Charitable Organizations Templates

Documents:

228

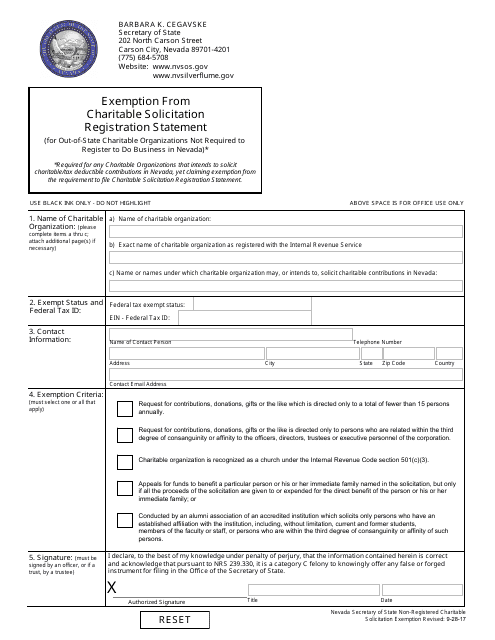

This type of document is used by out-of-state charitable organizations that are not required to register to do business in Nevada to claim exemption from the charitable solicitation registration statement.

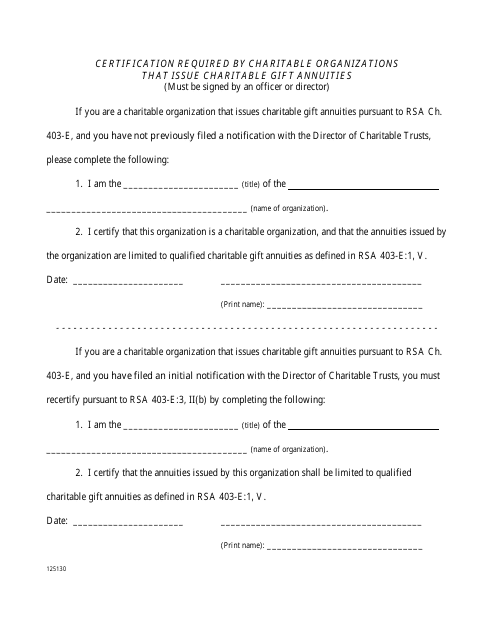

This document is required by charitable organizations in New Hampshire that issue charitable gift annuities. It outlines the certification process for these organizations.

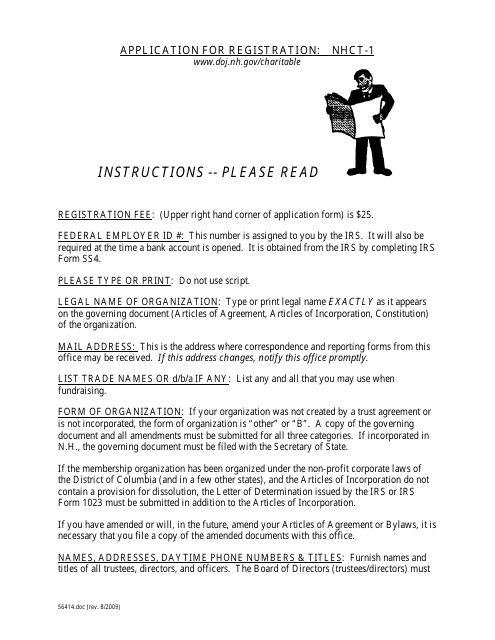

This form is used to apply for registration of a charitable trust in the state of New Hampshire.

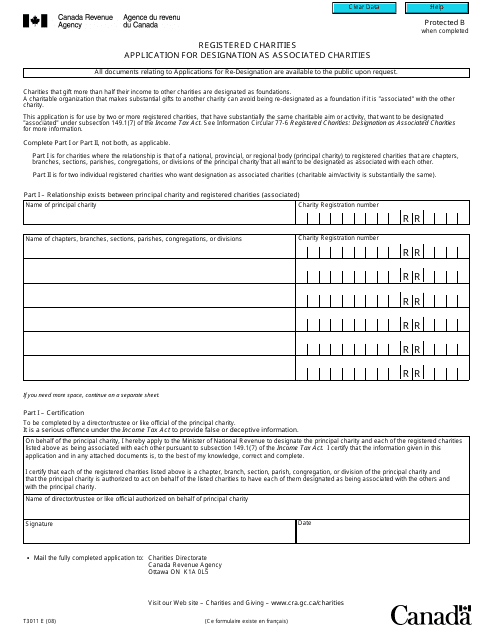

This form is used for applying for designation as associated charities in Canada.

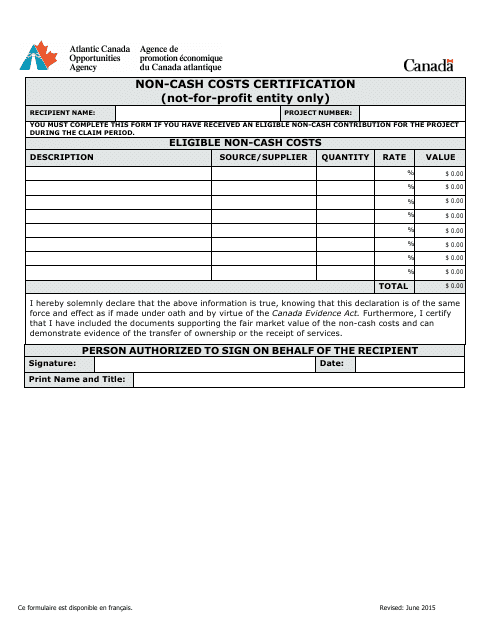

This document is used in Canada by not-for-profit entities to certify their non-cash costs.

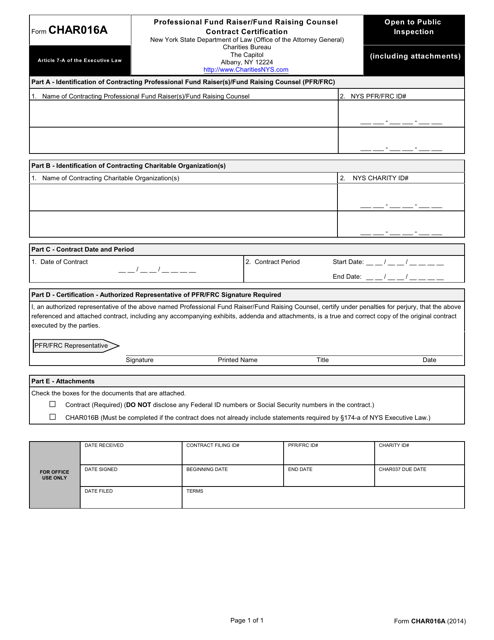

This form is used for certifying a professional fund raiser or fund raising counsel contract in New York.

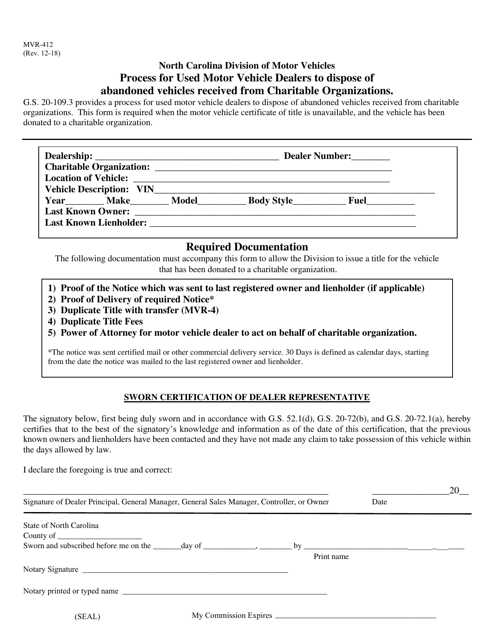

This form is used by used motor vehicle dealers in North Carolina to process the disposal of abandoned vehicles that have been received from charitable organizations.

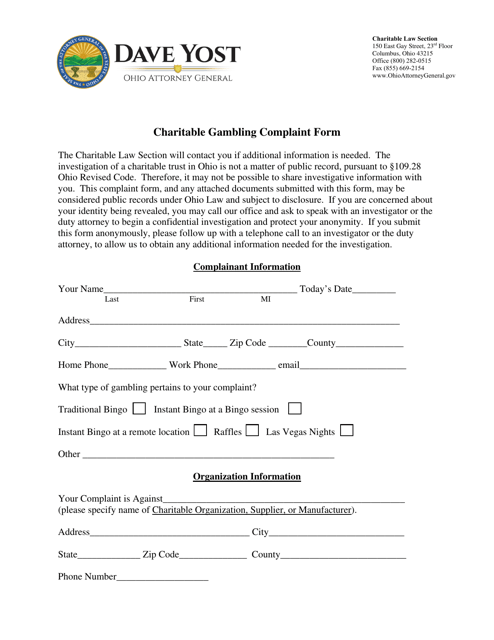

This form is used for filing complaints regarding charitable gambling activities in the state of Ohio.

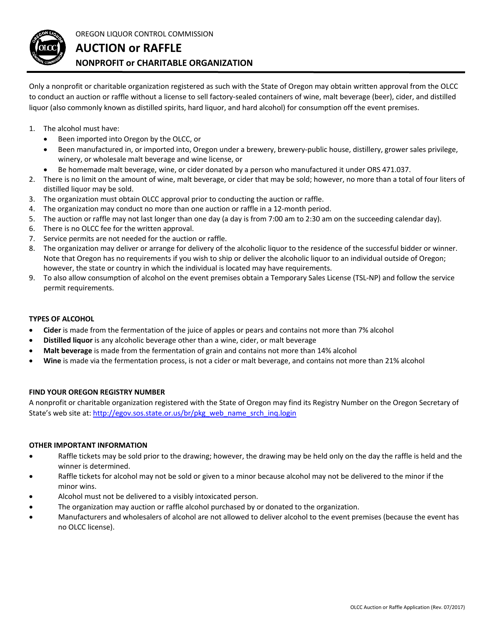

This document is for nonprofit or charitable organizations in Oregon that want to conduct an auction or raffle for fundraising purposes.

This guide provides information on financial assistance options available for individuals in the United States seeking to cover the costs of hearing aids. It includes resources and programs that can help make hearing aids more affordable and accessible.

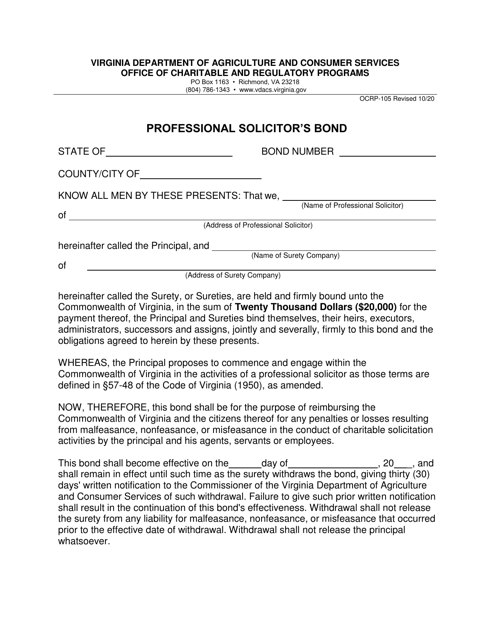

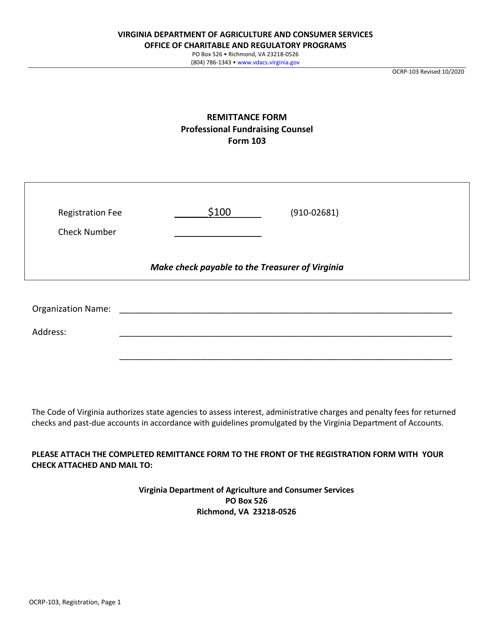

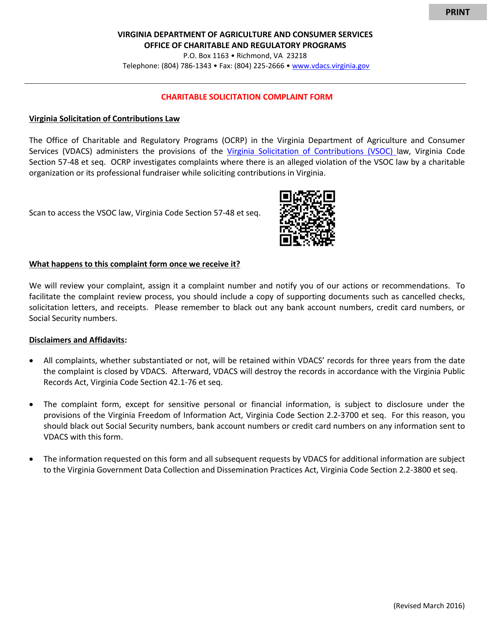

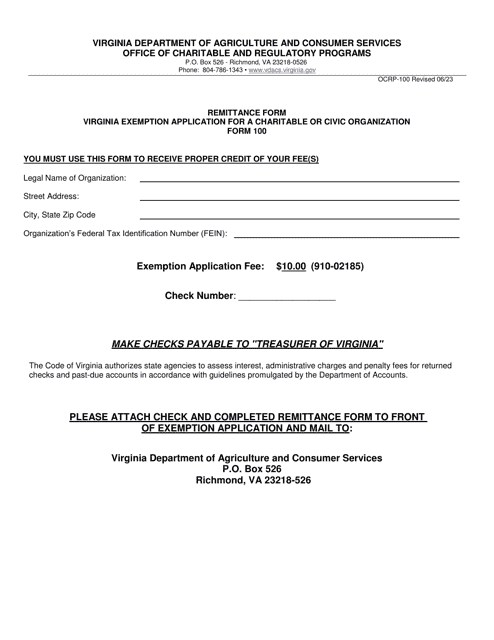

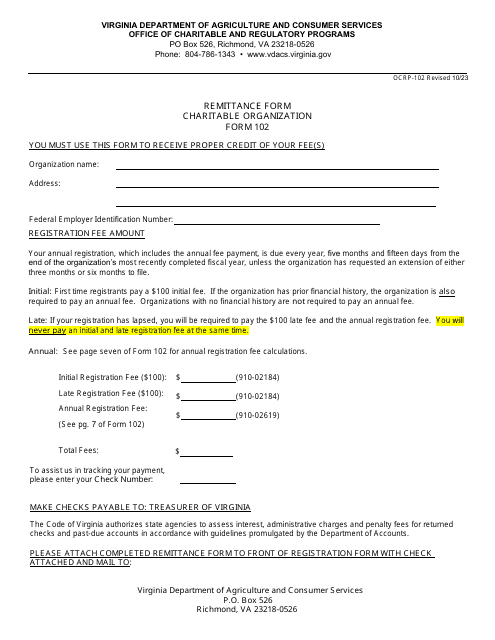

This Form is used for reporting charitable solicitation compliance in the state of Virginia. It ensures that organizations are following the necessary rules and regulations for soliciting donations.

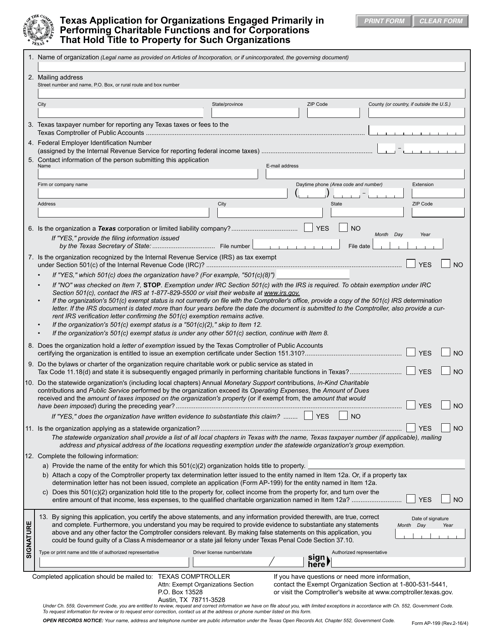

This form is used for organizations primarily engaged in performing charitable functions and for corporations that hold title to property for such organizations in Texas. It is an application form for these types of organizations to apply for certain exemptions and benefits.

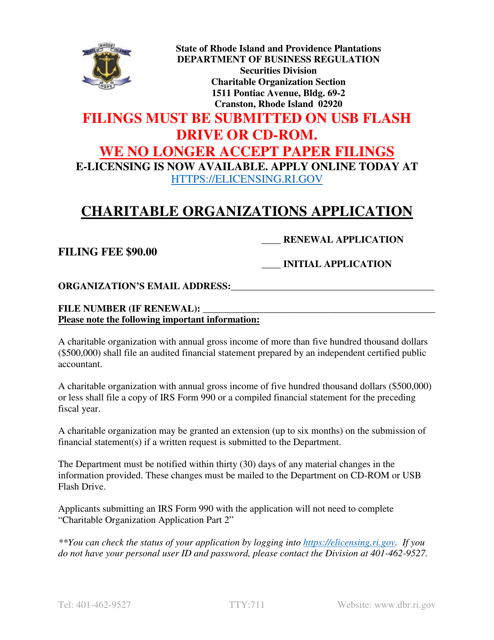

This document is used for applying to charitable organizations in Rhode Island.

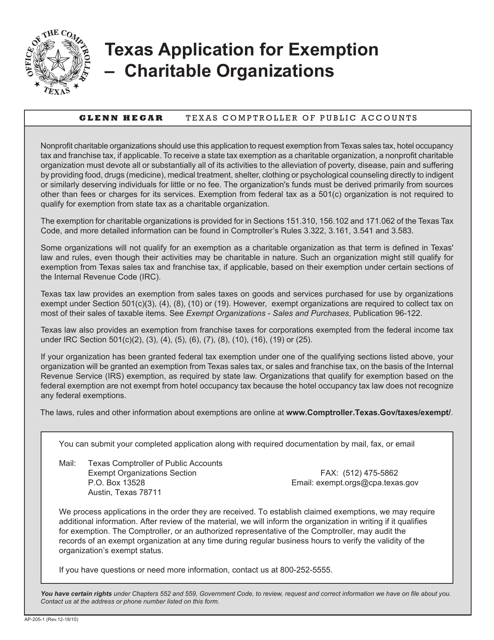

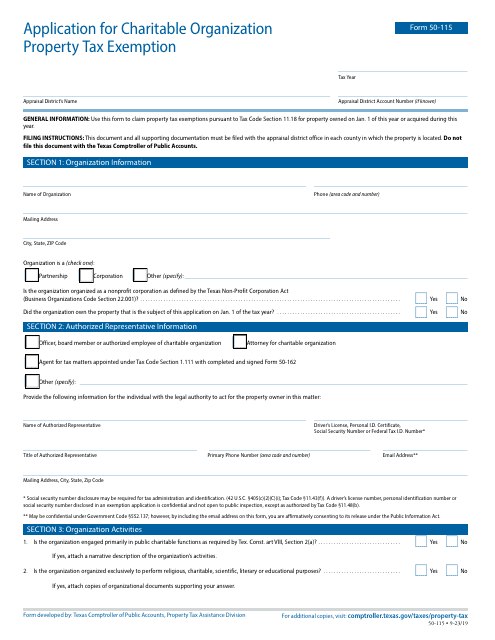

This form is used for applying for exemption for charitable organizations in Texas.

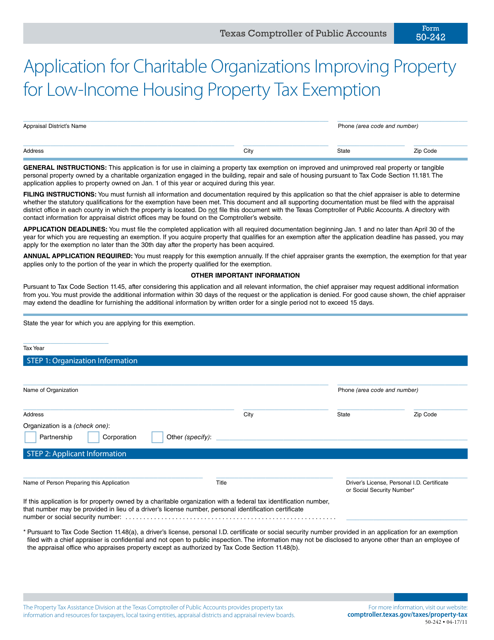

This Form is used for applying for a property tax exemption in Texas for charitable organizations that improve property for low-income housing.

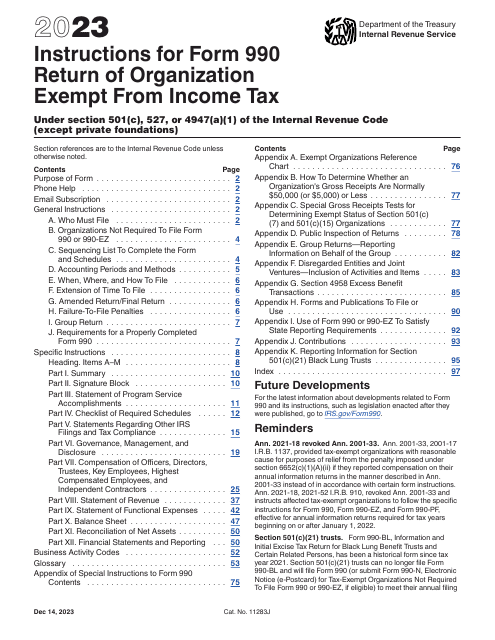

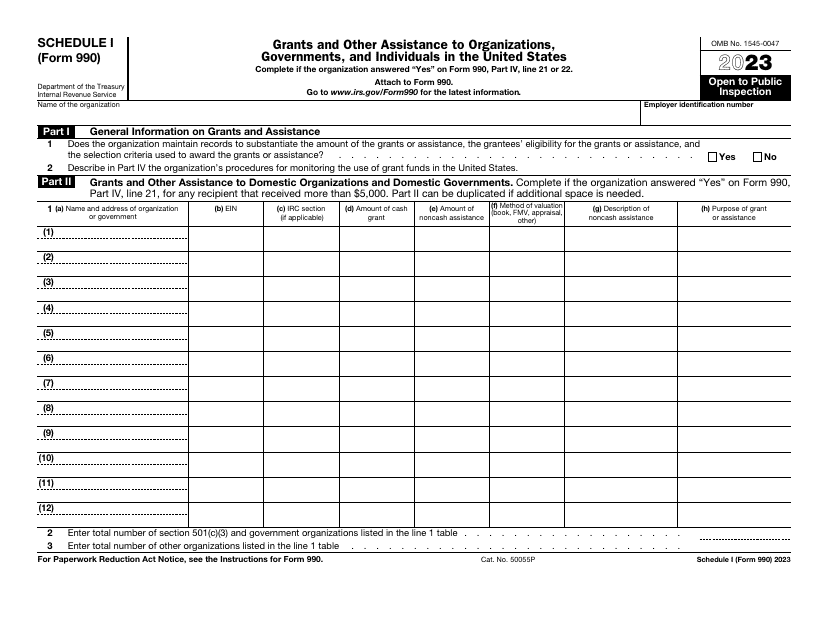

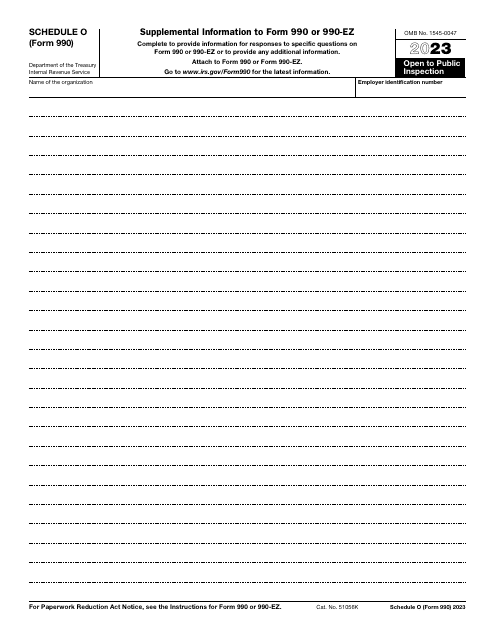

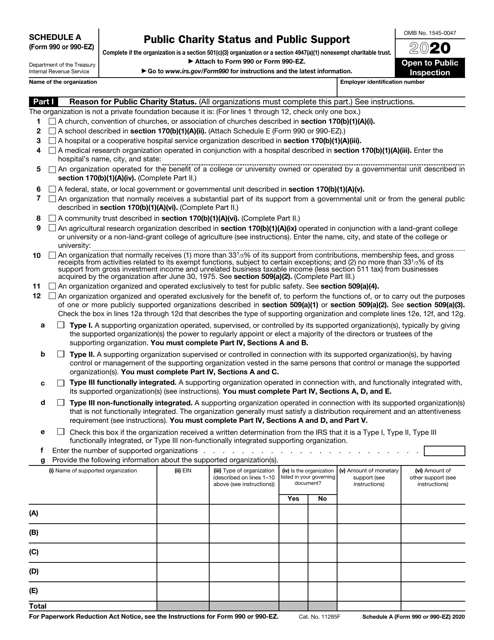

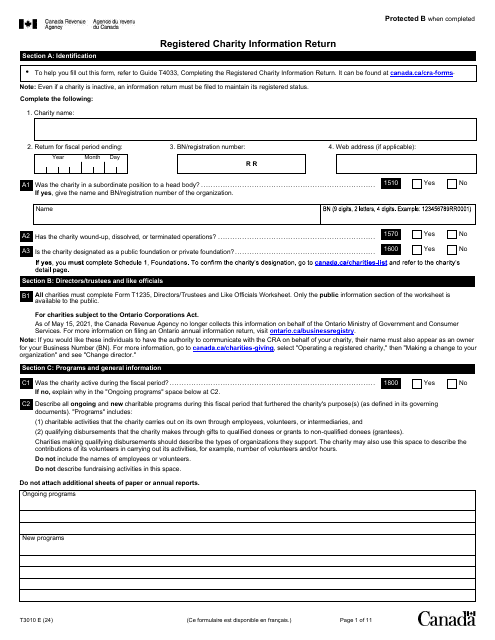

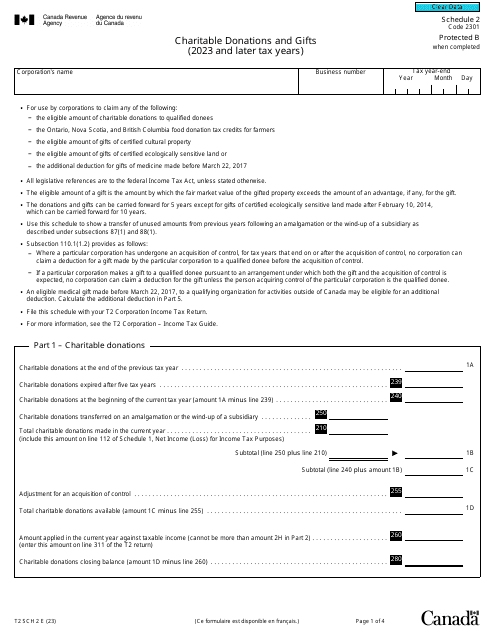

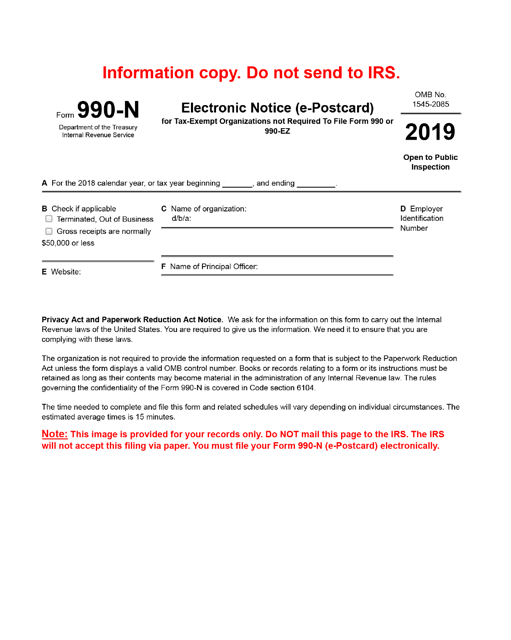

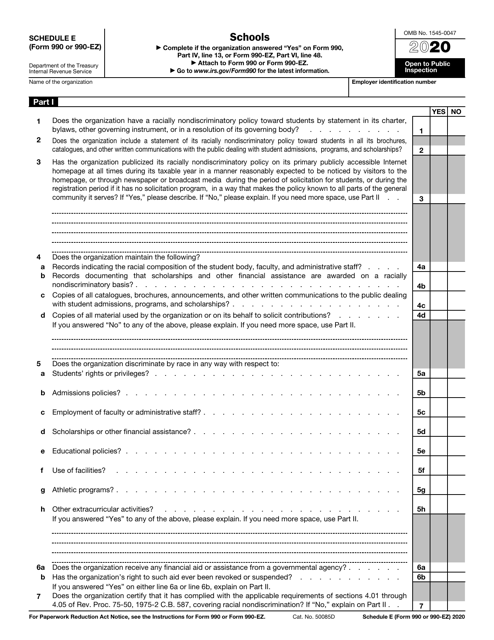

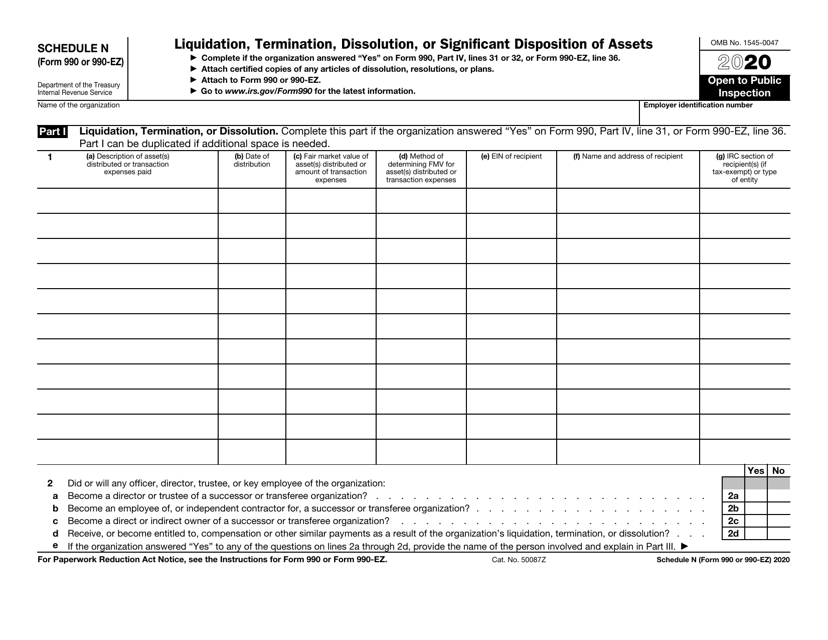

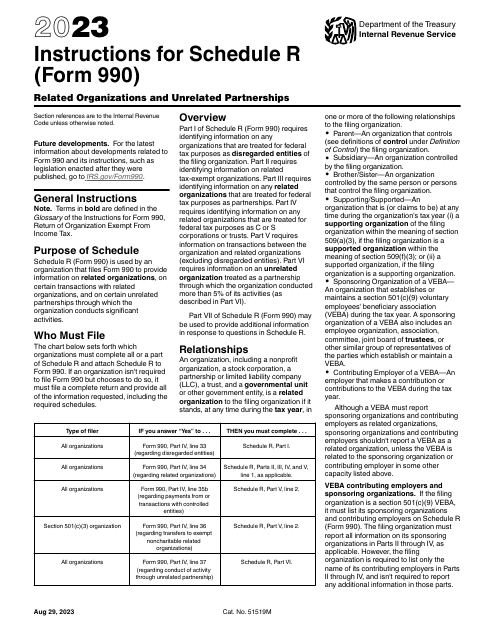

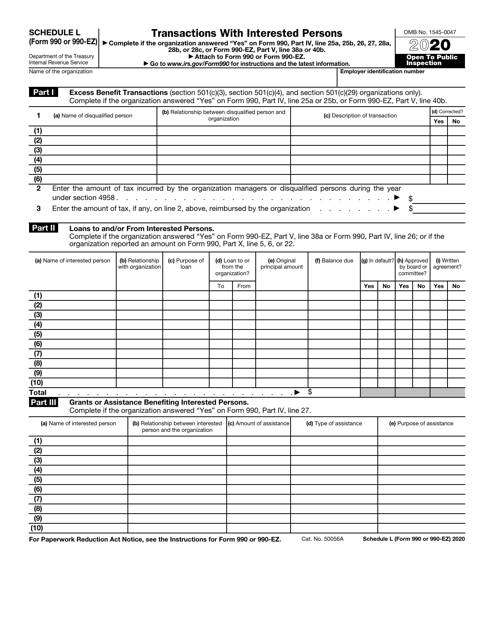

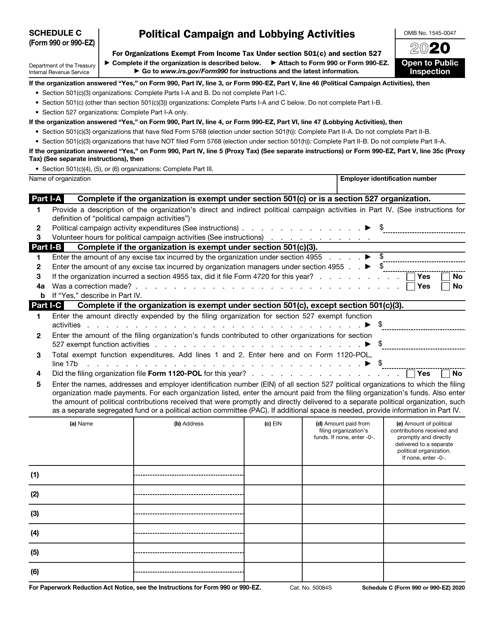

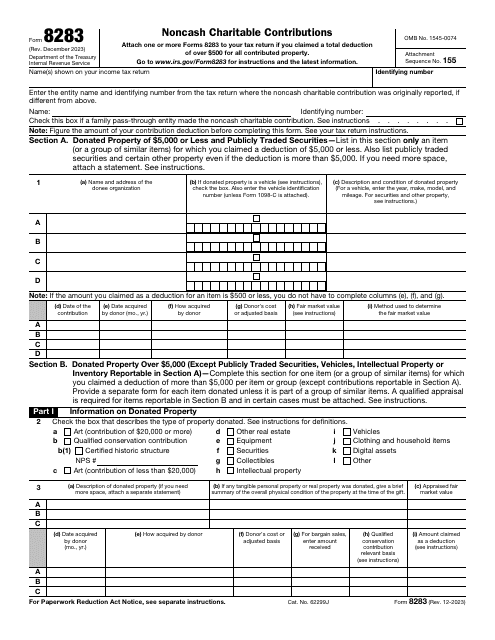

This is a fiscal document used by nonprofit organizations to report the main specifics of their operations to tax authorities.

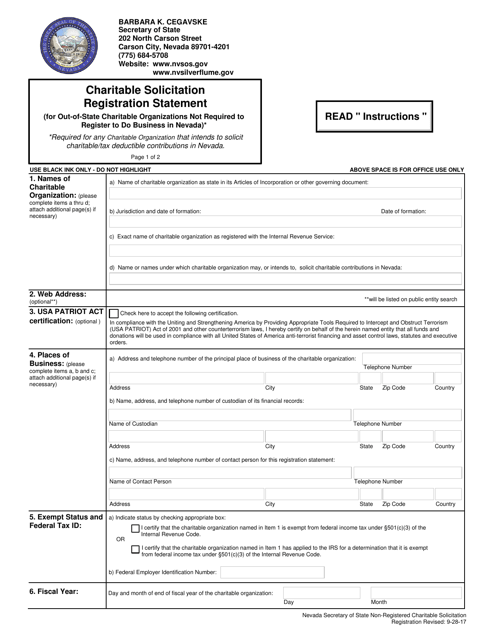

This document is for out-of-state charitable organizations that are not required to register to do business in Nevada. It is used to submit a registration statement for charitable solicitation in the state of Nevada.

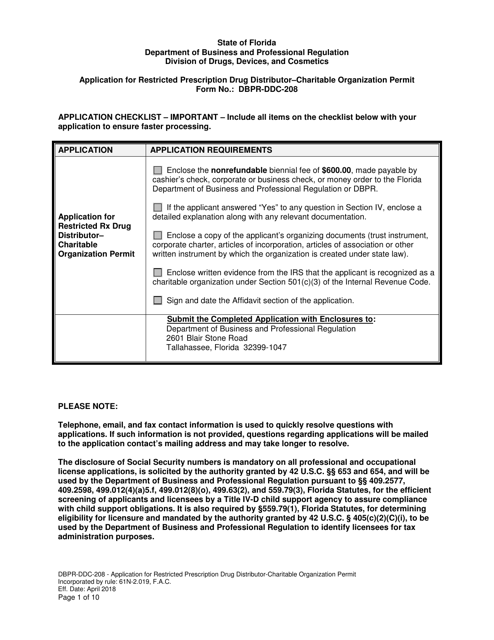

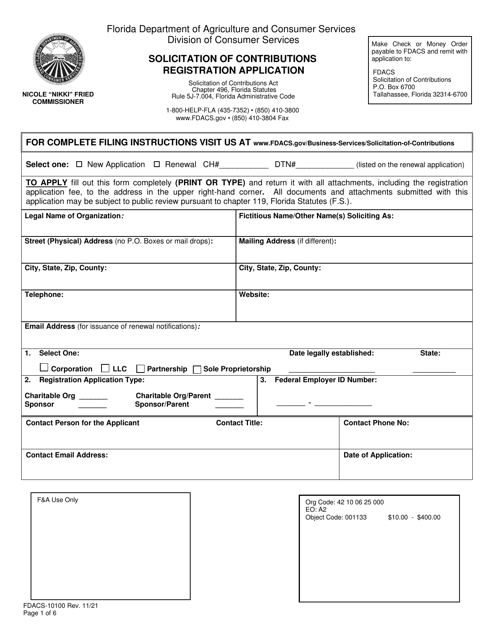

This form is used for applying for a permit to be a restricted prescription drug distributor as a charitable organization in the state of Florida.

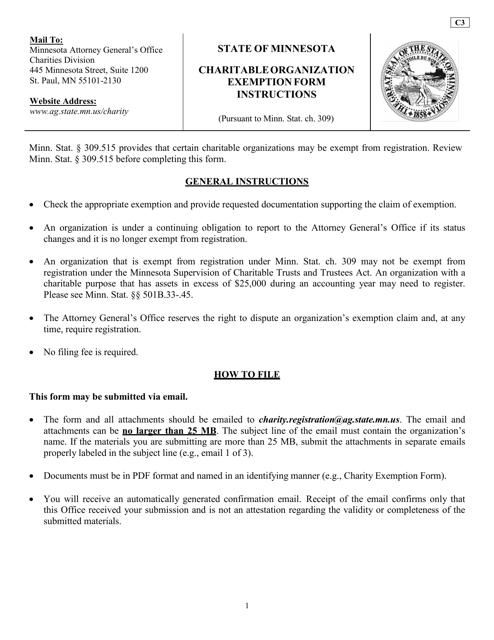

This form is used to apply for an exemption for a charitable organization in the state of Minnesota.