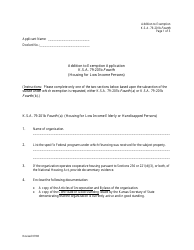

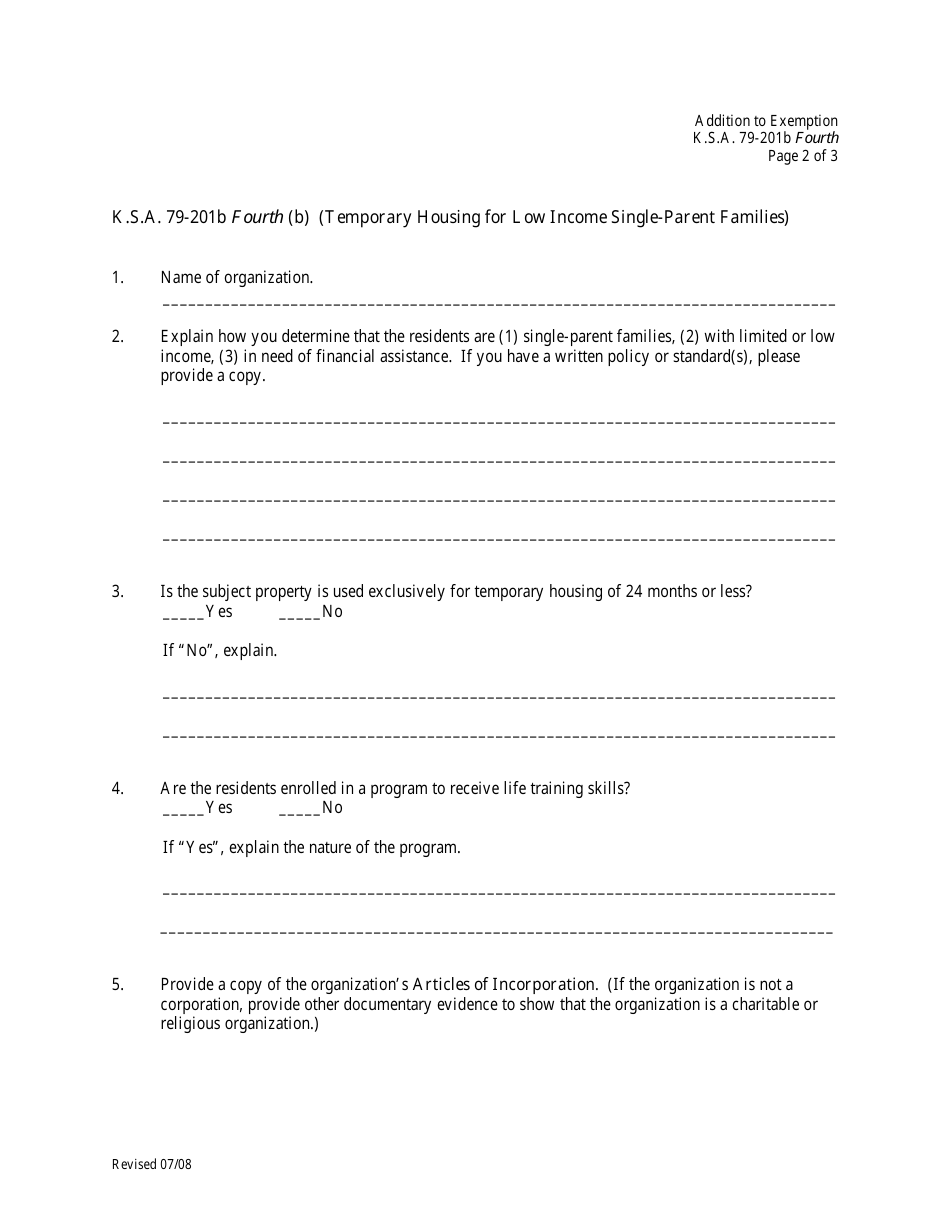

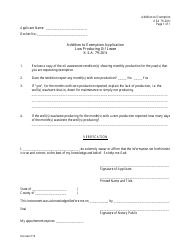

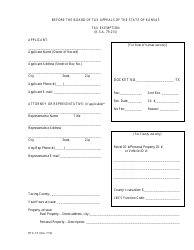

Addition to Exemption Application (Housing for Low Income Persons) - Kansas

Addition to Exemption Application (Housing for Low Income Persons) is a legal document that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas.

FAQ

Q: What is the addition to exemption application for housing for low income persons?

A: The addition to exemption application for housing for low income persons is a form used in Kansas to apply for exemption from property taxes for low-income housing.

Q: Who is eligible to apply for the exemption?

A: Low-income persons who own or operate housing properties in Kansas are eligible to apply for the exemption.

Q: What does the exemption provide?

A: The exemption provides a reduction or elimination of property taxes for qualifying low-income housing properties.

Q: How do I apply for the exemption?

A: You can apply for the exemption by submitting the addition to exemption application form to the appropriate authority in Kansas.

Q: Are there any eligibility requirements for the exemption?

A: Yes, there are eligibility requirements including income limits and compliance with certain regulations for low-income housing properties.

Q: Is there a deadline to submit the application?

A: Yes, there is usually a deadline to submit the application. It is recommended to check with the relevant authority for the specific deadline.

Q: What documents do I need to include with the application?

A: You may need to include documents such as financial statements, property ownership documents, and tenant information with the application.

Q: What happens after I submit the application?

A: After you submit the application, it will be reviewed by the appropriate authority and a decision will be made regarding the exemption.

Q: Can I appeal if my application is denied?

A: Yes, you have the right to appeal the decision if your application for the exemption is denied.

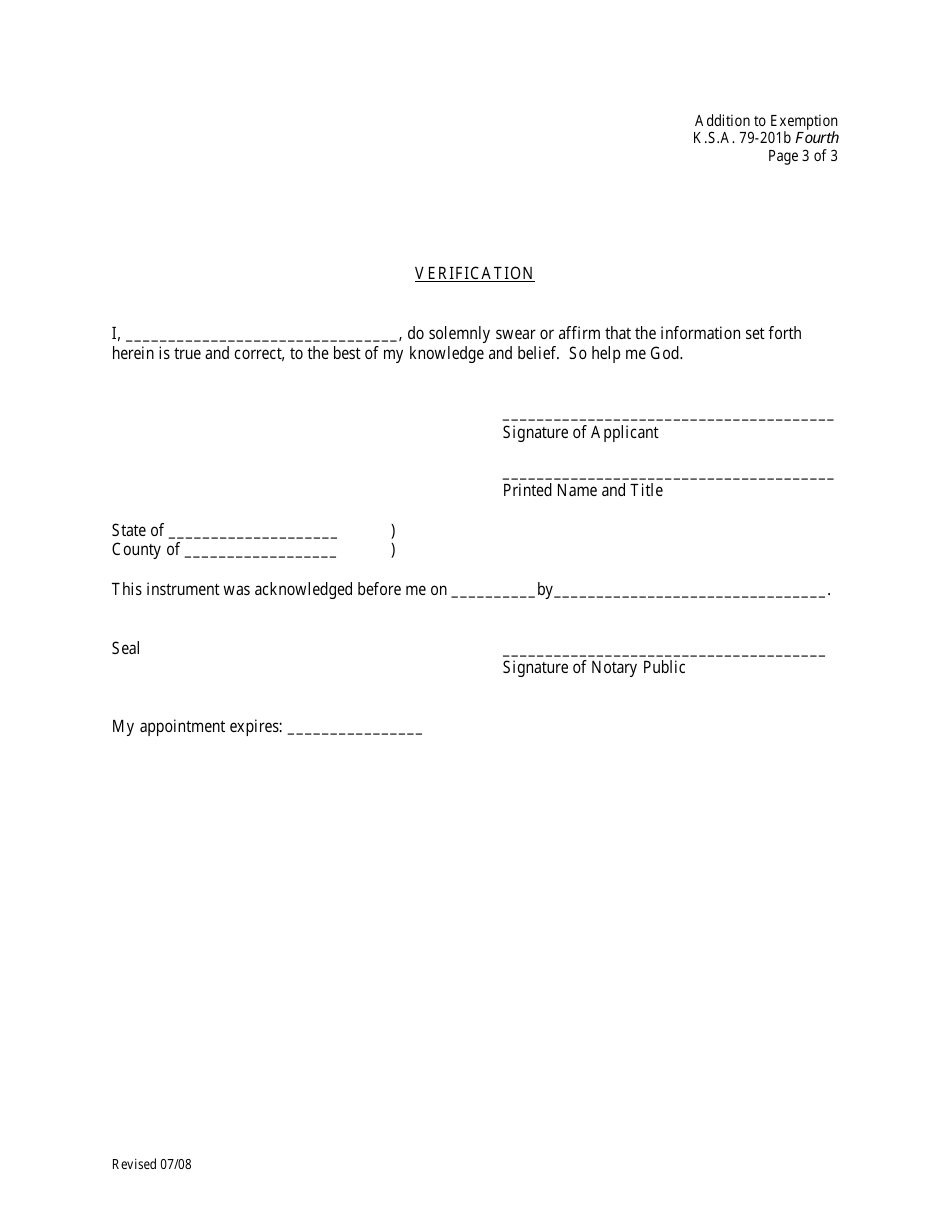

Form Details:

- Released on July 1, 2008;

- The latest edition currently provided by the Kansas Board of Tax Appeals;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.