Tobacco Tax Templates

Documents:

87

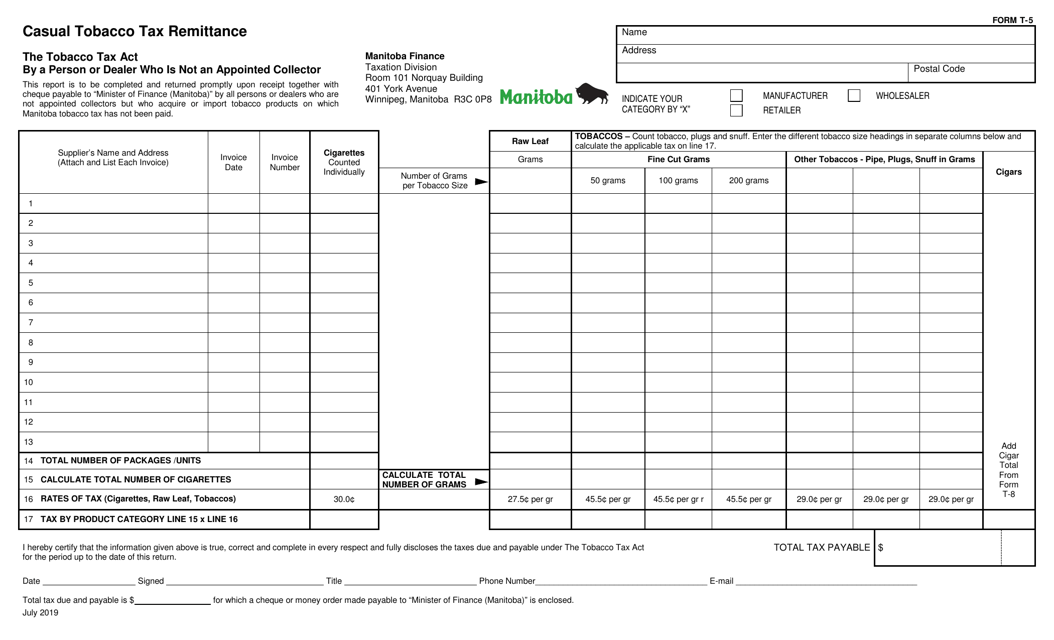

This form is used for remitting casual tobacco tax in the province of Manitoba, Canada. It is required for individuals or businesses who sell tobacco products on a casual basis.

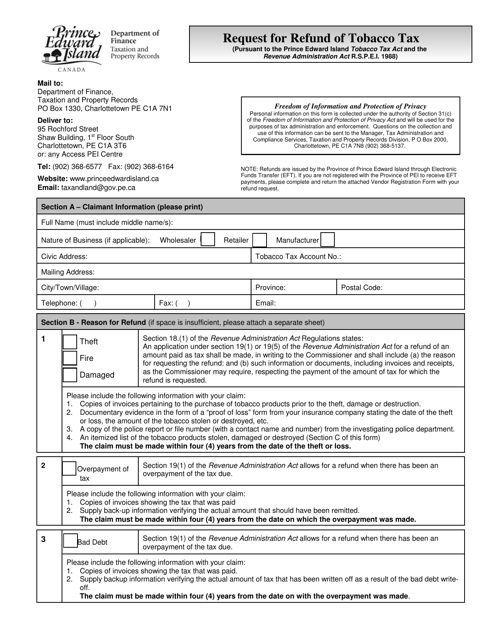

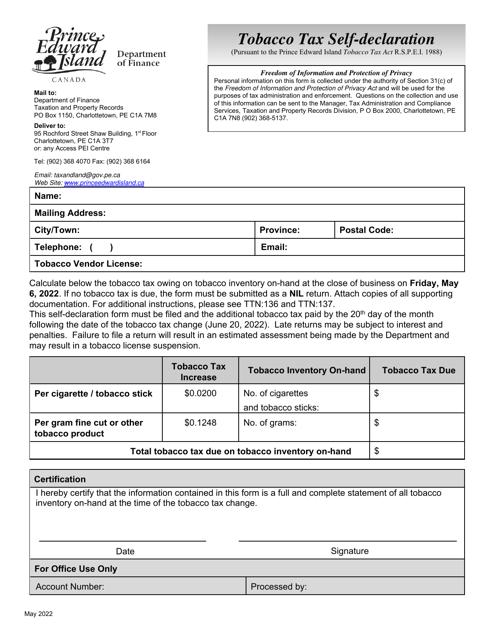

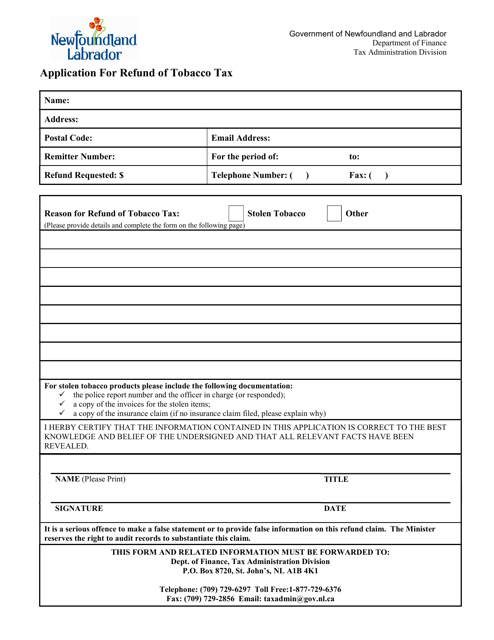

This document is a request form for residents of Prince Edward Island, Canada who wish to request a refund for tobacco tax.

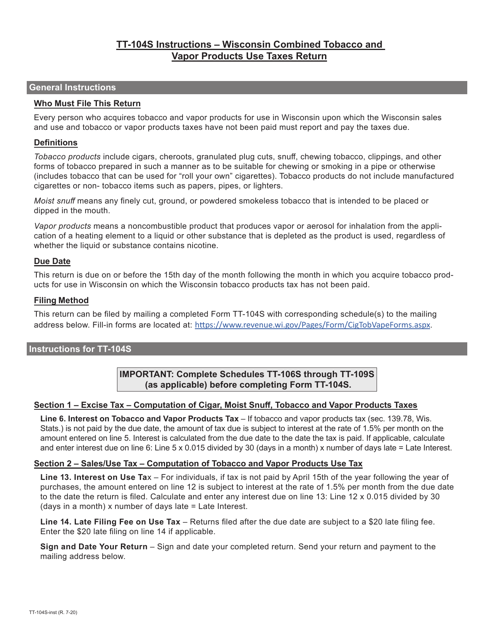

This Form is used for reporting and paying use taxes on tobacco and vapor products in Wisconsin. It provides instructions on how to fill out and submit the TT-104S form for compliance with state tax laws.

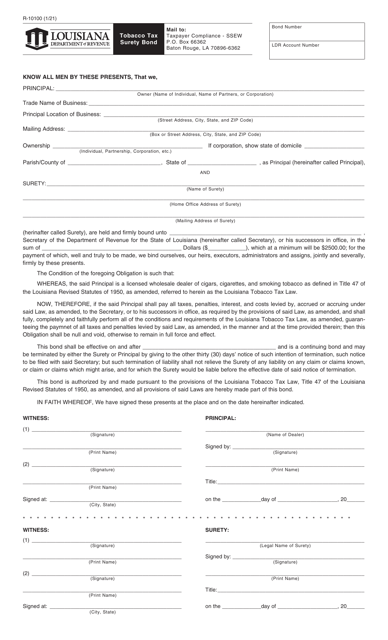

This form is used for obtaining a surety bond for tobacco tax purposes in Louisiana.

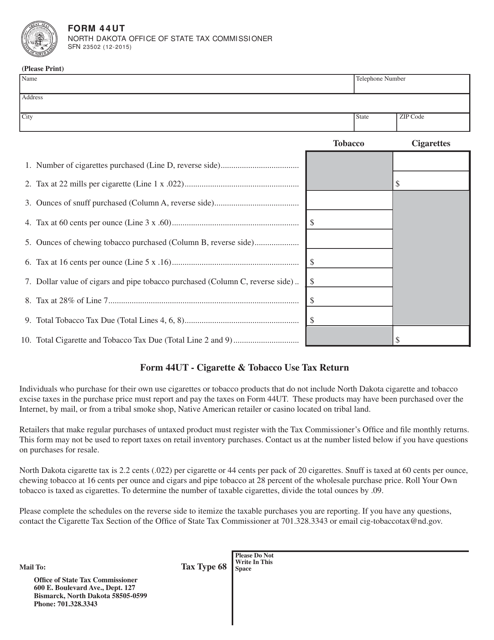

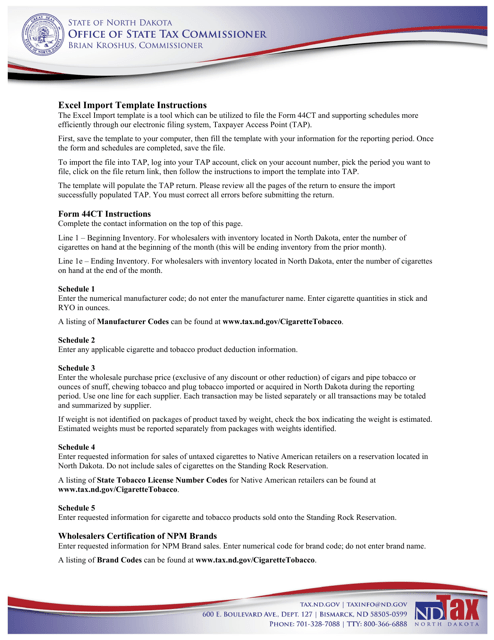

This document is used for filing the Cigarette & Tobacco Use Tax Return in North Dakota.

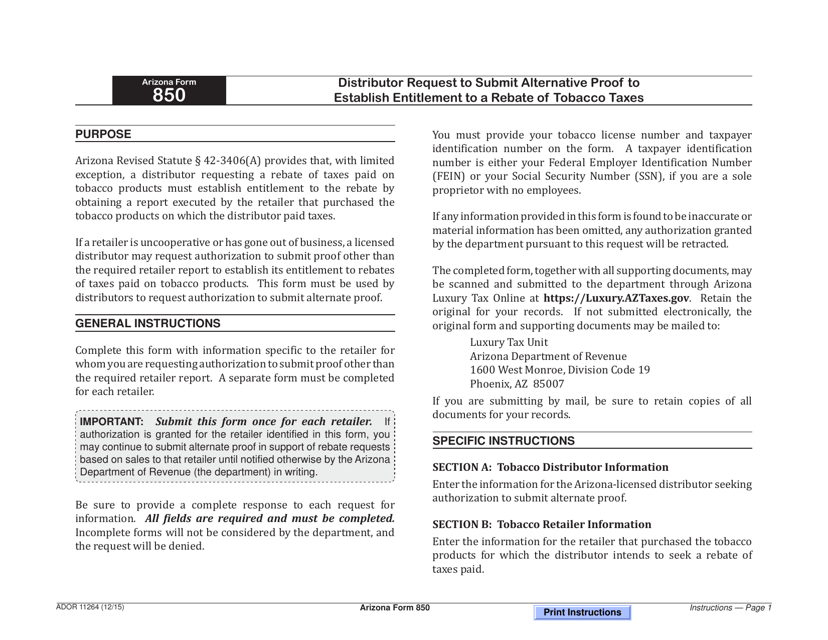

This form is used in Arizona for distributors to request permission to submit alternative proof to establish entitlement to a rebate of tobacco taxes.

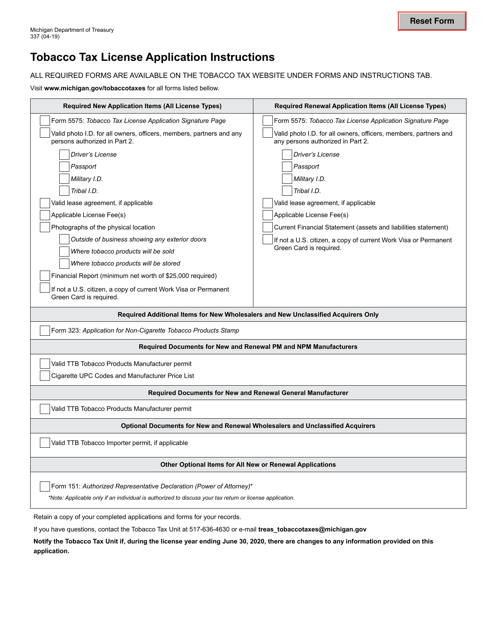

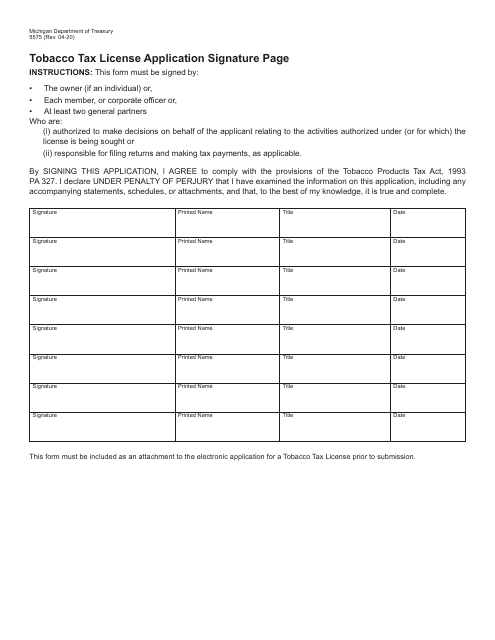

This document provides instructions for applying for a tobacco tax license in Michigan. It guides individuals or businesses on how to complete the necessary forms and submit the required information to obtain a license for selling tobacco products in the state.

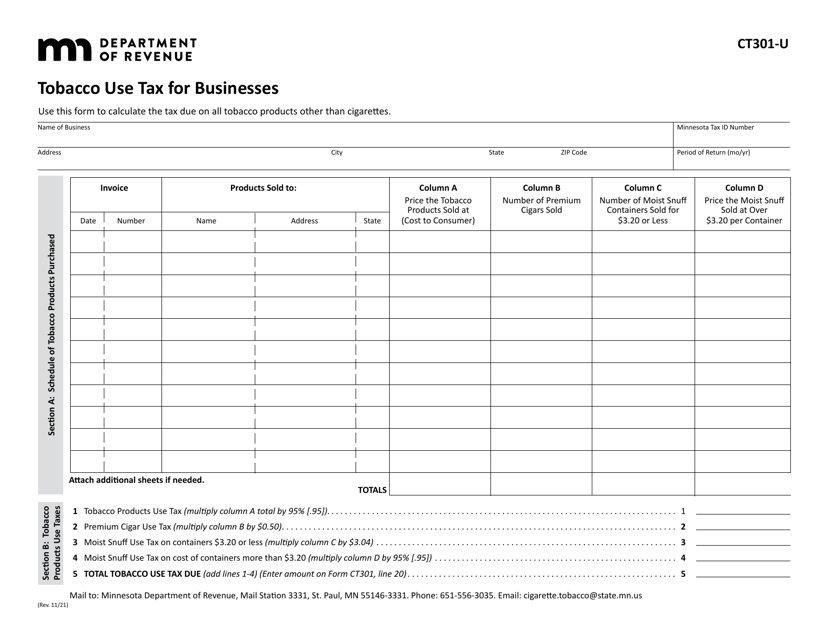

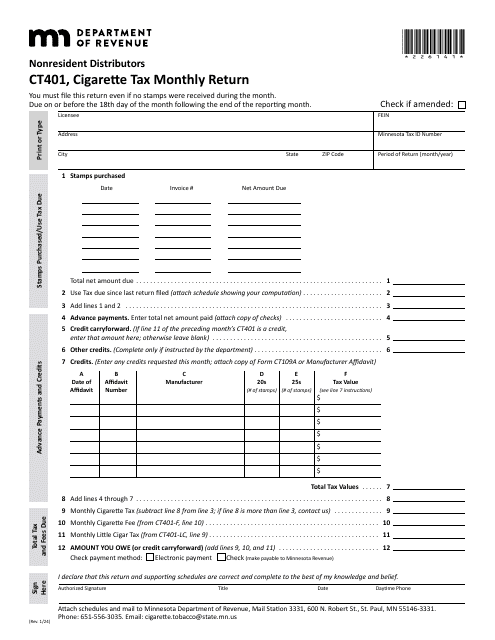

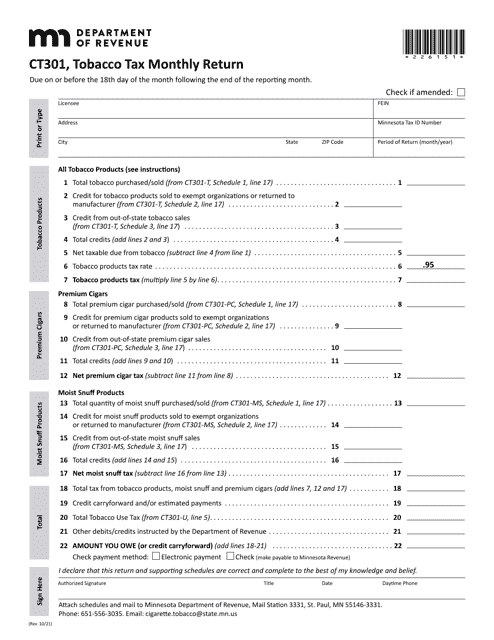

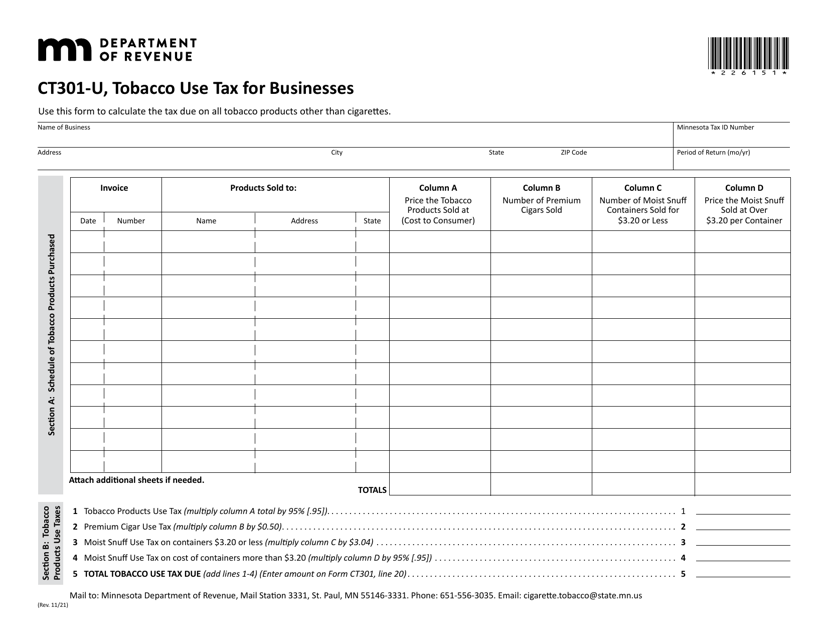

This form is used for businesses in Minnesota to report and pay tobacco use tax.

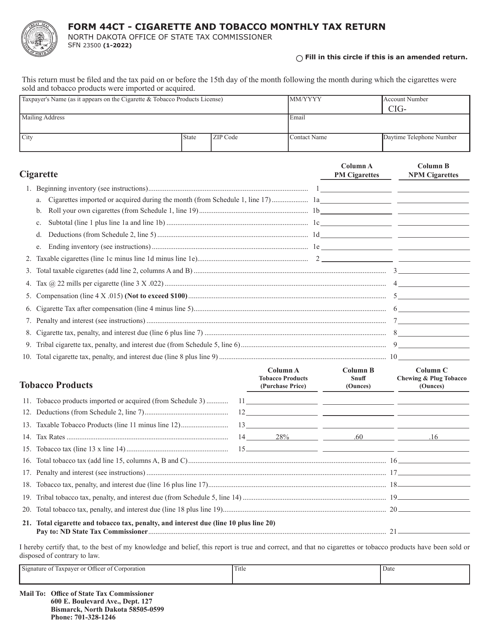

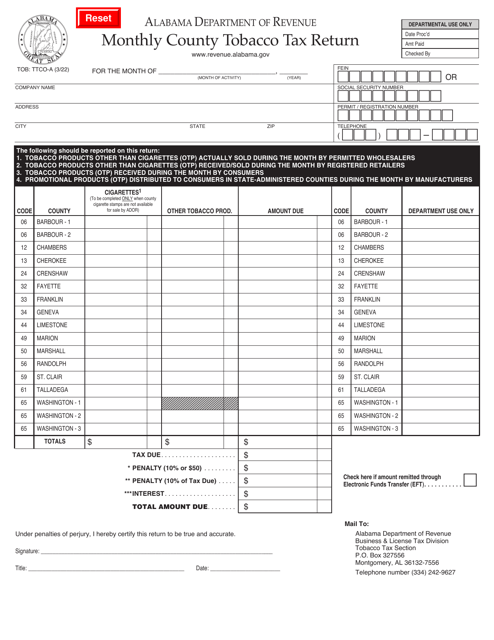

This document is for reporting and paying taxes on cigarettes and tobacco products on a monthly basis in North Dakota. It provides instructions on how to fill out and submit Form 44CT, SFN23500.

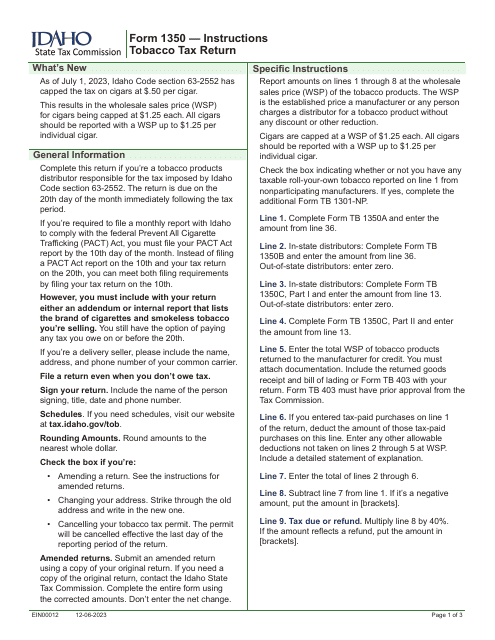

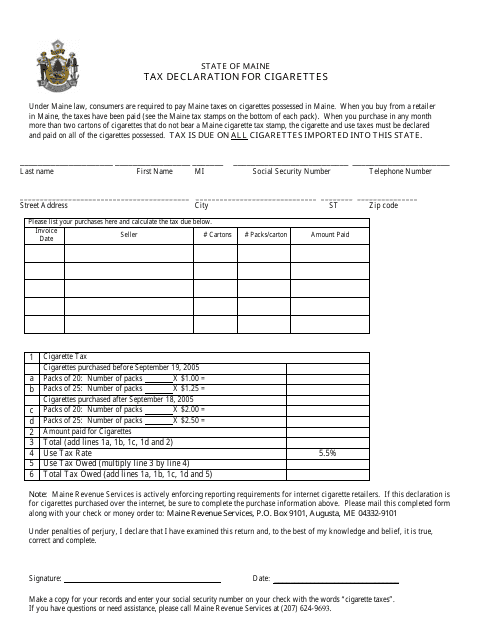

This form is used for declaring taxes on cigarettes in the state of Maine.

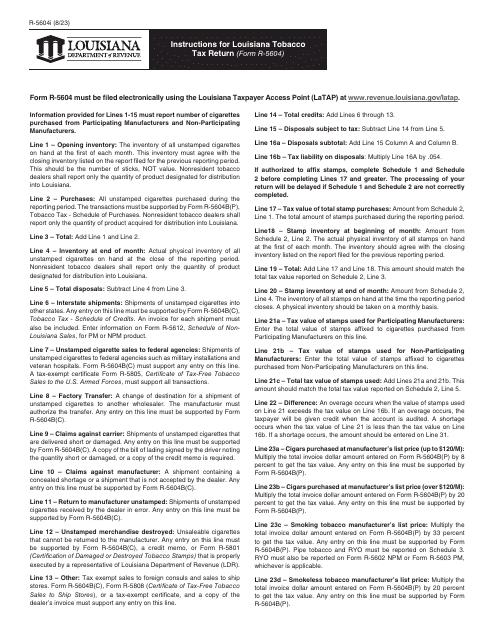

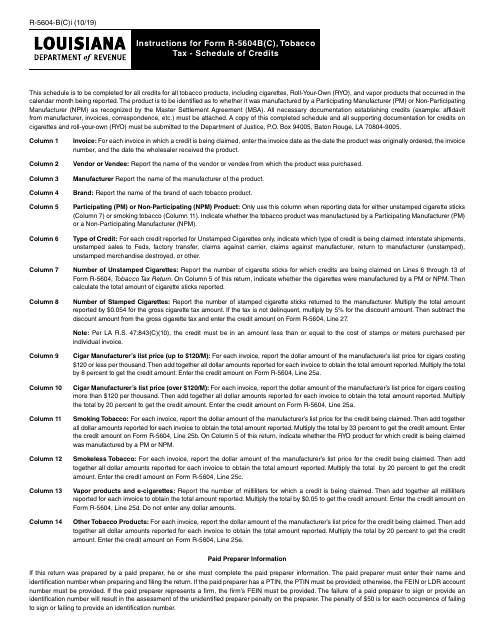

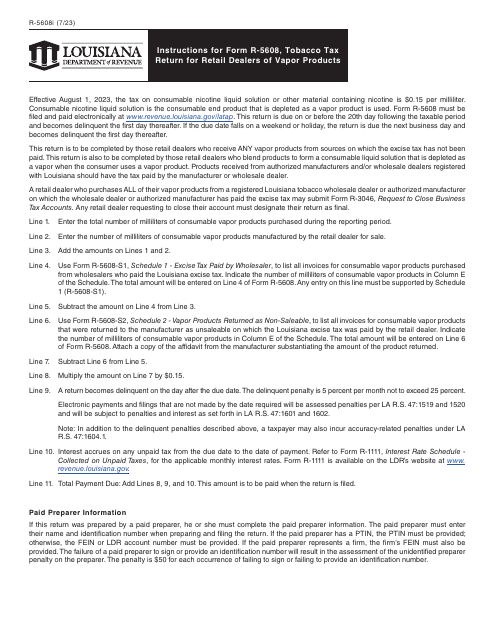

This Form is used for reporting and calculating tax credits related to tobacco in the state of Louisiana. It provides instructions to taxpayers on how to complete the Tobacco Tax Schedule of Credits.

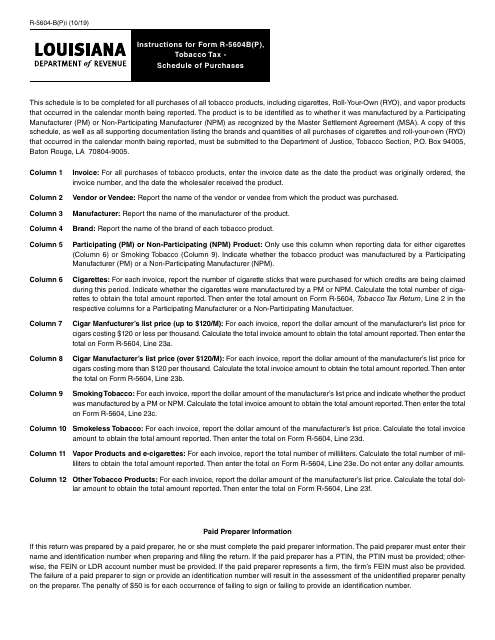

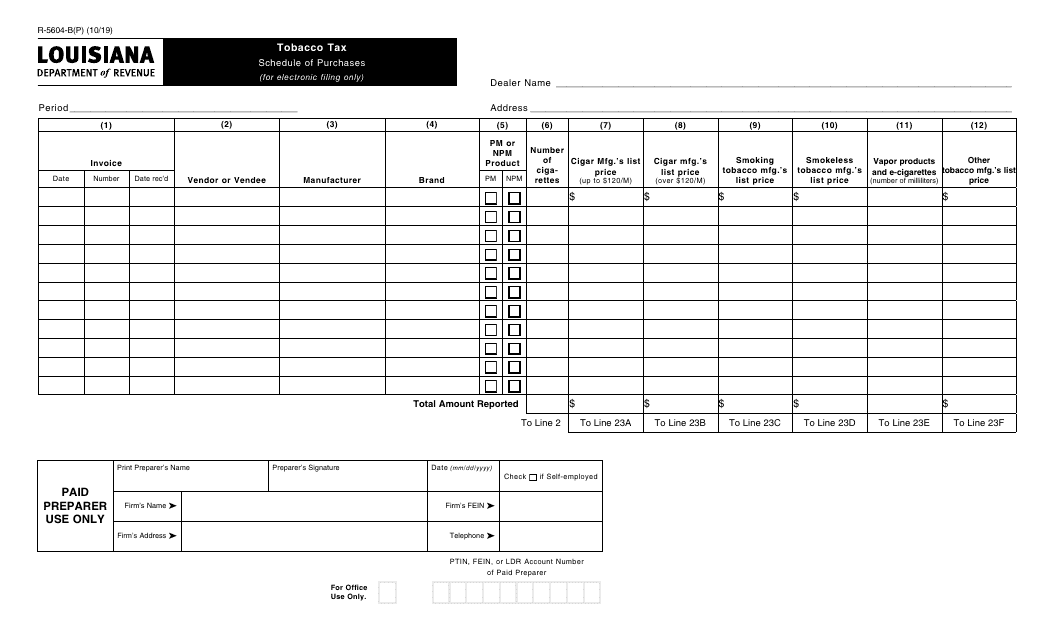

This type of document provides instructions for filling out the Form R-5604B(P), which is used to report tobacco purchases for tax purposes in Louisiana.

This form is used for the signature page of the Tobacco Tax License Application in Michigan.

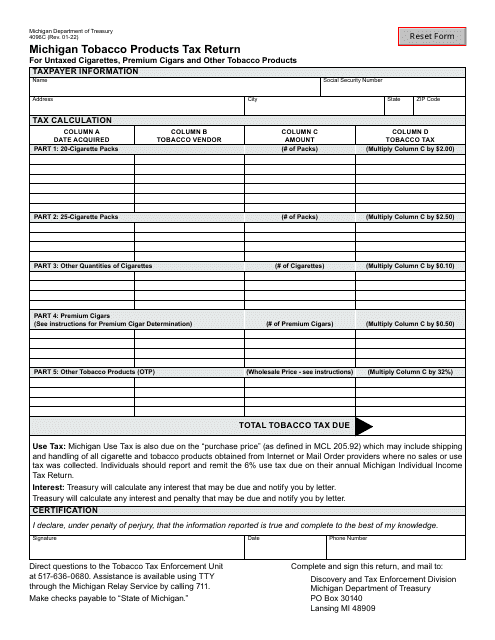

This form is used for reporting and paying taxes on untaxed cigarettes, premium cigars, and other tobacco products in the state of Michigan.

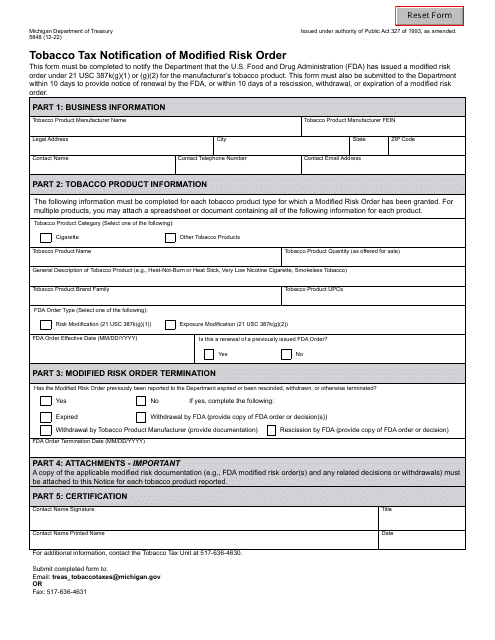

This form is used for notifying the Michigan Department of Treasury about any modified risk orders relating to tobacco tax.

This Form is used for businesses in Connecticut to report and pay tobacco use tax.

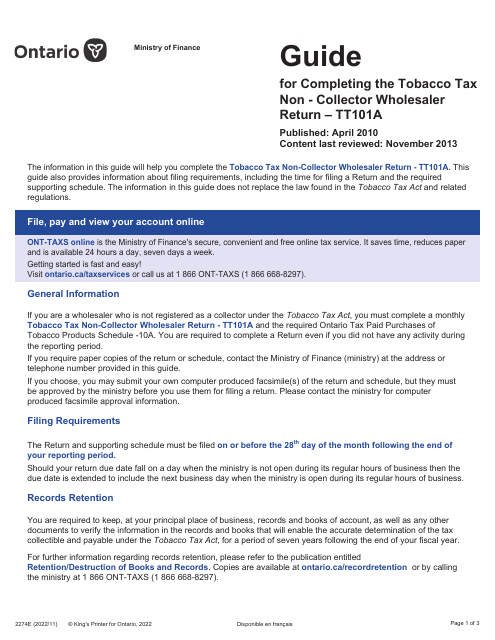

This form is used for providing guidance on how to complete the Tobacco Tax Non-collector Wholesaler Return - Tt101a in Ontario, Canada.