Interest Rates Templates

Looking for information about interest rates? Explore our comprehensive collection of documents relating to interest rates, also known as interest rate documents. Whether you need a template for securing a loan, a package for purchasing a guaranty, a pre-approval letter for a mortgage, a promissory note template, or a loan application form for a residential home heating program, we have your needs covered. Our extensive range of interest rate documents ensures that you have access to the essential resources and information you need to make informed decisions. Take advantage of our user-friendly platform to access the latest documents related to interest rates.

Documents:

105

This form is used for creating a security agreement for a public deposit in the state of Connecticut.

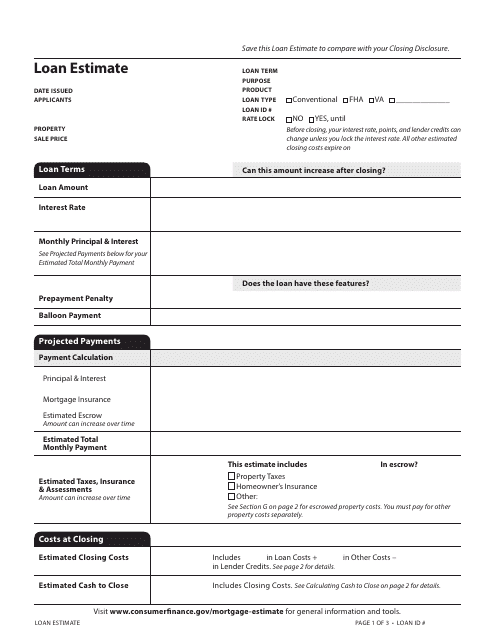

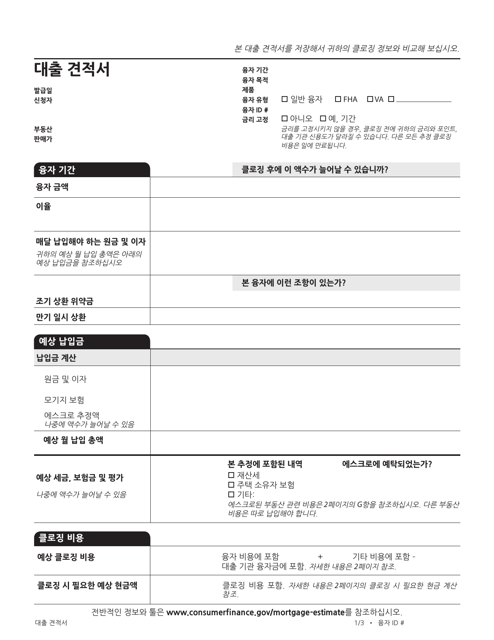

This document is used for providing borrowers with an estimate of the costs and terms associated with a mortgage loan. It includes details on interest rate, closing costs, and monthly payments.

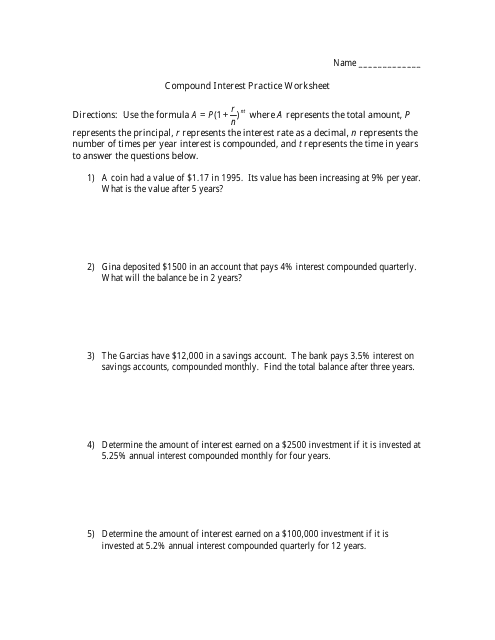

This worksheet is designed to help you practice solving compound interest problems. It includes a variety of questions that require you to calculate the future value of an investment using the compound interest formula.

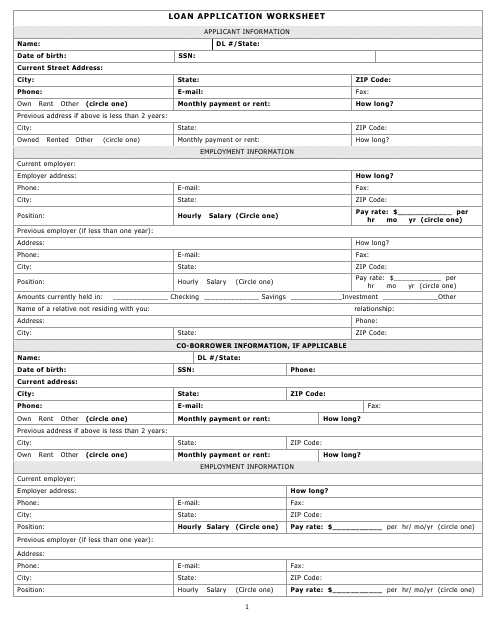

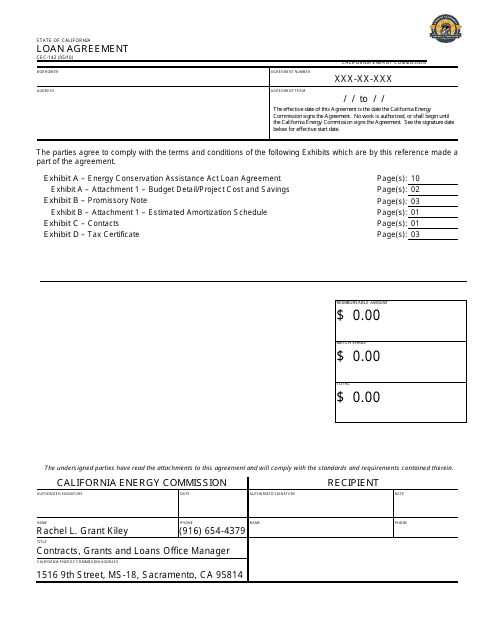

This form is used for creating a loan agreement in the state of California. It outlines the terms and conditions of the loan, including the amount borrowed, interest rates, and repayment terms.

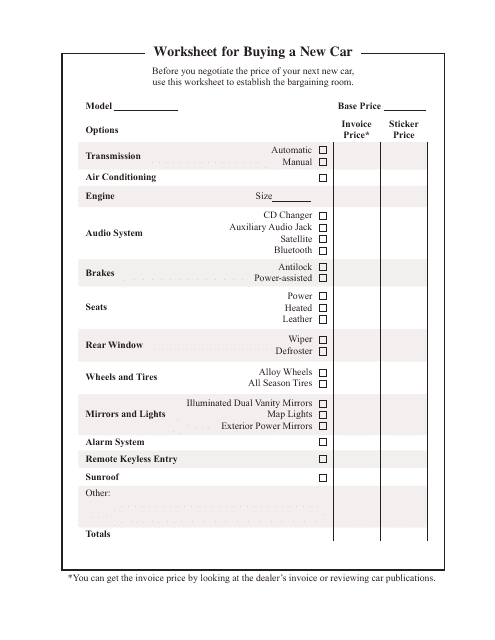

This worksheet template helps you organize and compare important information when buying a car, such as price, features, and financing options. It allows you to make an informed decision and keep track of your car buying process.

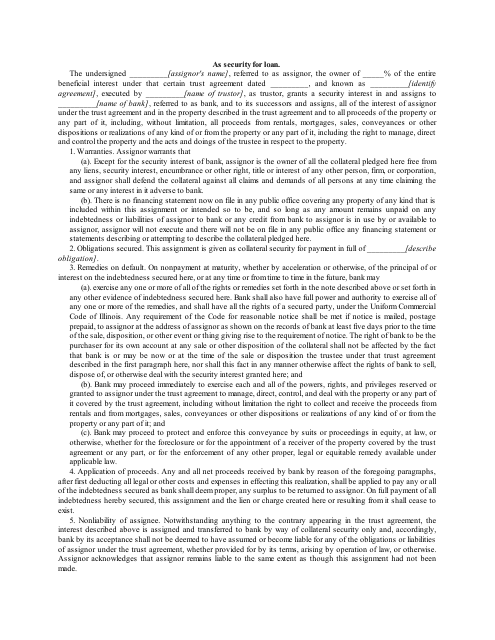

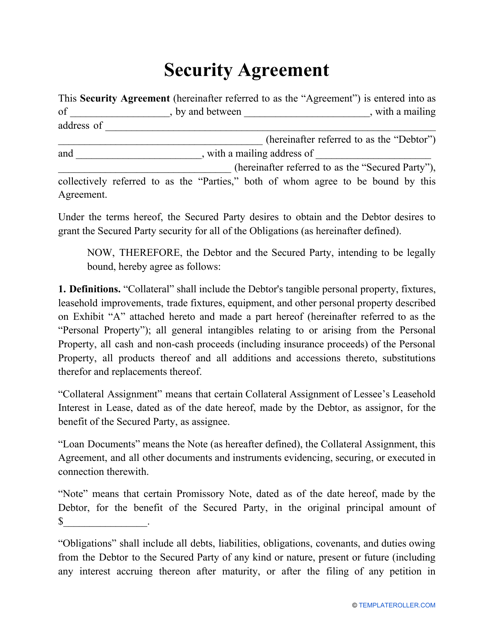

This document is a template that is used when providing security for a loan. It helps outline the terms and conditions of the security agreement between the lender and the borrower.

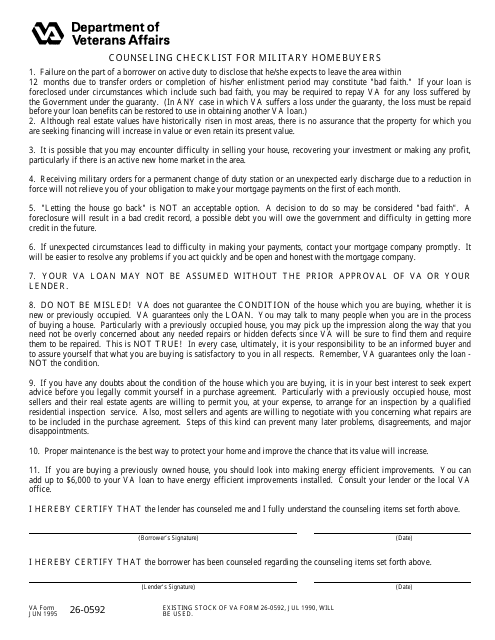

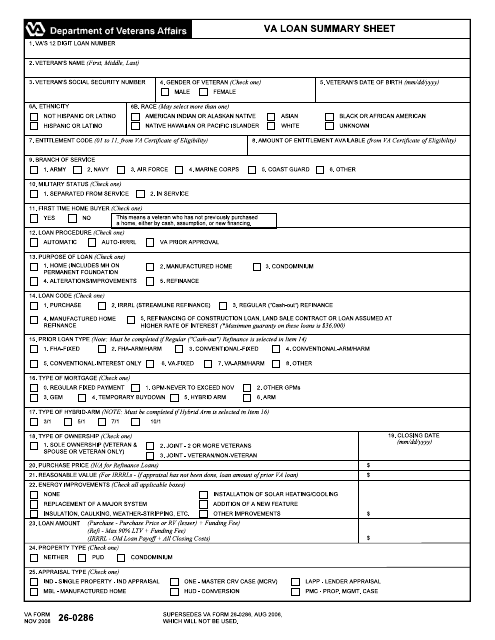

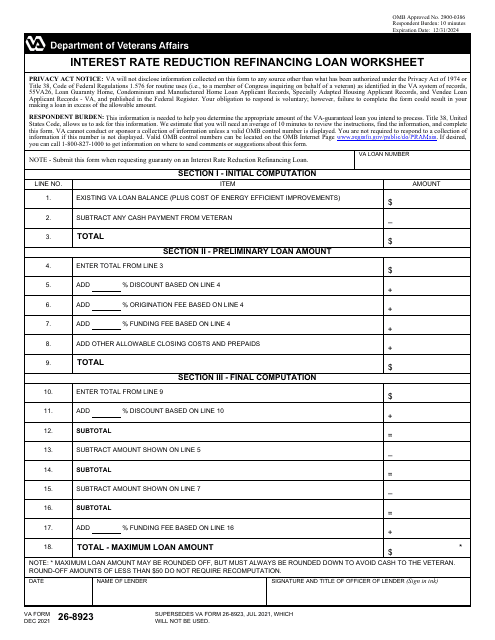

U.S. Servicemembers may use this VA checklist to obtain a loan with the help of the Federal Housing Administration.

This document provides a summary of information related to a VA loan. It is used to summarize important details of a VA loan application.

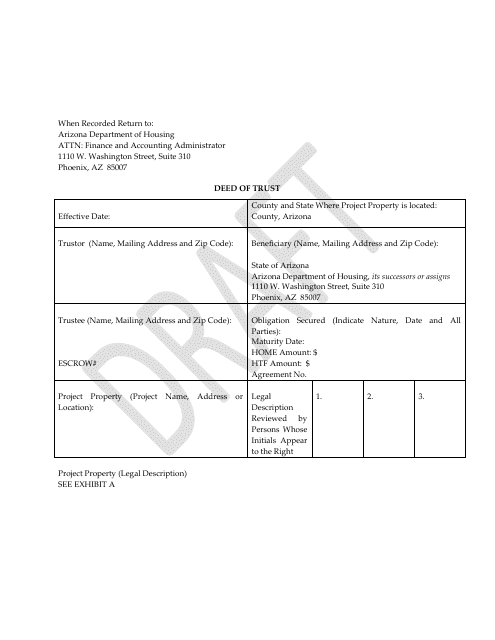

This type of document is a draft version of a Deed of Trust specific to the state of Arizona. It is used to specify the terms and conditions of a trust agreement relating to real estate property.

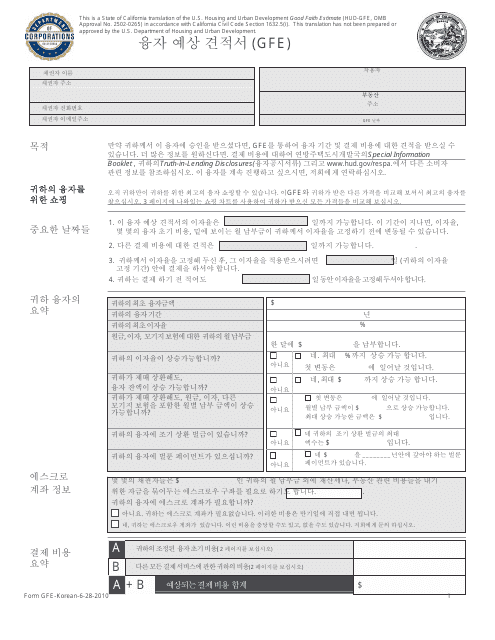

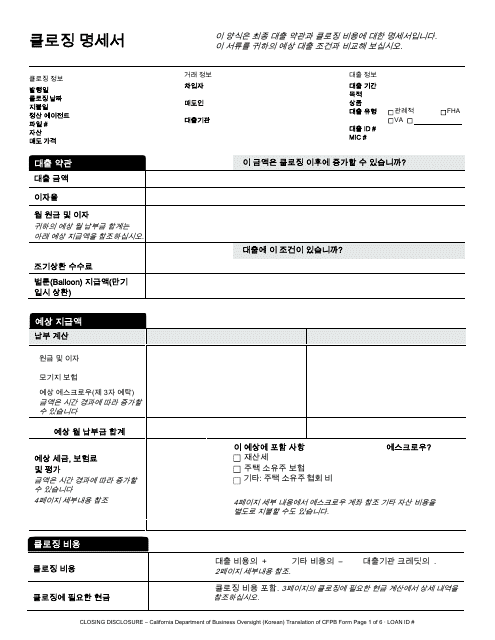

This type of document is used for providing an estimate of the closing costs for a mortgage loan in California. The form is available in Korean.

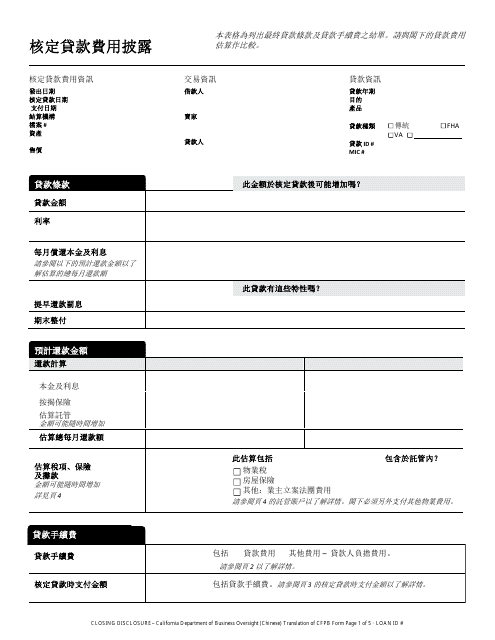

This document is used for providing closing details in a real estate transaction in California. It is available in Chinese language for convenience.

This document is used for providing the final details of a mortgage loan to a borrower in California who speaks Korean. It is required by law and outlines the terms and costs associated with the loan.

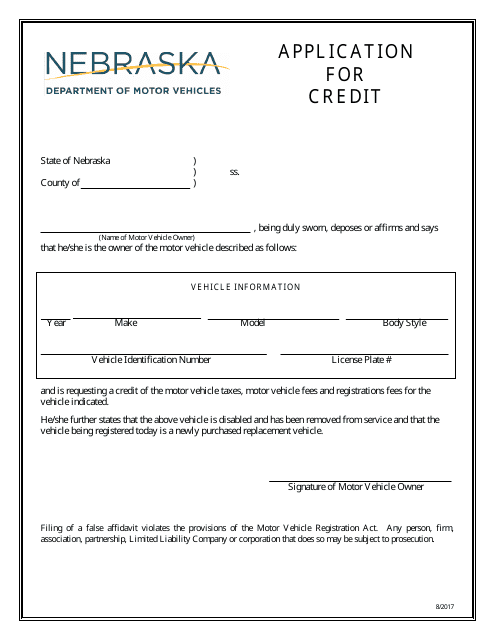

This document is used for applying for credit in the state of Nebraska. It is a form that individuals fill out to request credit from a lender or financial institution.

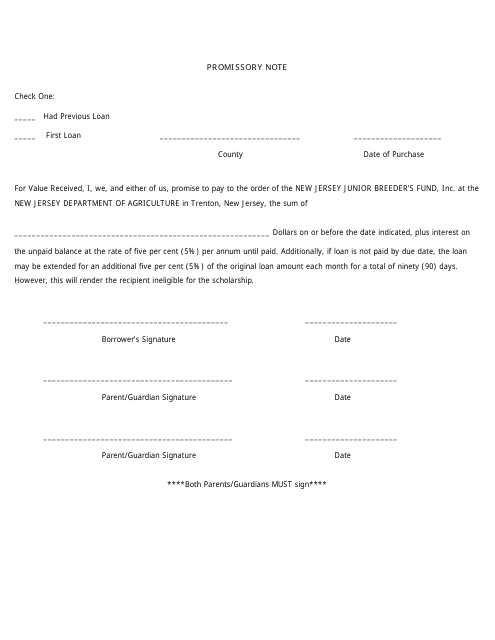

This type of document, known as a Promissory Note, is commonly used in New Jersey. It is a legal agreement that outlines the terms and conditions of a loan or debt. The note contains information such as the amount borrowed, the repayment schedule, and any interest involved. It serves as a written promise to repay the borrowed amount according to the agreed terms.

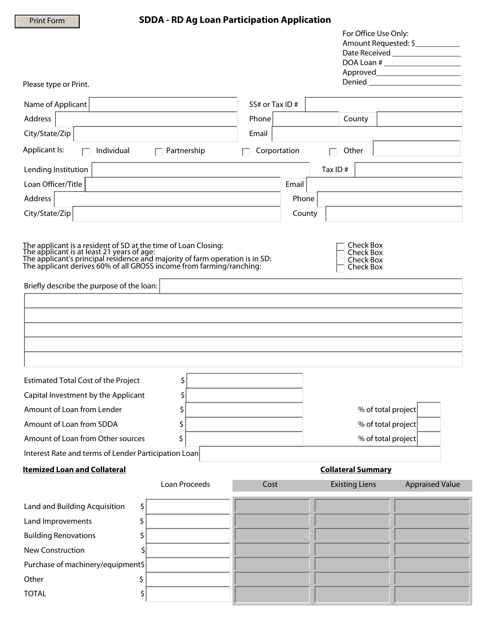

This form is used for applying for a loan participation program in South Dakota specifically for agricultural purposes.

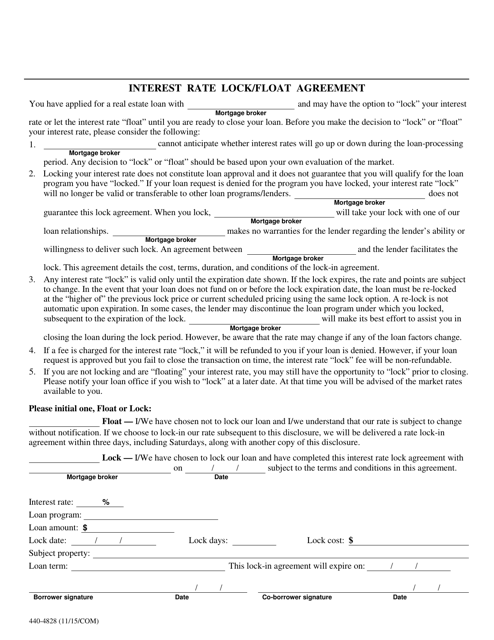

This form is used for an interest rate lock/float agreement in the state of Oregon.

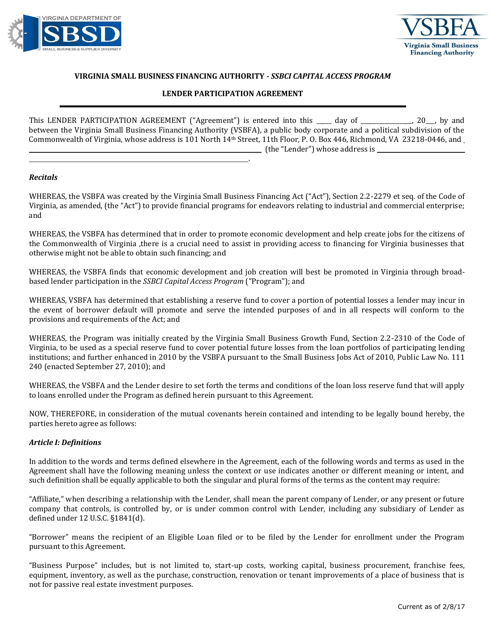

This document outlines the agreement between a lender and the state of Virginia for participation in the State Small Business Credit Initiative (SSBCI) Capital Access Program (CAP). It specifies the terms and conditions of the lender's participation.

This document provides a loan estimate form from the Consumer Financial Protection Bureau specifically for residents of California who speak Korean. The form is used to understand the terms and costs associated with a loan.

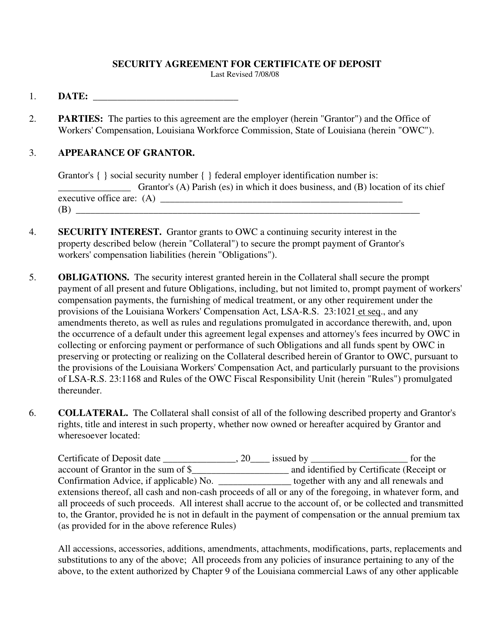

This document is used for securing a certificate of deposit in the state of Louisiana. It outlines the terms and conditions of the agreement between the depositor and the financial institution.

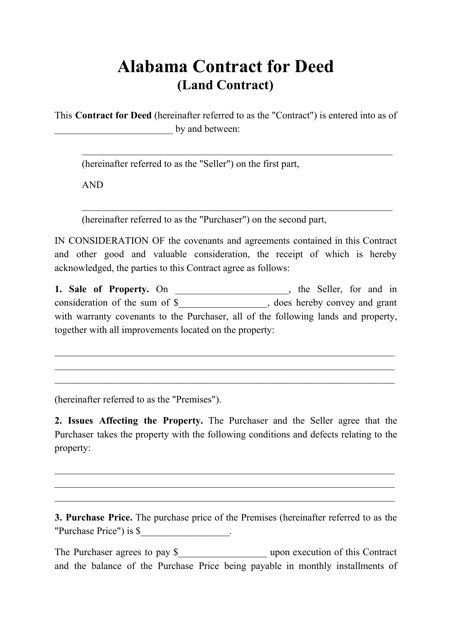

This document is used for a type of real estate transaction known as a contract for deed or land contract in the state of Alabama.

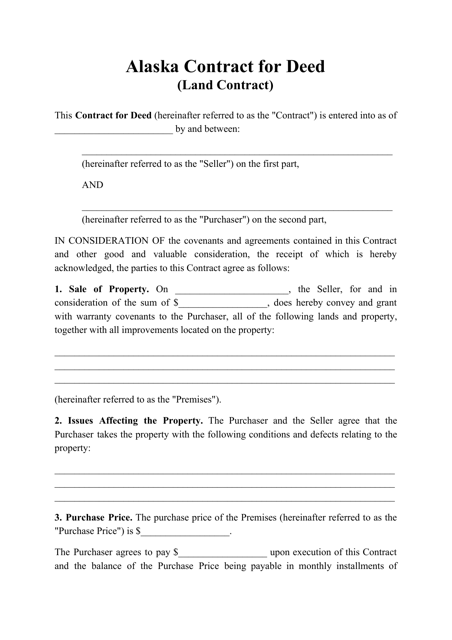

This document is used for purchasing real estate in Alaska through a contract for deed, also known as a land contract.

This document is used in Louisiana for a contract called "Contract for Deed" or "Land Contract". It outlines the terms and conditions for buying or selling land, where the seller retains ownership until the buyer completes payment.

This document is a legally binding agreement used in Montana for the sale of a property where the seller finances the purchase and retains the title until the buyer fulfills the payment.

This document is used for the sale of property in New Mexico where the seller acts as the lender and the buyer makes installment payments.

This document is used for a type of real estate transaction known as a Contract for Deed, also known as a Land Contract, in Oklahoma. It outlines the agreement between the buyer and seller for the purchase of a property, where the buyer makes payments directly to the seller until the property is fully paid off.

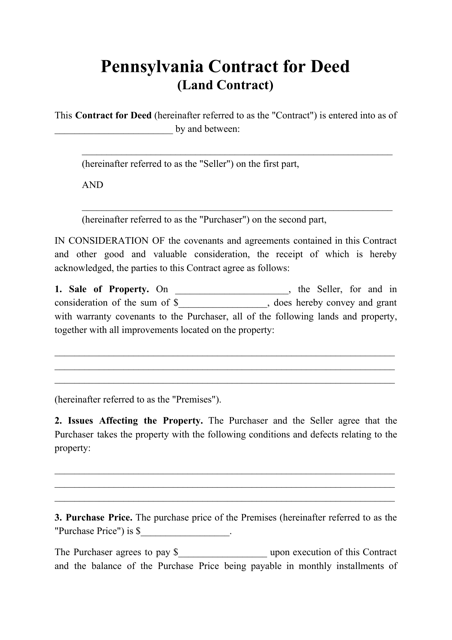

This document is used for a contract between a buyer and a seller in Pennsylvania, where the buyer agrees to purchase a property from the seller through monthly installments instead of obtaining traditional financing.

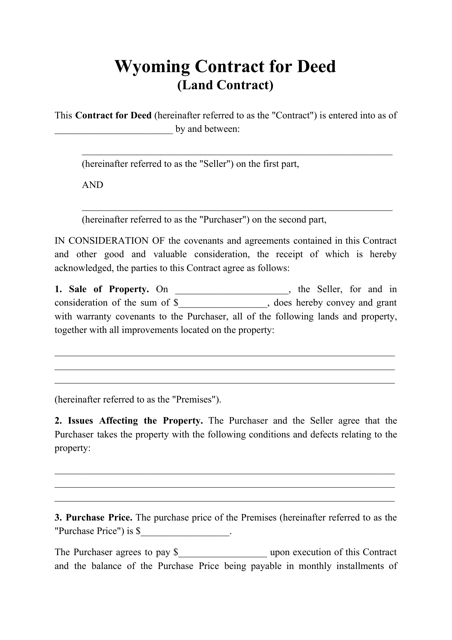

This document is a Contract for Deed, also known as a land contract, which is used in the state of Wyoming. It outlines the terms and conditions for the sale of a property where the buyer takes possession but makes payments to the seller over time, rather than obtaining financing from a traditional lender.

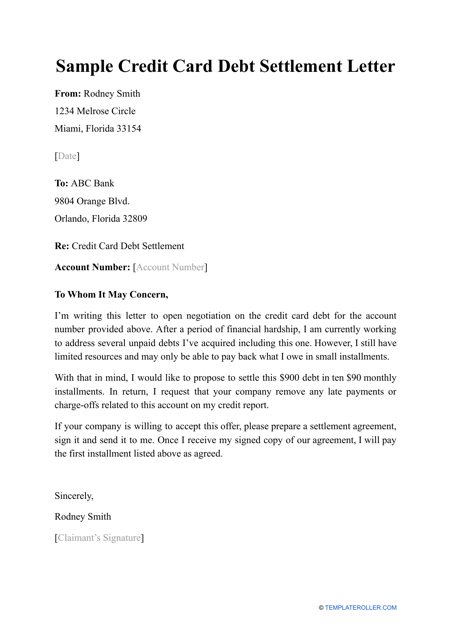

This type of debt settlement letter is used by filers who want to decrease the debt on their credit card.

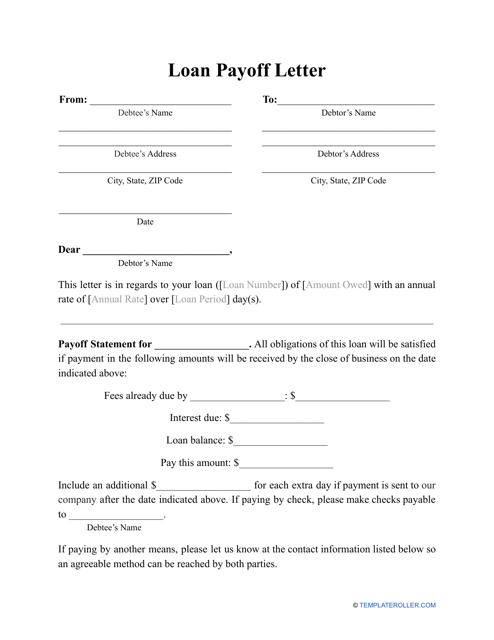

This letter provides detailed instructions on how to pay off a loan.

This document describes the changes in the Canadian mortgage market and its impact.

This is a contract used to document and formalize all obligations that regulate receiving the loan and paying it back.

This Form is used for requesting a payoff statement in the state of Texas. A payoff statement provides information on the remaining balance and any additional fees or charges needed to fully satisfy a loan or mortgage.

This type of agreement is used when a corporation borrows money from a shareholder in order to explain the details of the loan and to serve as evidence of the debt.

This is a formal document signed by a lender and a borrower in which the borrower provides their property or interest in an asset as collateral for a loan.

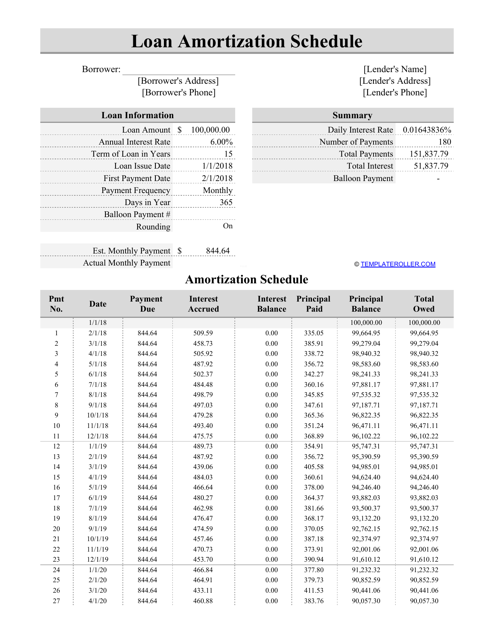

An individual can use this spreadsheet to outline payments for a loan, to calculate the money that goes towards the lender and to the interest until the borrower has paid off the entire amount of a loan.

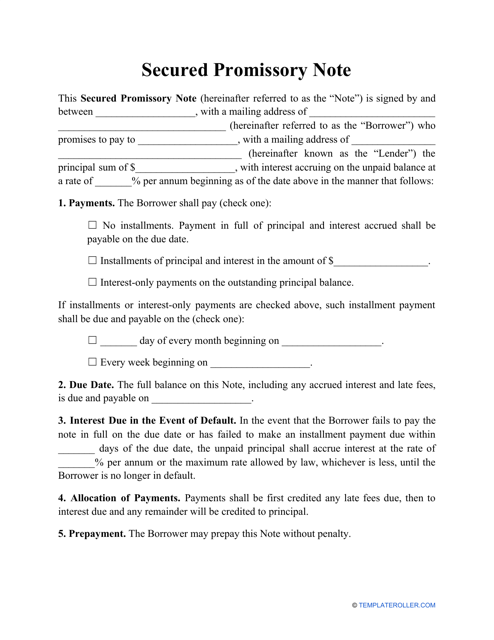

Individuals may use this template when they would like to secure a financial obligation to legally bind a borrower to pay their loan back to a lender.

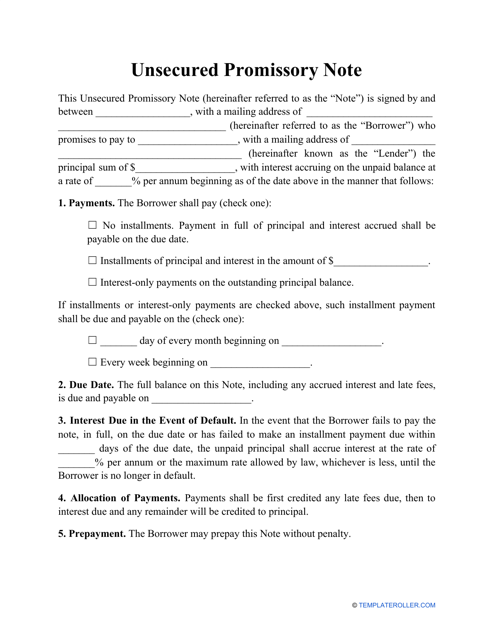

This template establishes the basic terms of the agreement between a lender and a borrower regarding the money the former has provided the latter with.