Tax Credit Templates

Documents:

3232

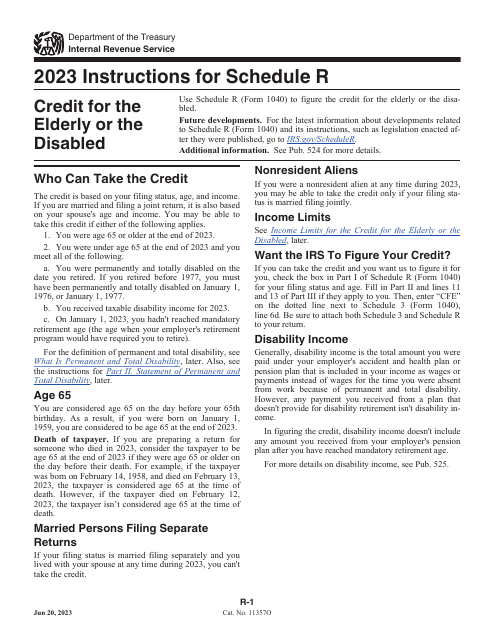

This is a document you may use to figure out how to properly complete IRS Form 6765

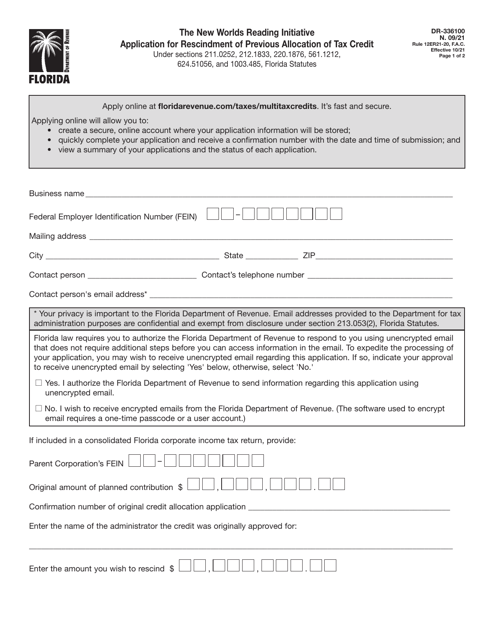

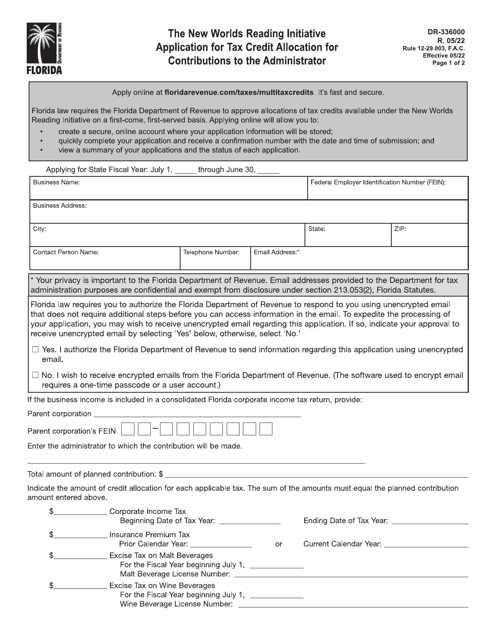

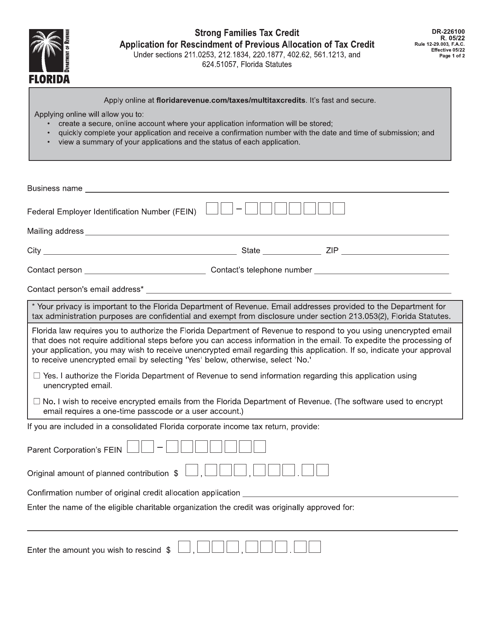

This form is used to apply for the rescindment of a previous allocation of tax credit in Florida through the New Worlds Reading Initiative Application.

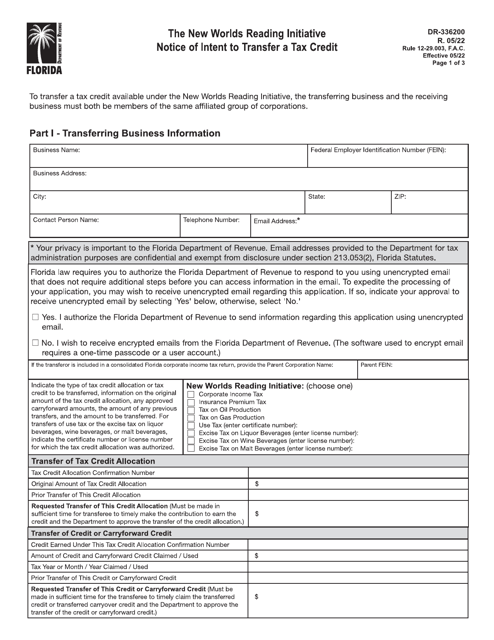

Form DR-336200 The New Worlds Reading Initiative Notice of Intent to Transfer a Tax Credit - Florida

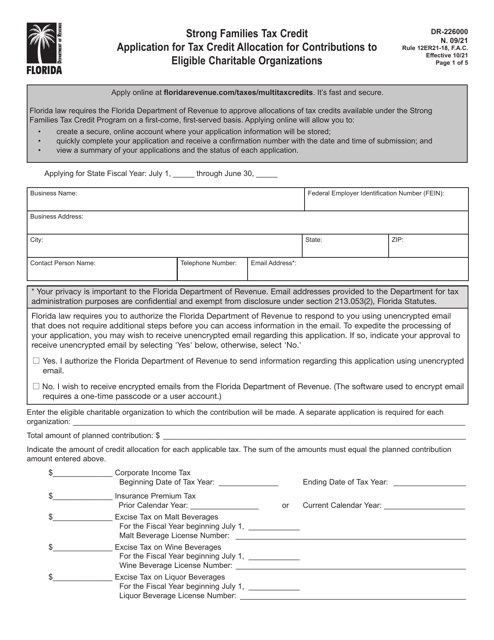

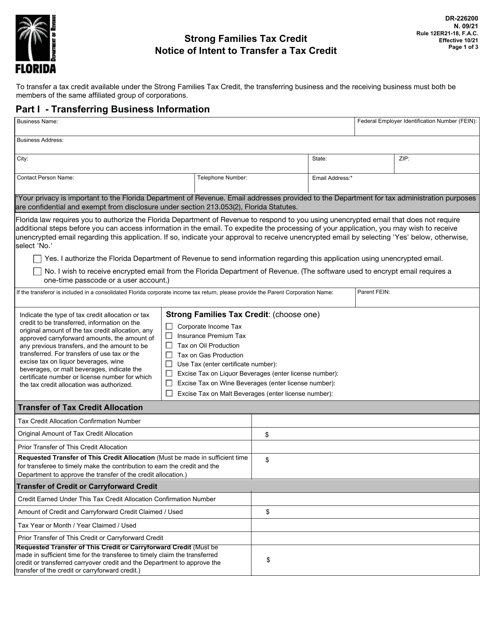

This form is used for applying for the Strong Families Tax Credit in Florida. It allows individuals and businesses to request a tax credit for contributions made to eligible charitable organizations that support strong families.

This form is used for notifying the Florida Department of Revenue about your intent to transfer a tax credit related to the Strong Families Tax Credit.

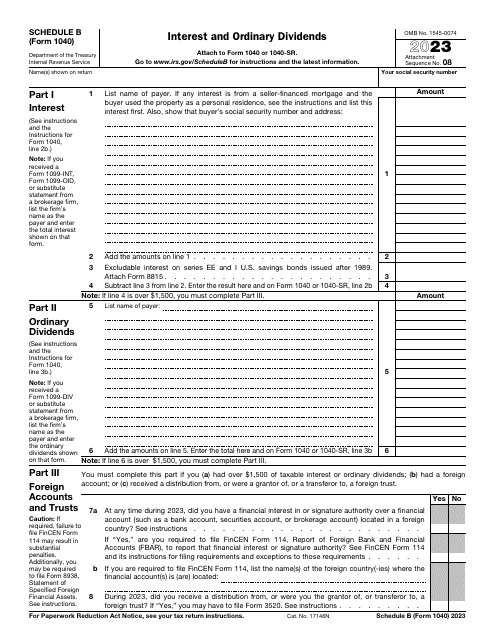

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

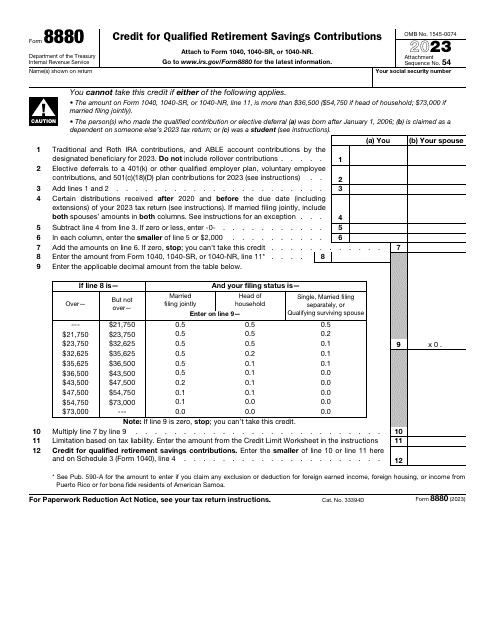

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

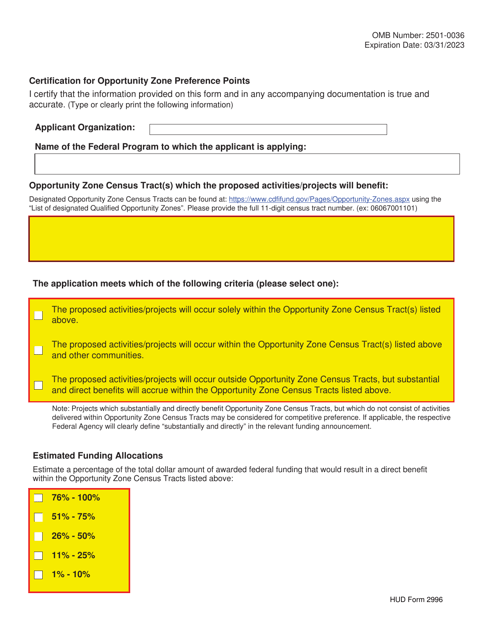

This form is used for certifying eligibility for preference points related to Opportunity Zones.

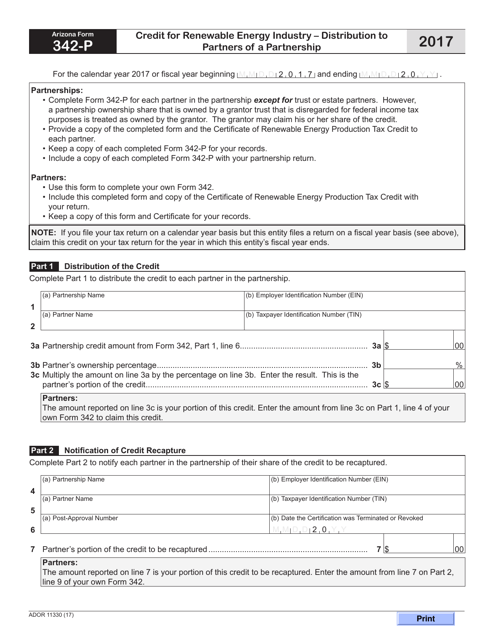

This form is used for claiming the Credit for Renewable Energy Industry - Distribution to Partners of a Partnership in the state of Arizona.