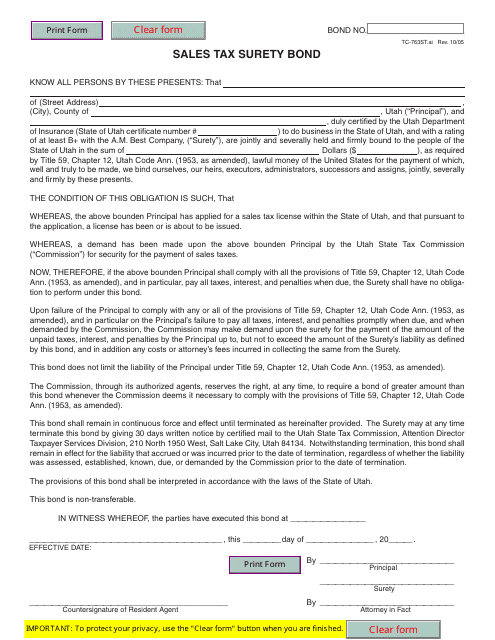

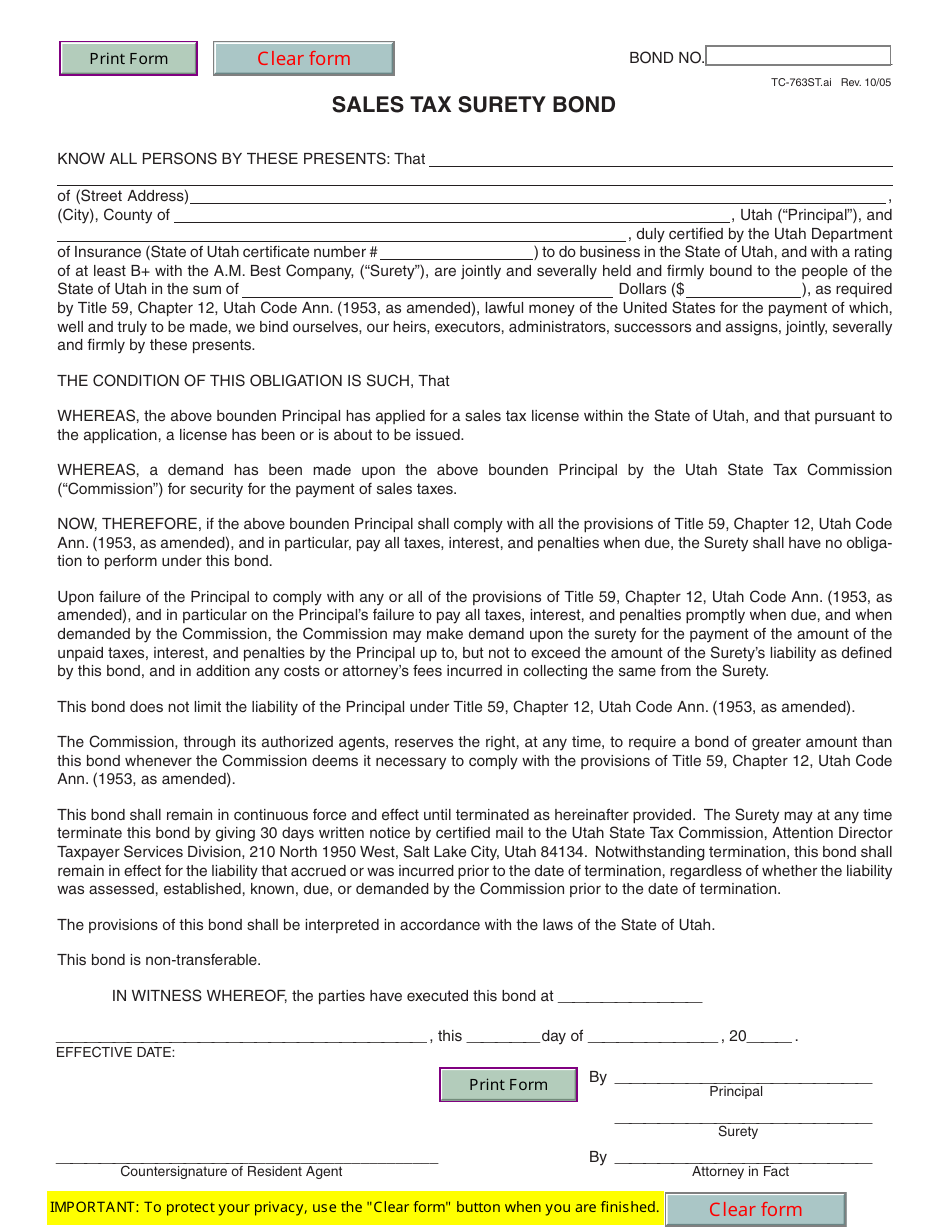

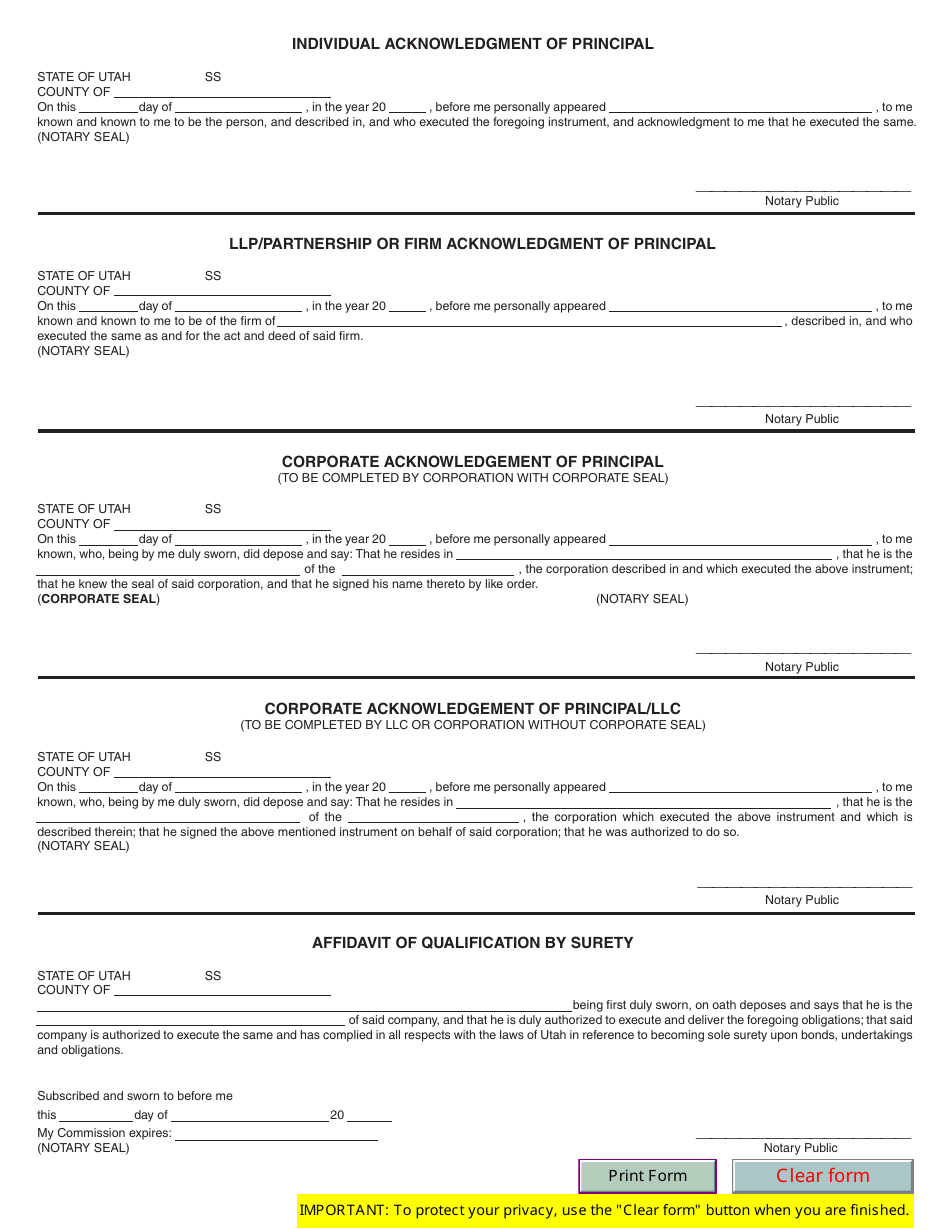

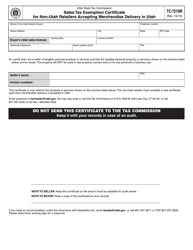

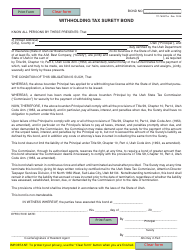

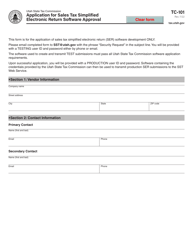

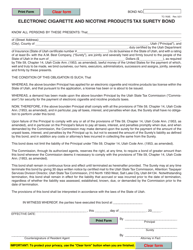

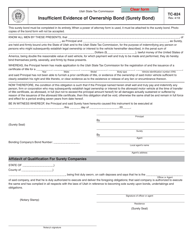

Form TC-763ST Sales Tax Surety Bond - Utah

What Is Form TC-763ST?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC-763ST Sales Tax Surety Bond?

A: TC-763ST Sales Tax Surety Bond is a form that is used in Utah to secure the payment of sales taxes.

Q: Who needs to file Form TC-763ST?

A: Businesses in Utah that are required to collect and remit sales taxes may need to file Form TC-763ST.

Q: What is the purpose of the Sales Tax Surety Bond?

A: The purpose of the Sales Tax Surety Bond is to provide a guarantee that the business will fulfill its obligation to pay sales taxes to the state of Utah.

Q: How much does the Sales Tax Surety Bond cost?

A: The cost of the Sales Tax Surety Bond varies depending on factors such as the amount of sales taxes owed and the creditworthiness of the business.

Q: What are the consequences of not filing the Sales Tax Surety Bond?

A: Failure to file the Sales Tax Surety Bond when required may result in penalties, fines, and possible legal action by the state of Utah.

Form Details:

- Released on October 1, 2005;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-763ST by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.