Charitable Organizations Templates

Are you looking to learn more about charitable organizations and the valuable work they do? Look no further! Our comprehensive collection of documents provides a wealth of information on these non-profit entities. From financial assistance guides to tax forms and registration instructions, we've got you covered!

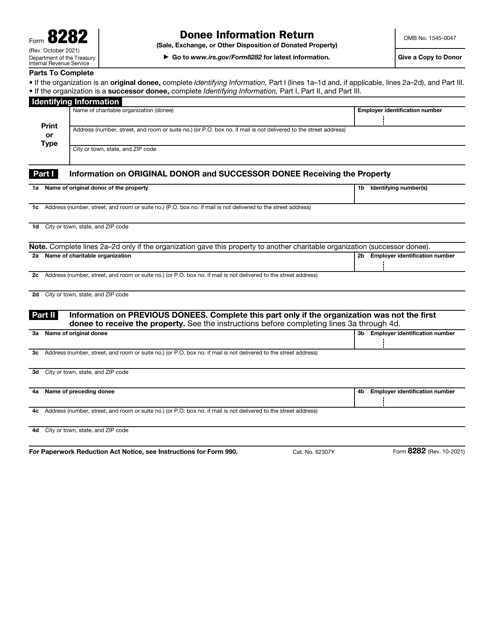

Discover various documents, including "Your Guide to Financial Assistance for Hearing AIDS" which offers valuable insights on finding financial support for hearing aids. For those interested in the legal and financial aspects of charitable organizations, explore the "IRS Form 990 (990-EZ) Schedule N", which delves into the liquidation, termination, dissolution, or significant disposition of assets.

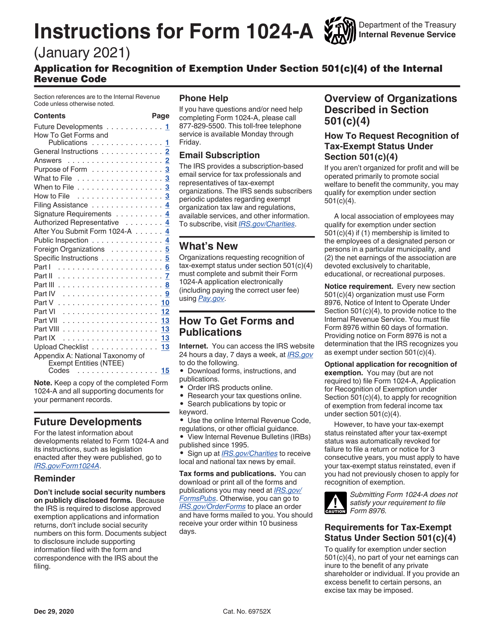

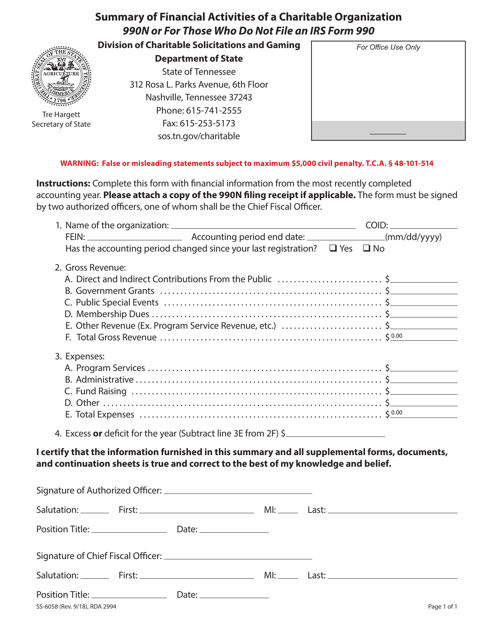

If you're a private foundation or a section 4947(A)(1) nonexempt charitable trust treated as a private foundation, the "Instructions for IRS Form 990-PF" will guide you through the process of filing your return. Similarly, the "Instructions for Form SS-6001 Application" provides step-by-step instructions on how to register a charitable organization in Tennessee.

Additionally, for an overview of a charitable organization's public status and support, check out the "IRS Form 990 Schedule A." This document sheds light on the organization's public charity status and the level of public support it receives.

Our collection of documents surrounding charitable organizations is essential for individuals, donors, volunteers, and anyone interested in contributing to the betterment of society. Start exploring today and make a positive impact in your community!

Documents:

228

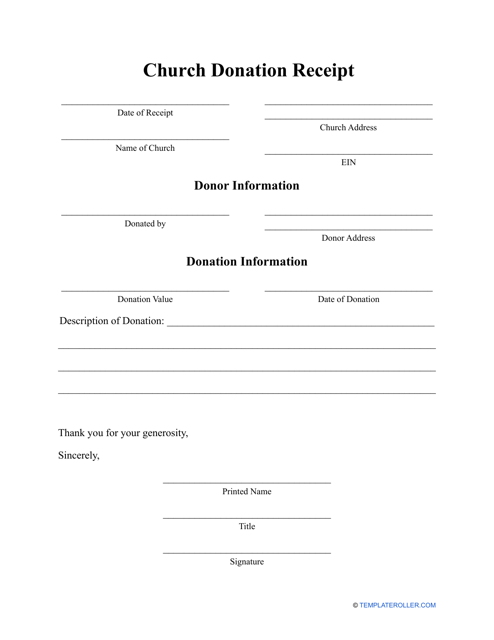

This type of template acts as a document that keeps a note of any donations that have been gifted to a church.

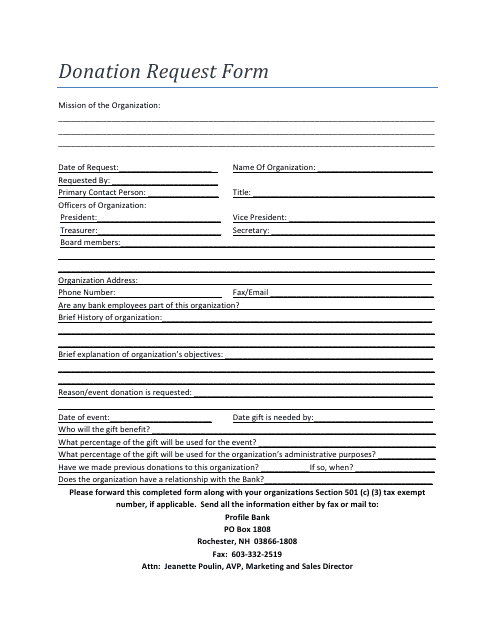

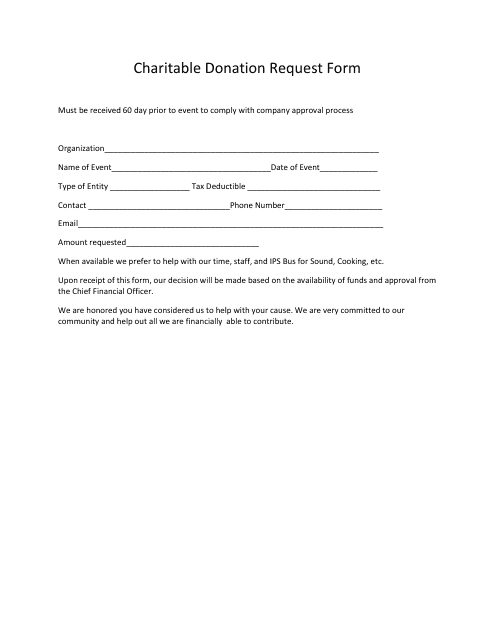

This form is used for requesting donations in the state of New Hampshire.

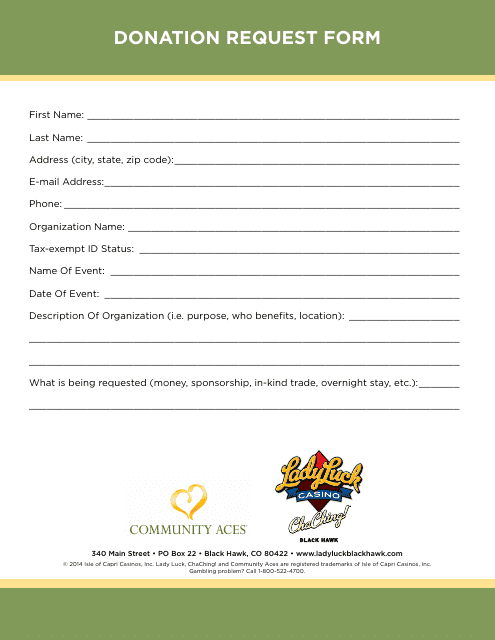

This Form is used for submitting a request for donations to Ladyluck organization.

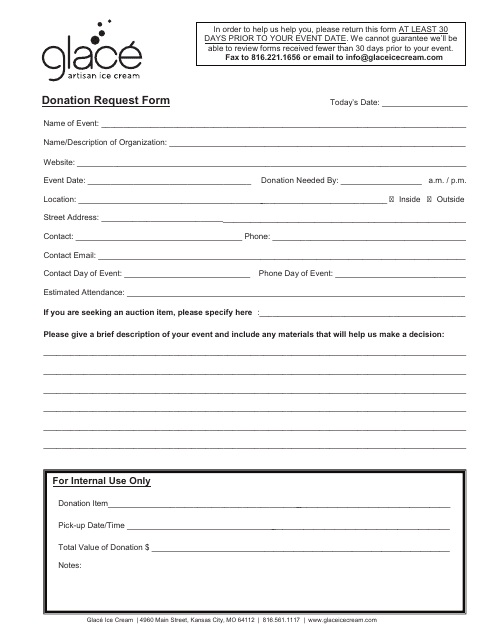

This form is used for requesting donations from individuals and organizations for Glace.

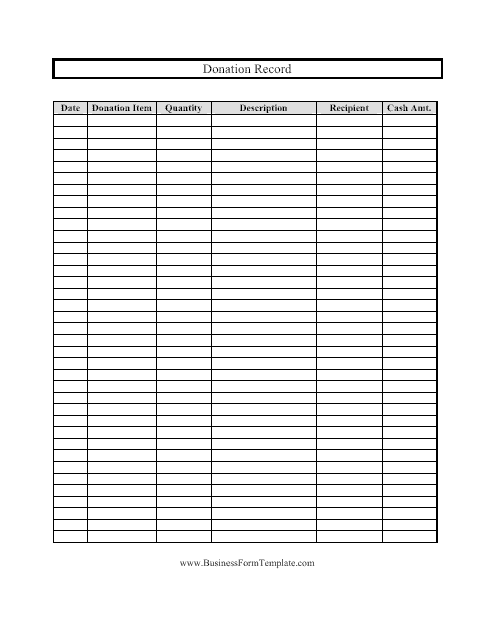

This template is used for tracking and organizing donation records. It helps you keep a record of all the donations received, including the donor's information, the amount donated, and the date of donation.

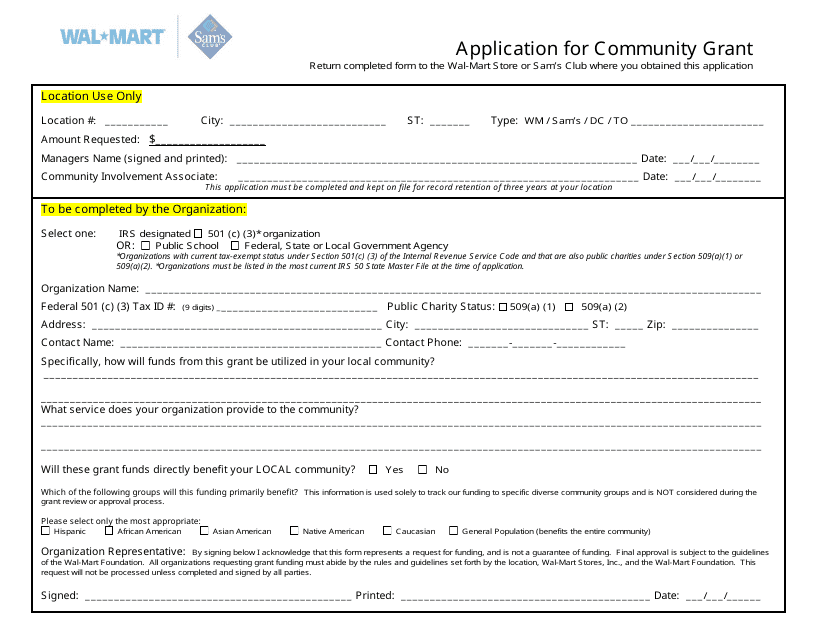

This Form is used for applying for a community grant from Walmart, a popular retail company in the United States. The grant supports local community projects and initiatives.

This template is used for creating a gift card that can be given as a donation to a charity.

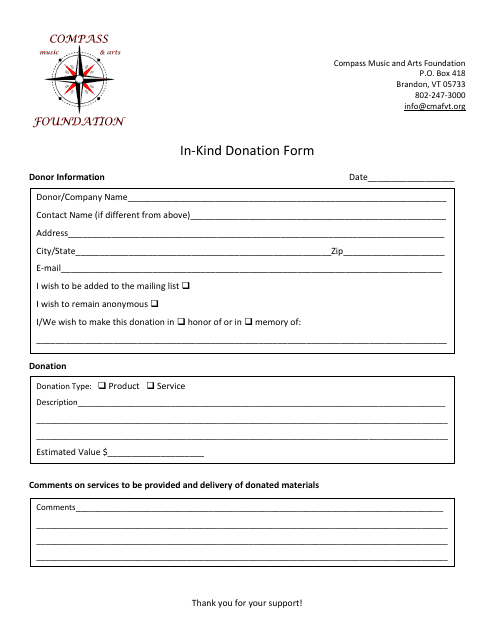

This document is used for recording and requesting in-kind donations to the Compass Music and Arts Foundation.

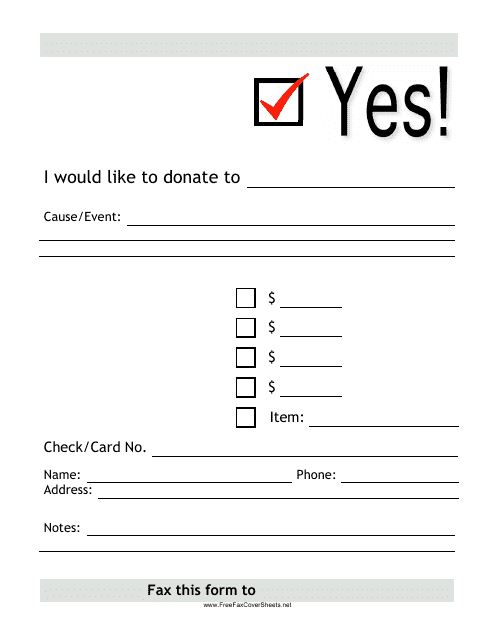

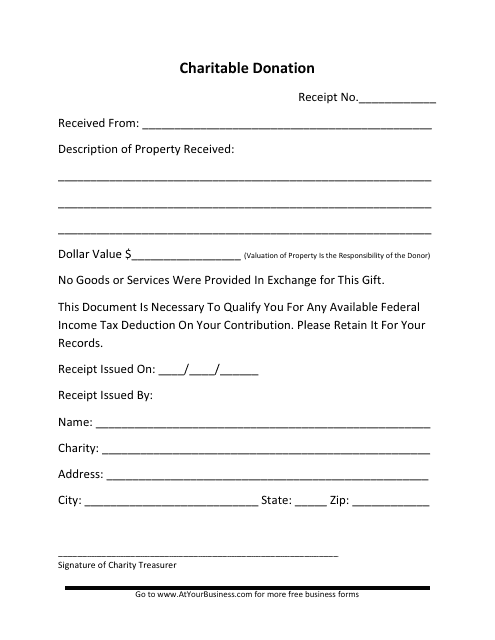

This Form is used for making charitable donations to non-profit organizations.

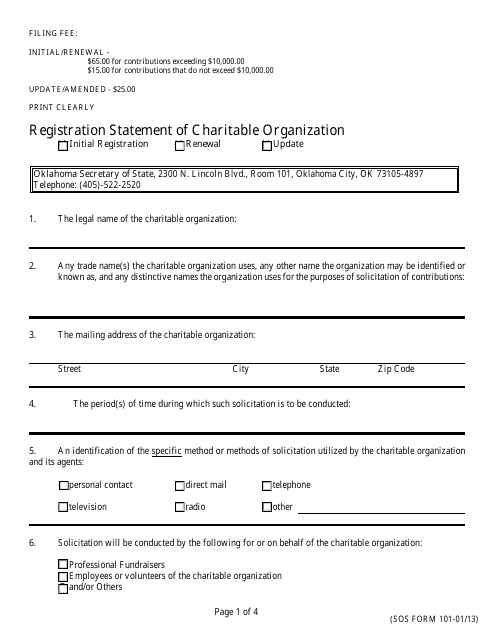

This Form is used for registering a charitable organization in Oklahoma. It is required by the state to ensure transparency and accountability in the fundraising activities of the organization.

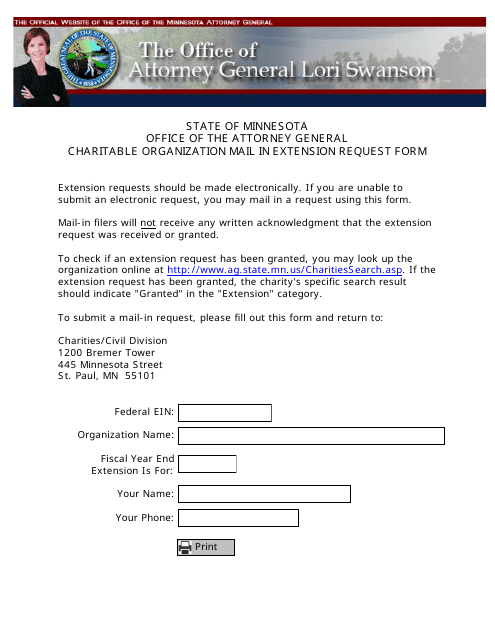

This Form is used to request an extension for mailing requirements for charitable organizations in Minnesota.

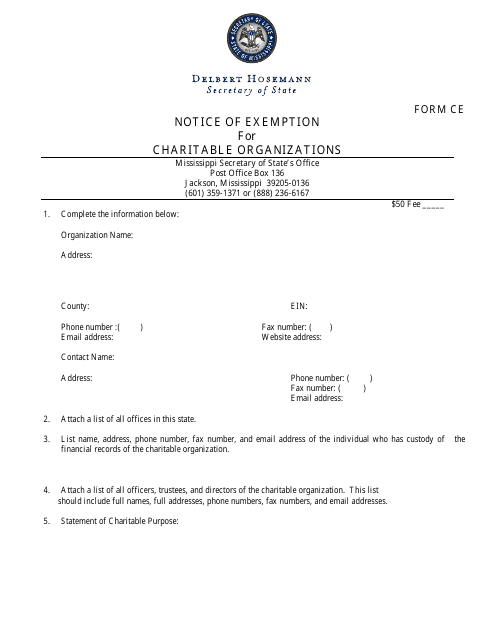

This form is used for charitable organizations in Mississippi to apply for an exemption from certain taxes.

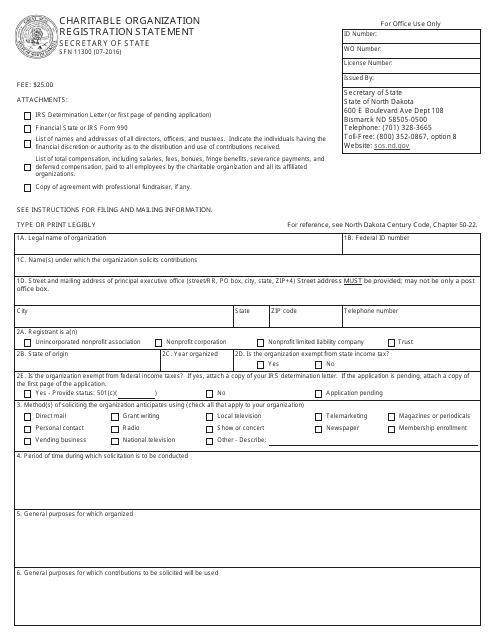

This form is used for registering a charitable organization in North Dakota.

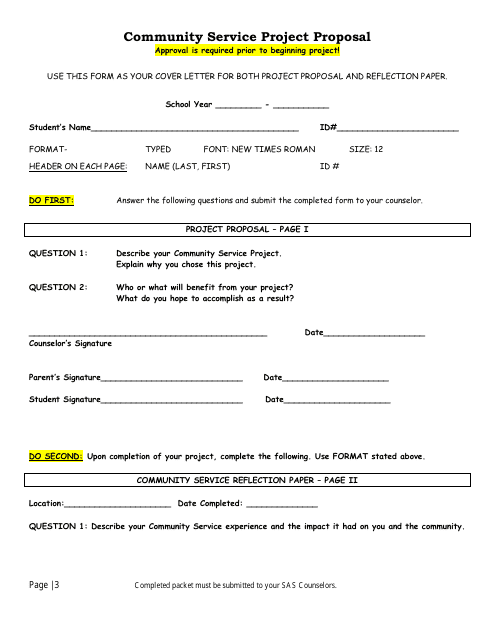

This form is used for submitting a proposal for a community service project.

This document is used for requesting donations for charitable purposes.

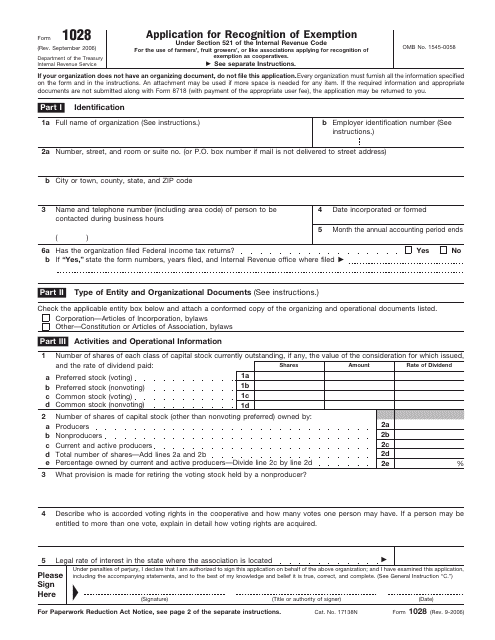

This form is used for applying recognition of exemption under Section 521 of the Internal Revenue Code.

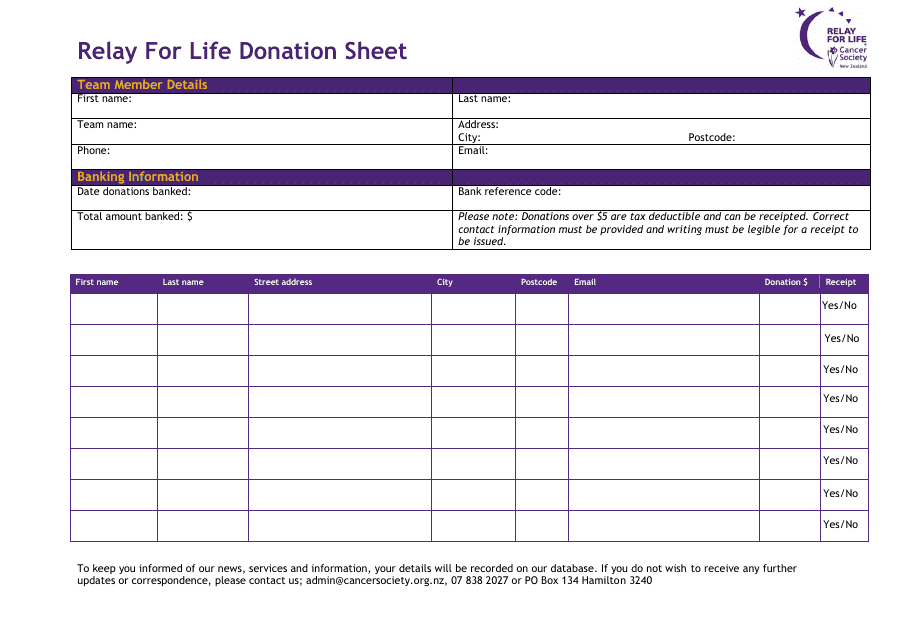

This document is a template for recording donations for the Relay for Life event organized by the Cancer Society. Use this sheet to easily track and collect donations from participants and sponsors.

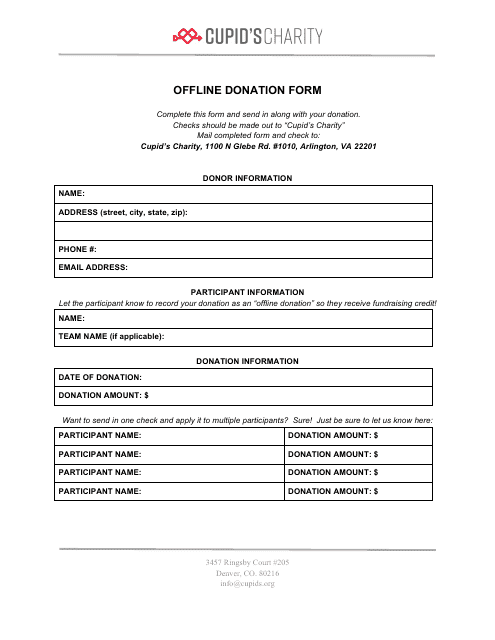

This document is an Offline Donation Form for Cupid's Charity, a non-profit organization. It allows individuals to make a donation to the charity outside of an online platform.

This form is used for the Army Emergency Relief Annual Fund Campaign. It assists in collecting donations for soldiers in need.

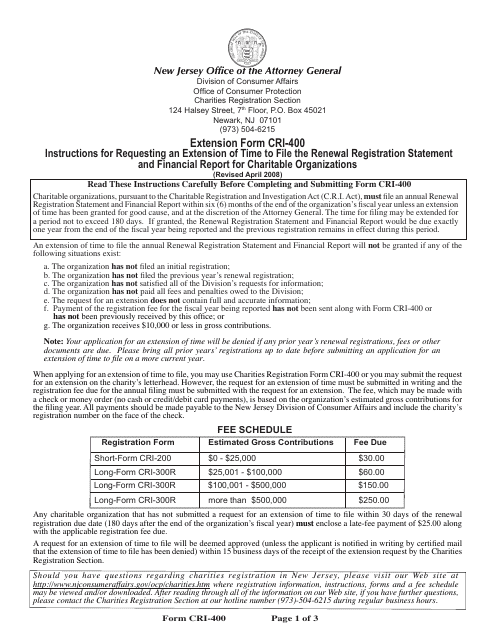

This Form is used for applying for an extension of time to file the annual renewal registration statement and financial report for a charitable organization in New Jersey.

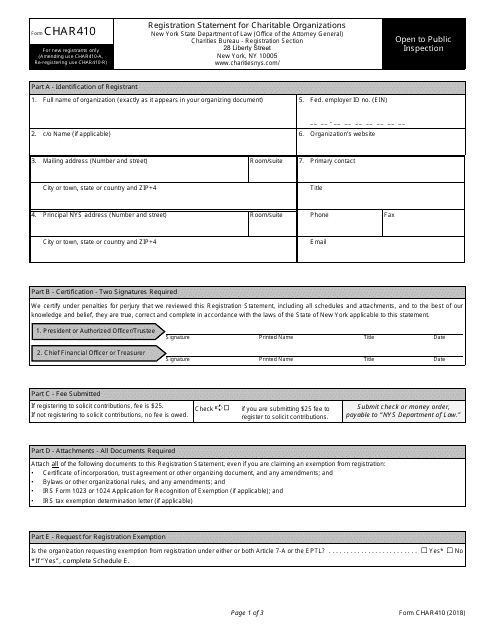

This Form is used for registering charitable organizations in the state of New York. It is required for organizations that wish to solicit or receive contributions from the public.

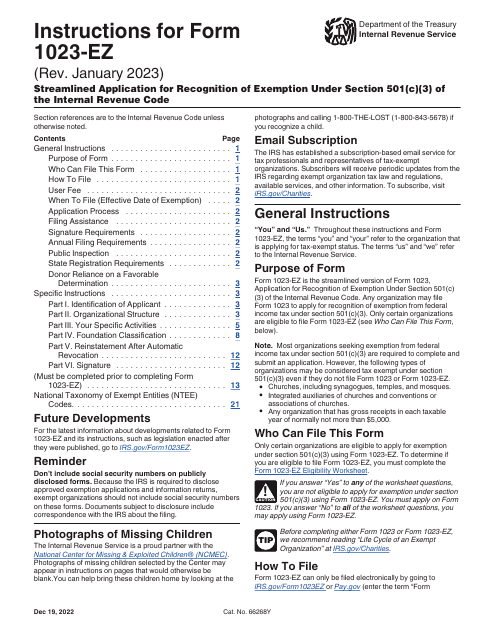

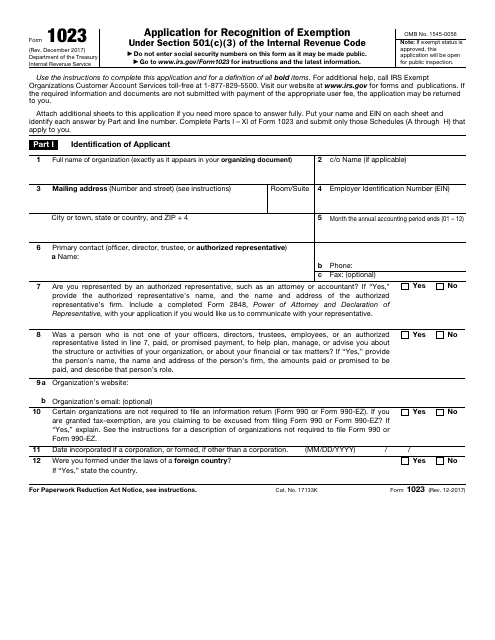

This Form is used for applying for tax-exempt status for charitable organizations with the IRS.

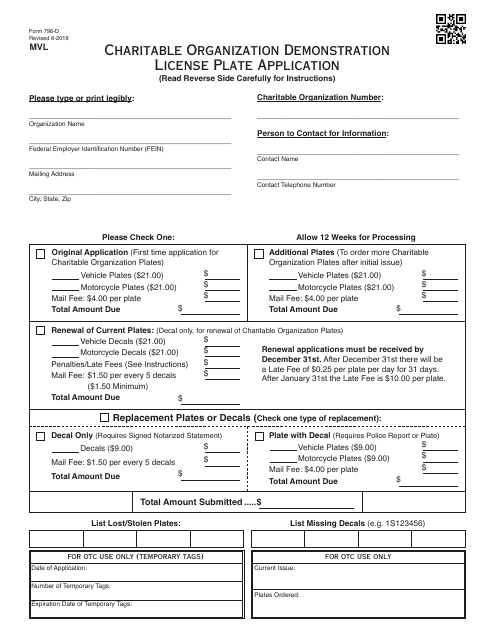

This Form is used for applying for a Charitable Organization Demonstration License Plate in Oklahoma.

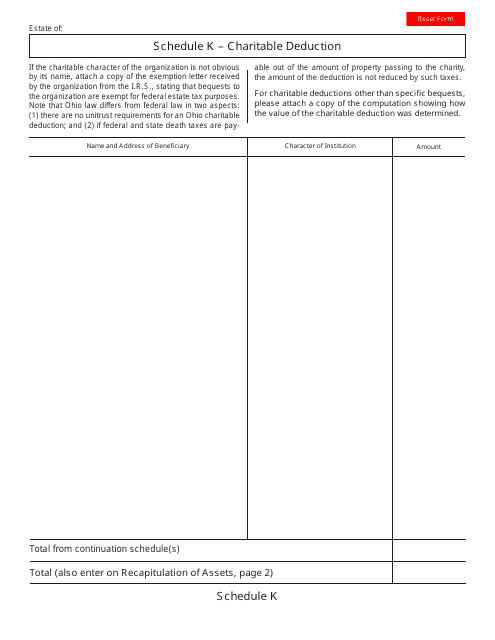

This document is used for reporting charitable deductions on Schedule K in Ohio. It is used to claim deductions for donations made to qualified charitable organizations.

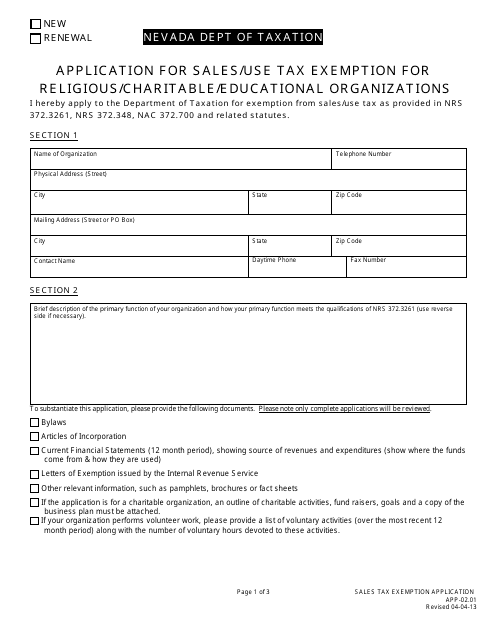

This form is used for religious, charitable, and educational organizations in Nevada to apply for sales and use tax exemption.

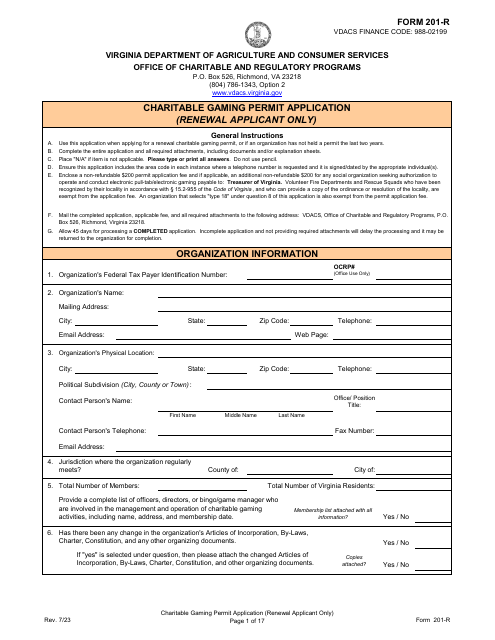

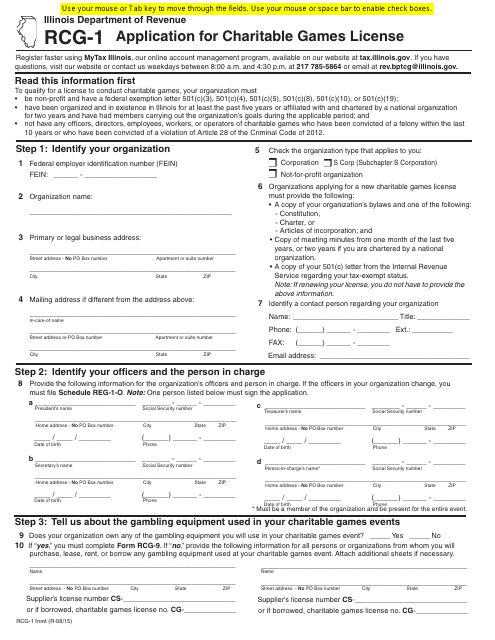

This form is used for applying for a charitable games license in the state of Illinois. It is required for organizations that wish to hold charitable games such as bingo, raffles, and poker tournaments.

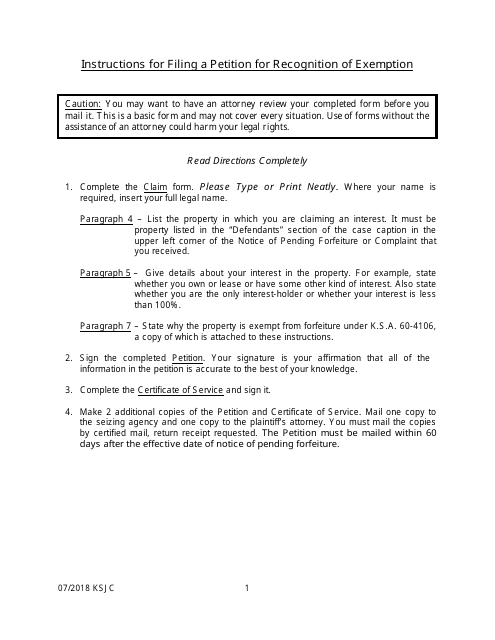

This form is used for petitioning the state of Kansas to recognize an organization's tax exempt status

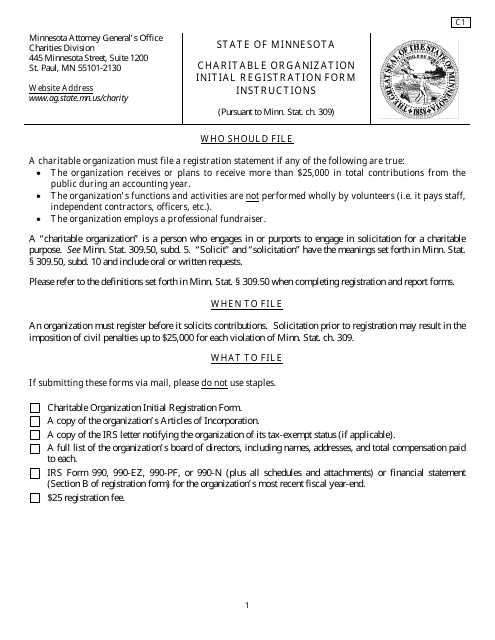

This Form is used for registering a charitable organization in Minnesota for the first time.

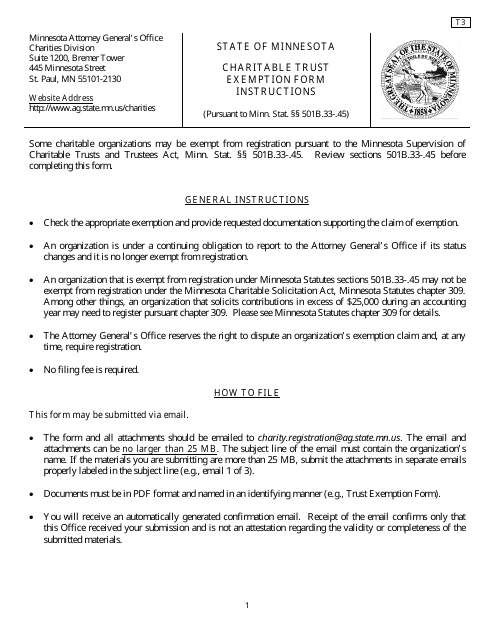

This form is used for applying for charitable trust exemption in the state of Minnesota.

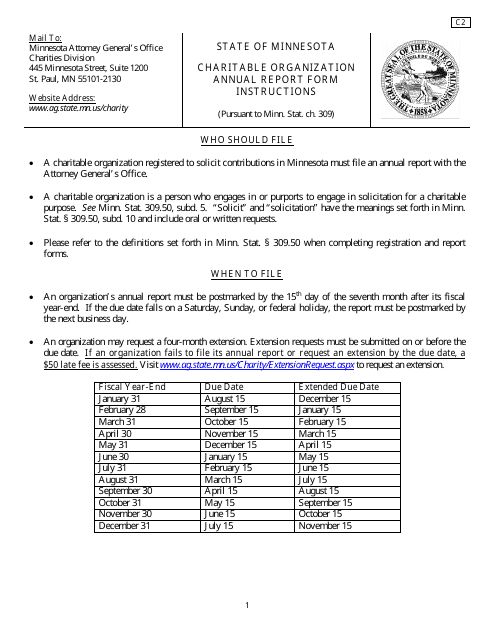

This form is used for charitable organizations in Minnesota to file their annual report.

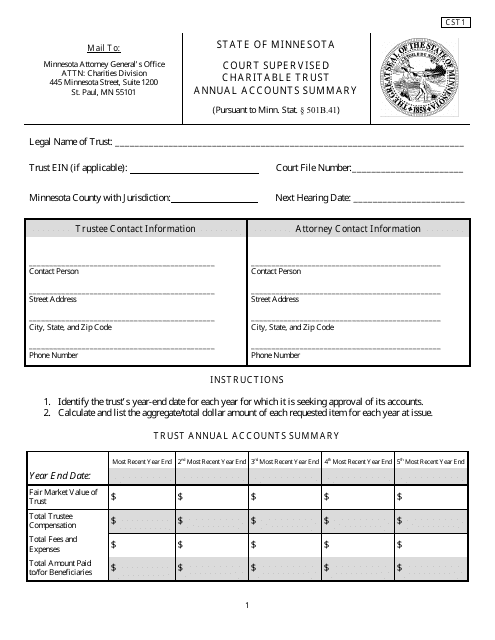

This form is used for submitting the annual accounts summary of a court-supervised charitable trust in Minnesota.

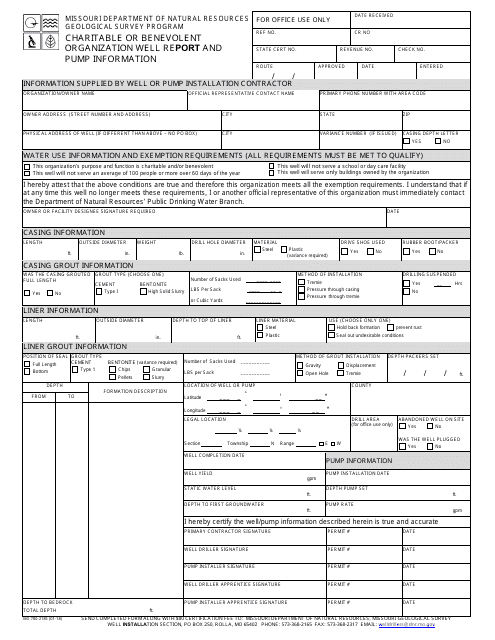

This form is used to report well and pump information for charitable or benevolent organizations in Missouri as part of the Geological Survey Program.

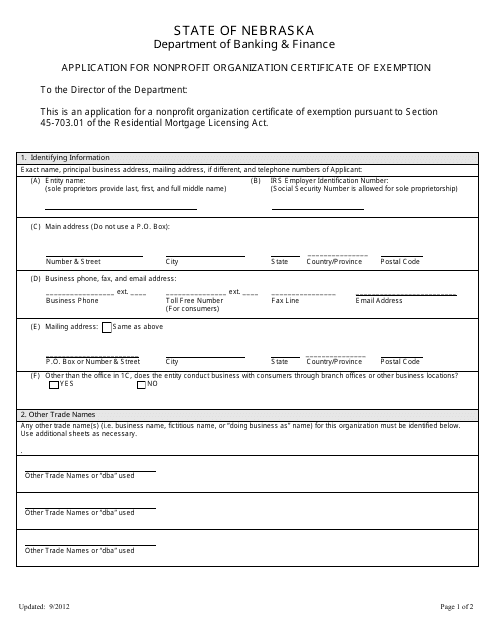

This document is used for applying for a certificate of exemption for nonprofit organizations in the state of Nebraska.