This version of the form is not currently in use and is provided for reference only. Download this version of

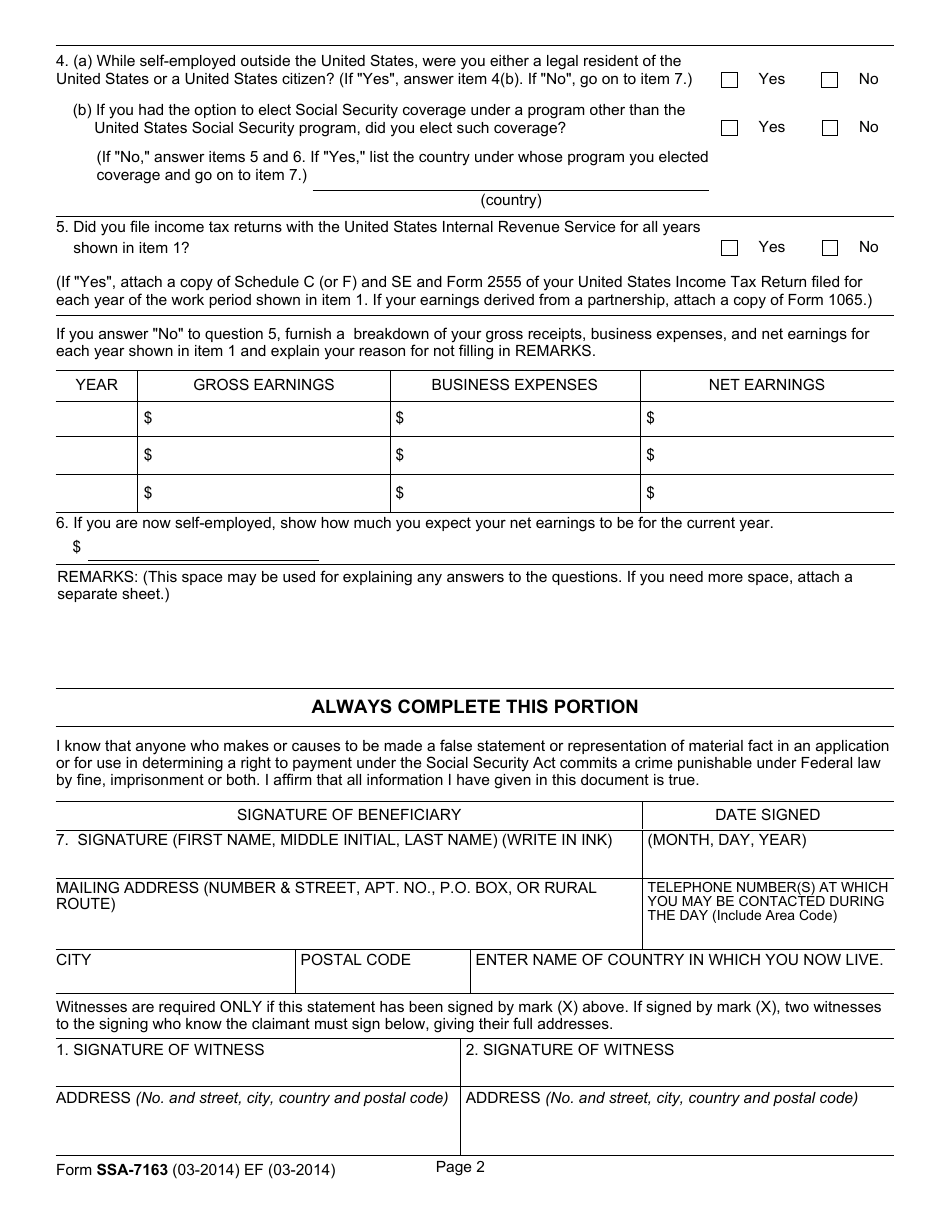

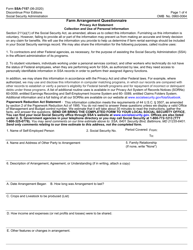

Form SSA-7163

for the current year.

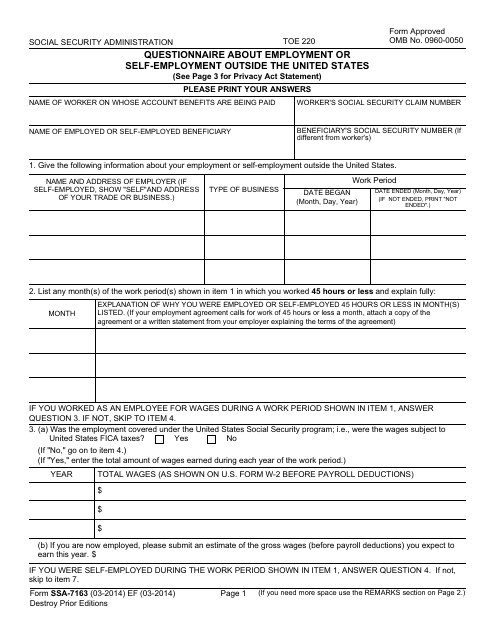

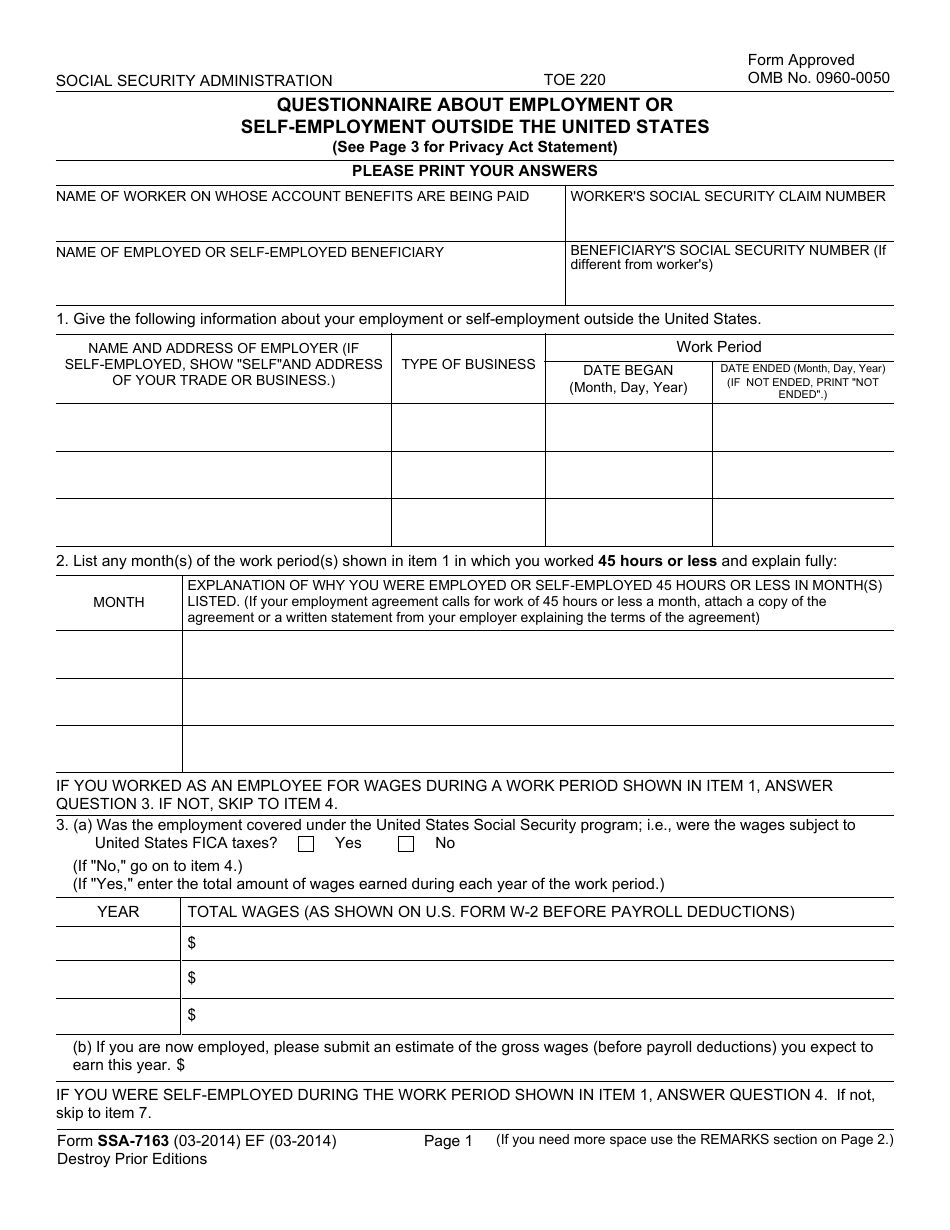

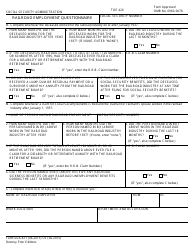

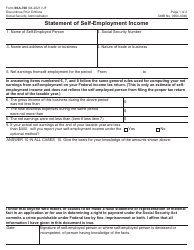

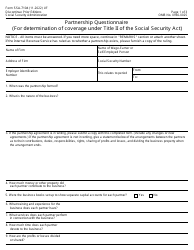

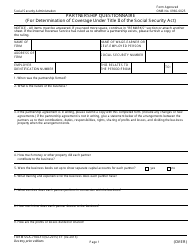

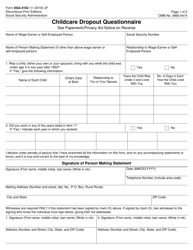

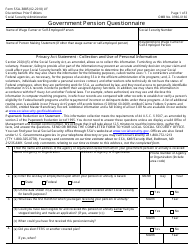

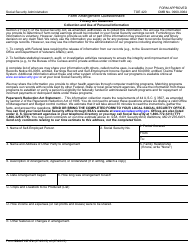

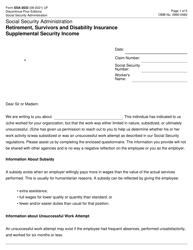

Form SSA-7163 Questionnaire About Employment or Self-employment Outside the United States

What Is Form SSA-7163?

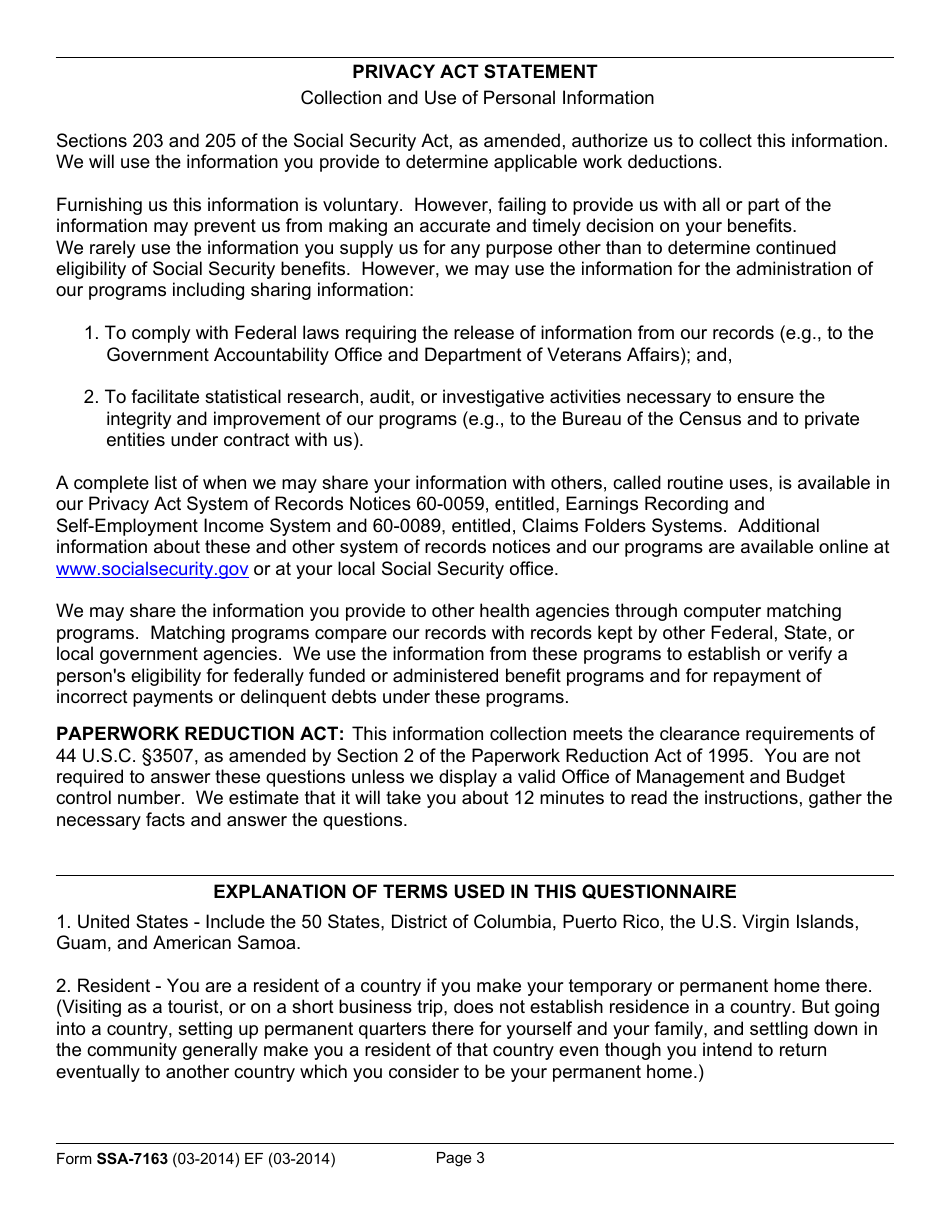

This is a legal form that was released by the U.S. Social Security Administration on March 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-7163?

A: Form SSA-7163 is a questionnaire about employment or self-employment outside the United States.

Q: Who needs to file Form SSA-7163?

A: Individuals who have worked or been self-employed outside the United States and are receiving Social Security benefits.

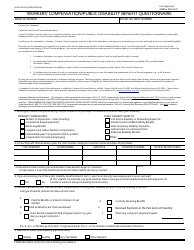

Q: What is the purpose of Form SSA-7163?

A: The purpose of Form SSA-7163 is to gather information about employment or self-employment outside the United States that may affect an individual's eligibility for Social Security benefits.

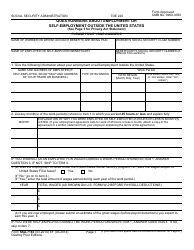

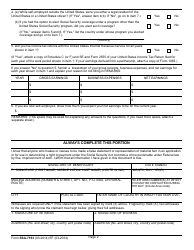

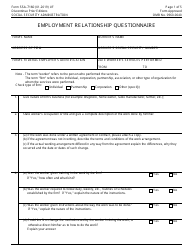

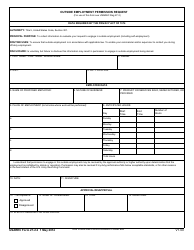

Q: What information is required on Form SSA-7163?

A: Form SSA-7163 requires information such as the name and address of the employer, dates of employment, and details of the work performed.

Q: When should I file Form SSA-7163?

A: You should file Form SSA-7163 as soon as possible after you have worked or been self-employed outside the United States.

Q: What happens if I do not file Form SSA-7163?

A: If you do not file Form SSA-7163, it may affect your eligibility for Social Security benefits based on your employment or self-employment outside the United States.

Q: Are there any penalties for not filing Form SSA-7163?

A: There may be penalties, such as reduction or suspension of Social Security benefits, if you fail to provide the necessary information on Form SSA-7163.

Q: Is there a deadline for filing Form SSA-7163?

A: There is no specific deadline for filing Form SSA-7163, but it is recommended to file it as soon as possible to avoid any potential delays or complications with your Social Security benefits.

Form Details:

- Released on March 1, 2014;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-7163 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.