Franchise Tax Templates

Documents:

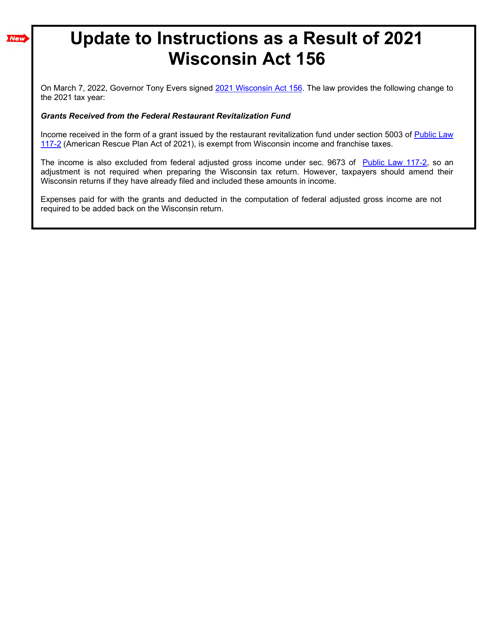

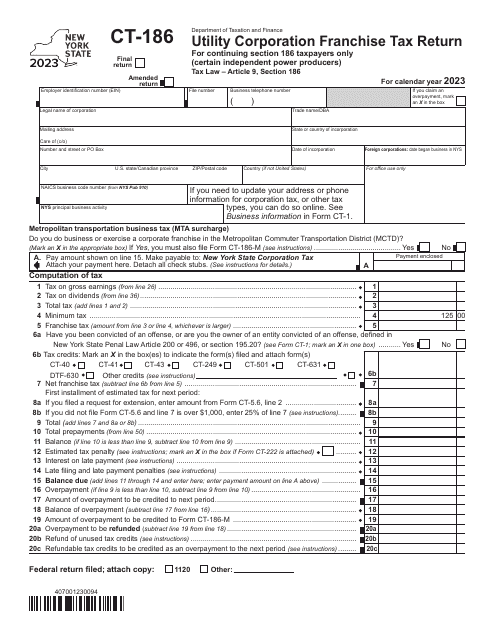

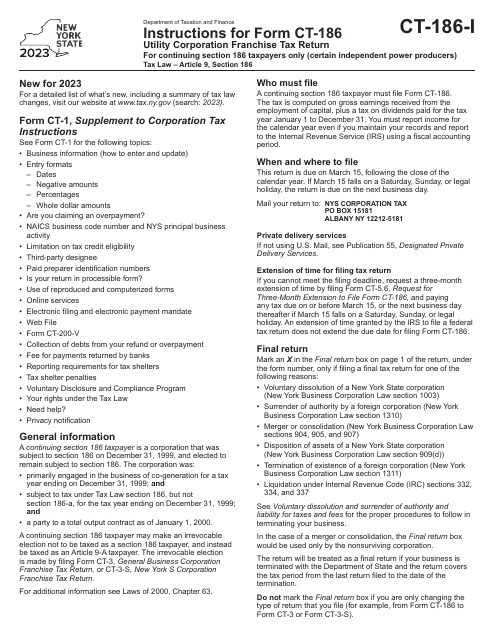

119

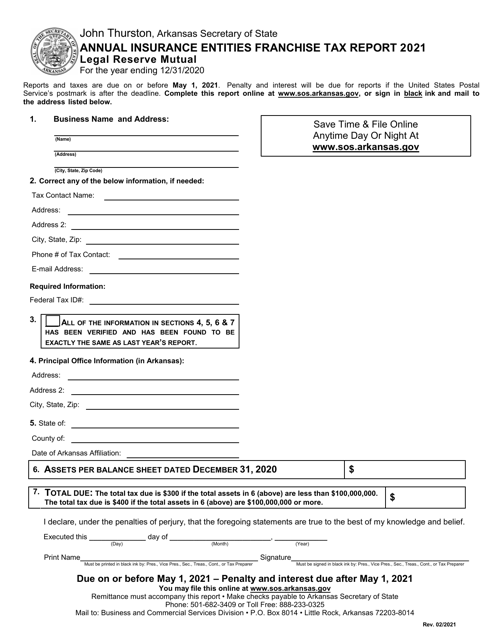

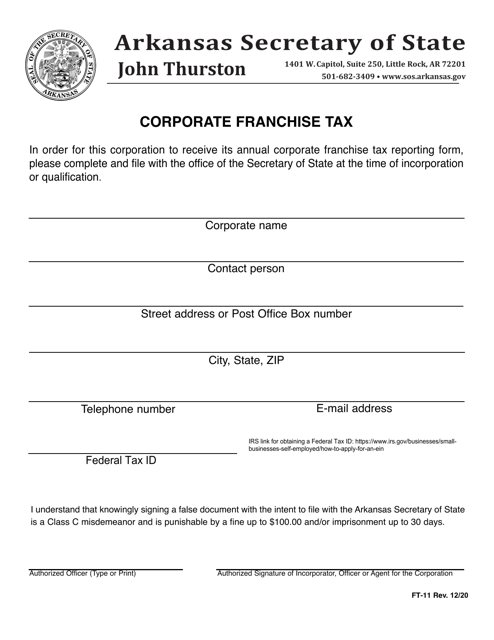

This Form is used for filing the Annual Insurance Entities Franchise Tax Report for Legal Reserve Mutual insurance companies in the state of Arkansas.

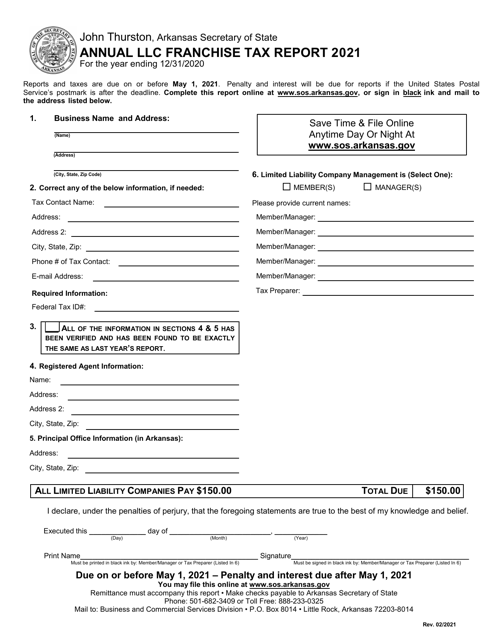

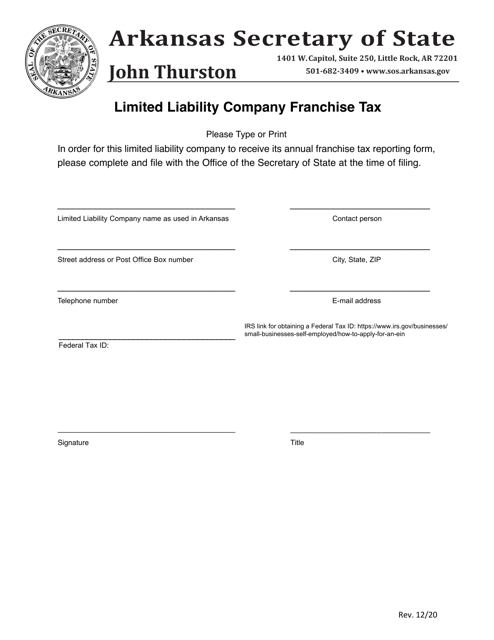

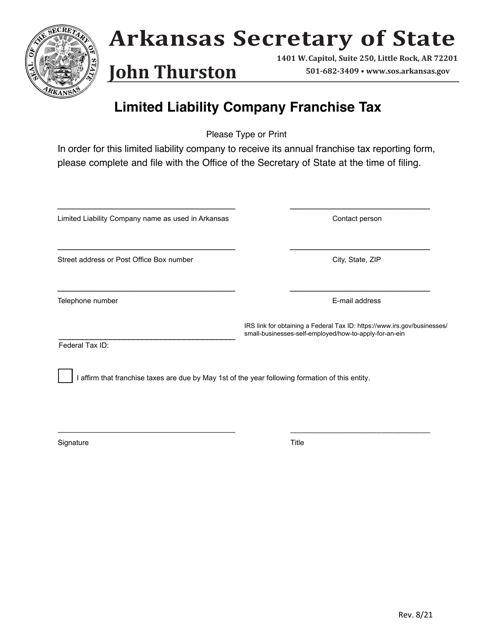

This document is used for registering a LLC for franchise tax in the state of Arkansas.

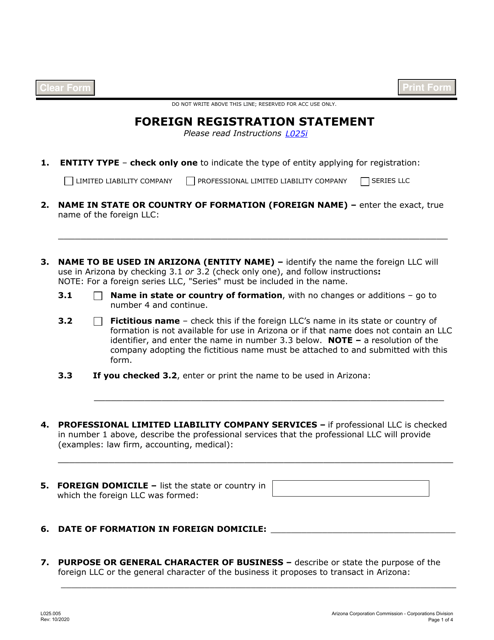

This form is used for foreign businesses that want to register in Arizona. It allows them to provide the necessary information to the state government.

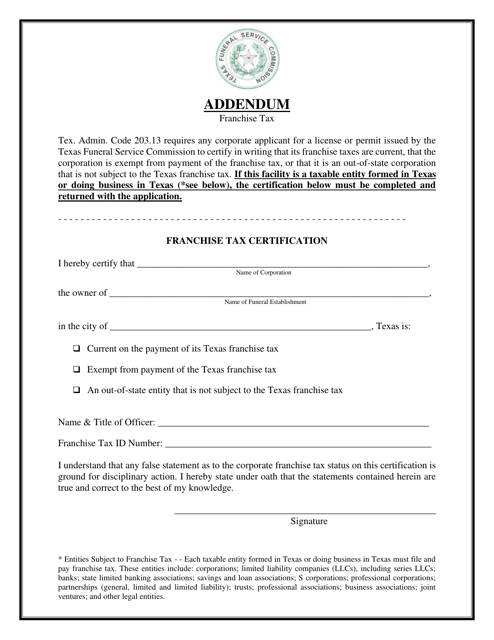

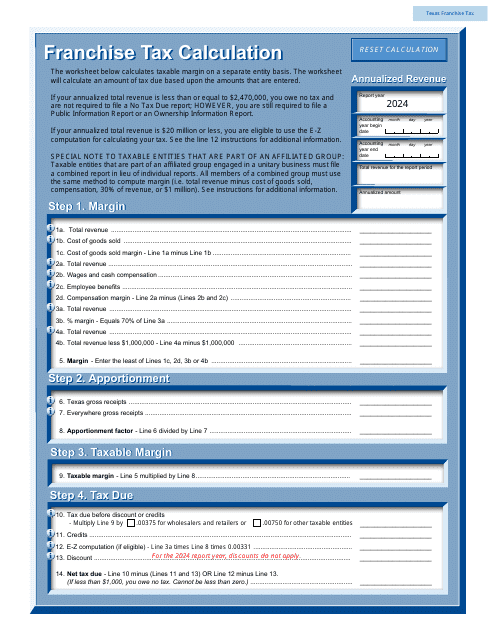

This document is used for reporting and certifying franchise tax information in the state of Texas.

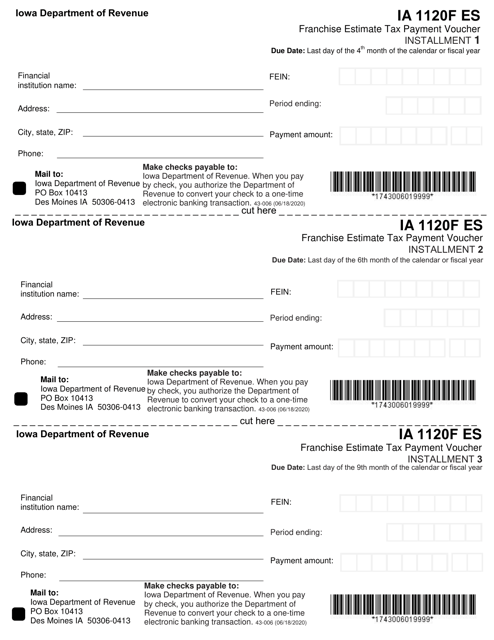

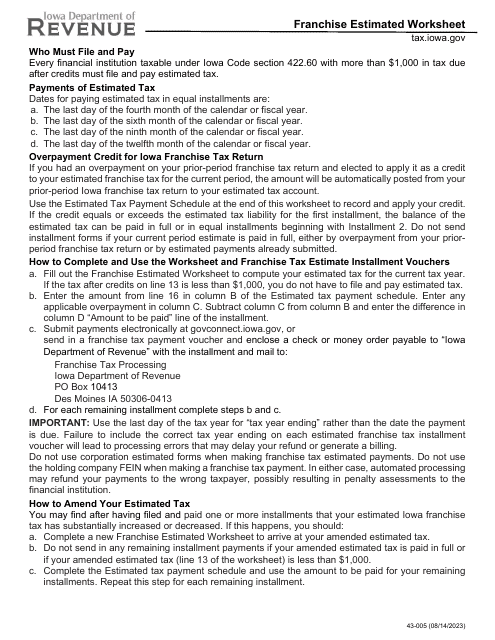

This type of document is used for making estimated tax payments for franchise taxes in the state of Iowa.

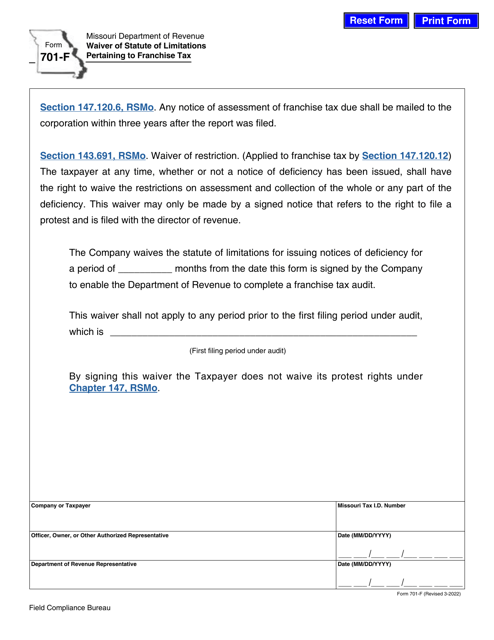

This form is used for requesting a waiver of the statute of limitations related to franchise tax in the state of Missouri.

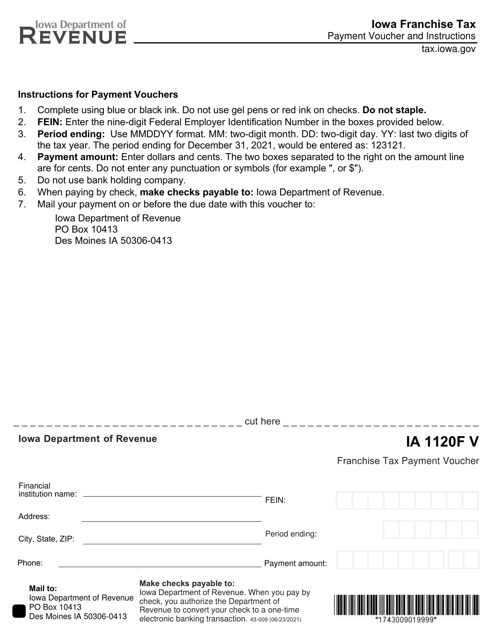

This Form is used for making franchise tax payments in Iowa.

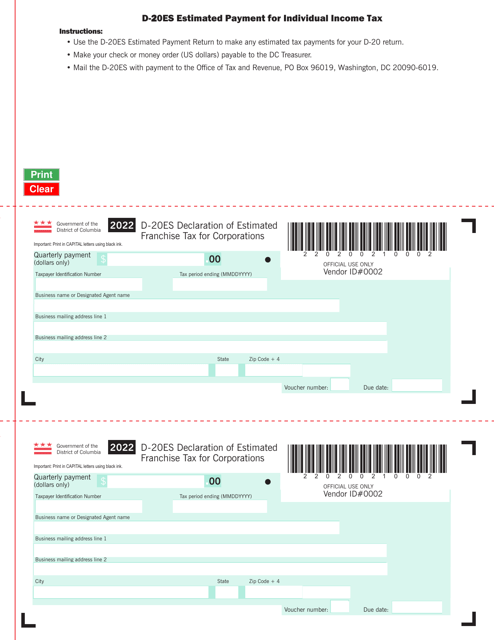

This form is used for corporations in Washington, D.C. to declare their estimated franchise tax.

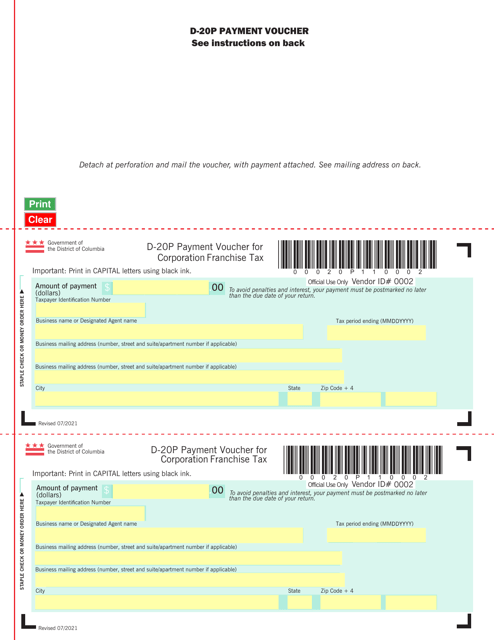

This form is used for making payment for Corporation Franchise Tax in Washington, D.C.

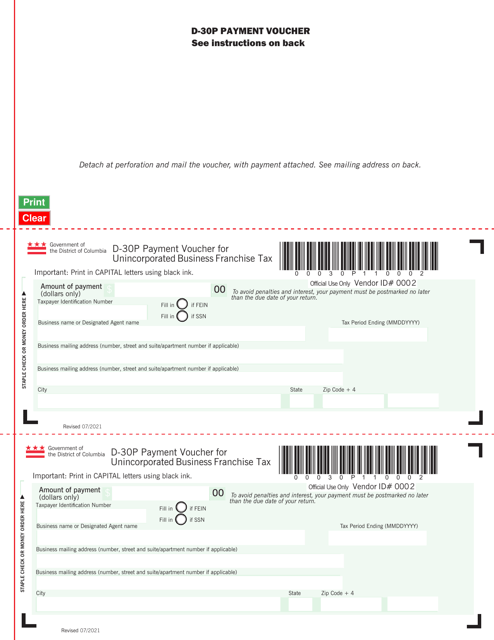

This form is used for making a payment for the Unincorporated Business Franchise Tax in Washington, D.C.

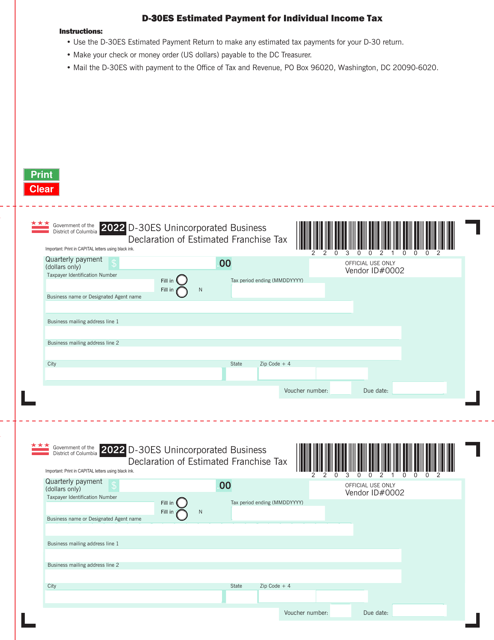

This form is used for unincorporated businesses in Washington, D.C. to declare their estimated franchise tax. It is used to calculate and pay the tax owed by the business.

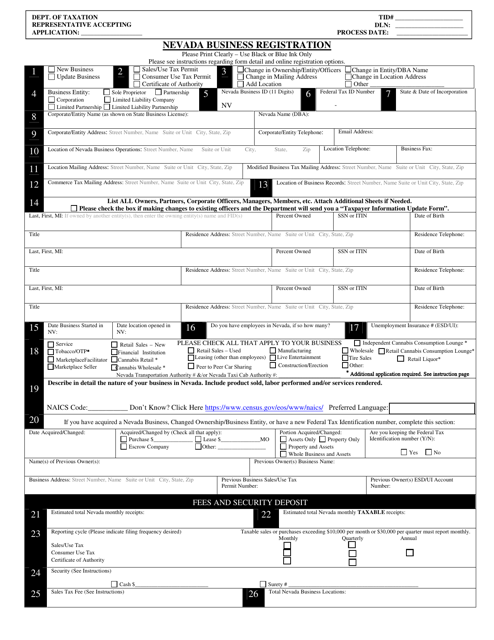

This document is used for registering a business in the state of Nevada. It is necessary to officially establish a business entity and comply with state regulations.