Tobacco Tax Templates

Welcome to our webpage on tobacco tax, also known as tobacco taxes or tobacco tax forms. This collection of documents provides information and resources related to the taxation of tobacco products in various jurisdictions.

At Templateroller.com, we understand the importance of complying with tobacco tax regulations and ensuring accurate reporting. Our goal is to equip you with the necessary tools and knowledge to navigate the complexities of tobacco taxation.

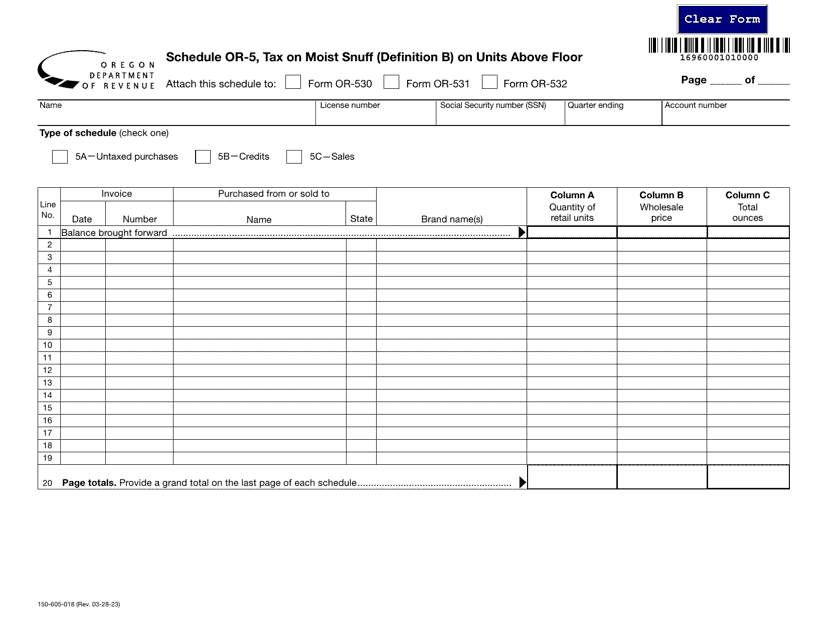

Whether you are an individual selling cigarettes in Massachusetts and need to file Form CTS-1C Schedule CTS-1C Stamped Cigarettes Sold in Massachusetts or a business applying for a tobacco tax license in Michigan using Form 337 Tobacco Tax License Application Instructions, we have the resources to guide you through the process.

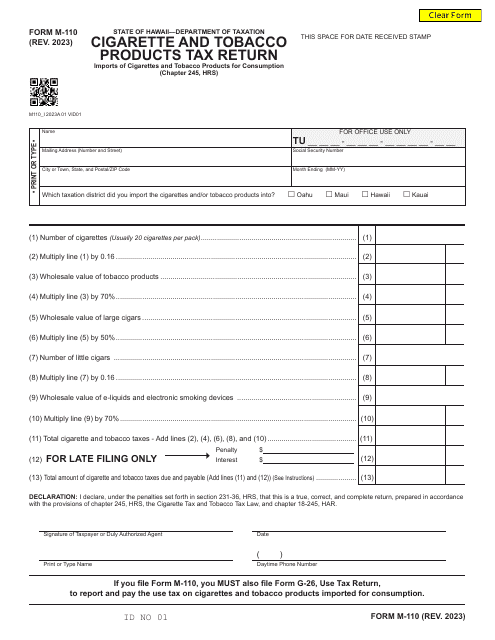

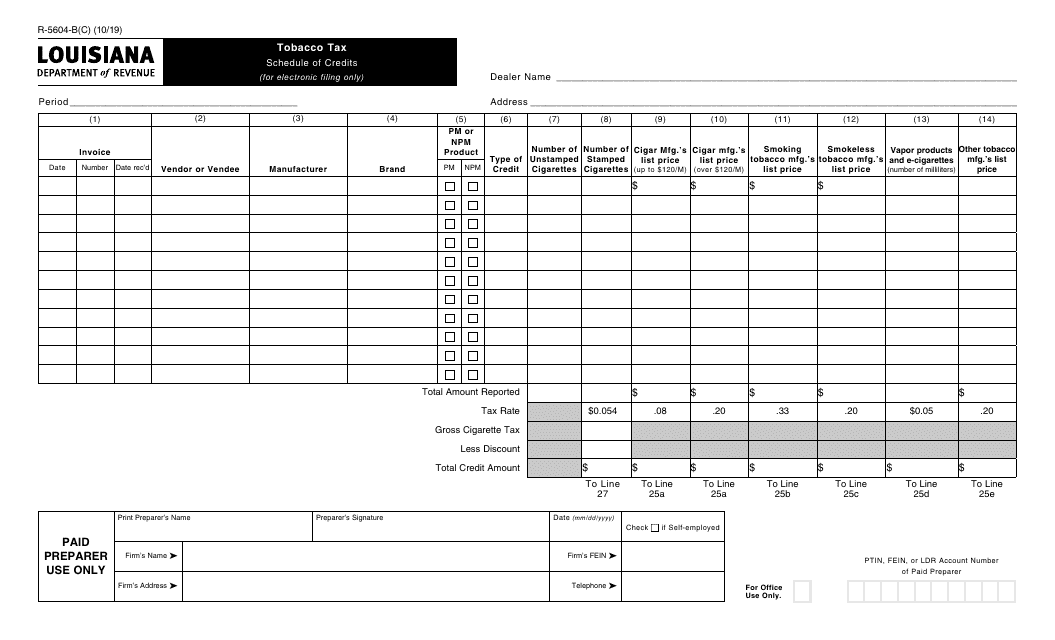

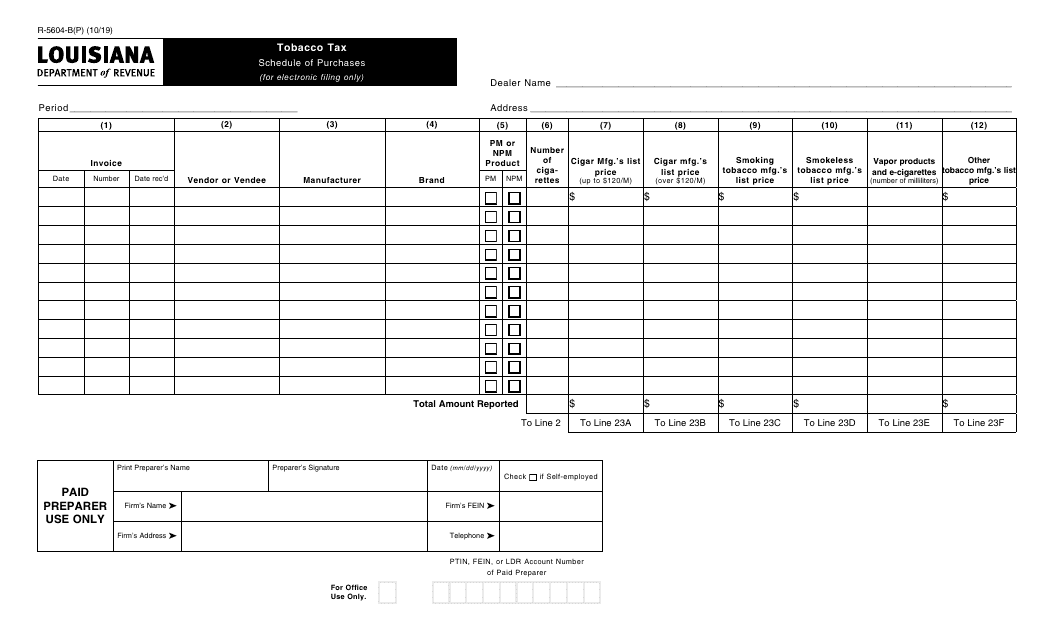

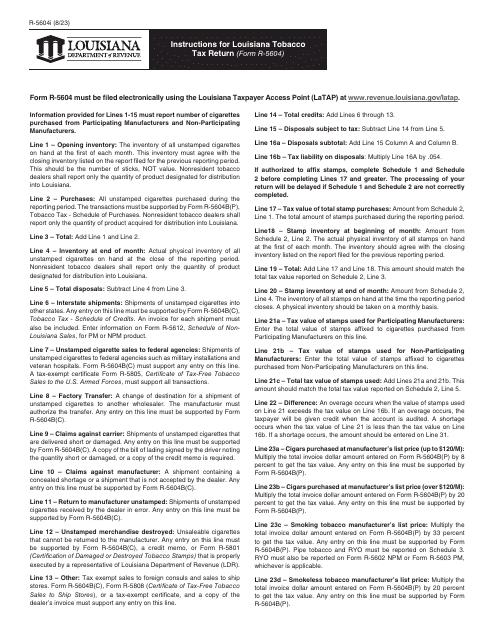

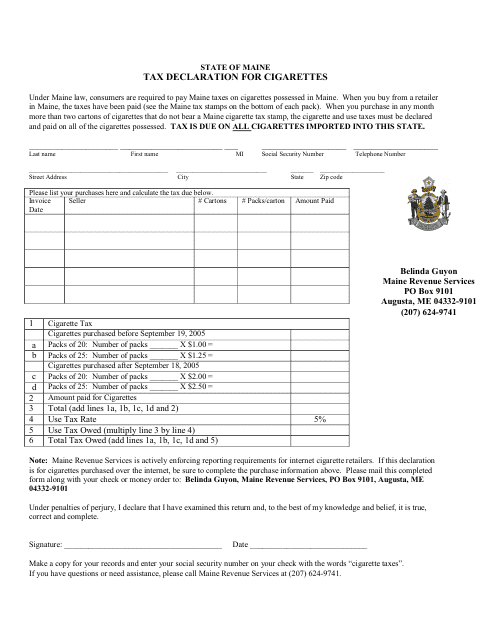

For residents of Idaho, we provide clear instructions on how to complete Form 1350 Tobacco Tax Return. Similarly, Maine residents can find guidance on the Tax Declaration for Cigarettes. Louisiana residents can benefit from our resources on Form R-5604-B(P) Tobacco Tax - Schedule of Purchases.

Our webpage aims to serve as a convenient hub for accessing these documents and understanding the requirements specific to your jurisdiction. We believe that by simplifying the process of accessing and understanding tobacco tax forms, we can empower individuals and businesses to meet their obligations efficiently and accurately.

Stay compliant with tobacco tax regulations and simplify your reporting process with the help of our comprehensive collection of tobacco tax resources. Explore our webpage today and take the first step towards staying informed and meeting your obligations.

Documents:

87

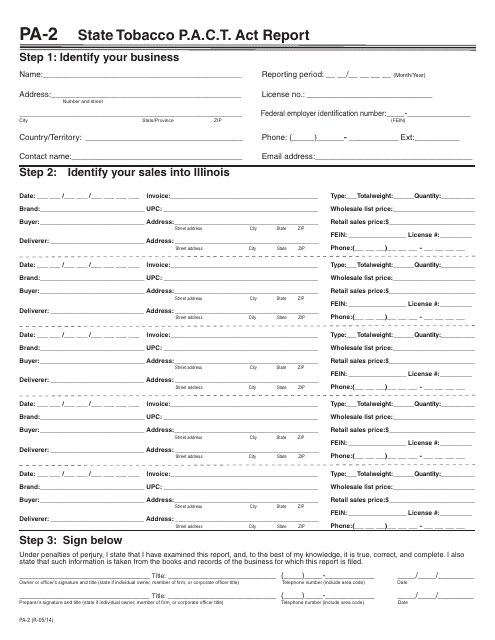

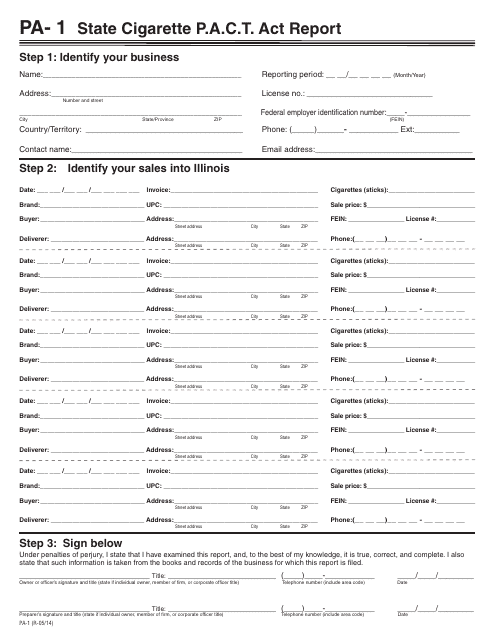

This form is used for submitting a State Tobacco P.A.C.T. Act report in the state of Illinois. It is a requirement for businesses involved in the sale of tobacco products to report their sales and shipments to comply with the P.A.C.T. Act.

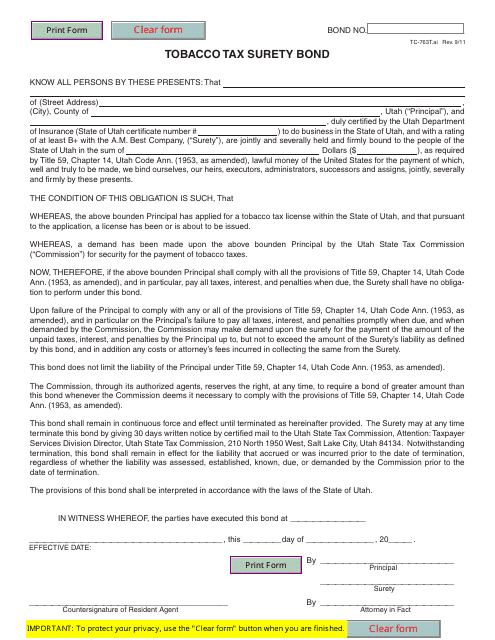

This form is used for obtaining a tobacco tax surety bond in Utah.

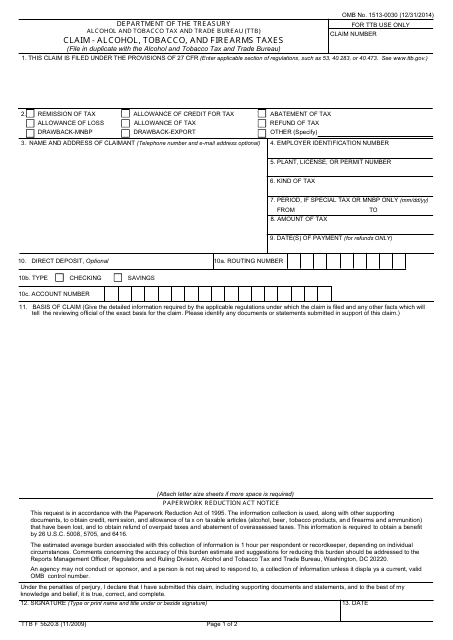

This form is used for claiming refunds for alcohol, tobacco, and firearms taxes in the United States.

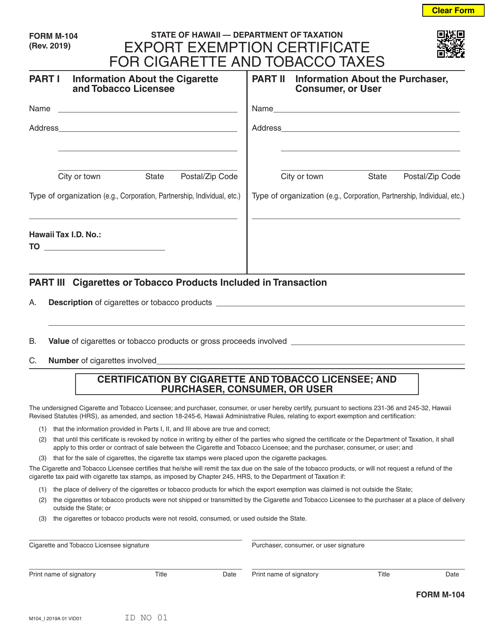

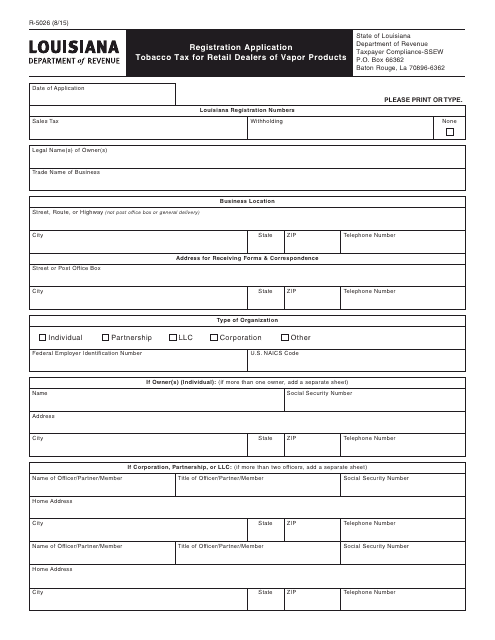

This form is used for retail dealers of vapor products in Louisiana to apply for registration and pay tobacco tax.

This Form is used for declaring and reporting taxes on cigarettes in the state of Maine.

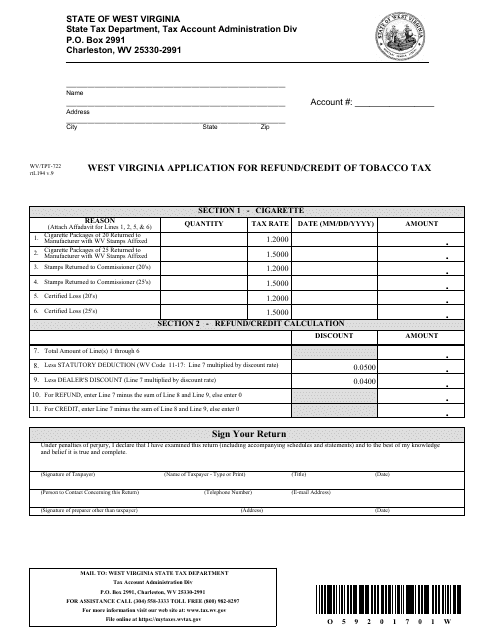

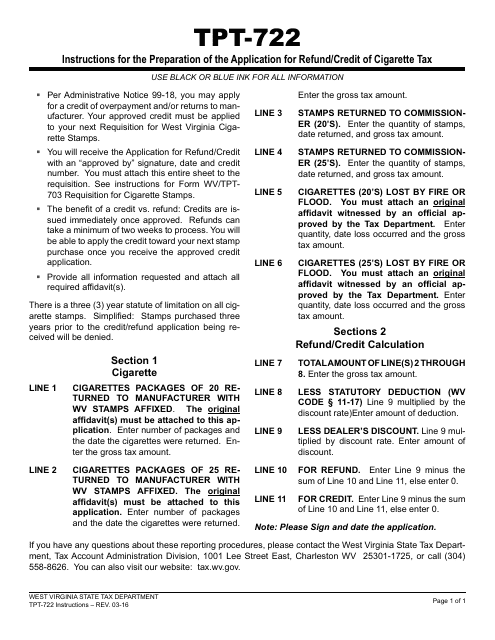

This Form is used for applying for a refund or credit of tobacco tax in the state of West Virginia.

This Form is used for applying for a refund or credit of tobacco tax in West Virginia.

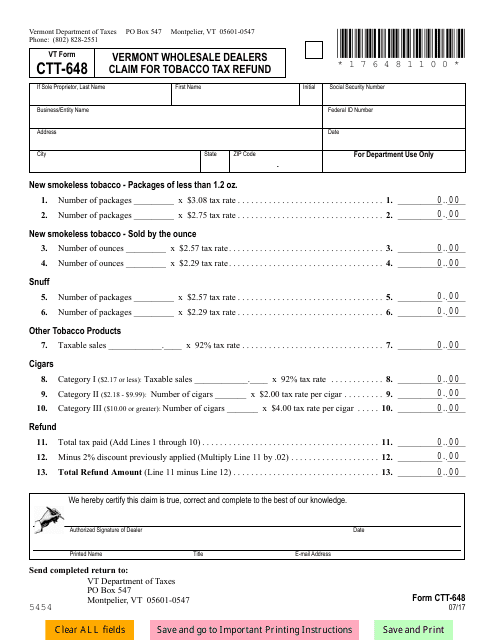

This form is used for Vermont wholesale dealers to claim a refund on tobacco tax.

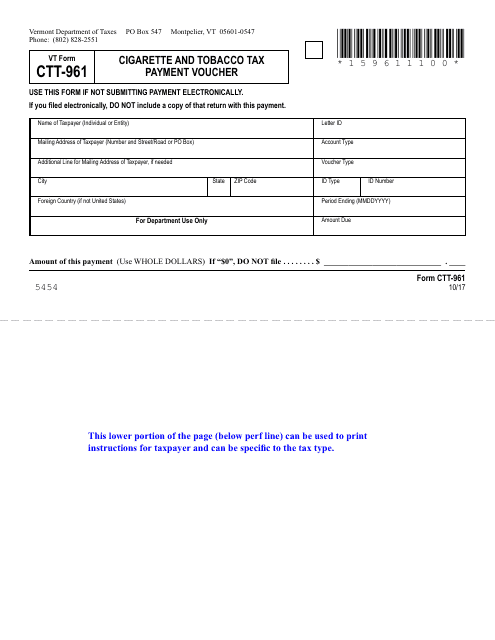

This form is used for making cigarette and tobacco tax payments in Vermont.

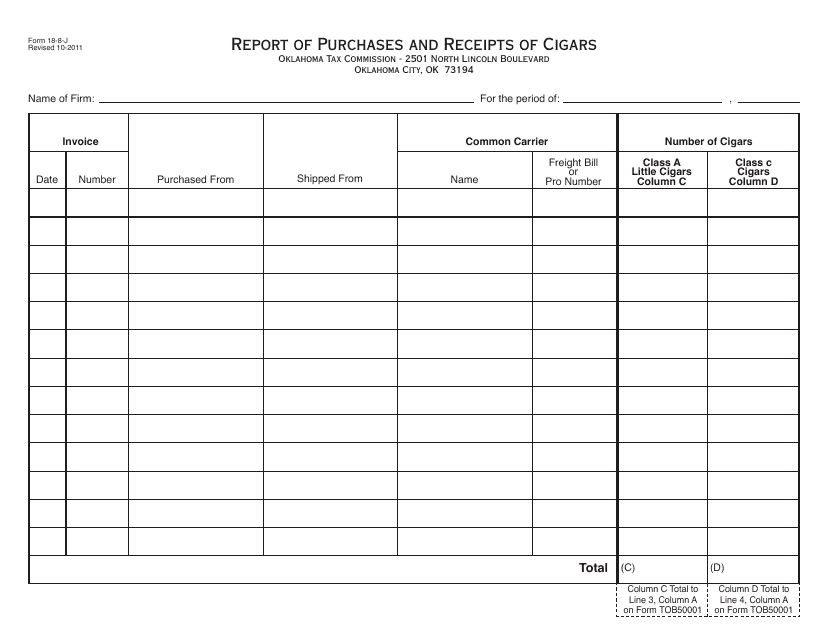

This form is used for reporting purchases and receipts of cigars in the state of Oklahoma.

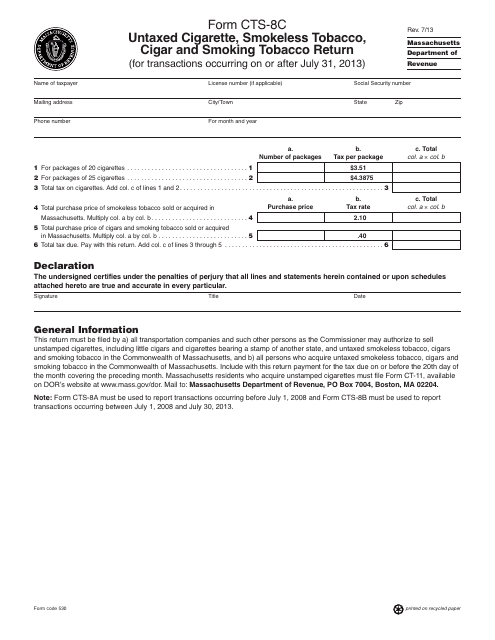

This form is used for reporting and paying taxes on untaxed cigarettes, smokeless tobacco, cigars, and smoking tobacco in Massachusetts.

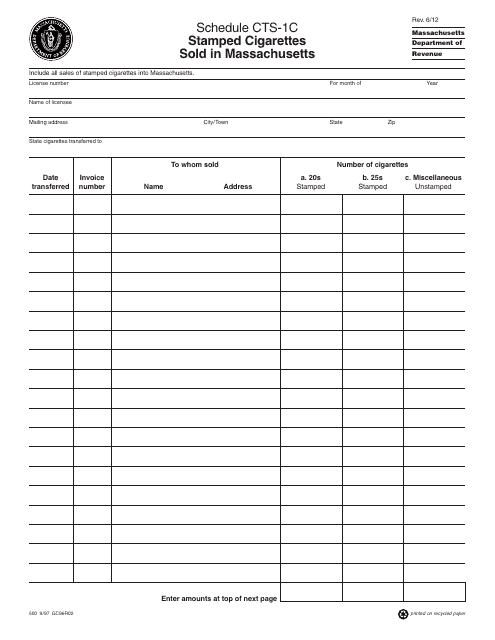

This form is used for reporting the sales of stamped cigarettes in Massachusetts.

This form is used for reporting information related to the P.A.C.T. Act (Prevent All Cigarette Trafficking Act) for cigarette sales in the state of Illinois.

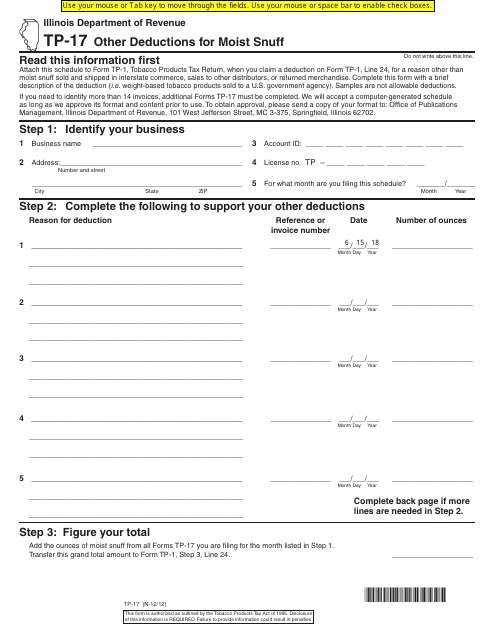

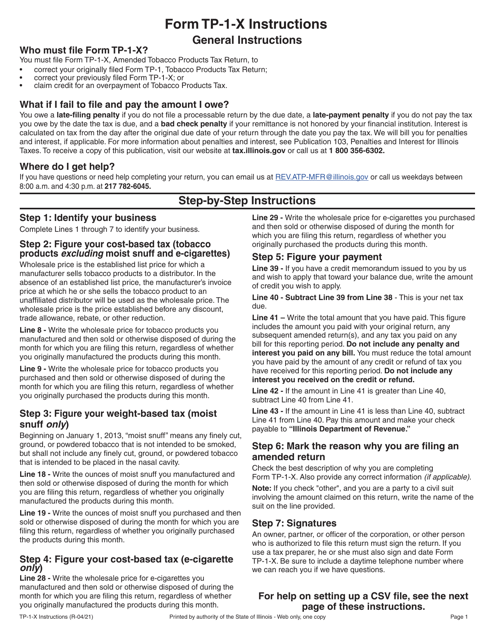

This Form is used for reporting other deductions related to the purchase of moist snuff in the state of Illinois.

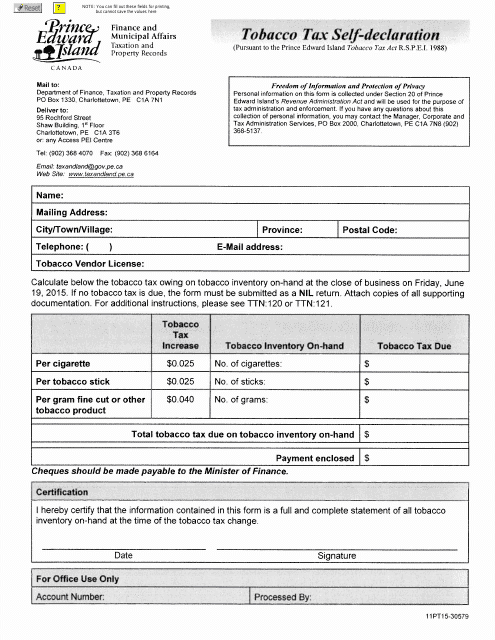

This form is used for individuals and businesses in Prince Edward Island, Canada to self-declare their tobacco taxes.

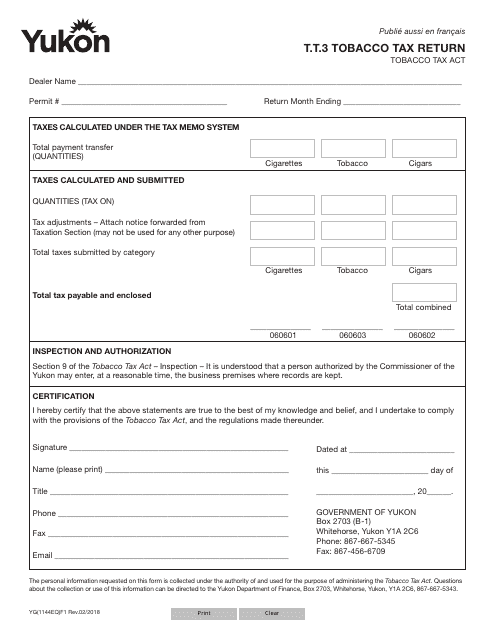

This form is used for filing tobacco tax returns in Yukon, Canada.

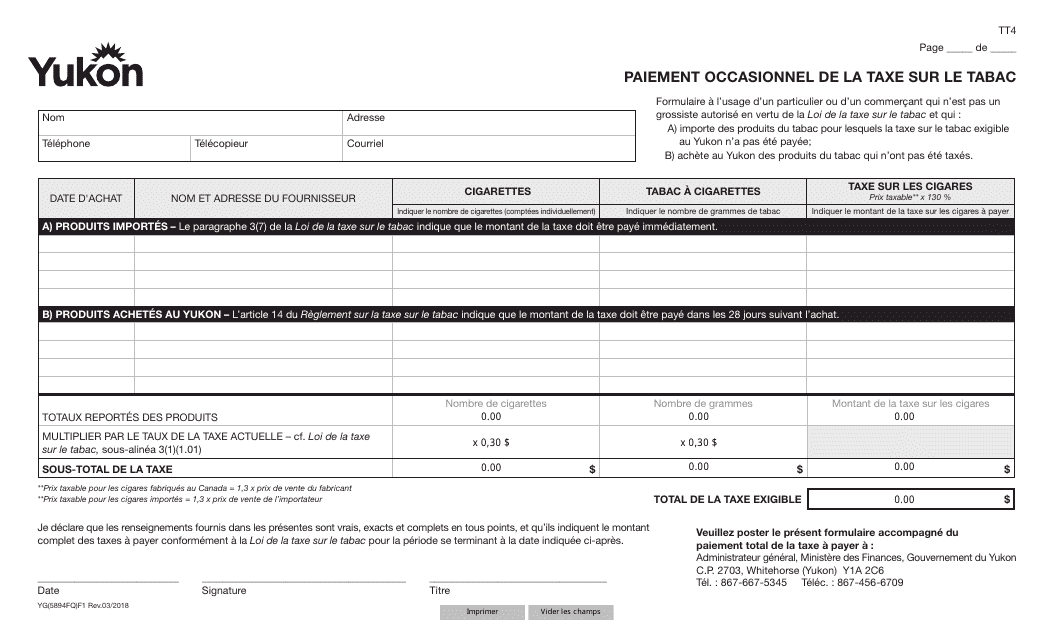

This document is used for making occasional tobacco tax payments in Yukon, Canada. (French)

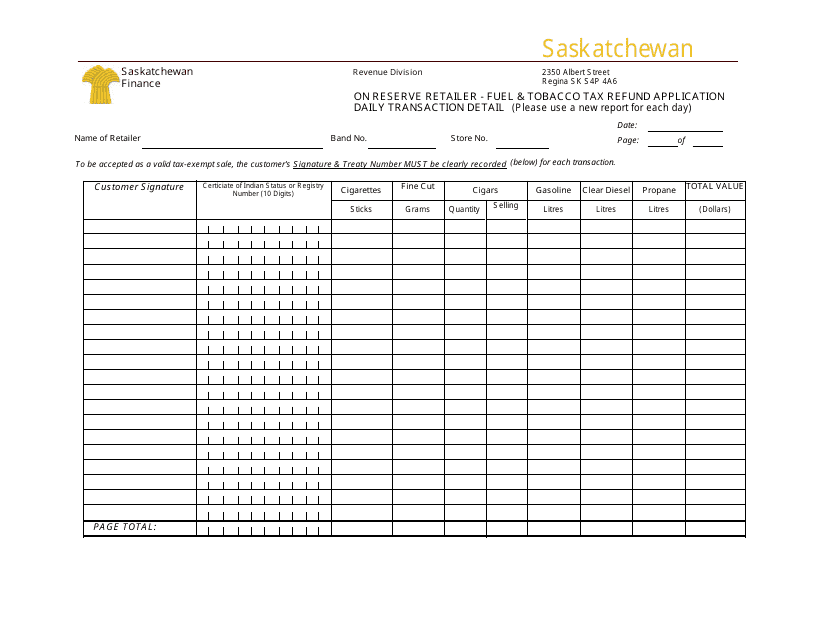

This document is used to track daily transactions and details related to fuel and tobacco tax refund applications for reserve retailers in Saskatchewan, Canada.

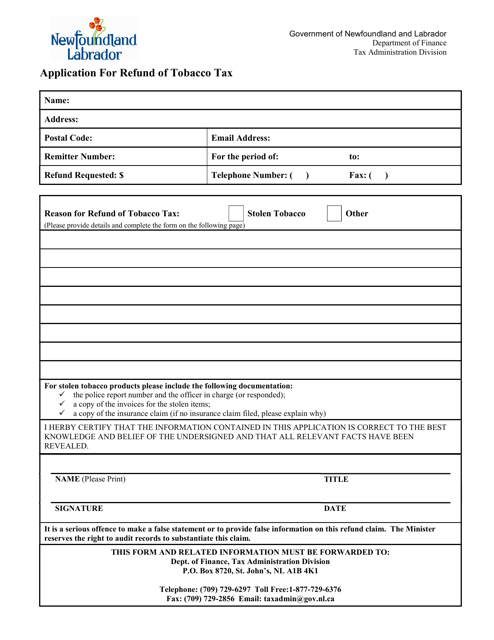

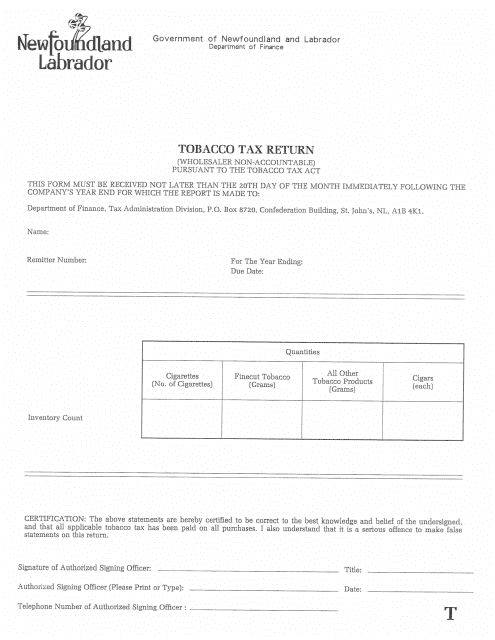

This form is used for reporting and paying tobacco taxes for wholesalers in Newfoundland and Labrador, Canada. It is specifically for wholesalers who are not required to keep detailed records of their tobacco sales.

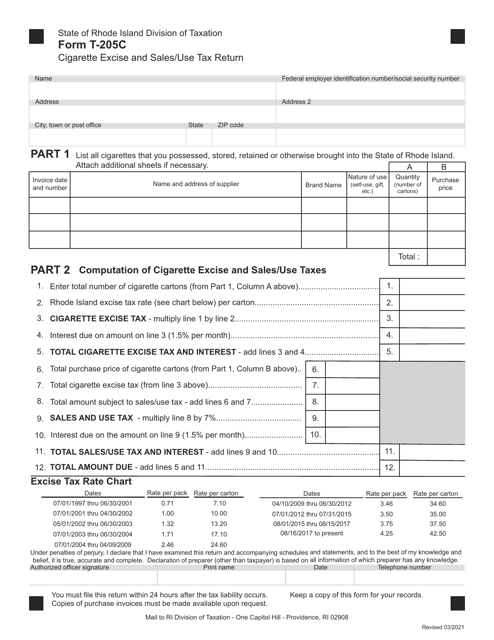

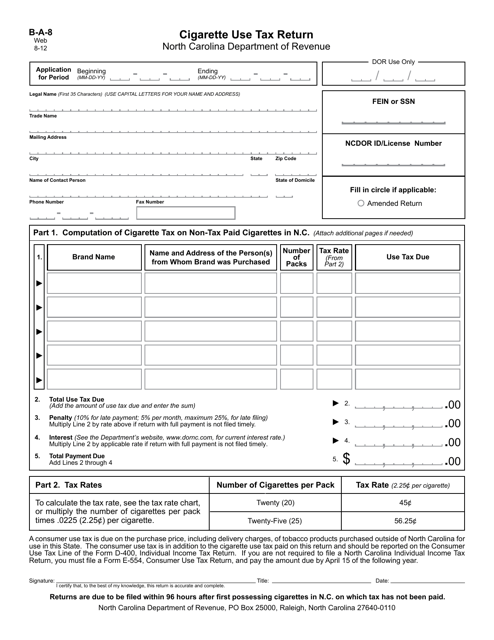

This document is used for reporting and paying cigarette use tax in North Carolina. It is required for individuals or businesses engaged in the sale, distribution, or importation of cigarettes in the state.

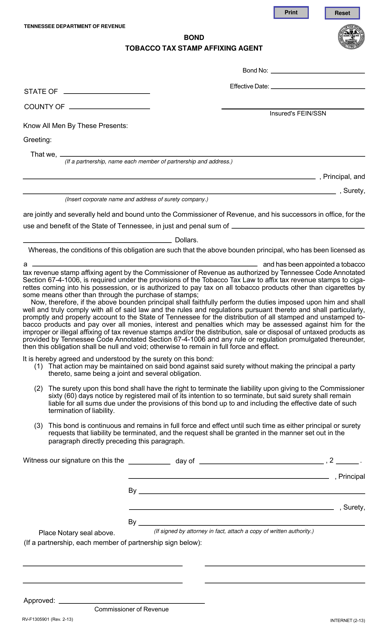

This form is used for obtaining a bond as a tobacco tax stamp affixing agent in the state of Tennessee.

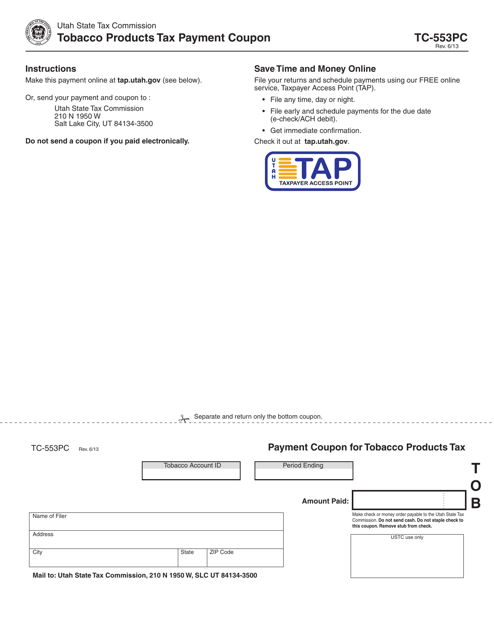

This form is used for making tobacco products tax payments in Utah.

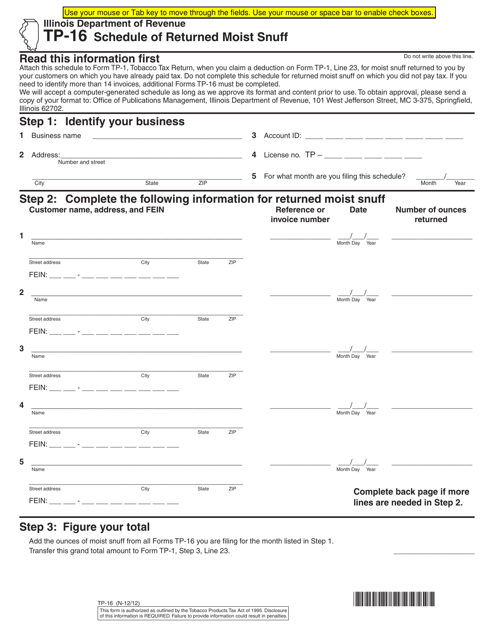

This document is used to report the schedule of returned moist snuff in Illinois.

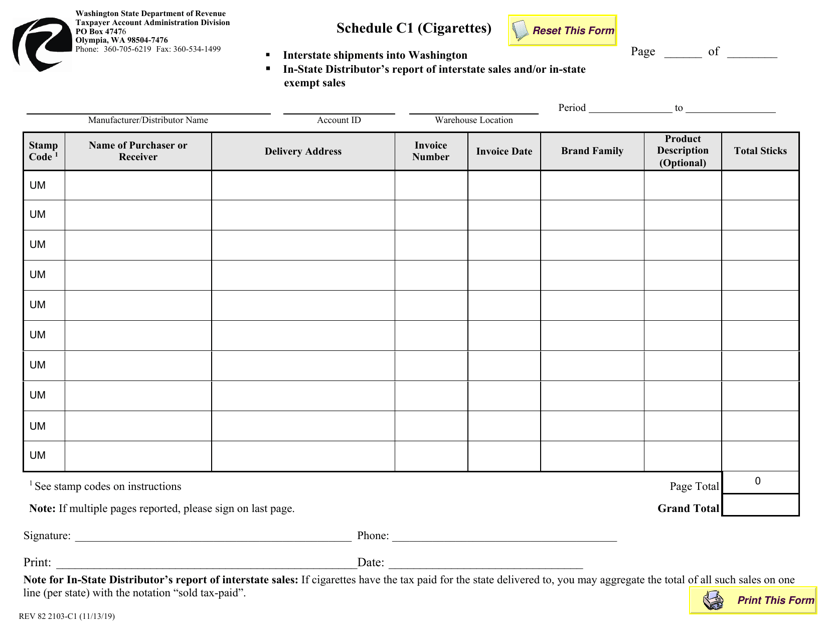

This Form is used for reporting the sales of cigarettes in the state of Washington.