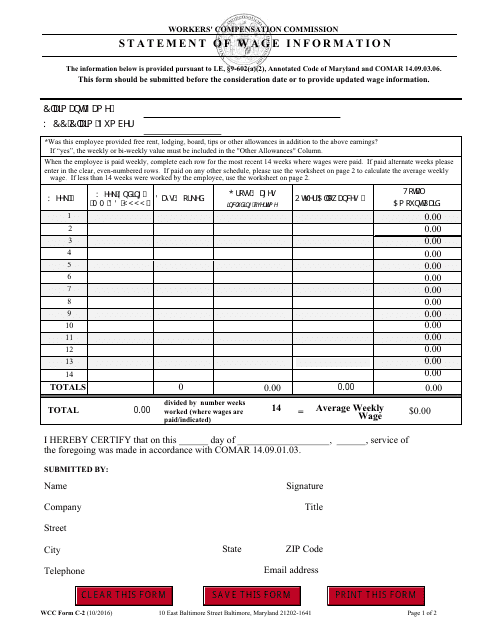

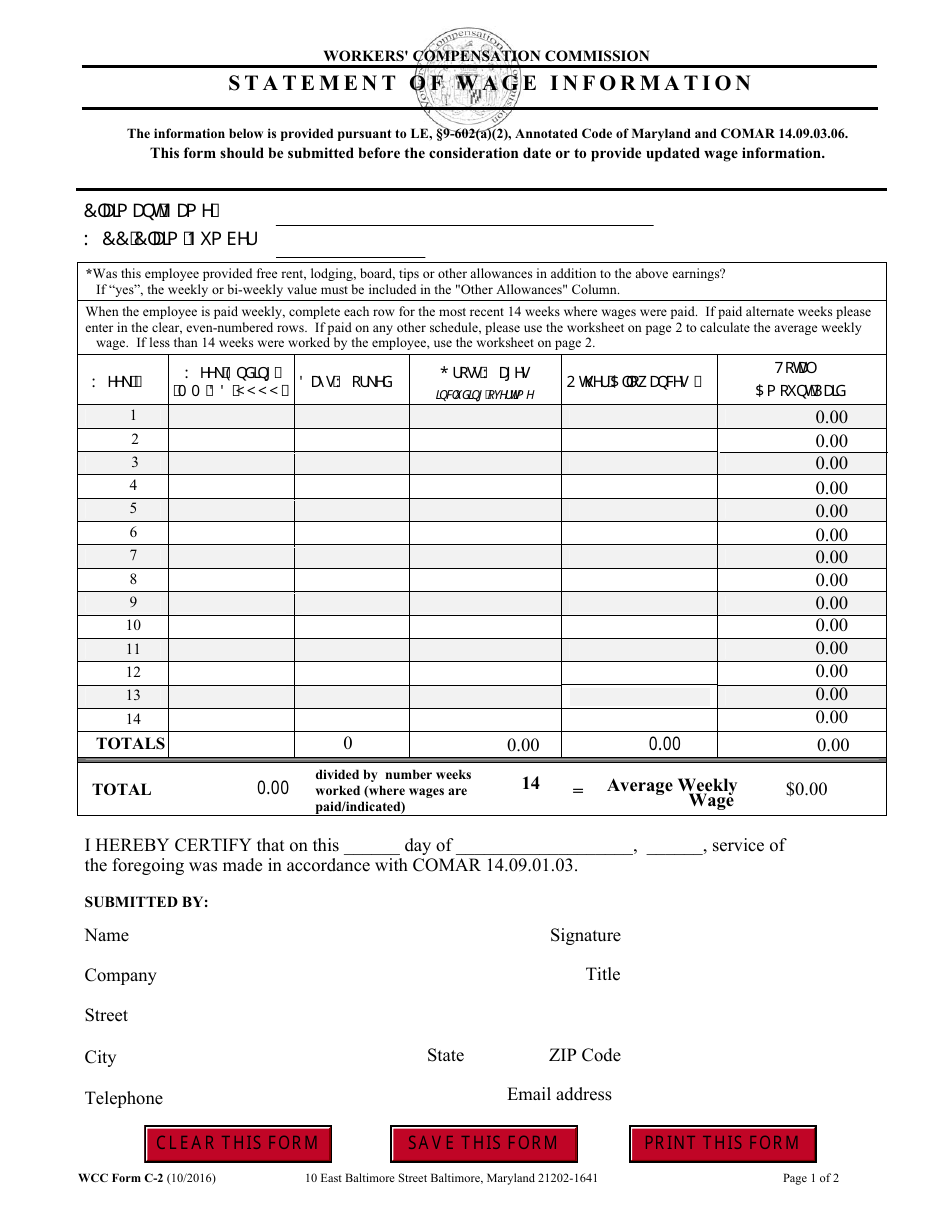

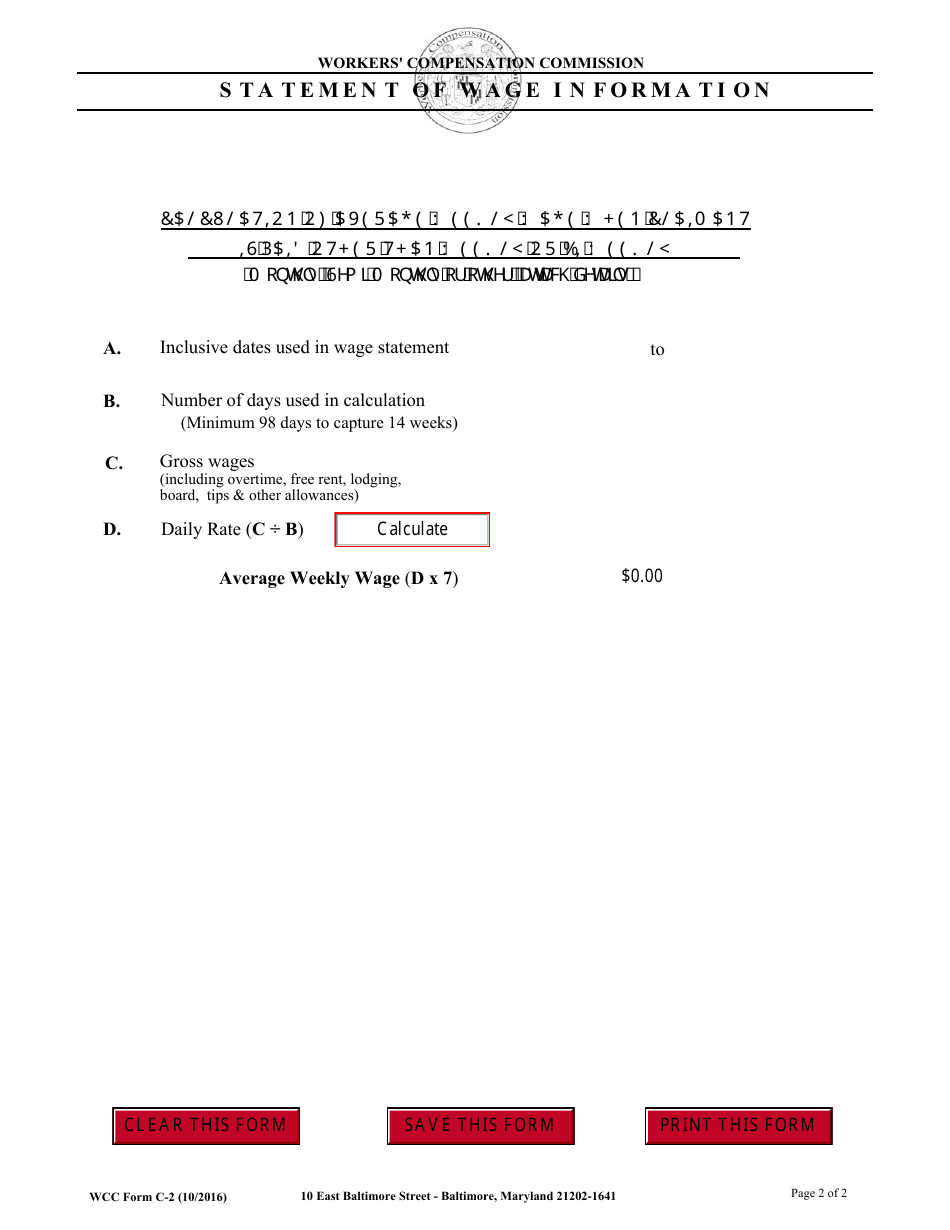

WCC Form C-2 Statement of Wage Information - Maryland

What Is WCC Form C-2?

This is a legal form that was released by the Maryland Workers' Compensation Commission - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WCC Form C-2?

A: WCC Form C-2 is the Statement of Wage Information form used in Maryland.

Q: Who needs to file WCC Form C-2?

A: Employers in Maryland are required to file WCC Form C-2.

Q: What is the purpose of WCC Form C-2?

A: WCC Form C-2 is used to report wage information of employees to the Workers' Compensation Commission in Maryland.

Q: When is WCC Form C-2 due?

A: WCC Form C-2 is typically due annually by April 15th.

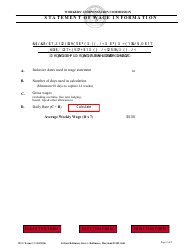

Q: What information is required on WCC Form C-2?

A: WCC Form C-2 requires the employer's business information, employee information, and wage details.

Q: Are there any penalties for not filing WCC Form C-2?

A: Yes, failure to file WCC Form C-2 can result in penalties and fines imposed by the Workers' Compensation Commission.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Maryland Workers' Compensation Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of WCC Form C-2 by clicking the link below or browse more documents and templates provided by the Maryland Workers' Compensation Commission.