Tax Penalty Templates

Are you facing tax penalties? Do you need assistance with understanding and resolving your tax penalty situation? Look no further, because our comprehensive collection of tax penalty resources is here to help you.

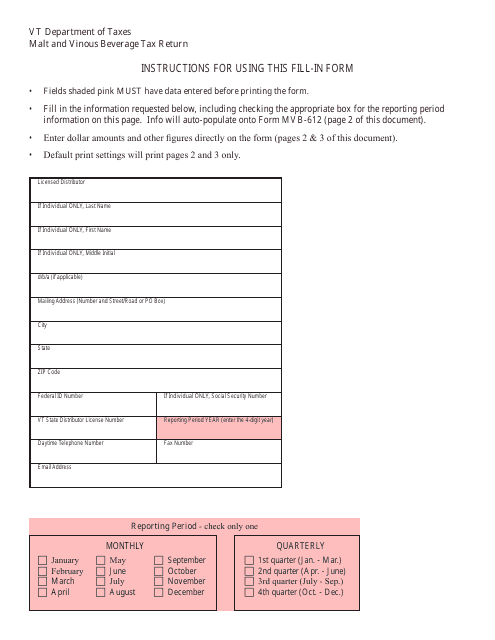

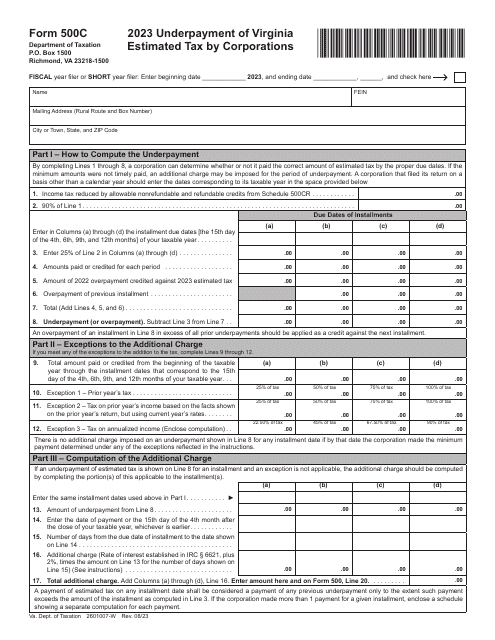

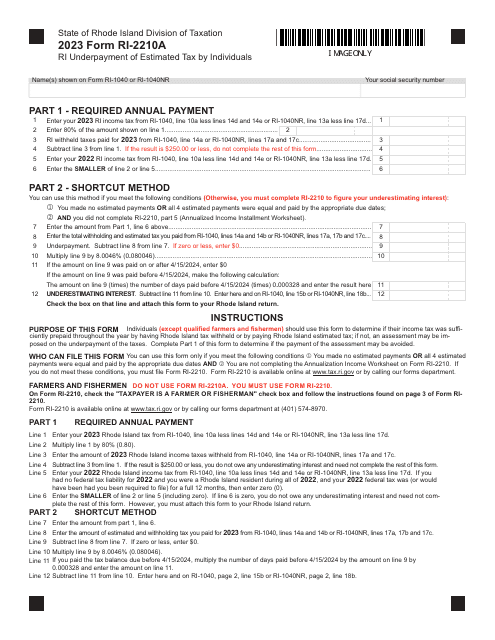

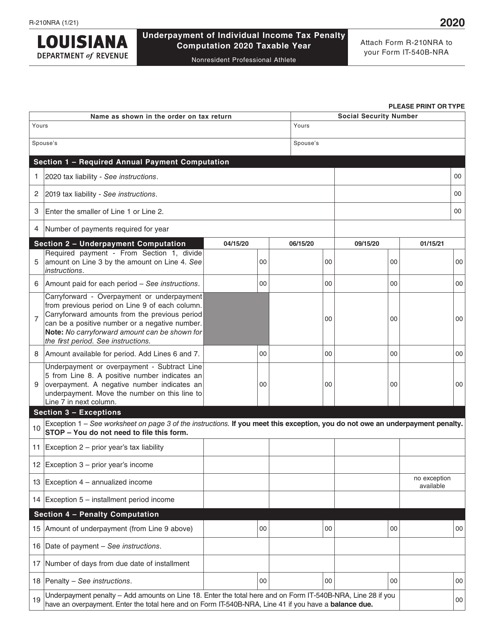

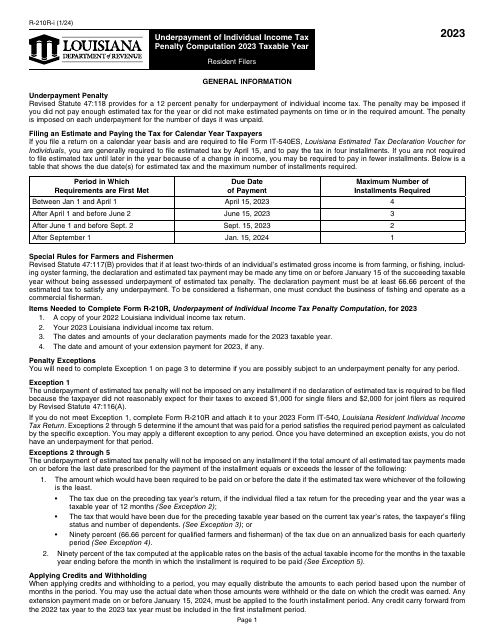

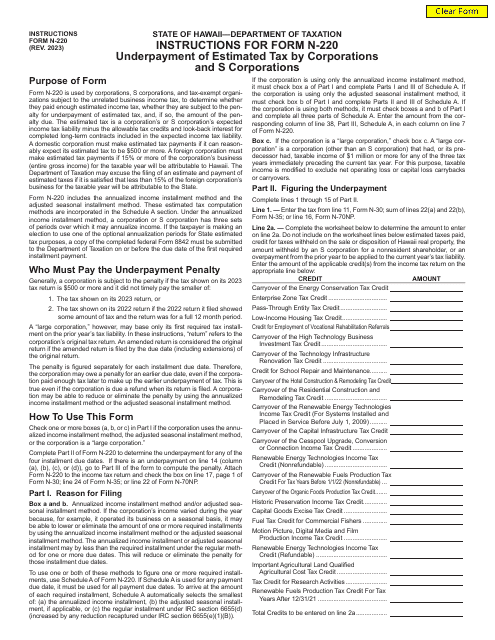

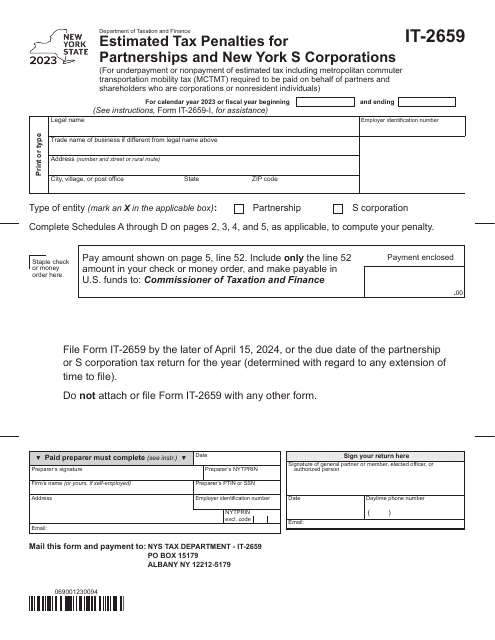

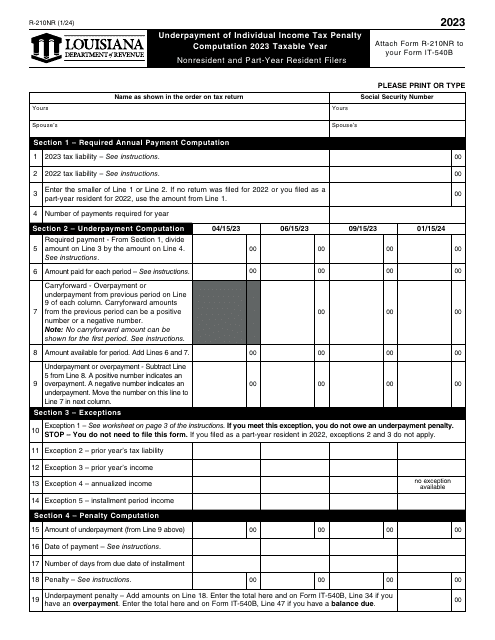

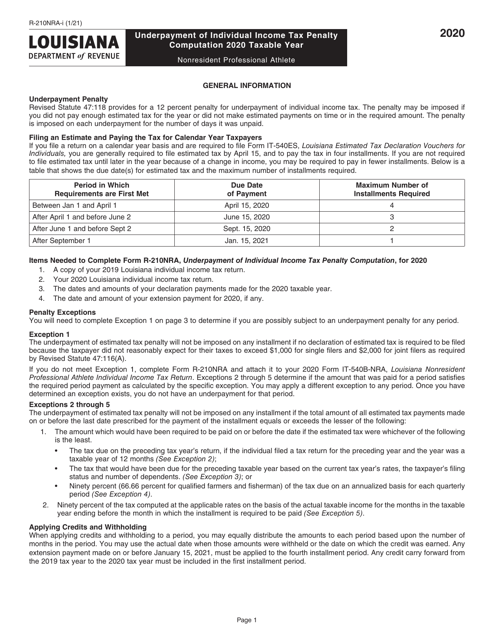

Our tax penalty documents cover everything you need to know about tax penalties. From forms and instructions for state-specific penalties such as the VT Form MVB-612 Malt and Vinous Beverage Tax Return in Vermont, the Form R-210NRA Underpayment of Individual Income Tax Penalty in Louisiana, and the Form M1 Schedule M15 Underpayment of Estimated Income Tax in Minnesota, to penalty computations for different types of filers like the Form R-210NR Underpayment of Individual Income Tax Penalty Computation for non-residents and part-year residents in Louisiana, and the Instructions for Form R-210R Underpayment of Individual Income Tax Penalty Computation for resident filers in Louisiana.

Our tax penalty resources provide valuable information on understanding, calculating, and resolving your tax penalties. Whether you are an individual or a business, our documents will guide you through the process of handling tax penalties effectively.

Don't let tax penalties weigh you down. Explore our tax penalty resources today and find the assistance you need to navigate the complex world of tax penalties.

Documents:

95

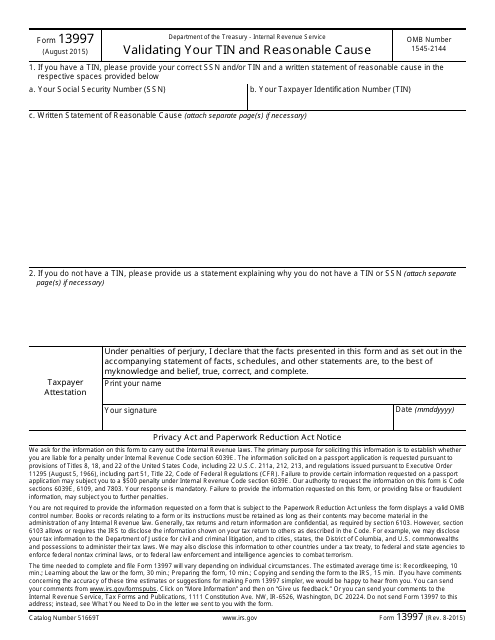

This Form is used for validating your Taxpayer Identification Number (TIN) and providing a reasonable cause explanation.

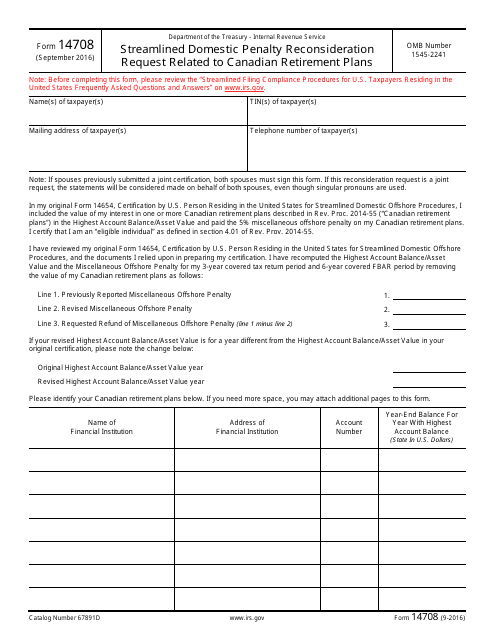

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

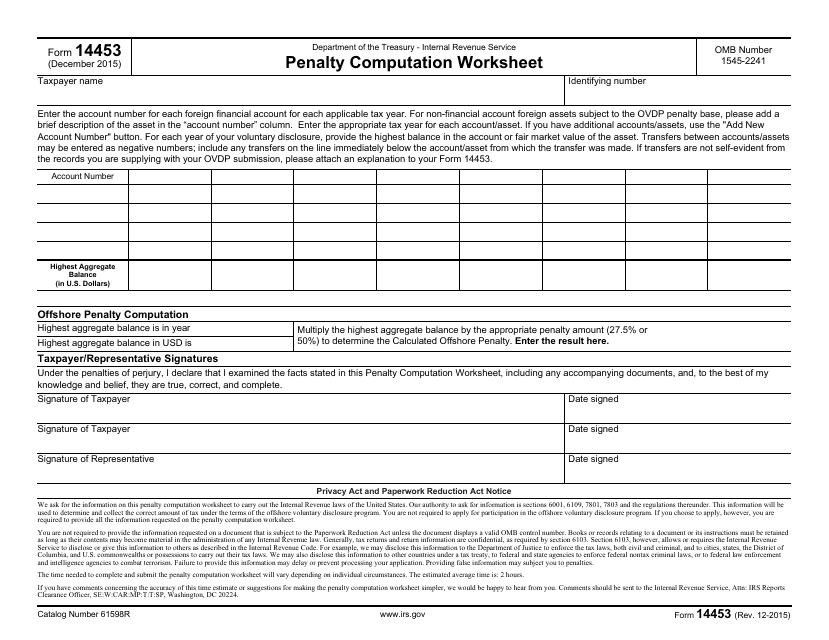

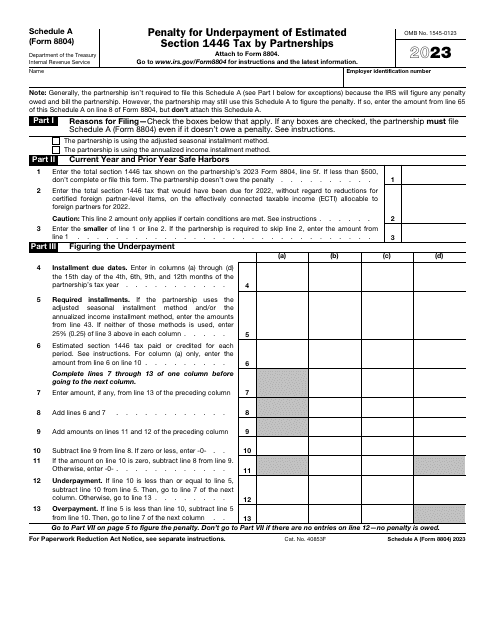

This document is used to calculate penalties owed to the IRS. It provides a worksheet for determining the amount of the penalty.

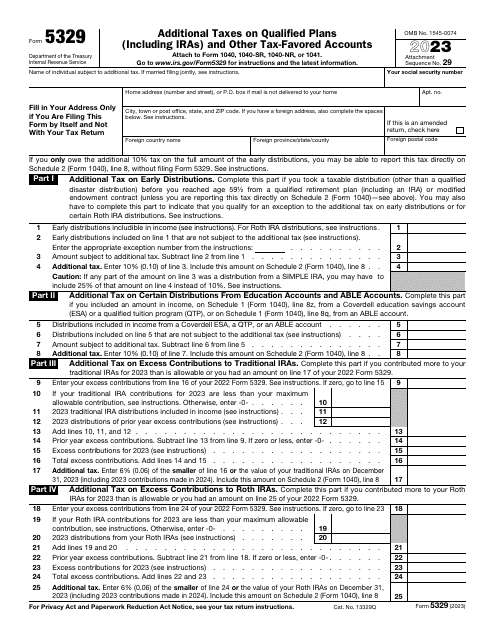

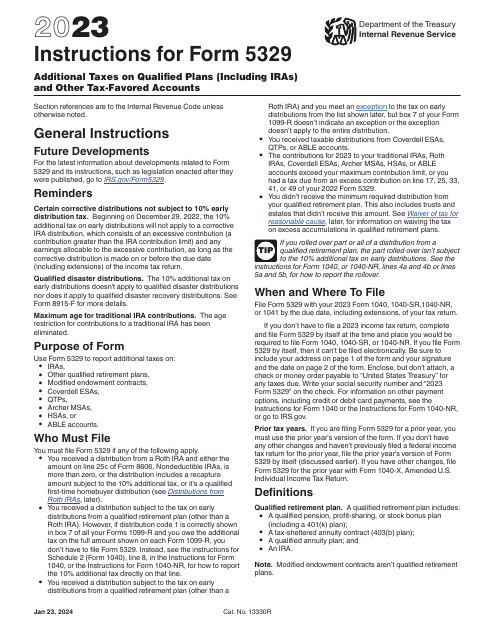

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

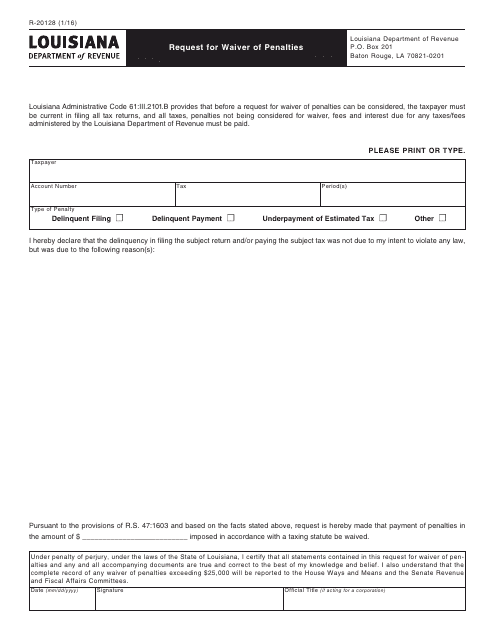

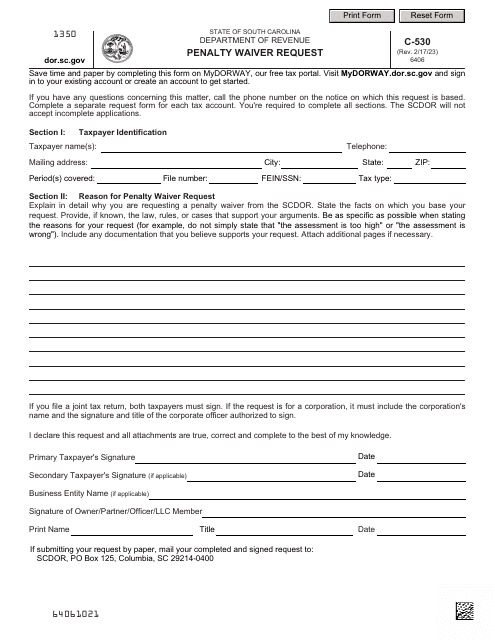

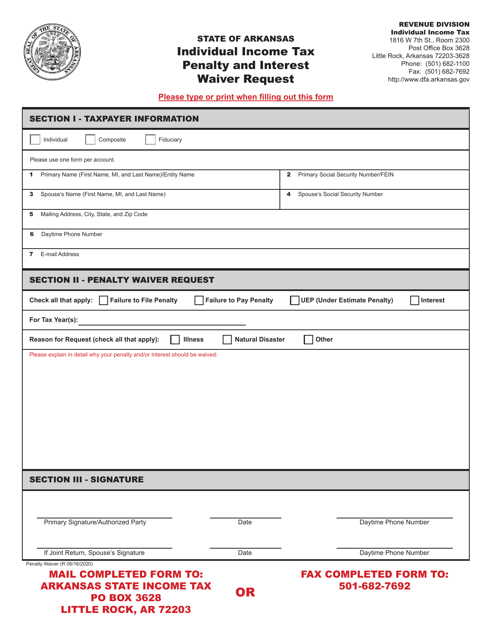

This Form is used for requesting a waiver of penalties in the state of Louisiana.

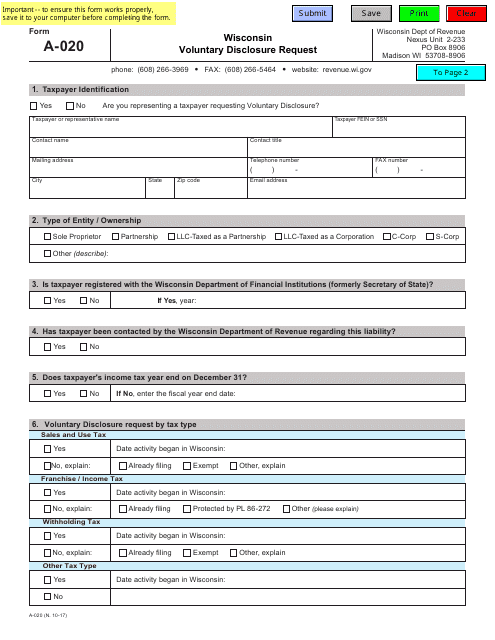

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

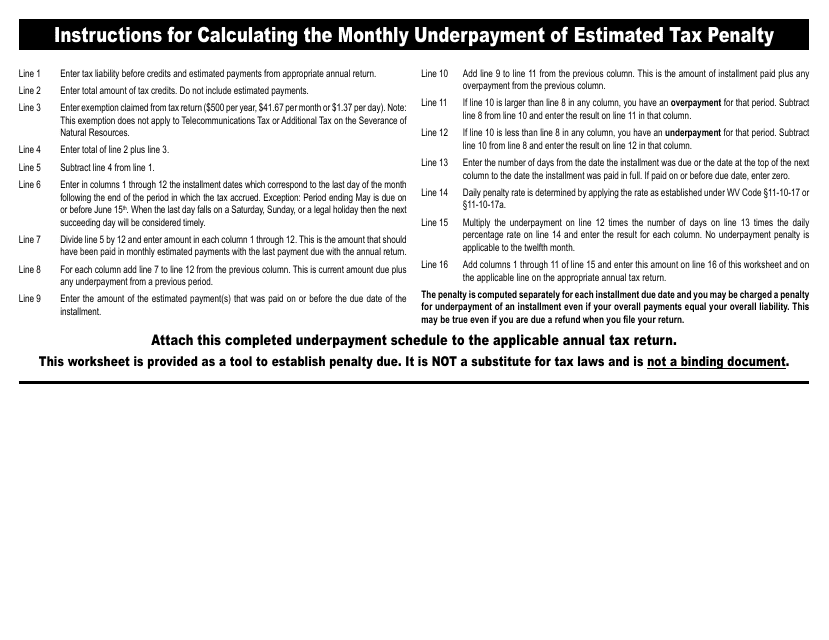

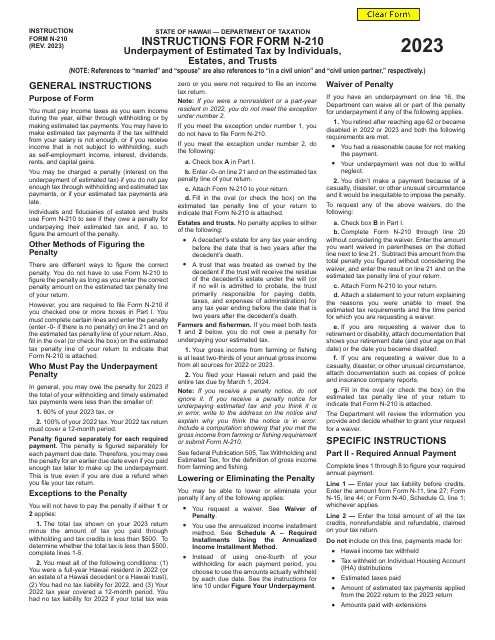

This document provides instructions for calculating the monthly underpayment of estimated tax penalty in West Virginia. It explains how to determine if you owe this penalty and how to calculate the correct amount.

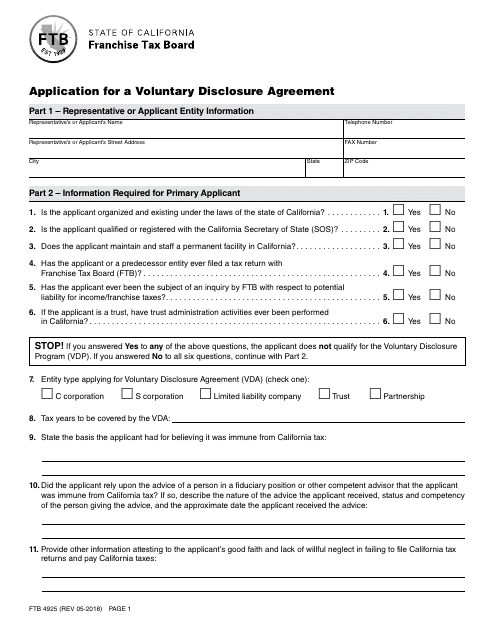

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

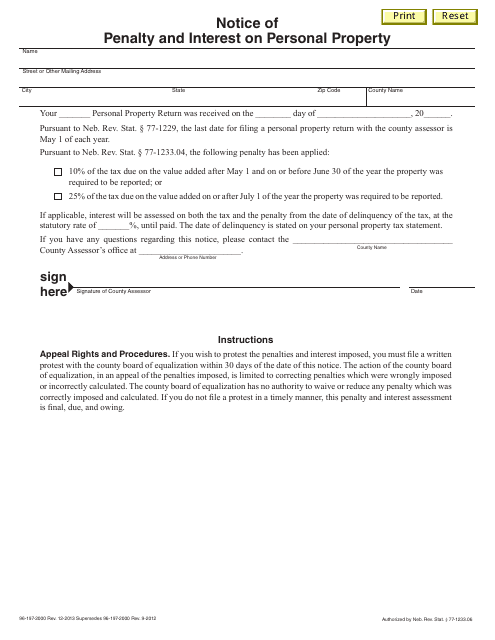

This document is a Notice of Penalty and Interest on Personal Property in the state of Nebraska. It is used to inform individuals about any penalties or interest charges imposed on their personal property.

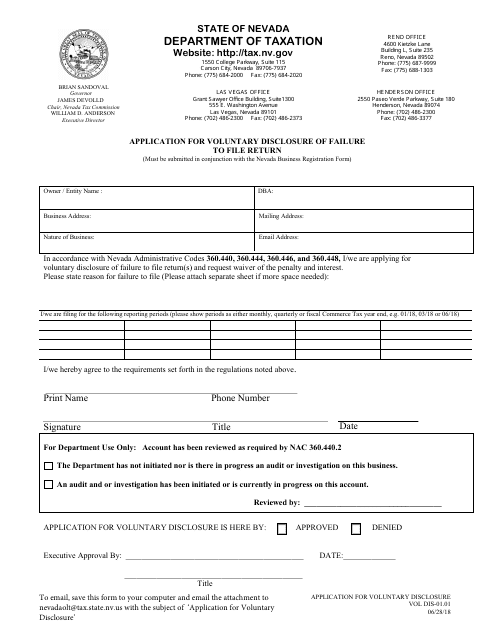

This form is used for individuals or businesses in Nevada who have failed to file a tax return and want to voluntarily disclose their mistake to the state. By filling out this application, you can avoid penalties and potential legal consequences.

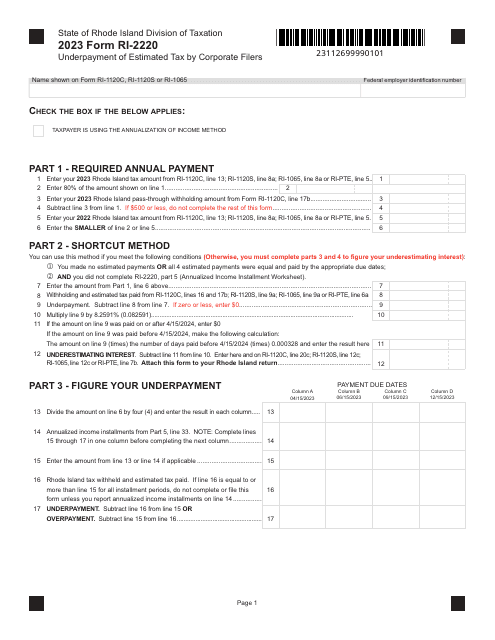

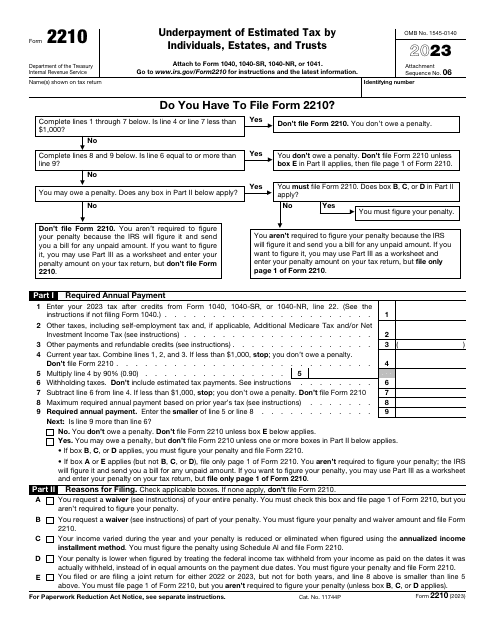

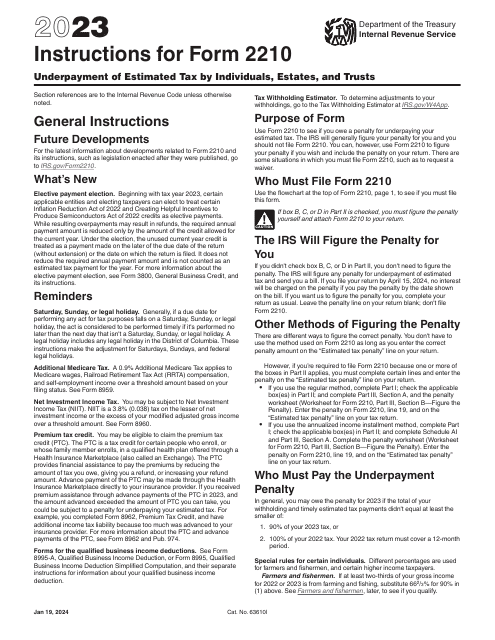

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

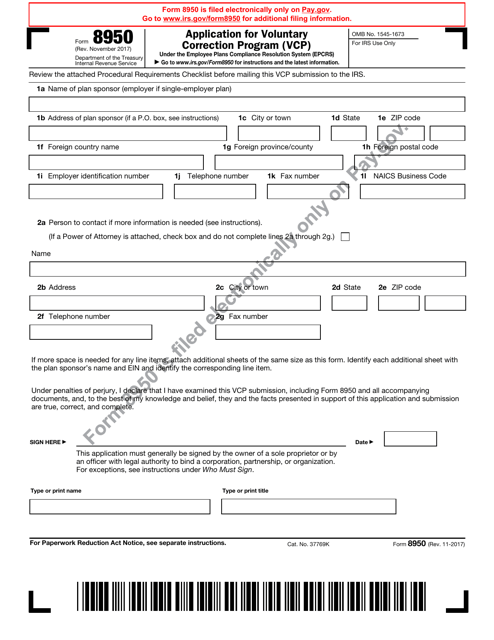

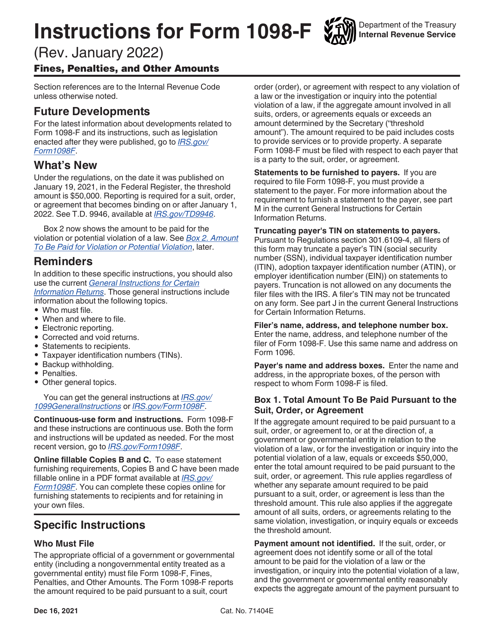

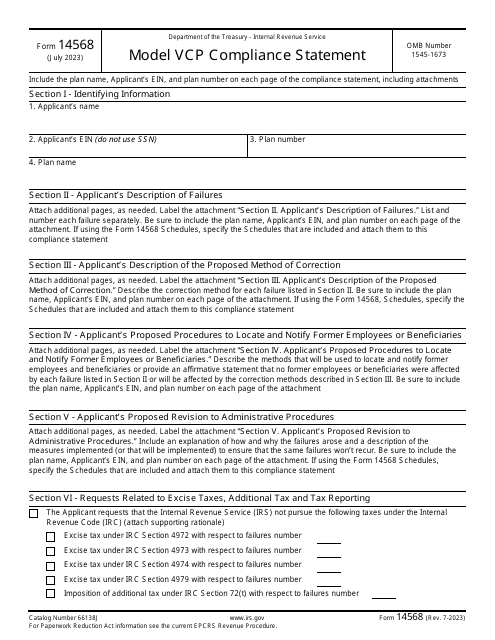

This form is used for applying to the IRS Voluntary Correction Program (VCP). The VCP allows employers to correct errors in their retirement plans and avoid penalties.

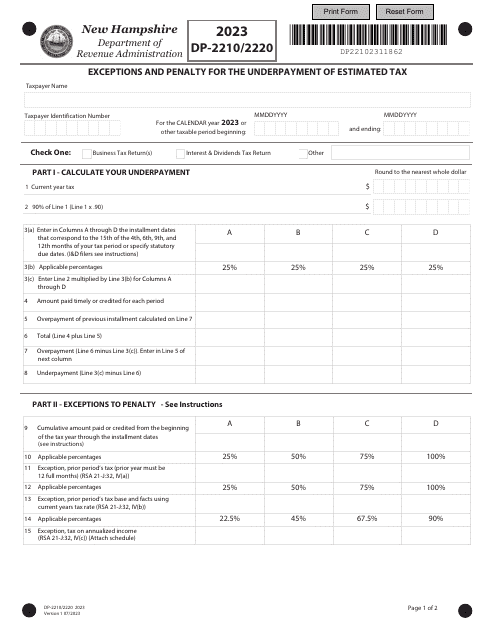

Form DP-2210/2220 Exceptions and Penalty for the Underpayment of Estimated Tax - New Hampshire, 2023

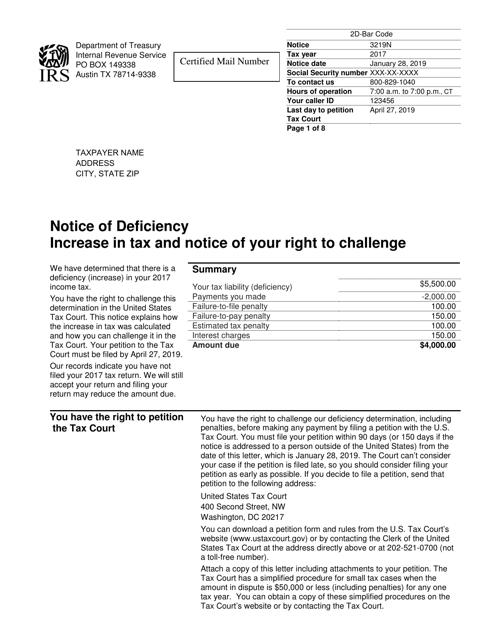

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

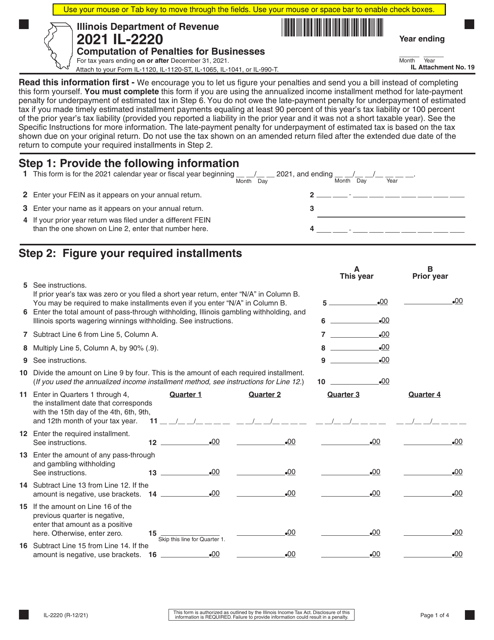

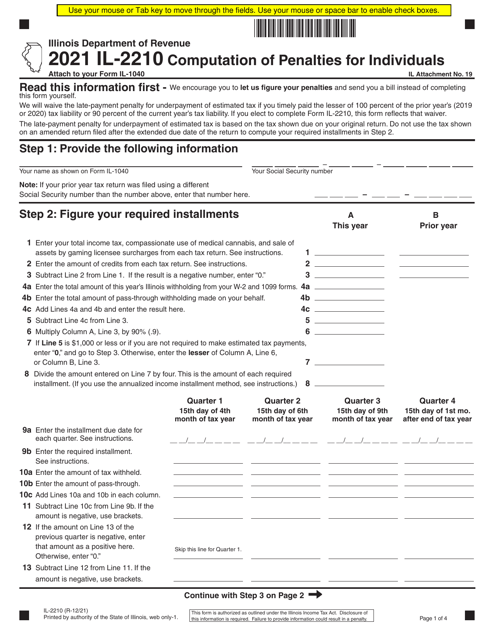

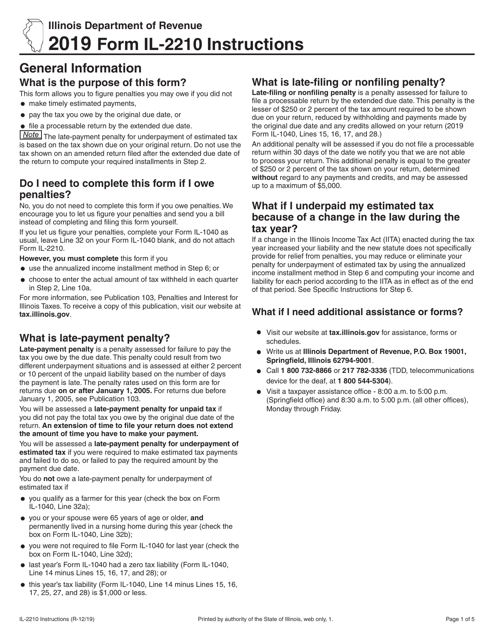

This form is used for calculating penalties for individuals in Illinois who have underpaid their taxes or failed to file their tax returns on time. It provides instructions on how to compute the penalties and includes the necessary calculations.