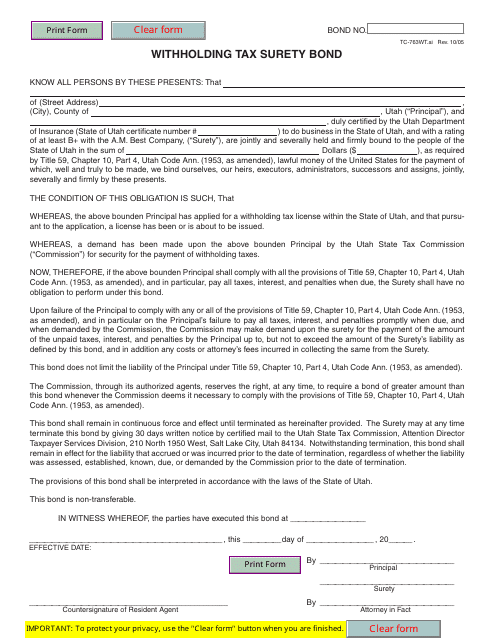

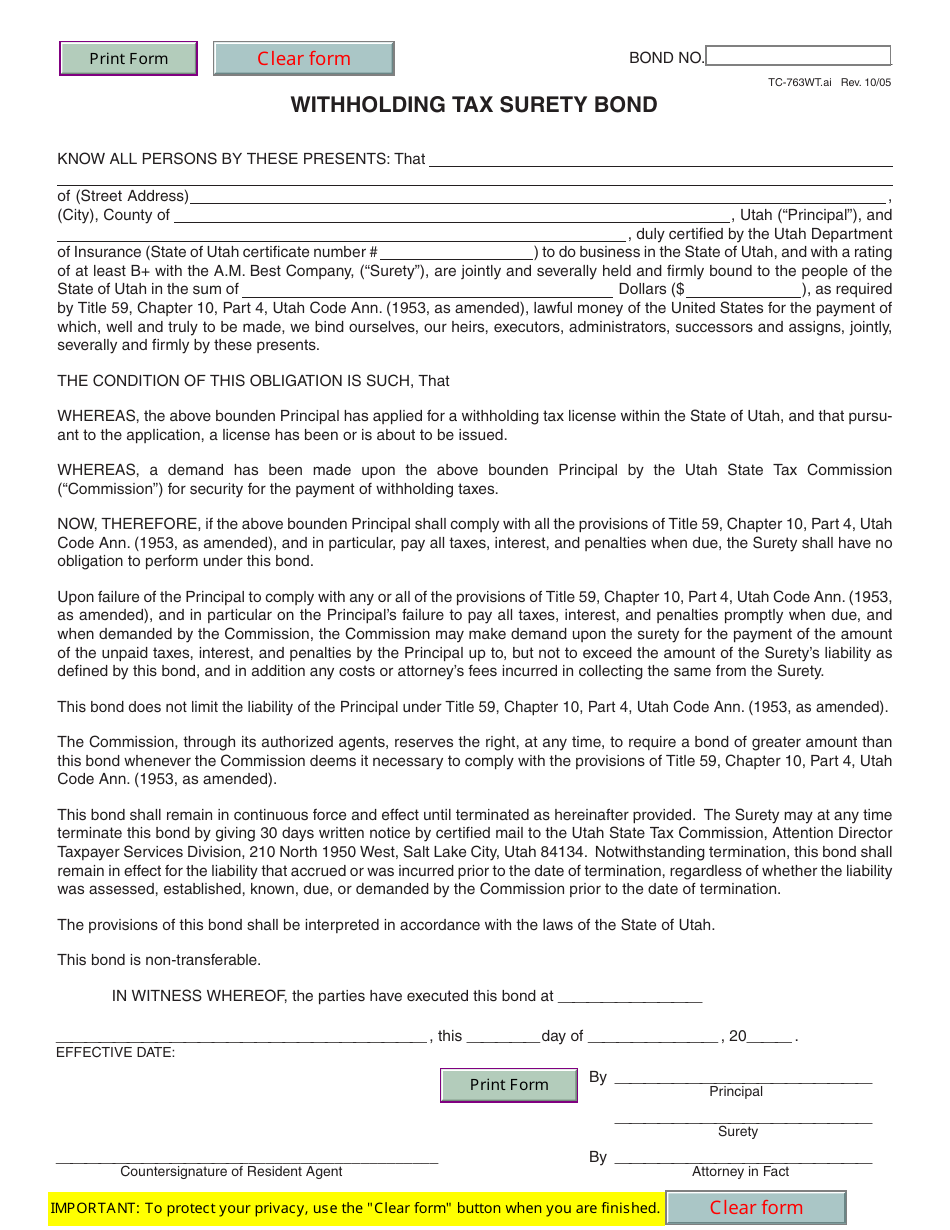

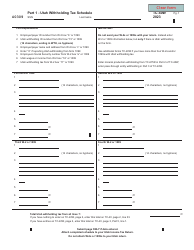

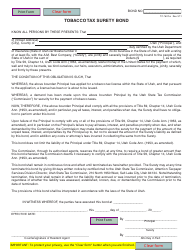

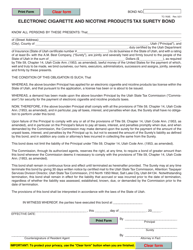

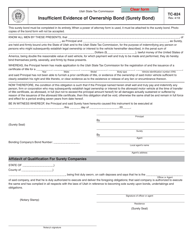

Form TC-763WT Withholding Tax Surety Bond - Utah

What Is Form TC-763WT?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-763WT?

A: Form TC-763WT is a Withholding Tax Surety Bond used in Utah.

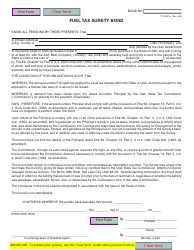

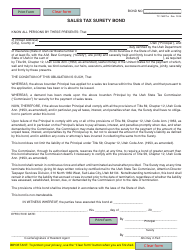

Q: What is a Withholding Tax Surety Bond?

A: A Withholding Tax Surety Bond is a form of financial guarantee required by the state of Utah for certain businesses.

Q: Why is Form TC-763WT used?

A: Form TC-763WT is used to secure the payment of withholding tax liabilities for a business that does not meet the criteria for an exemption.

Q: Who needs to file Form TC-763WT?

A: Businesses that are required to withhold taxes in Utah and do not meet the exemption criteria may need to file Form TC-763WT.

Q: Is there a fee for filing Form TC-763WT?

A: Yes, there is a fee associated with filing Form TC-763WT. The amount of the fee may vary depending on the amount of the surety bond required.

Q: Are there any exemptions to filing Form TC-763WT?

A: Yes, some businesses may be exempt from filing Form TC-763WT if they meet certain criteria outlined by the Utah State Tax Commission.

Q: What happens if I don't file Form TC-763WT?

A: Failure to file Form TC-763WT when required may result in penalties and interest being assessed by the Utah State Tax Commission.

Q: When is Form TC-763WT due?

A: The due date for filing Form TC-763WT varies depending on the specific circumstances of the business. It is important to check the instructions provided by the Utah State Tax Commission or consult with a tax professional to determine the appropriate deadline.

Form Details:

- Released on October 1, 2005;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-763WT by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.