Tax Penalty Templates

Documents:

95

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

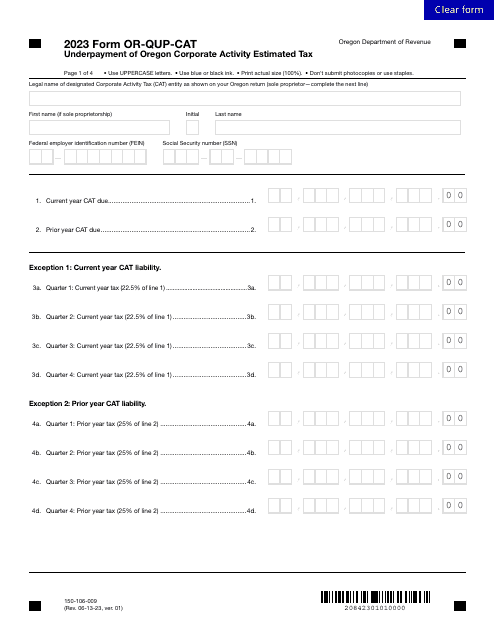

Form OR-QUP-CAT (150-106-009) Underpayment of Oregon Corporate Activity Estimated Tax - Oregon, 2023

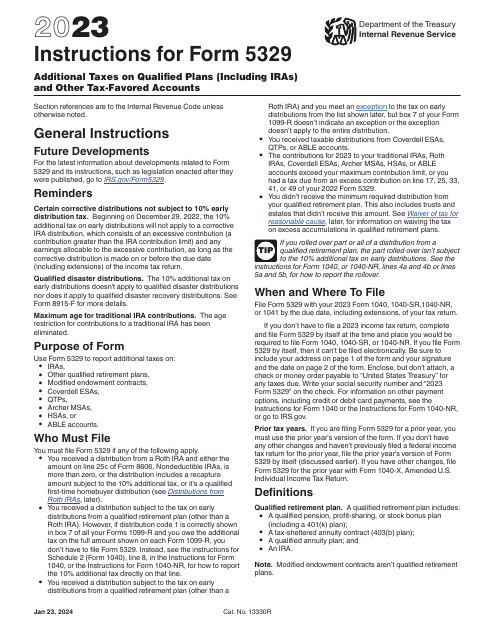

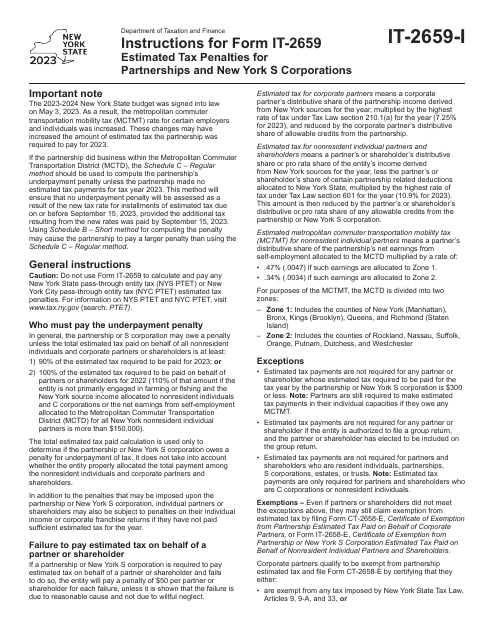

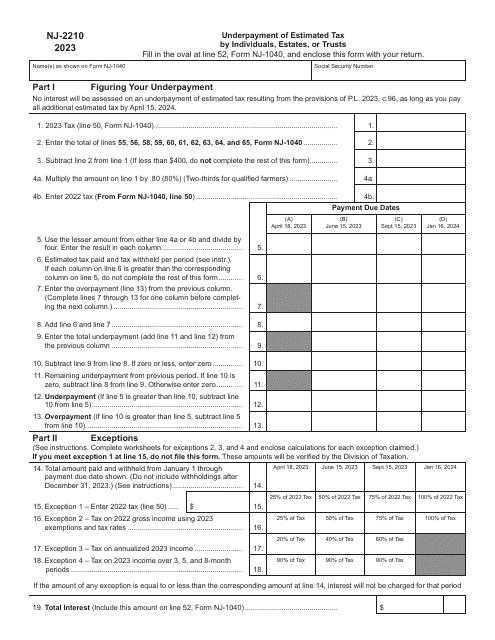

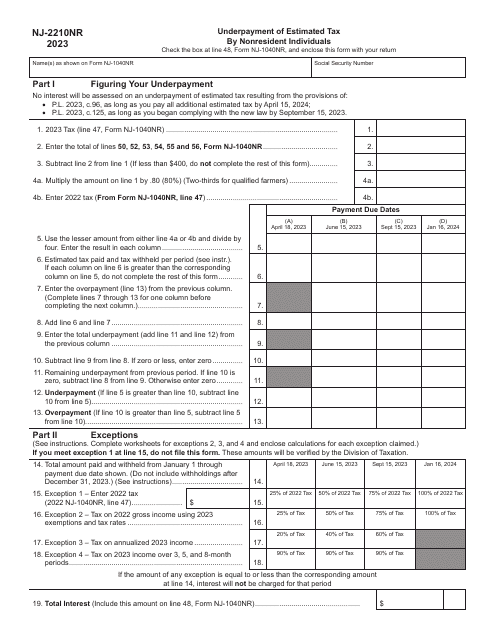

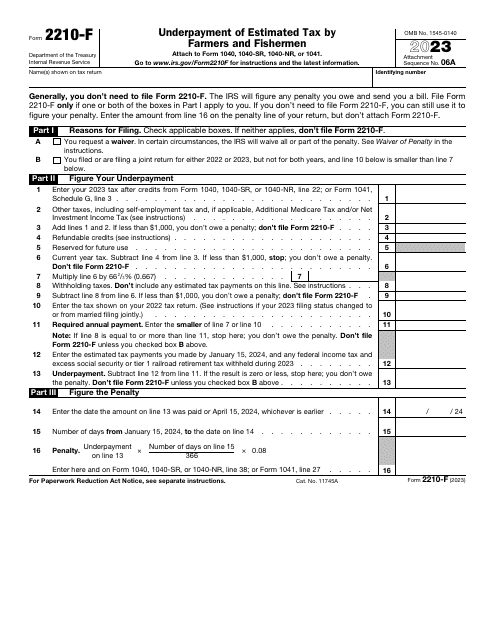

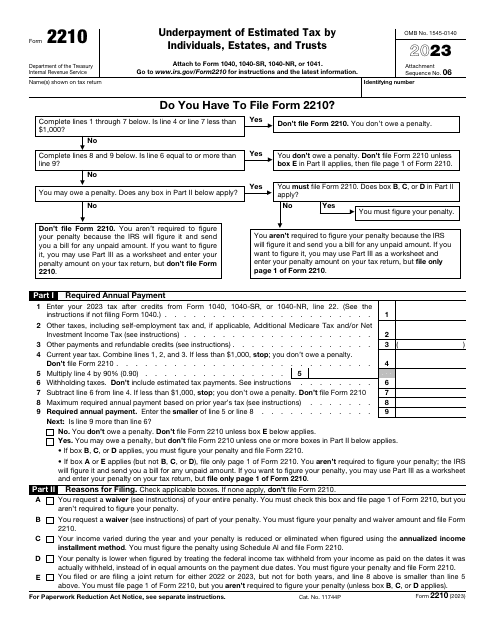

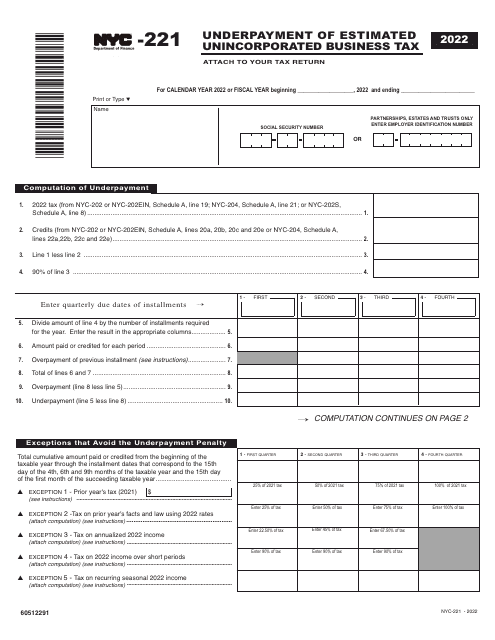

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

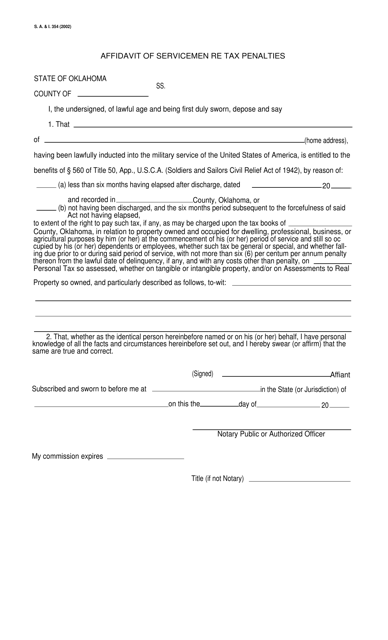

This form is used for filing an affidavit by servicemen to request a waiver of tax penalties in Oklahoma.

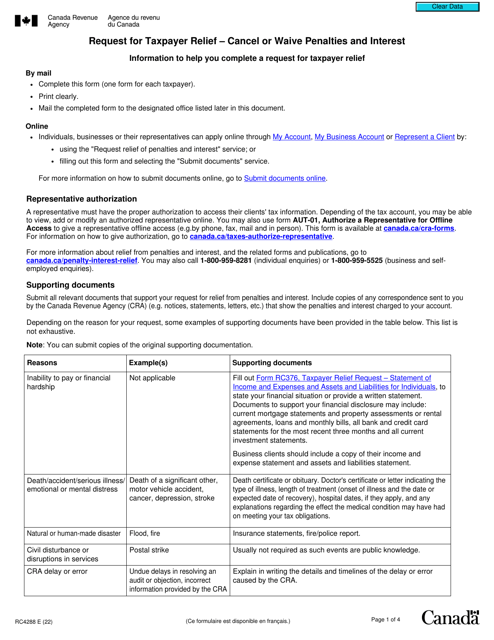

This form acts as the supporting documentation a Canadian person will need to submit when they are unable to pay their annual taxes due to extenuating circumstances.

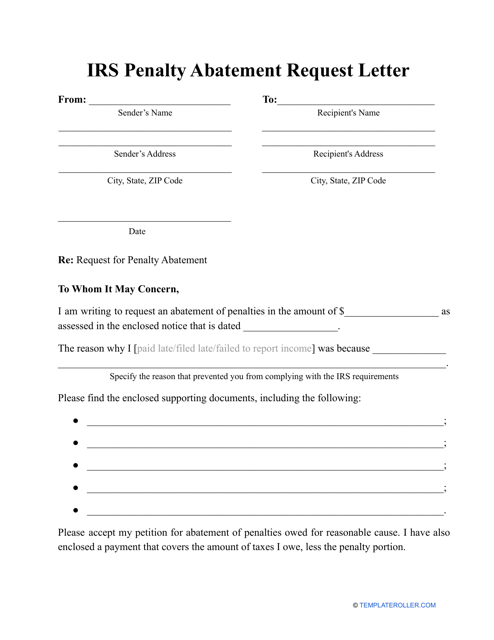

A taxpayer may prepare a letter such as this and send it to the Internal Revenue Service (IRS) to ask the latter to waive a penalty imposed for not filing a required tax return on time or not paying their taxes.

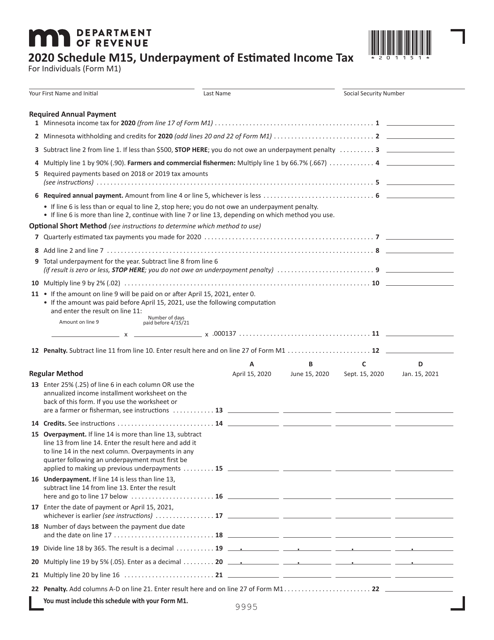

This form is used for calculating underpayment of estimated income tax in the state of Minnesota.

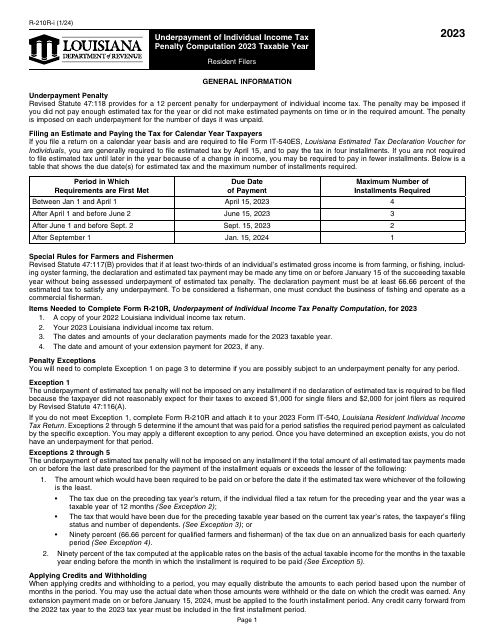

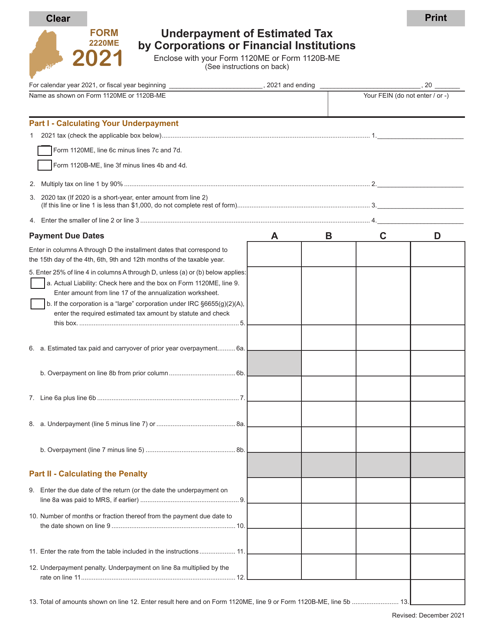

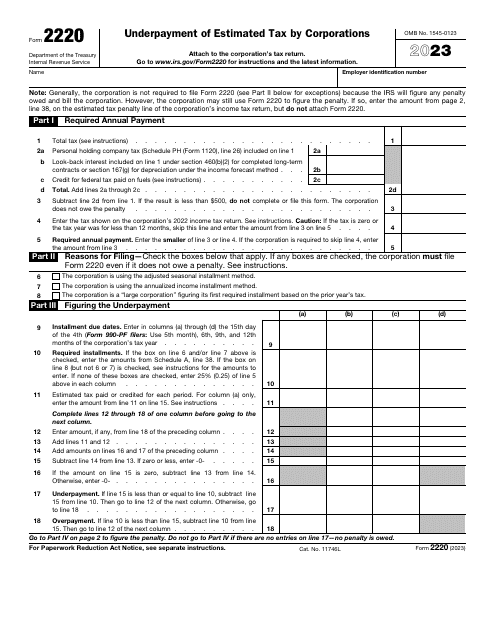

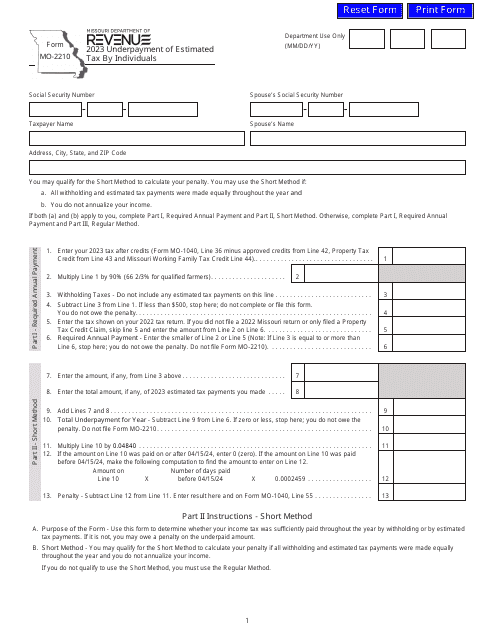

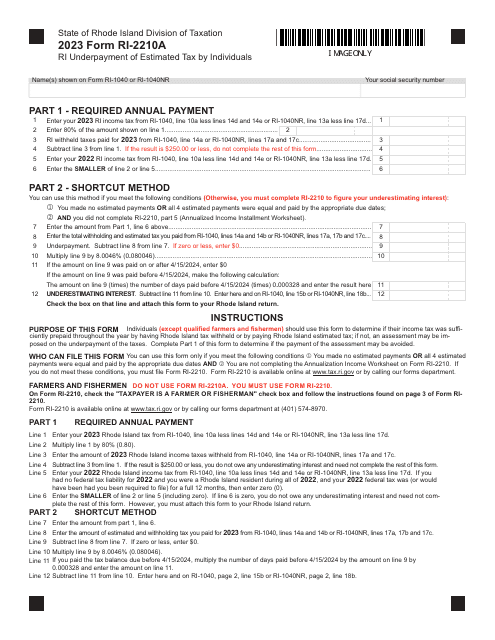

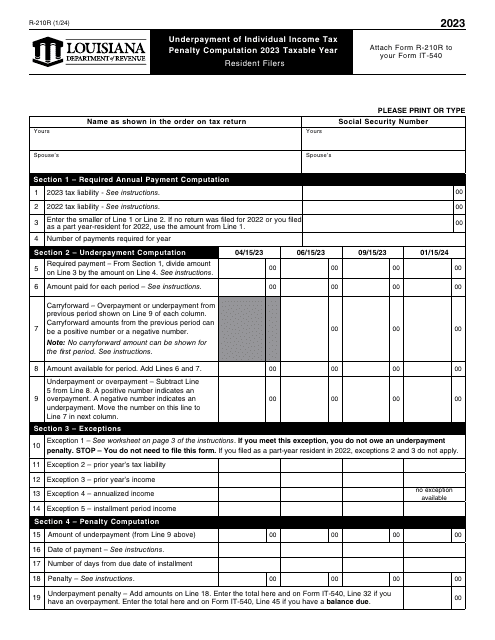

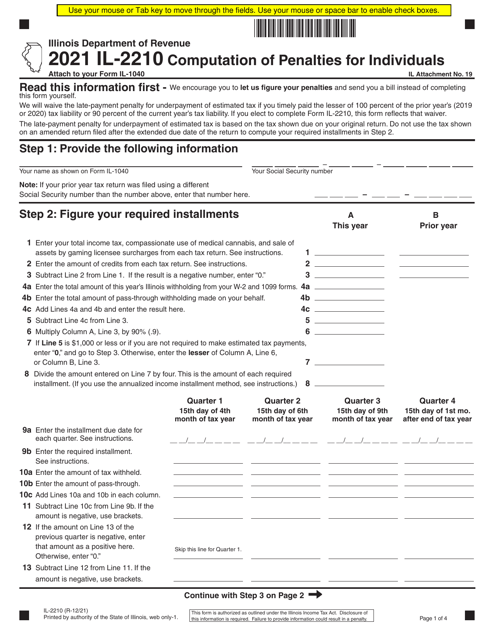

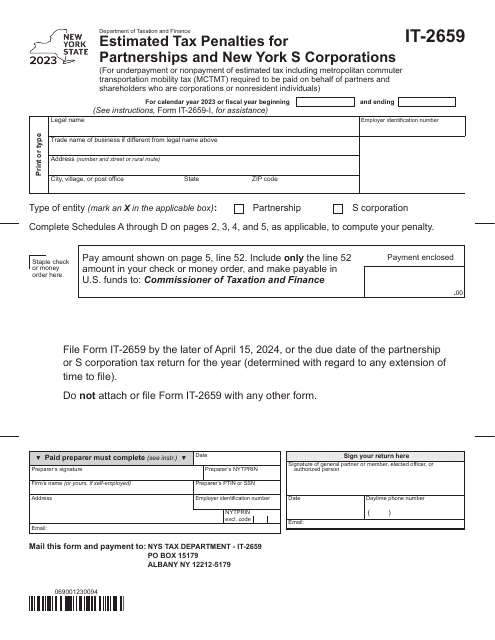

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

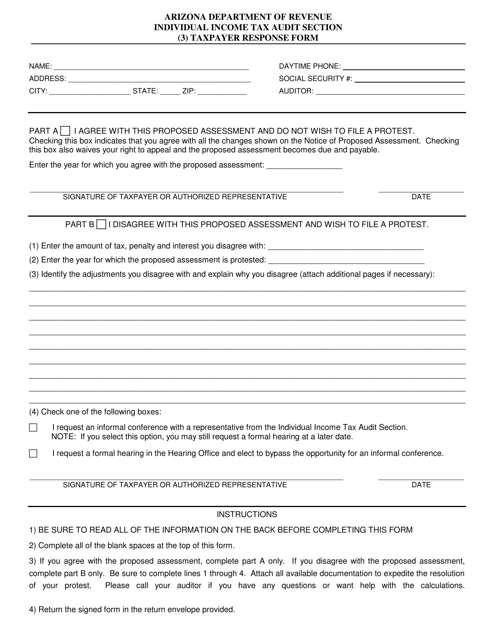

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

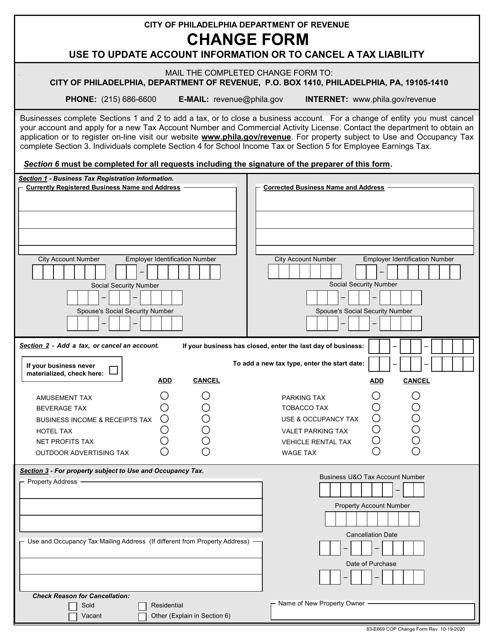

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

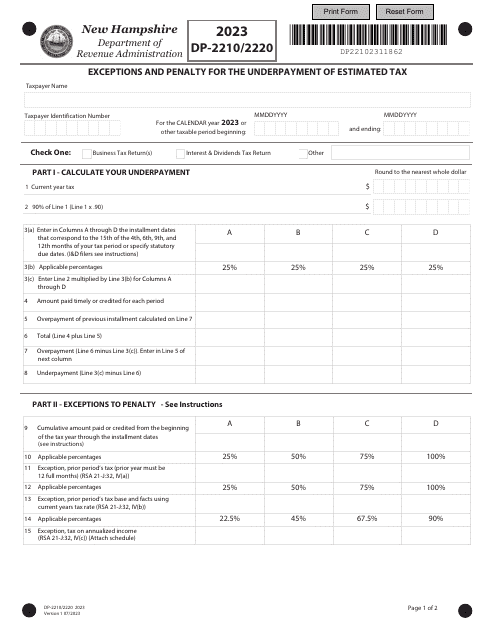

Form DP-2210/2220 Exceptions and Penalty for the Underpayment of Estimated Tax - New Hampshire, 2023

This is an IRS form governmental entities prepare and file in order to inform the government about deductible payments like fines and penalties they have made during a particular calendar year.