Tax Credit Templates

Documents:

3232

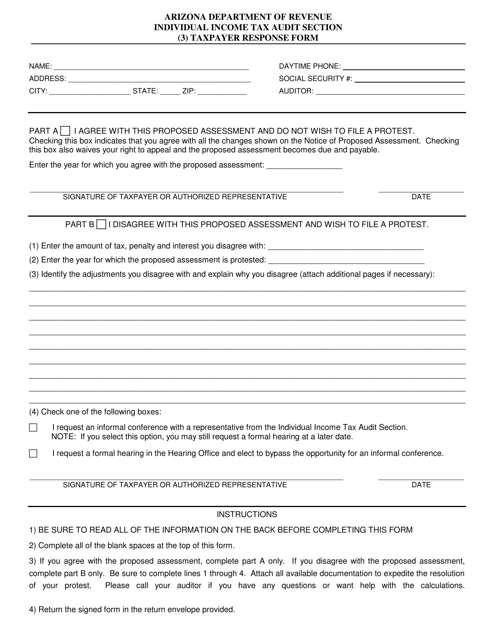

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

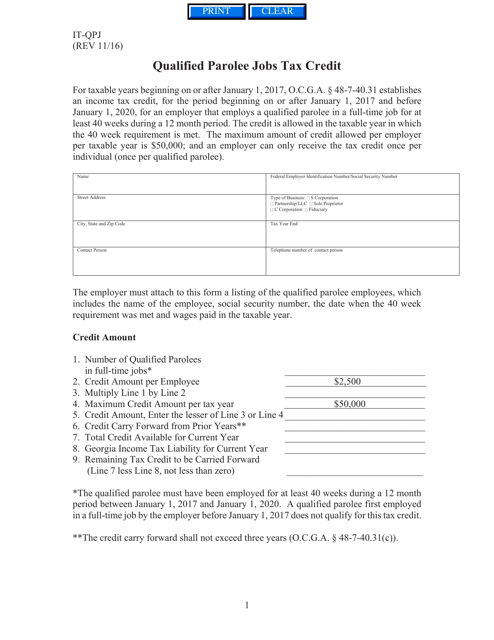

This Form is used for claiming the Qualified Parolee Jobs Tax Credit in Georgia.

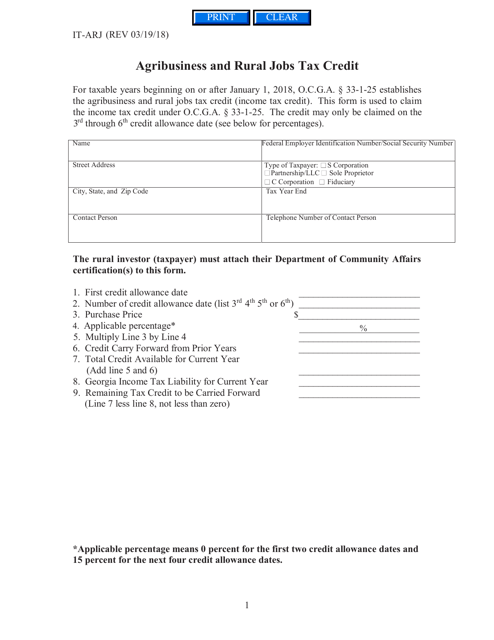

This Form is used for claiming the Agribusiness and Rural Jobs Tax Credit in the state of Georgia, United States.

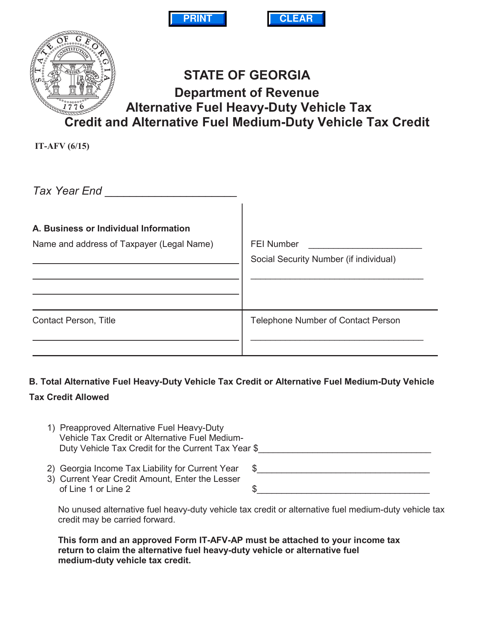

This form is used for claiming tax credits for alternative fuel heavy-duty vehicles and alternative fuel medium-duty vehicles in the state of Georgia.

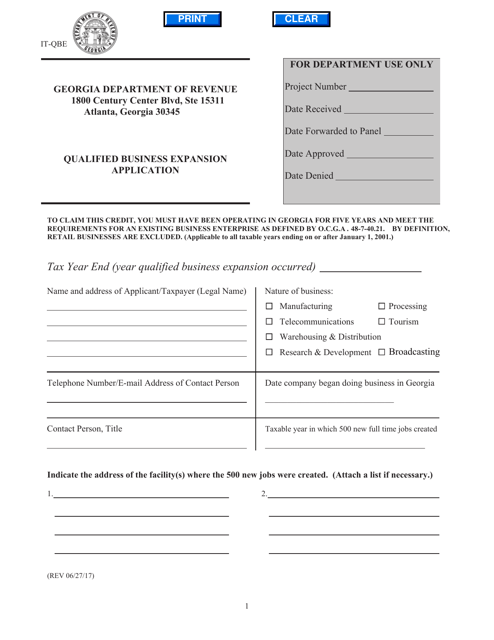

This form is used for submitting a Qualified Business Expansion Application in Georgia, United States. It is required for businesses seeking tax incentives for expanding their operations in the state.

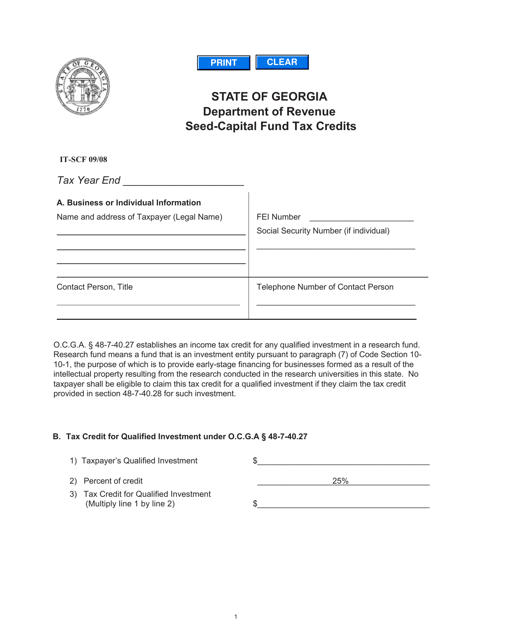

This form is used for claiming seed-capital fund tax credits in the state of Georgia, United States.

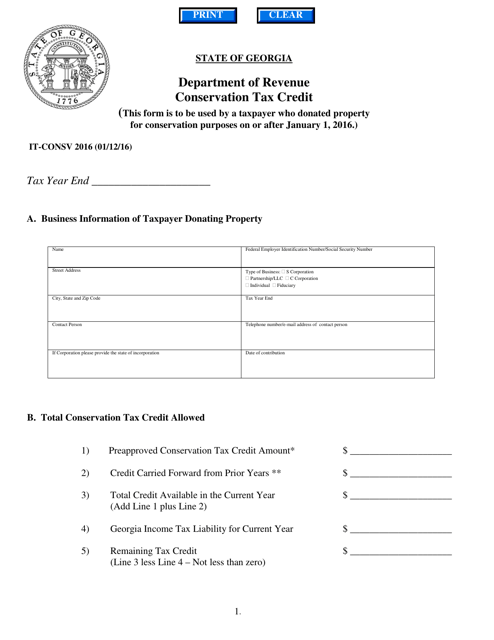

This Form is used for claiming the Conservation Tax Credit in the state of Georgia.

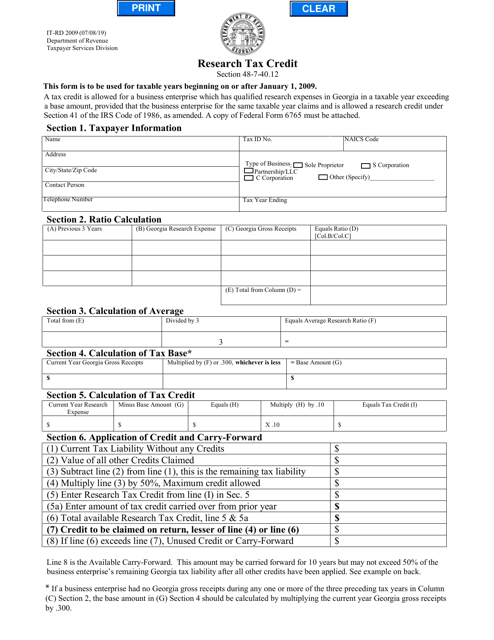

This form is used for claiming the research tax credit in Georgia, United States. It is used by businesses conducting qualified research activities to potentially reduce their tax liability.

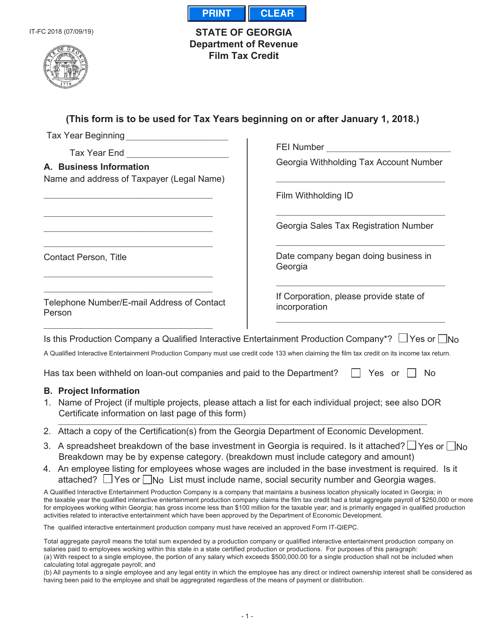

This Form is used for claiming film tax credits in Georgia, United States.

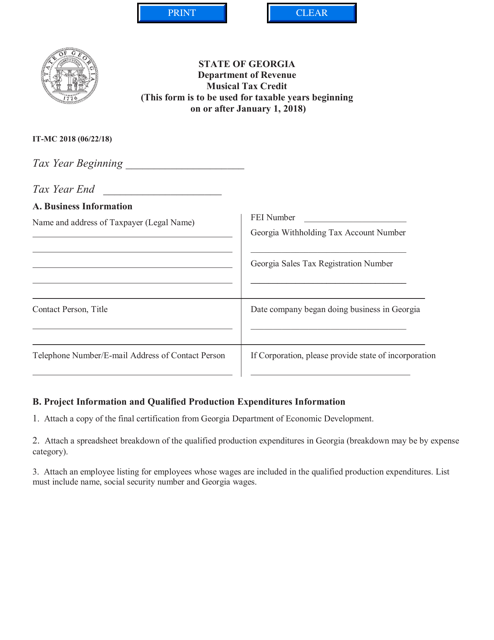

This document is a form used in Georgia (United States) for claiming the Musical Tax Credit.

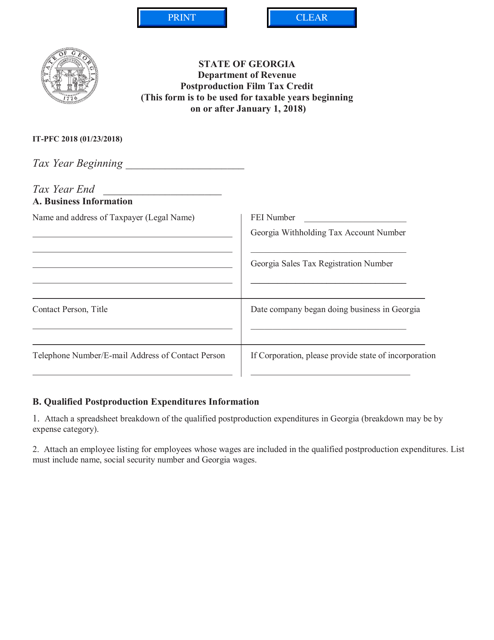

This form is used for claiming the Postproduction Film Tax Credit in the state of Georgia, United States.

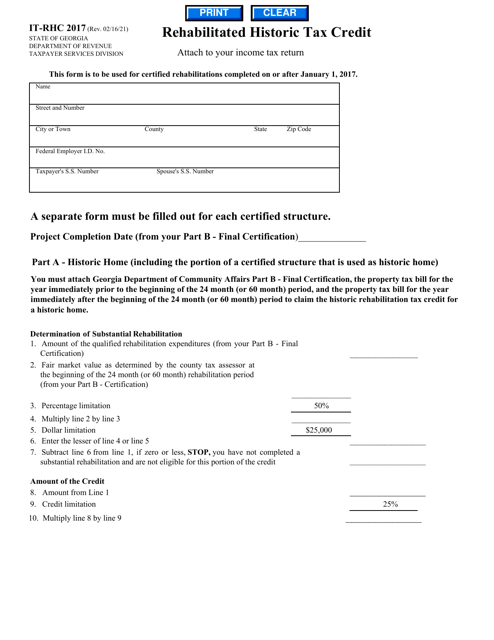

This form is used for claiming the Rehabilitated Historic Tax Credit in Georgia, United States. The credit is available for individuals and businesses who have made qualified expenses for rehabilitating historic properties.

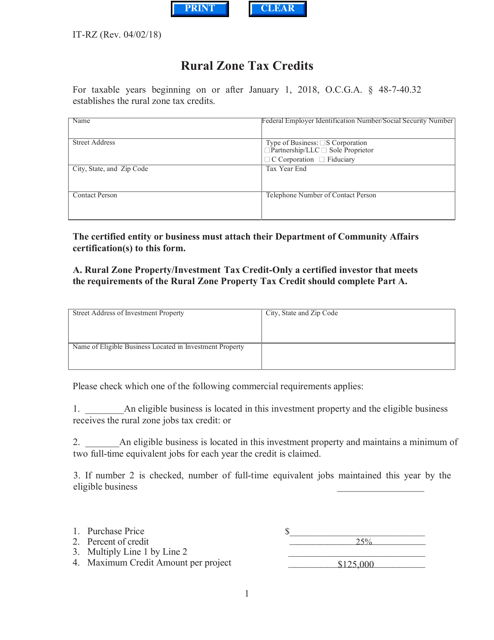

This form is used for claiming rural zone tax credits in the state of Georgia. It allows eligible individuals or businesses to receive tax credits for certain expenses incurred within designated rural zones.

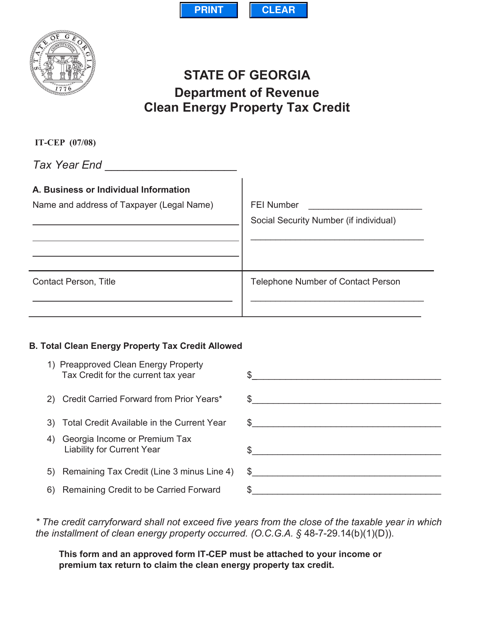

This Form is used for claiming the Clean Energy Property Tax Credit in the state of Georgia. It provides taxpayers with a credit for certain qualified clean energy property expenses.

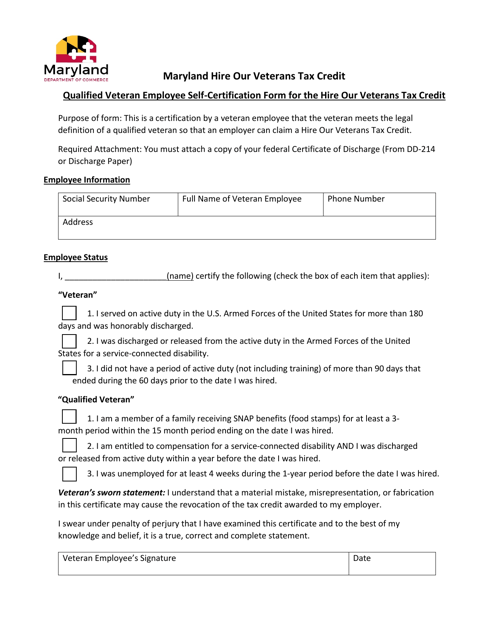

This document is for qualified veteran employees in Maryland to self-certify for the Hire Our Veterans Tax Credit.

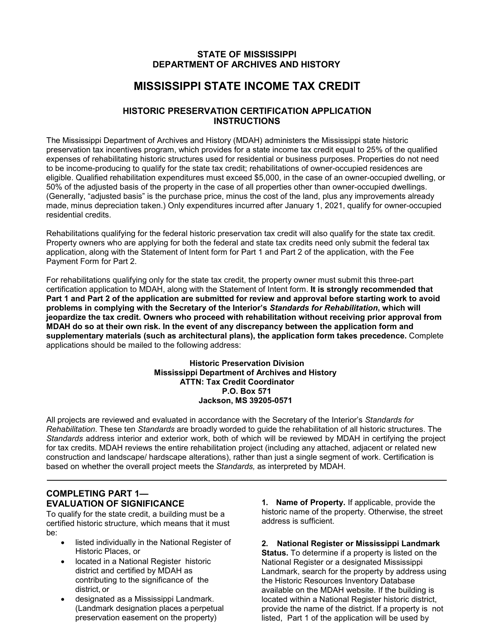

This document is for applying for a state income tax credit for historic preservation in Mississippi.

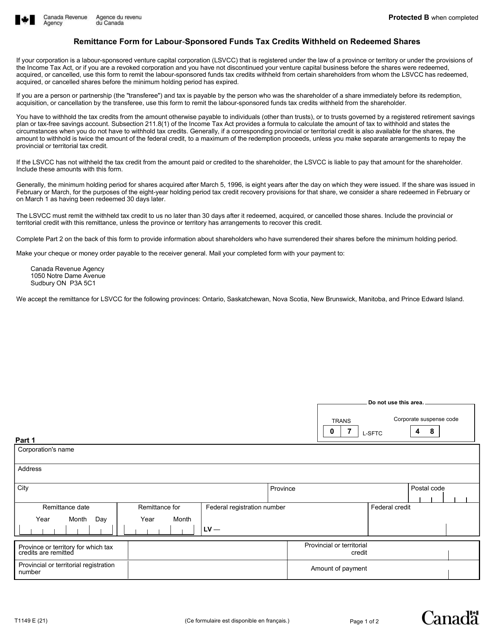

This form is used for remitting the tax credits withheld on redeemed shares of labour-sponsored funds in Canada.

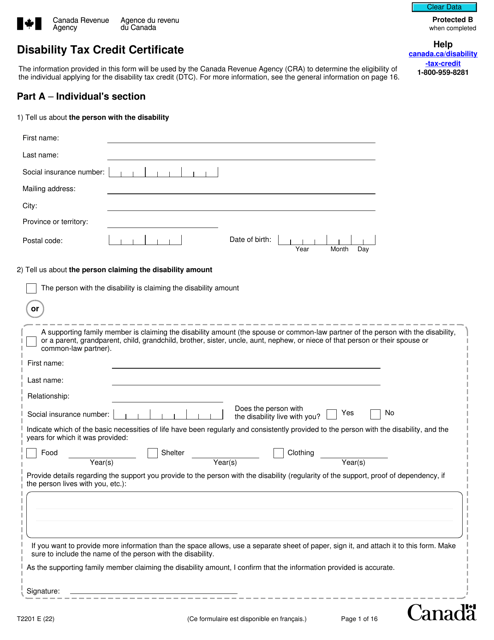

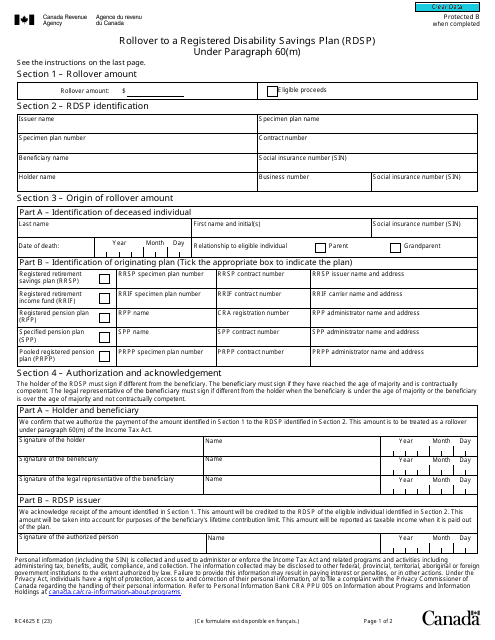

The purpose of this document is to provide the Canada Revenue Agency with information that will be enough for them to make a decision on whether an individual is eligible to receive a Disability Tax Credit.

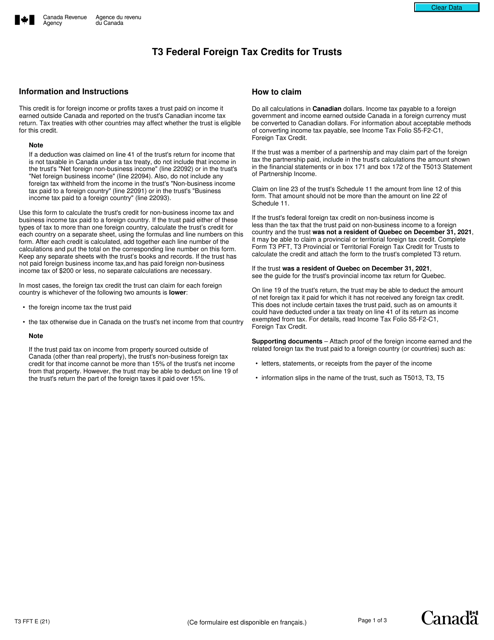

This form is used for reporting foreign tax credits for trusts in Canada. It helps trustees claim credits for taxes paid to foreign countries.

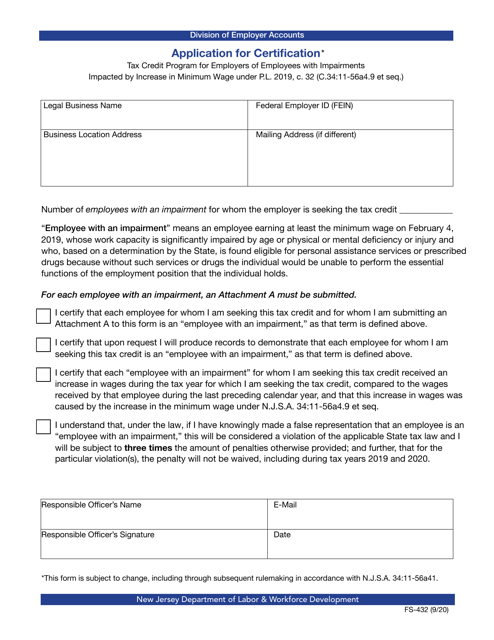

This form is used for employers in New Jersey to apply for certification in the Tax Credit Program for Employers of Employees with Impairments.

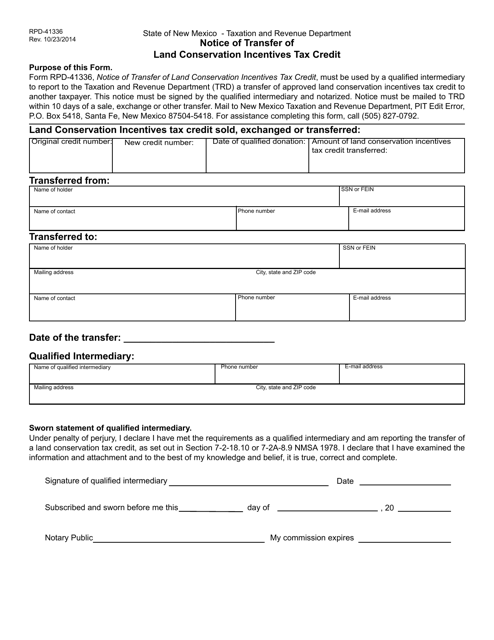

This form is used for notifying the transfer of a land conservation incentives tax credit in New Mexico. It is required to document the transfer of the tax credit to another party.

This form is used for applying for the Land Conservation Incentives Tax Credit in New Mexico. It provides instructions on how to fill out the form and apply for the credit.

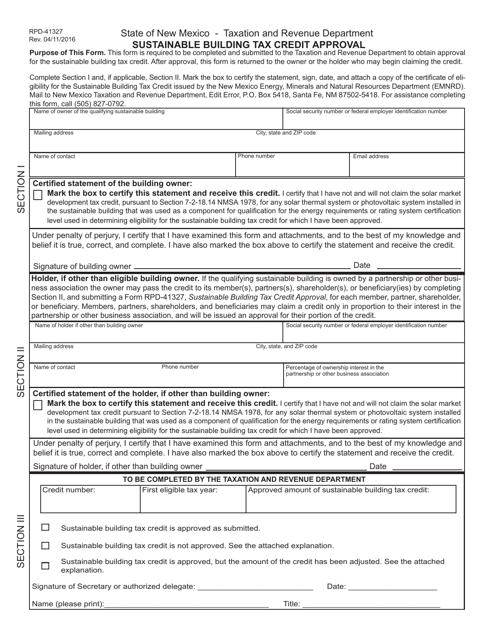

This form is used for applying for approval of sustainable building tax credit in New Mexico.

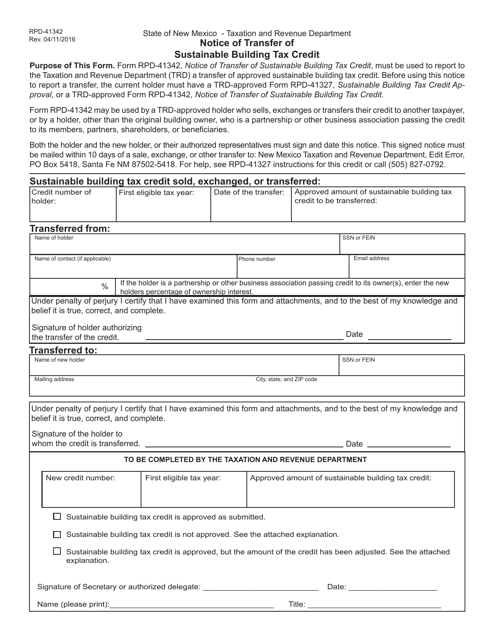

This Form is used for notifying the transfer of Sustainable Building Tax Credit in New Mexico.

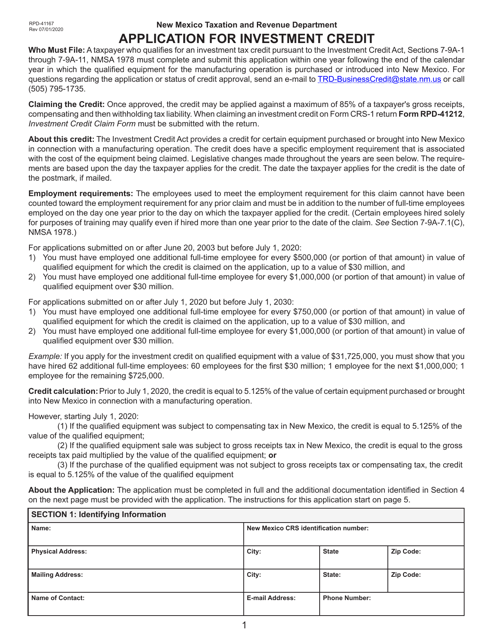

This form is used for applying for an investment credit in the state of New Mexico. It is for individuals or businesses seeking to receive a tax credit for their investment activities.

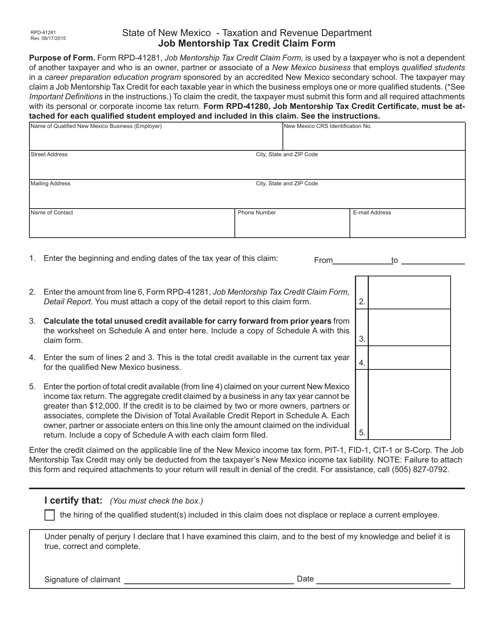

This form is used for claiming the Job Mentorship Tax Credit in New Mexico.

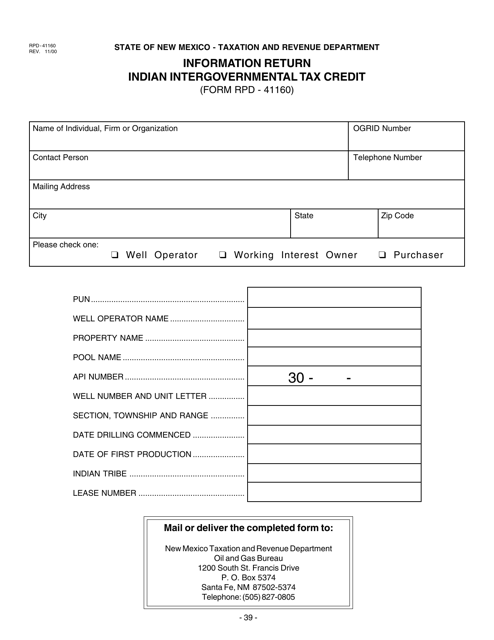

This form is used for claiming the Indian Intergovernmental Tax Credit in the state of New Mexico.

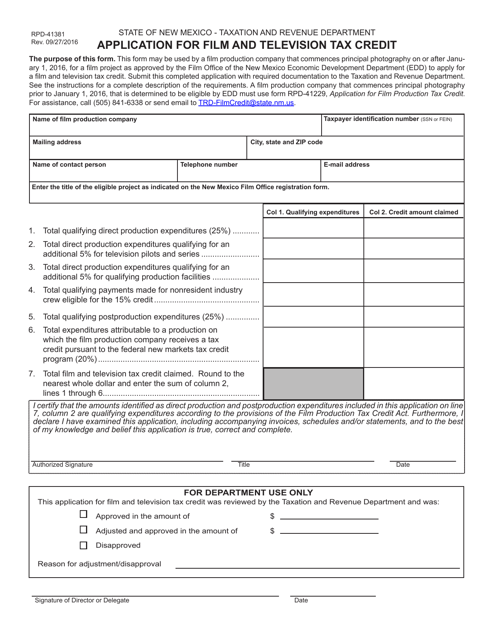

This Form is used for applying for the Film and Television Tax Credit for productions that took place in New Mexico prior to July 1, 2019.

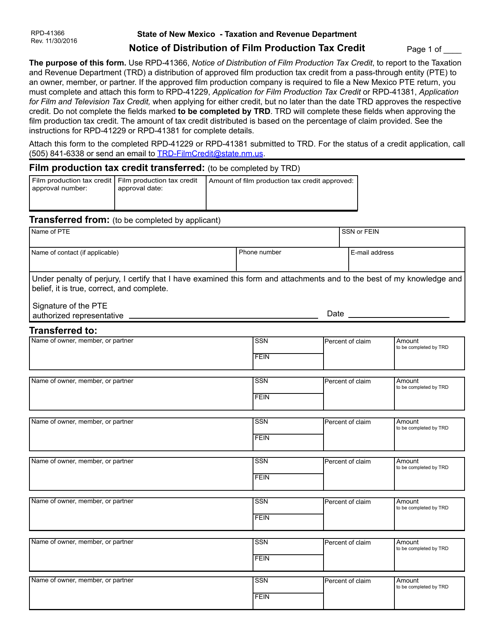

This Form is used for notifying the distribution of the Film Production Tax Credit in New Mexico. It is a document that ensures transparency and accountability in the tax credit distribution process for film production.

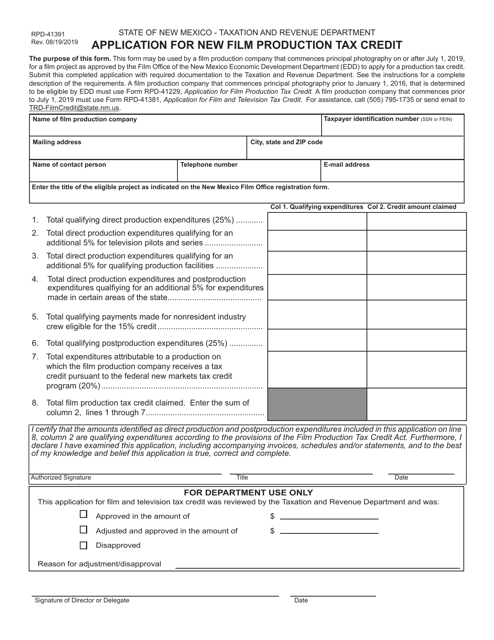

This form is used to apply for a new film production tax credit in the state of New Mexico.

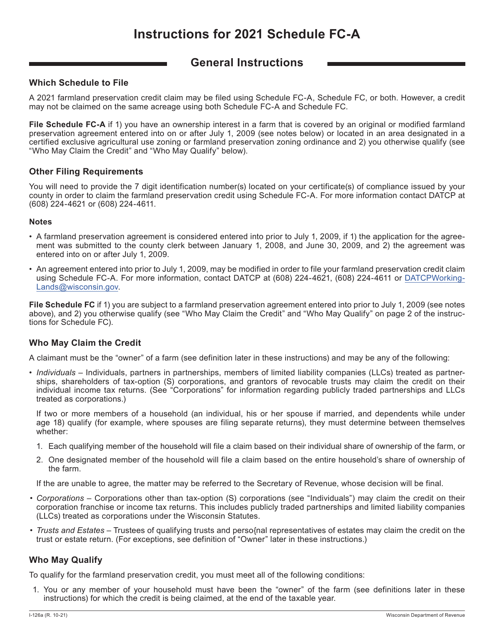

This Form is used for claiming the Farmland Preservation Credit in Wisconsin. It provides instructions on how to complete and file Form IC-025AI Schedule FC-A.