Franchise Tax Templates

Franchise tax is a tax imposed on businesses that operate as a franchise or have certain types of corporate structures. This tax is also known as franchise taxes or franchise tax forms. It is an important financial obligation that businesses must fulfill to maintain compliance with state laws.

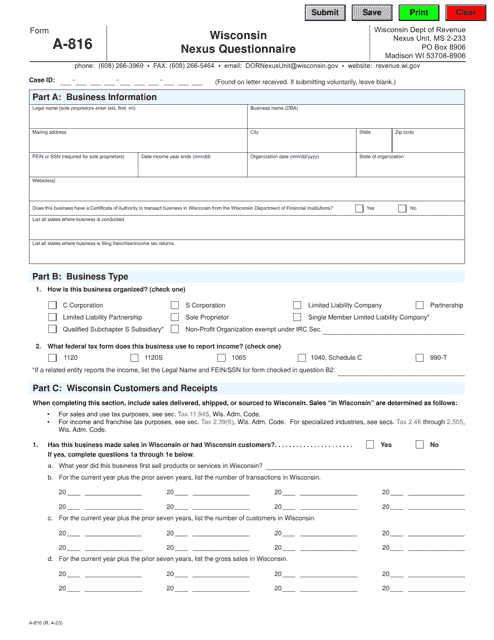

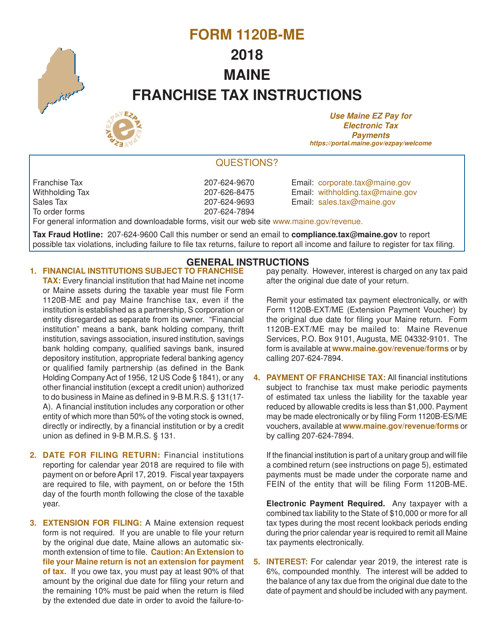

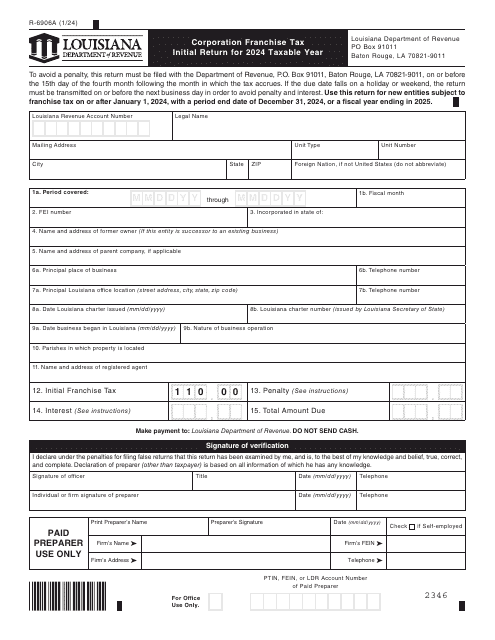

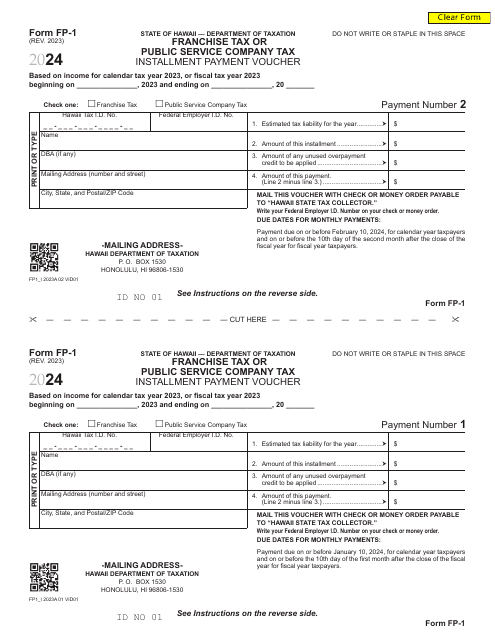

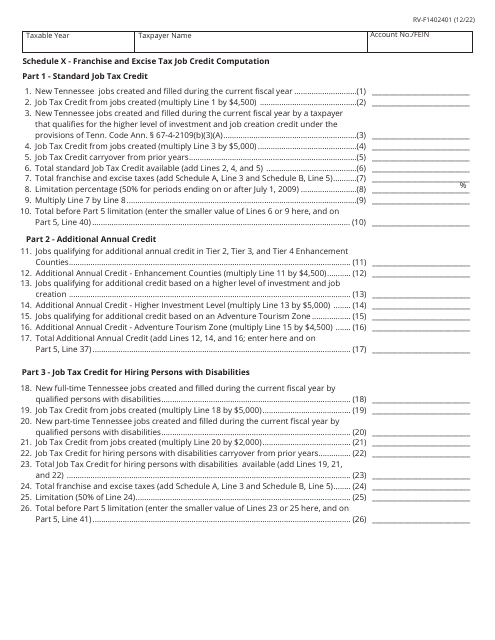

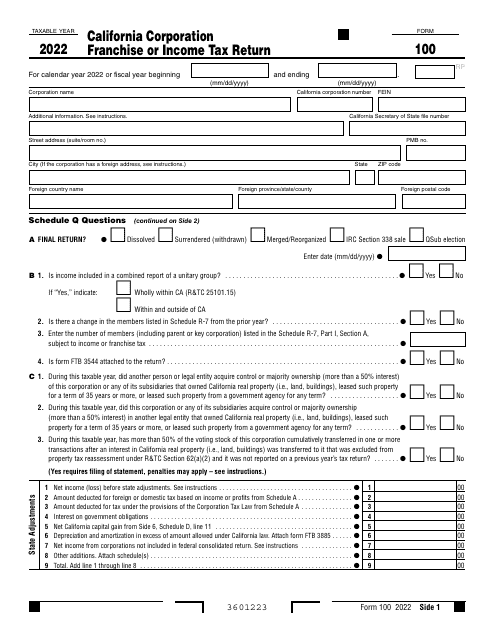

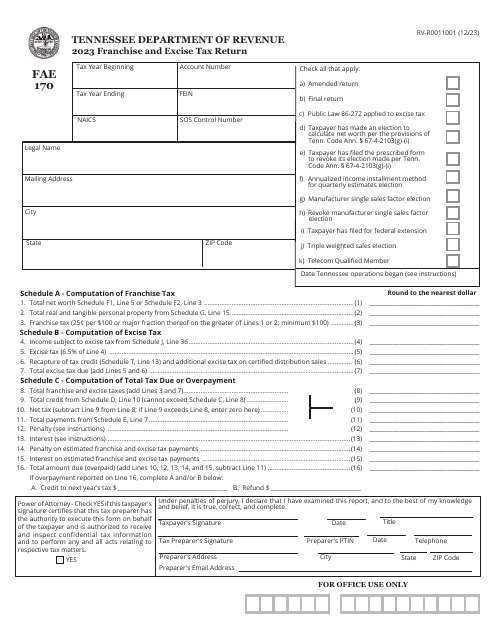

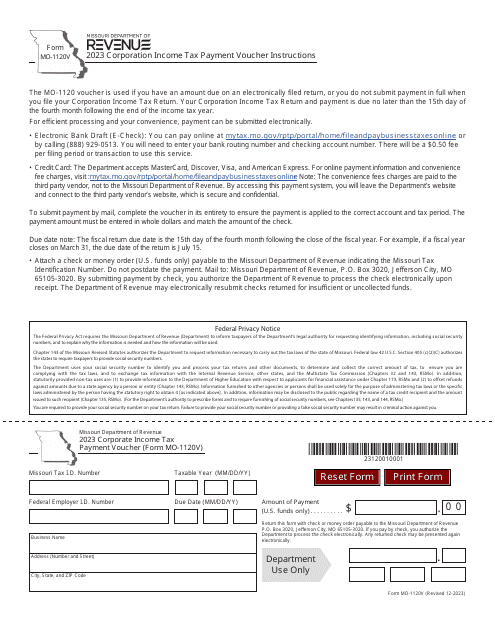

When it comes to franchise tax, each state may have its own specific requirements and regulations. These requirements often involve the filing of various franchise tax forms, such as the Franchise Tax Registration or the Estimated Franchise and Excise Tax Payments Worksheet. Additionally, specific forms may be required for various types of entities, such as transportation and transmission corporations or non-combined corporations.

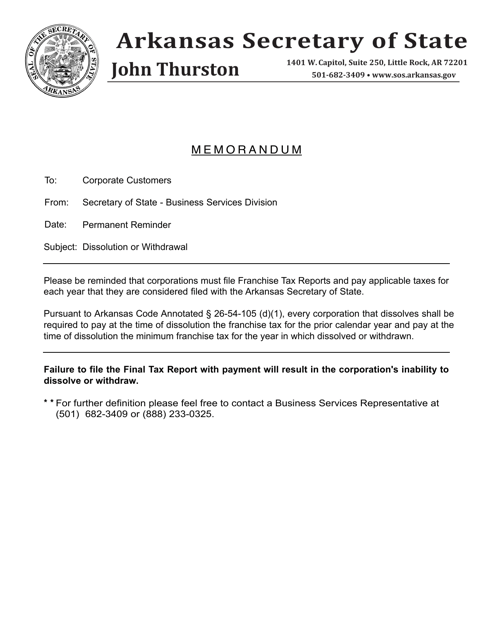

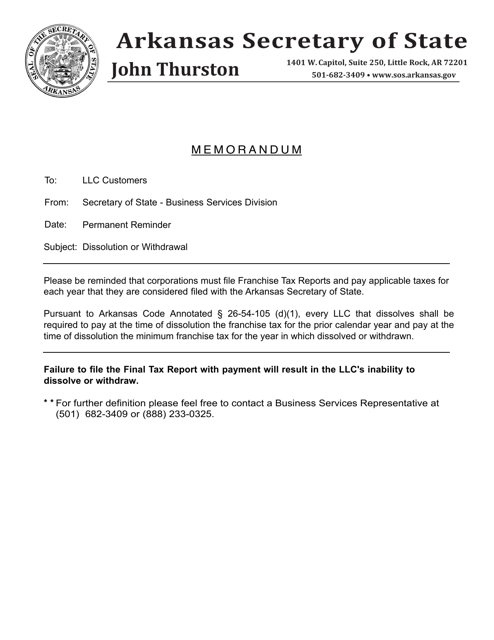

Understanding and complying with franchise tax obligations can be complex, but it is crucial for businesses to ensure their legal and financial standing. Failure to fulfill franchise tax requirements can lead to penalties, fines, or even the loss of the business's legal status.

If you are a business owner or a franchisee, it is vital to stay informed about your franchise tax obligations and remain up-to-date with any changes or updates to the laws. A knowledgeable tax professional can provide expert guidance and help you navigate the complexities of franchise tax.

At USA, Canada, and other countries document knowledge system, we provide comprehensive information and resources regarding franchise tax. Whether you need assistance with understanding franchise tax regulations, accessing the necessary forms, or seeking guidance on filing requirements, our platform can help you navigate the process efficiently and accurately.

Ensure your business's compliance with franchise tax laws and avoid unnecessary penalties by leveraging the resources and information available at USA, Canada, and other countries document knowledge system. Explore our platform today to access the latest information and support for your franchise tax needs.

Documents:

119

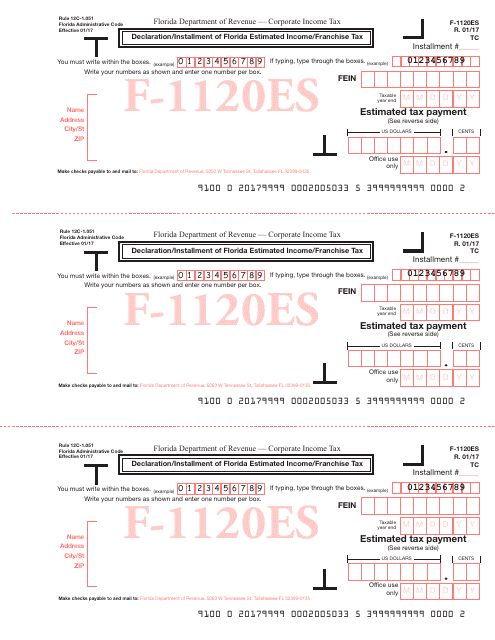

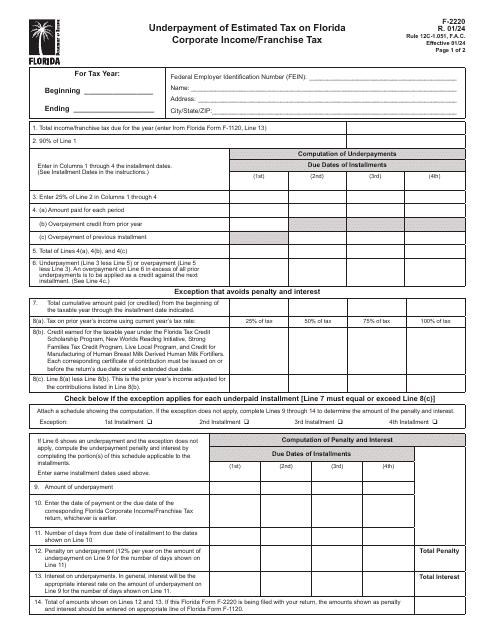

This Form is used for declaring and making installment payments of estimated income/franchise tax in Florida.

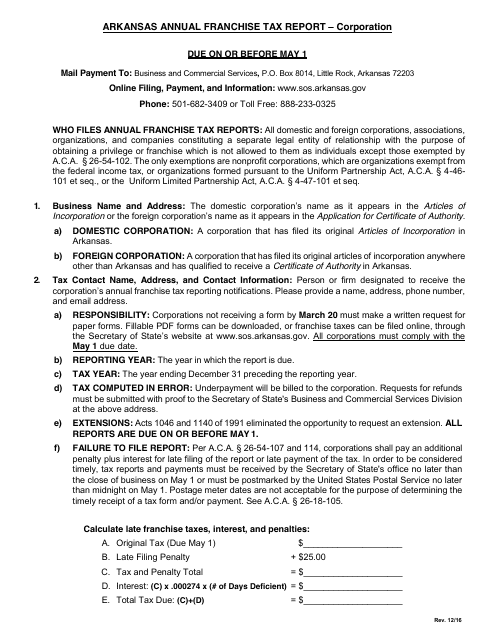

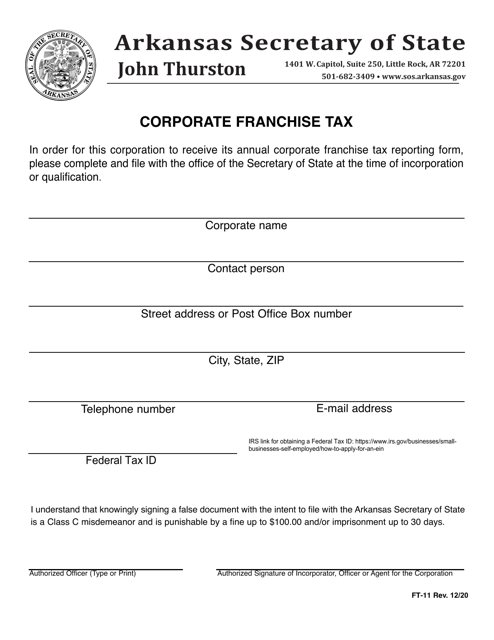

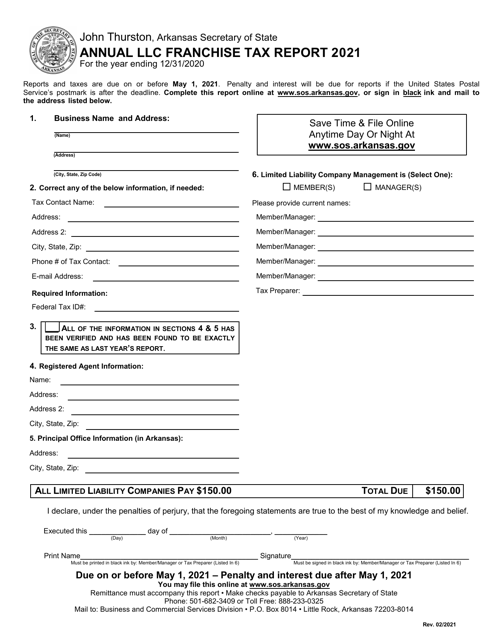

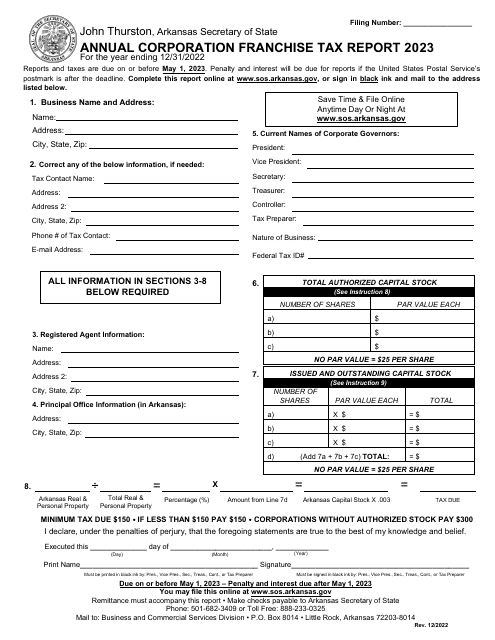

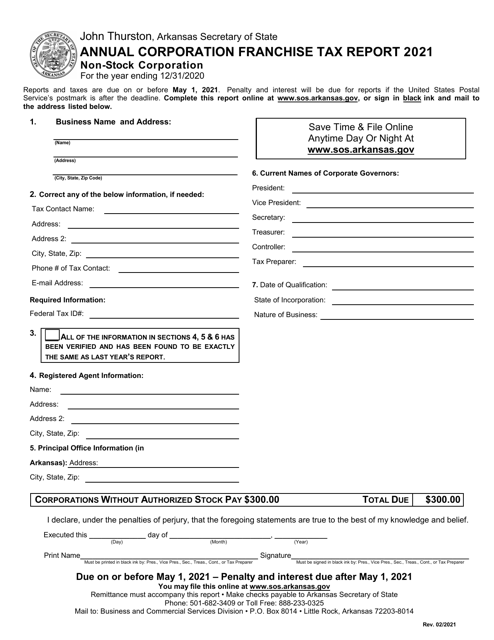

This document provides instructions for filling out the Annual Corporation Franchise Tax Report in Arkansas. It guides corporations on how to accurately report their taxes and includes step-by-step instructions for each section of the form.

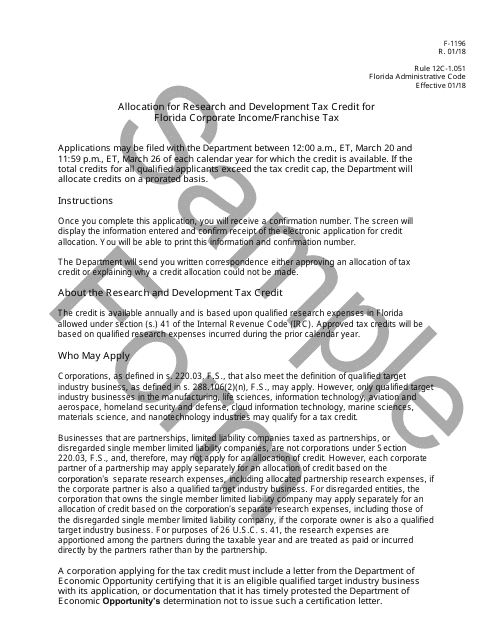

This form is used for allocating the research and development tax credit for Florida corporate income/franchise tax in the state of Florida.

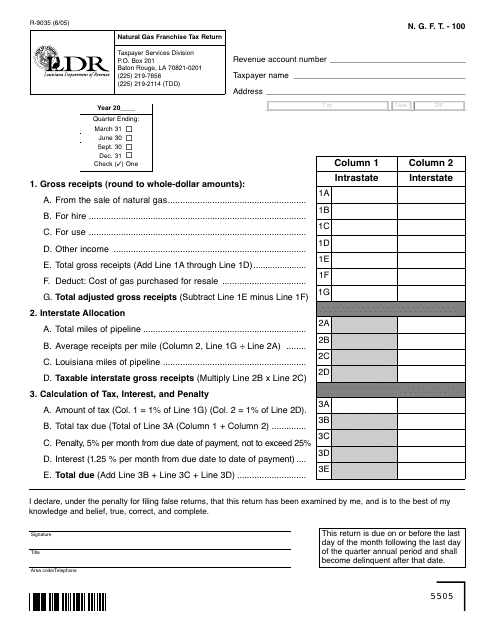

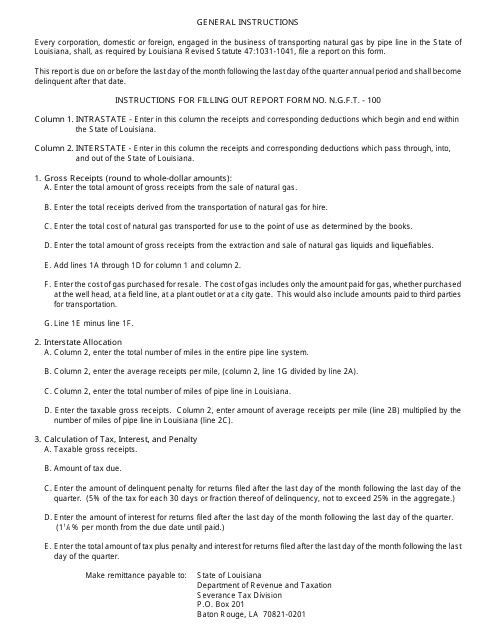

This form is used for filing the Natural Gas Franchise Tax Return in Louisiana.

This Form is used for filing the N.G.F.T.-100 Natural Gas Franchise Tax Return in Louisiana. It provides instructions for completing the form and filing the required tax return.

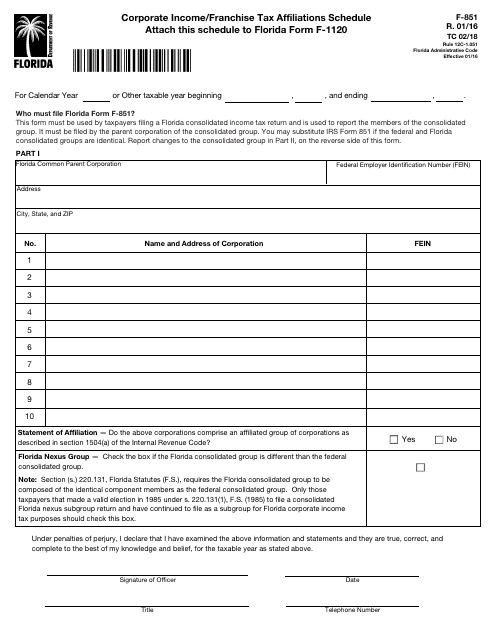

This Form is used for reporting corporate income and franchise tax affiliations in the state of Florida.

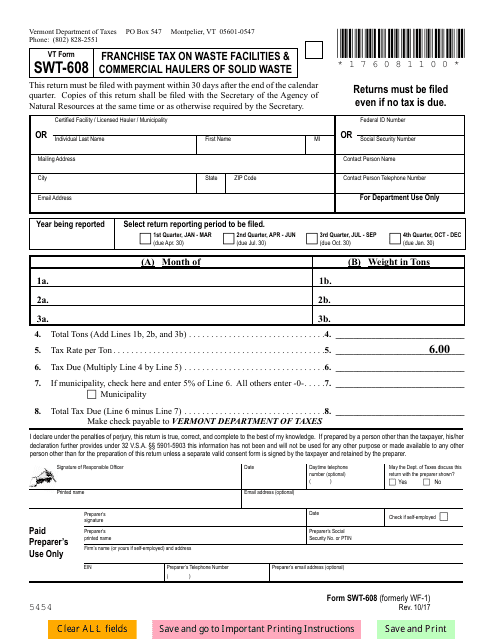

This Form is used for reporting and paying franchise tax on waste facilities and commercial haulers of solid waste in the state of Vermont.

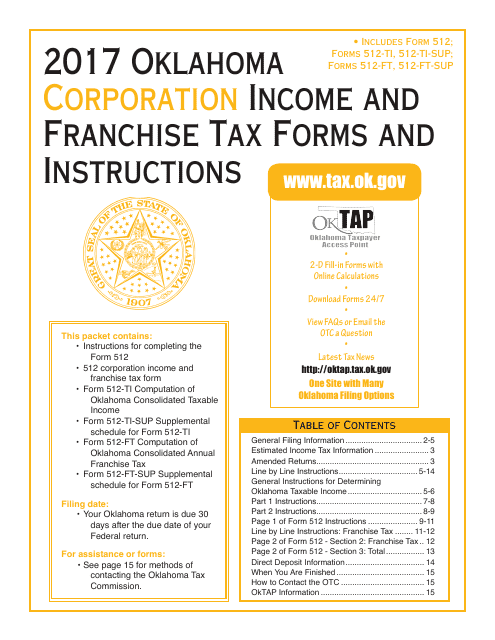

This document provides the necessary forms and instructions for filing corporation income and franchise taxes in the state of Oklahoma.

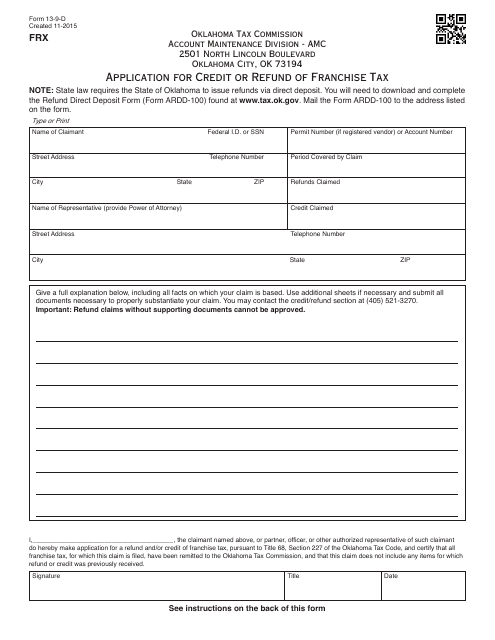

This form is used for applying for credit or refund of franchise tax in Oklahoma.

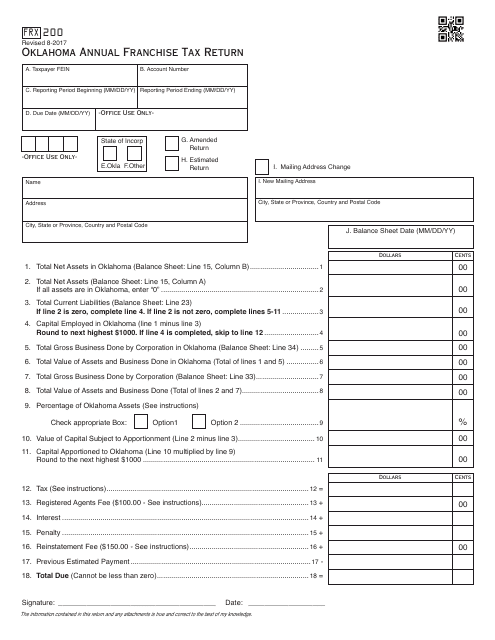

This form is used for filing the Oklahoma Annual Franchise Tax Return in Oklahoma.

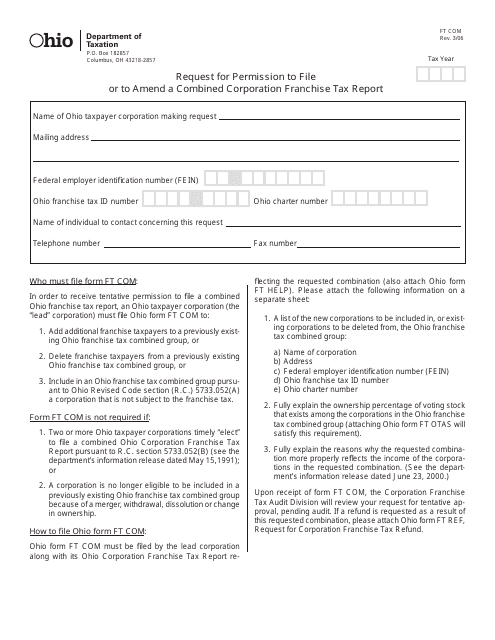

This form is used for requesting permission to file or amend a combined corporation franchise tax report in Ohio.

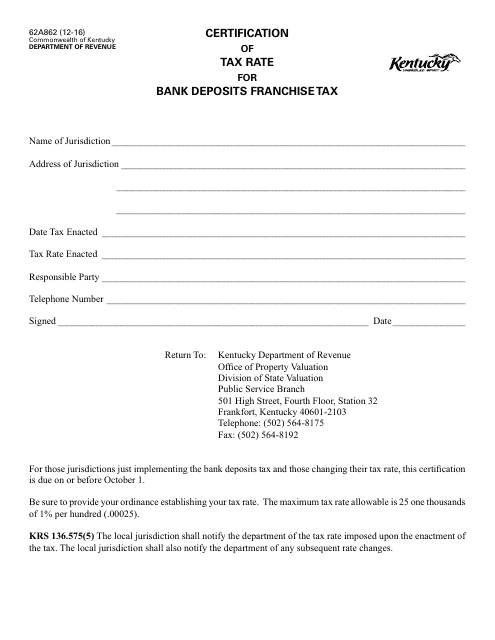

This form is used for certifying the tax rate for bank deposits franchise tax in the state of Kentucky.

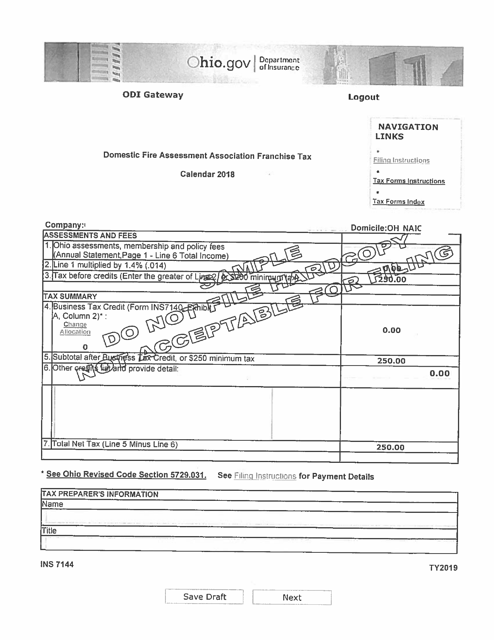

This Form is used for domestic fire assessment association franchise tax in Ohio.

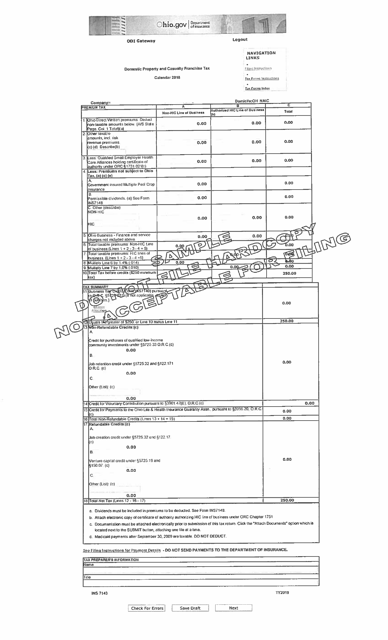

This form is used for paying franchise tax on domestic property and casualty insurance companies in the state of Ohio.

This form is used for Maine financial institutions to file their franchise tax return with the state.

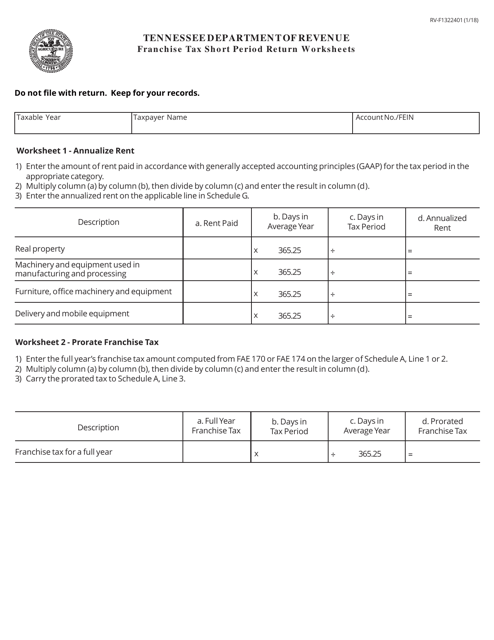

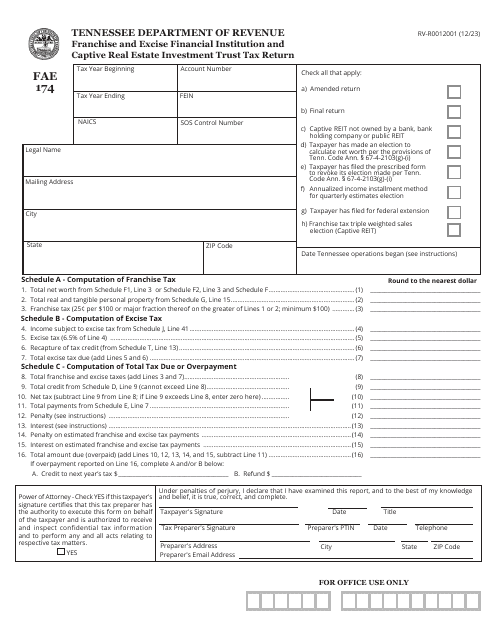

This form is used for completing worksheets for the franchise tax short period return in Tennessee.

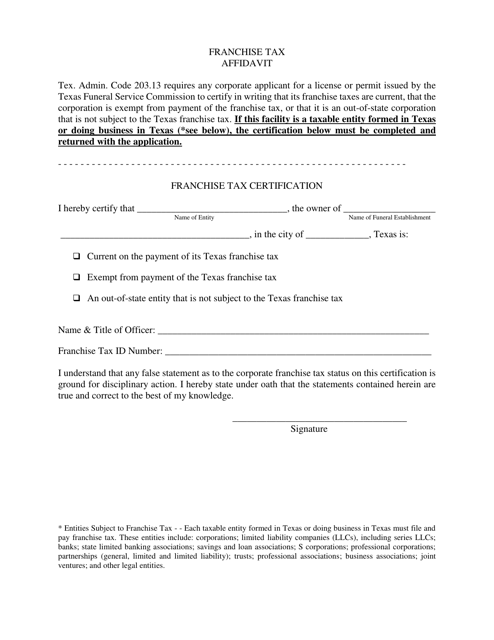

This Form is used for reporting franchise taxes in the state of Texas.

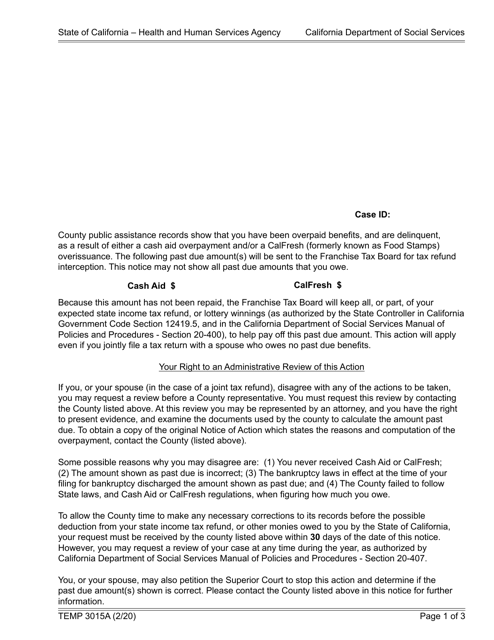

This form is used for the Franchise Tax Board (FTB) to provide an annual pre-offset notice in California.

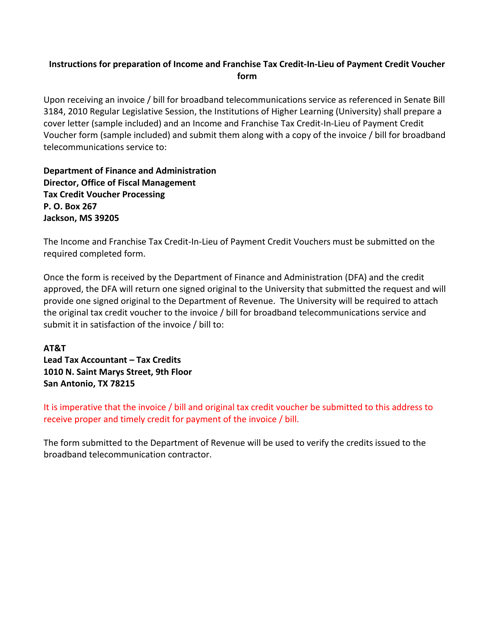

This document provides instructions for completing the Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher in Mississippi. It helps taxpayers understand how to claim a credit in place of making a payment for their income and franchise taxes.

This document is the Final Franchise Tax Report for businesses in the state of Arkansas. It is used to report and pay the final franchise tax for the year.

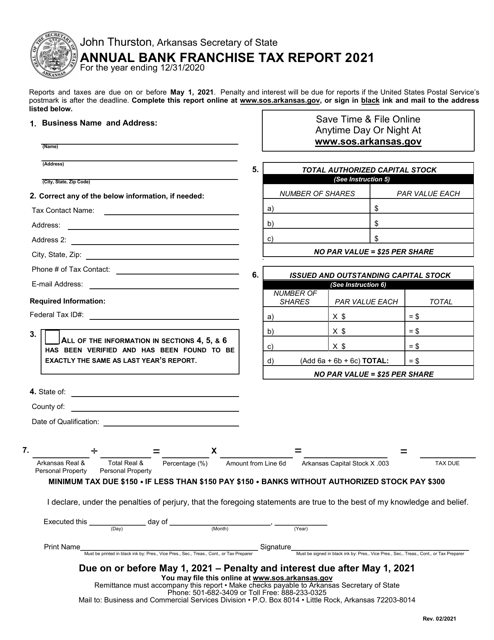

This document is used for reporting the annual franchise tax for banks operating in Arkansas.

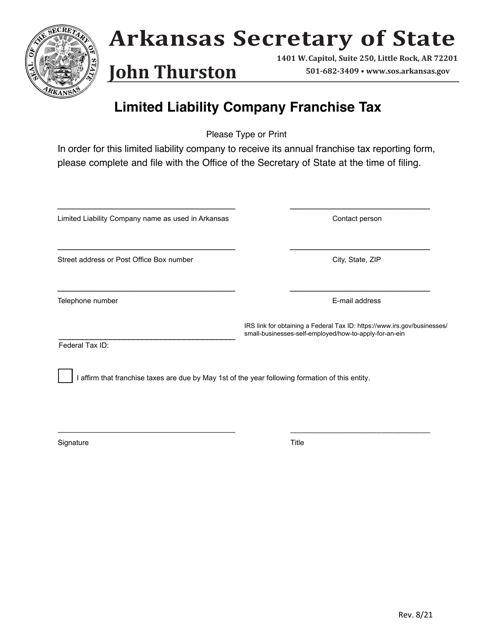

This form is used for submitting the final franchise tax report for a limited liability company (LLC) in Arkansas.

This document is for non-stock corporations in Arkansas to report their annual franchise taxes. Non-stock corporations are typically nonprofit organizations or professional associations.