Interest Rates Templates

Documents:

105

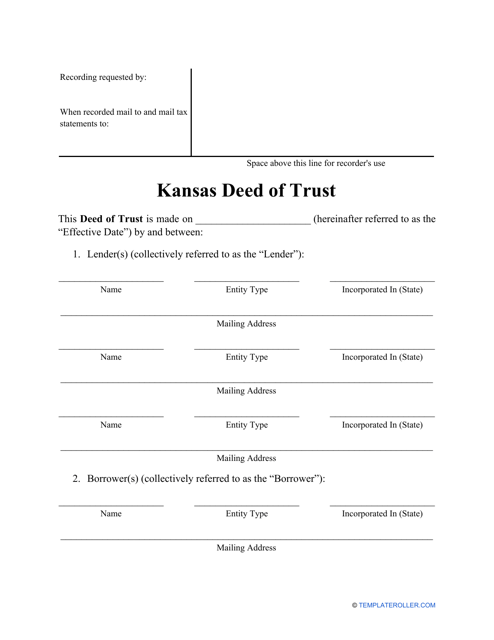

Are you looking to transfer property using a Deed of Trust? Complete this printable template when drafting your own Deed in the state of Kansas.

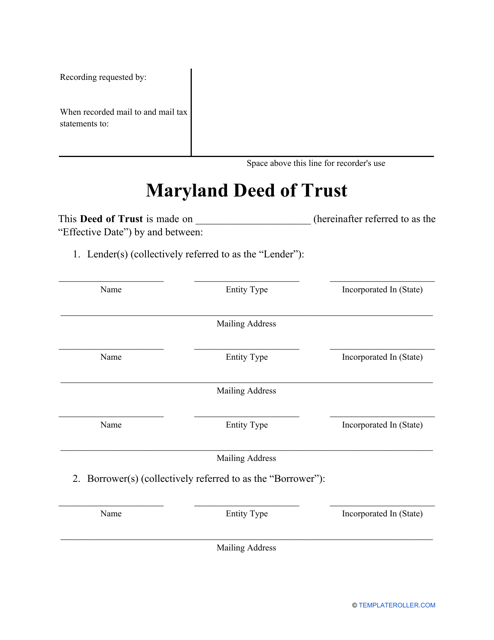

Complete this printable Deed of Trust template when making your own Deed in the state of Maryland.

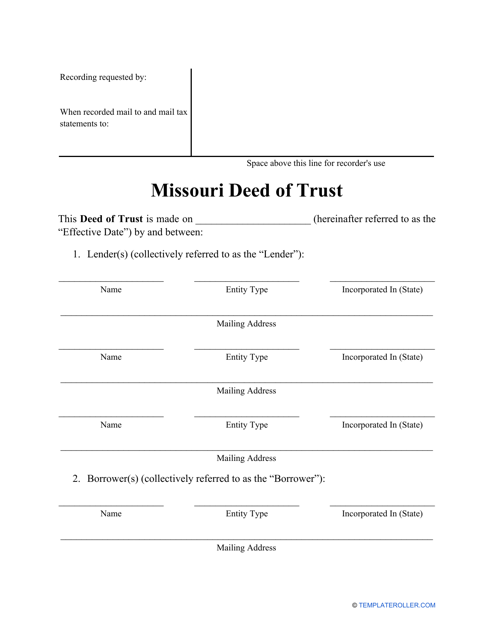

Complete this printable Deed of Trust template when making your own Deed in the state of Missouri.

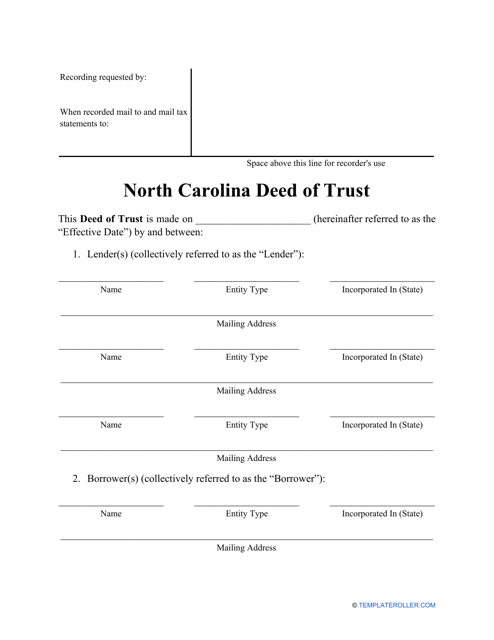

Use this printable template when making your own Deed of Trust in the state of North Carolina.

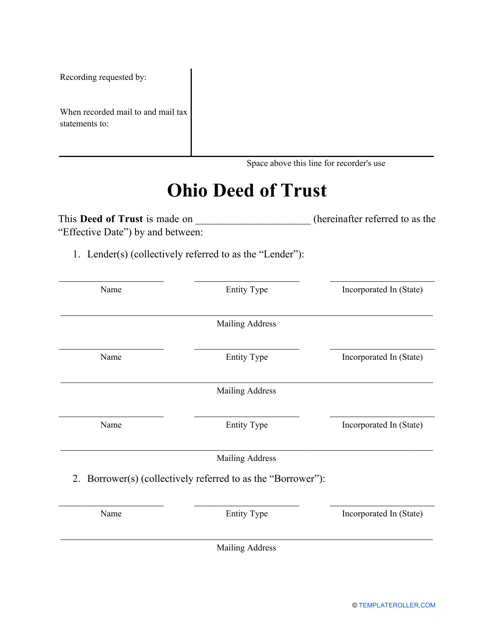

Complete this printable Deed of Trust template when making your own Deed in the state of Ohio.

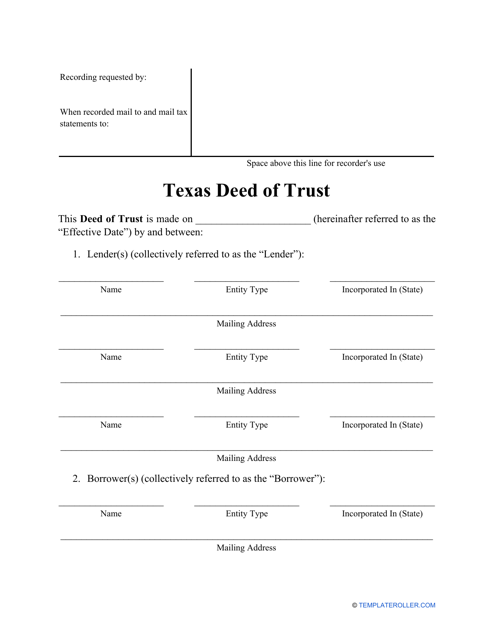

Complete this printable Deed of Trust template when making your own Deed in the state of Texas.

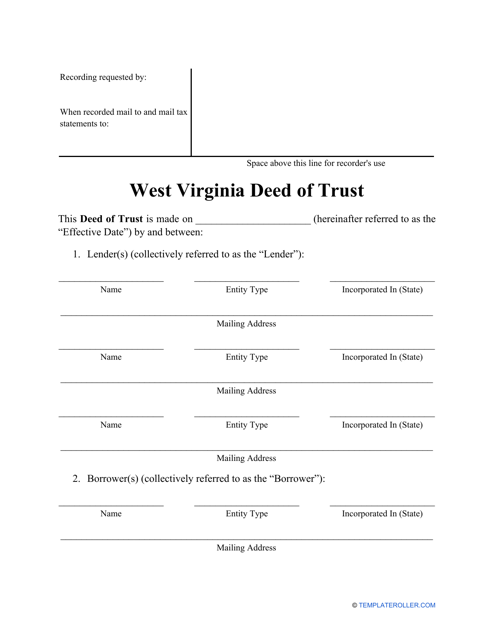

Are you looking to transfer property using a Deed of Trust? Complete this printable template when drafting your own Deed in the state of West Virginia.

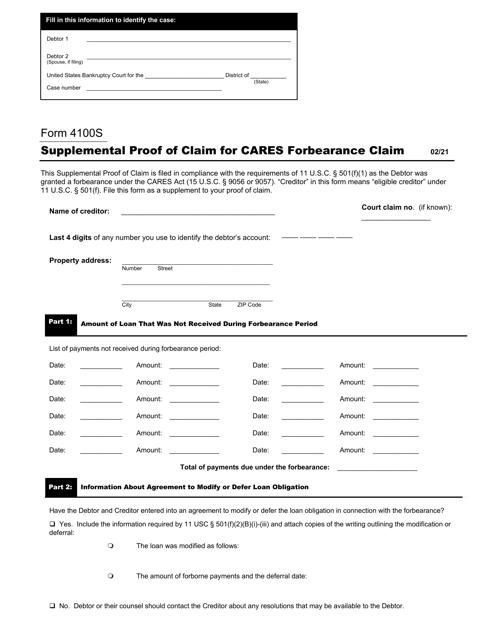

This Form is used for submitting additional proof of claim for a CARES Act forbearance claim. It allows individuals to provide additional documentation to support their claim for mortgage or loan forbearance due to the COVID-19 pandemic.

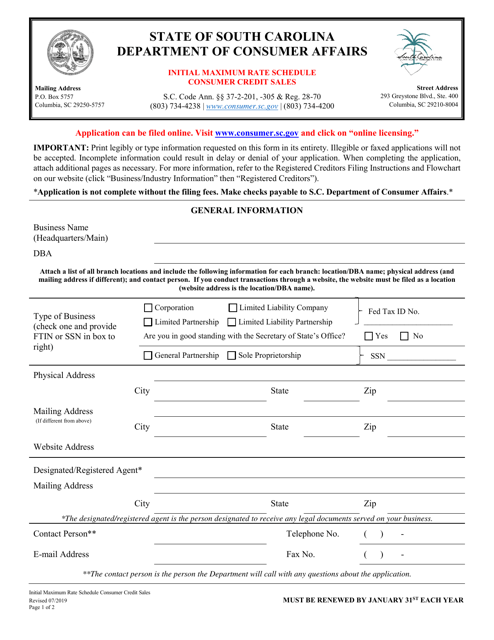

This document provides the maximum interest rates for consumer credit sales in South Carolina.

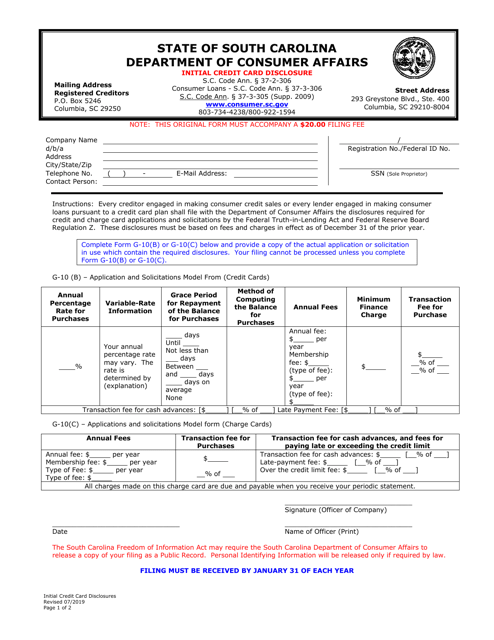

This document provides important information about the terms and conditions of a credit card in the state of South Carolina. It covers details such as interest rates, fees, and payment requirements.

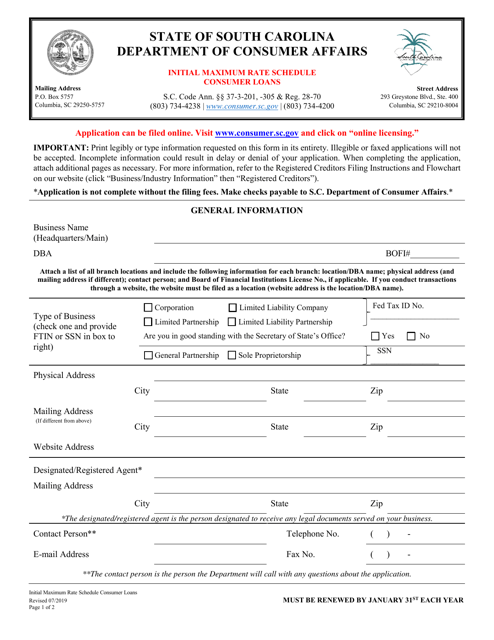

This document provides information about the maximum interest rates that can be charged for consumer loans in South Carolina.

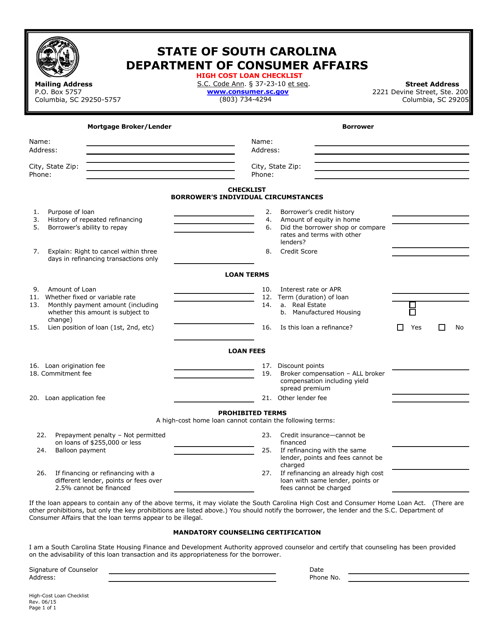

This document is a checklist that helps South Carolina residents assess the expenses and terms associated with high-cost loans in order to make informed decisions.

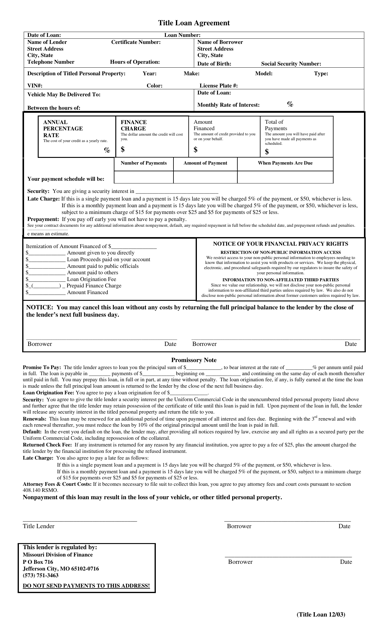

This document is a legally binding agreement used in Missouri for obtaining a title loan. It outlines the terms and conditions for borrowing money, using a vehicle's title as collateral.

This letter can be used as a reference to show that a customer has maintained a good credit history and has saved the necessary funds that will later help them qualify for a mortgage loan.

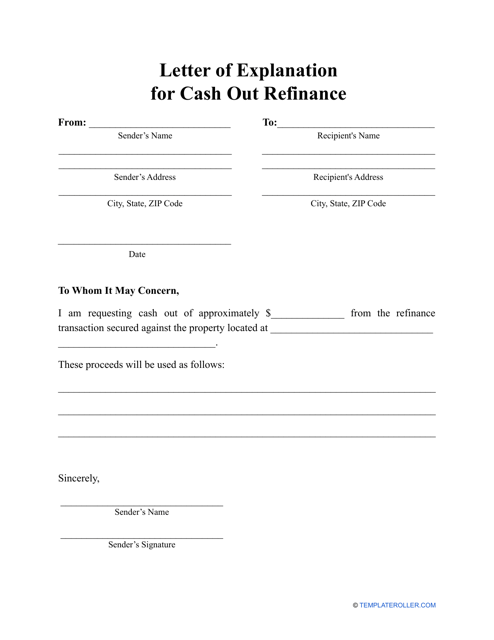

Individuals can use this type of letter when they want to explain to their potential lender why they need cash out refinancing.

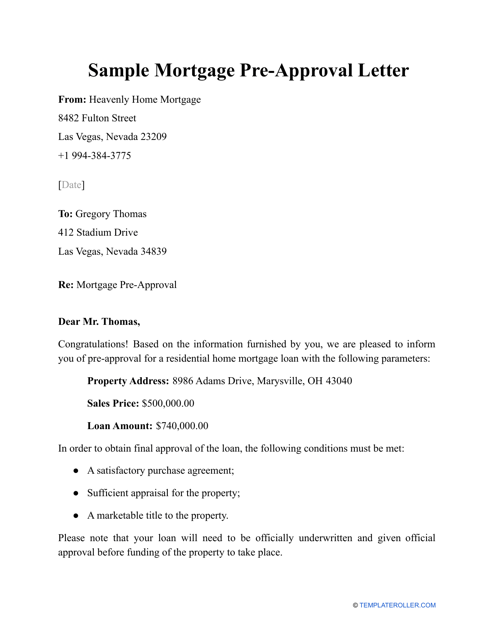

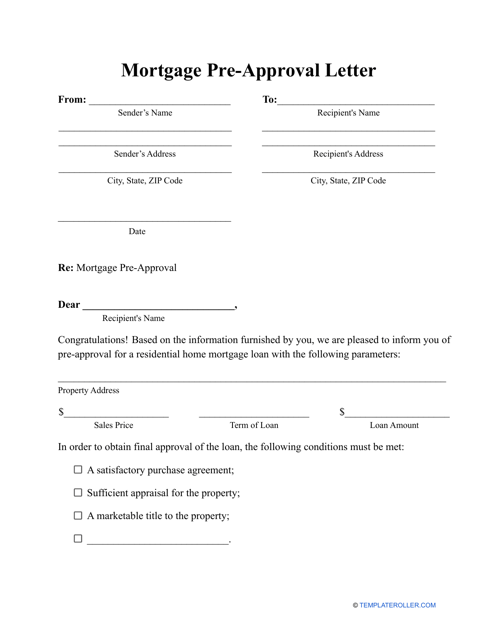

This is a written statement composed by a lender and sent to a borrower to notify the latter their mortgage application has been evaluated and approved subject to certain conditions the borrower must adhere to.

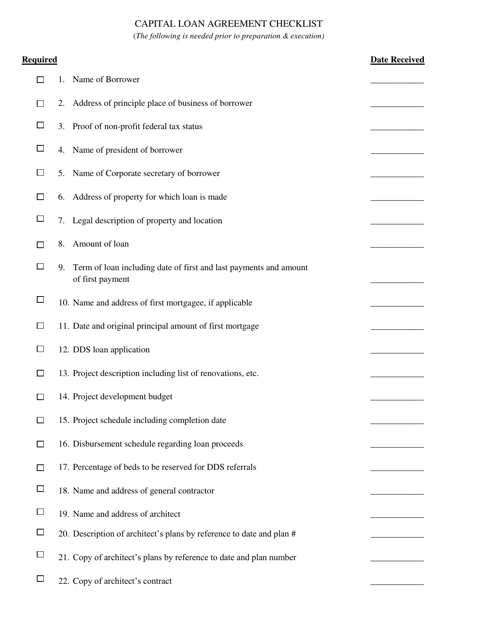

This document provides a checklist for a capital loan agreement in Connecticut. It outlines the necessary steps and requirements for obtaining a capital loan in the state.

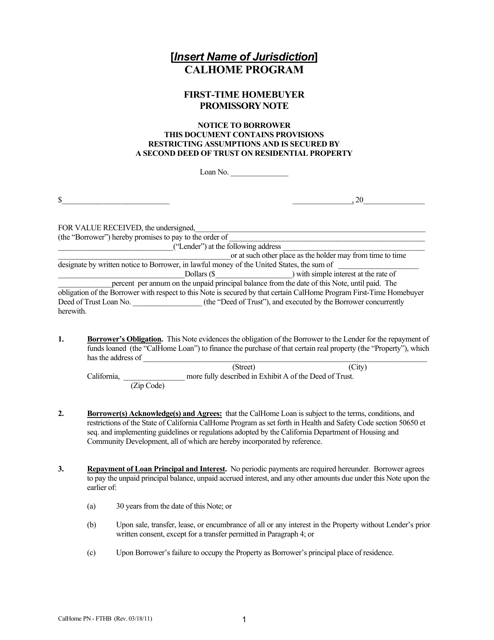

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

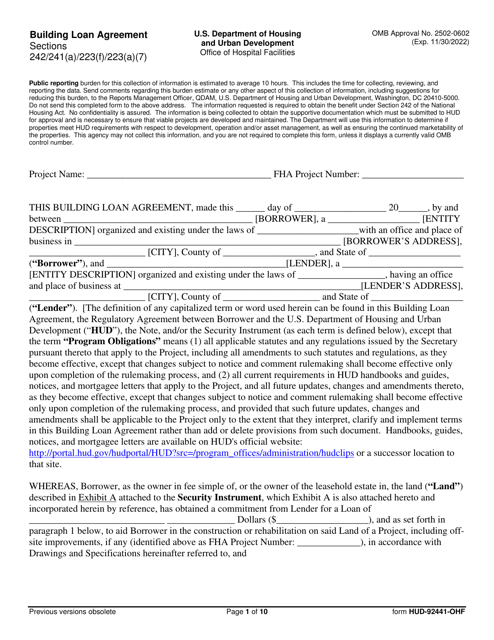

This document is a Building Loan Agreement form (Form HUD-92441-OHF) used by the U.S. Department of Housing and Urban Development (HUD) for financing the construction or rehabilitation of affordable housing projects.

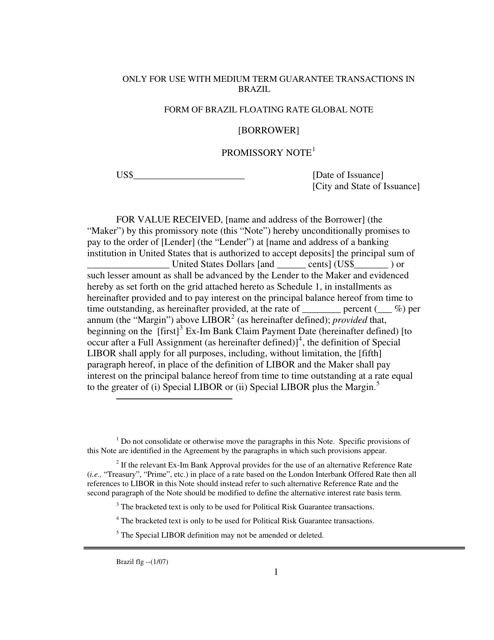

This document is a form of Brazil Floating Rate Global Note.

This form is used for signing a fixed rate single disbursement loan agreement. It outlines the terms and conditions of the loan, including the interest rate and repayment schedule.

This form of document is used for issuing floating rate serial notes, which are financial instruments with interest rates that adjust periodically based on market conditions.

This Form is used for a type of loan agreement known as a Floating Rate Single Disbursement Note.

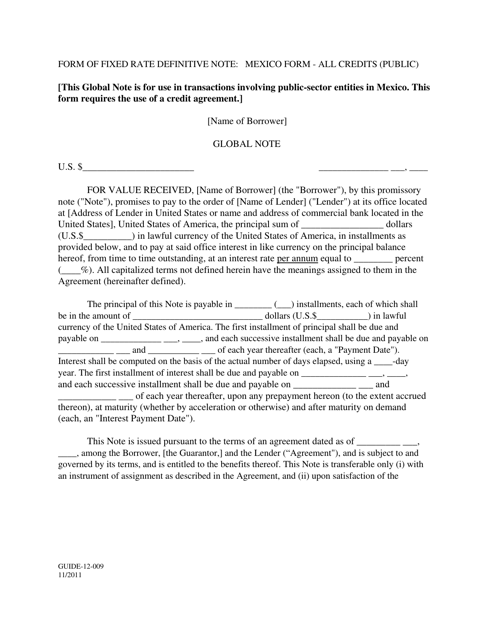

This form is used for creating a Mexican Promissory Note with a fixed interest rate for all types of credit.

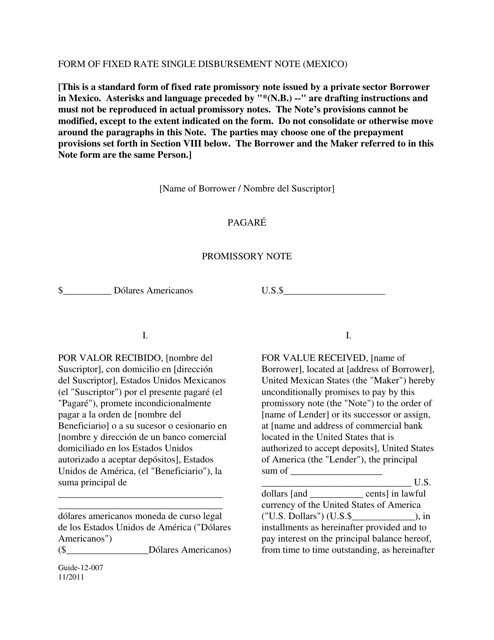

This document is a form that can be used in Mexico for a fixed rate single disbursement note. It is available in both English and Spanish.

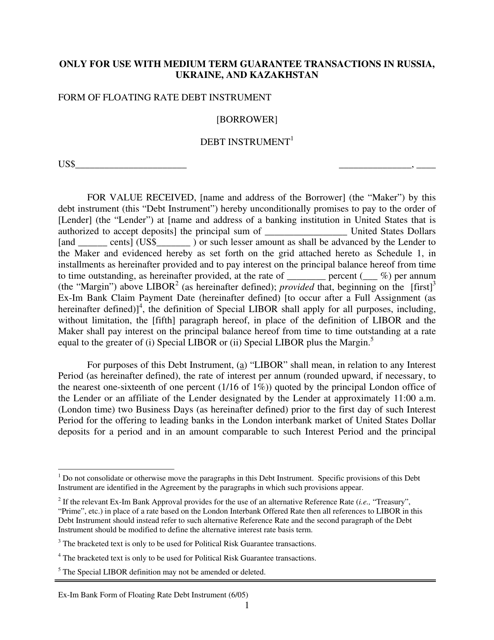

This document is a form used for creating a floating rate debt instrument. It outlines the terms and conditions of the loan, including the interest rate that will fluctuate based on a designated benchmark.

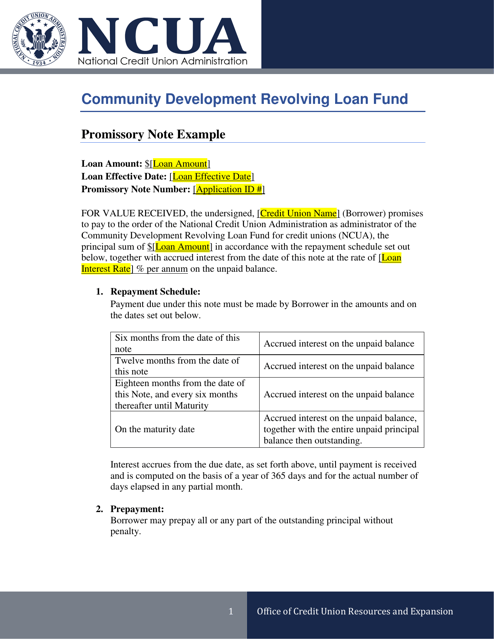

This document is a legal agreement between a lender and borrower that outlines the terms and conditions of a loan and the borrower's promise to repay the borrowed amount.

An individual or organization may use this type of template to loan out specific equipment to colleagues in various departments.

This type of document is a promissory note template specific to the state of Arkansas. It is used for creating a legally binding agreement between a borrower and a lender regarding the repayment of a loan.

This document is a template for a promissory note in the state of California. It outlines the terms and conditions of a loan, including the repayment schedule and interest rate.

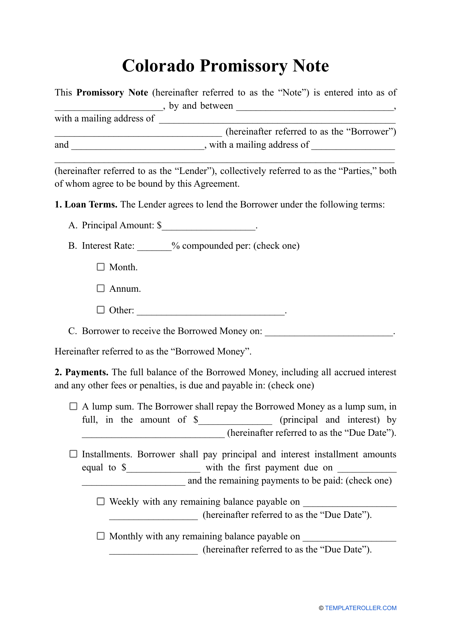

This form is used for creating a legally binding agreement in Colorado where one party agrees to pay a specified amount of money to another party by a specified date in the future.

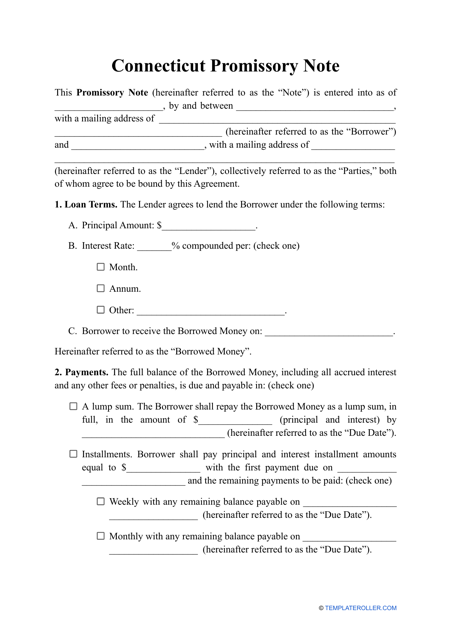

This document is a promissory note template specifically designed for use in Connecticut. It outlines the terms and conditions for repayment of a loan or debt.

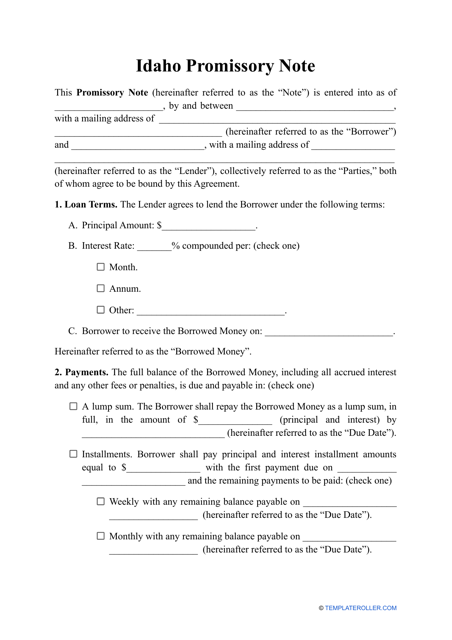

This document is a template for a promissory note in the state of Idaho. It outlines the terms and conditions of a loan agreement between a borrower and a lender.

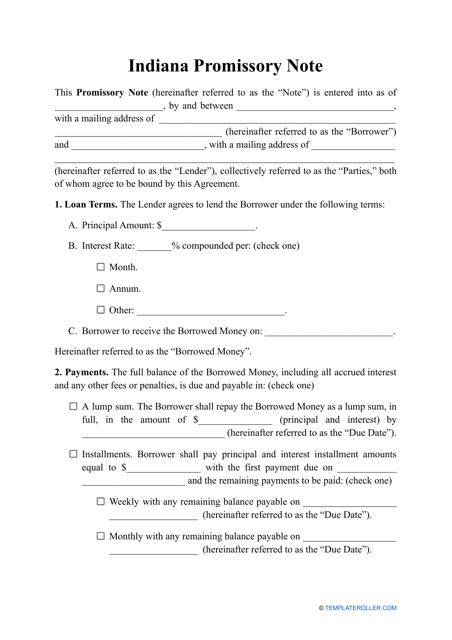

This document is a template for creating a promissory note in Indiana. A promissory note is a legal document that outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. This template can be customized to meet the specific needs of the borrower and lender in Indiana. Use this template to ensure a clear and legally binding agreement for a loan in Indiana.

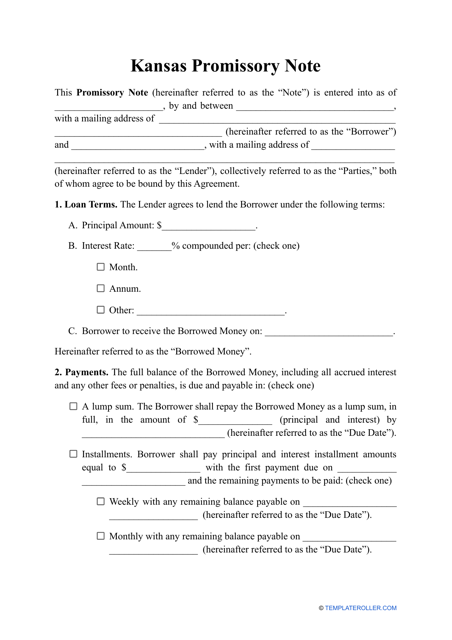

This document is a Promissory Note template specific to the state of Kansas. It is used to outline the terms and conditions of a loan or debt agreement between two parties.

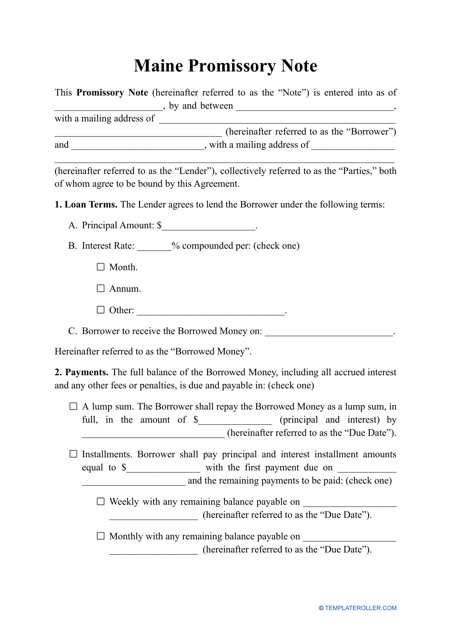

This document is a template for a promissory note in the state of Maine. It outlines the terms and conditions of a loan agreement between a lender and a borrower. Use this template to create a legally binding promissory note in Maine.

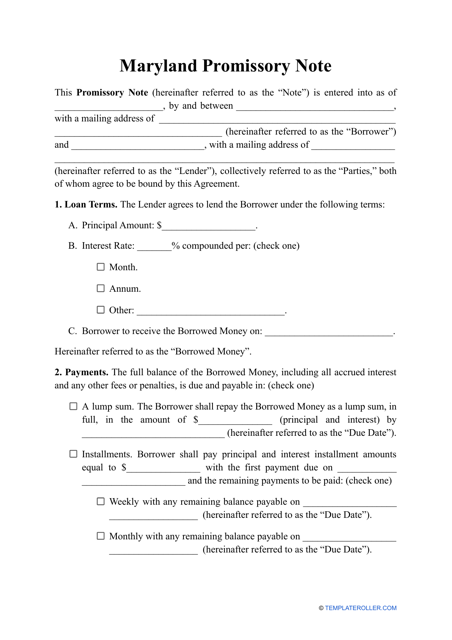

This document provides a template for creating a promissory note in the state of Maryland. It includes sections for the borrower's and lender's information, loan terms, and repayment details. Use this form to legally document a loan agreement in Maryland.

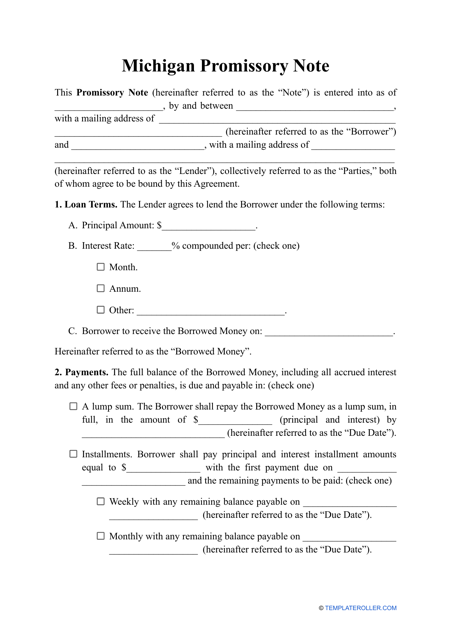

This document provides a template for a promissory note in the state of Michigan. It outlines the terms and conditions of a loan agreement between a borrower and a lender.