Sales and Use Tax Form Templates

Documents:

168

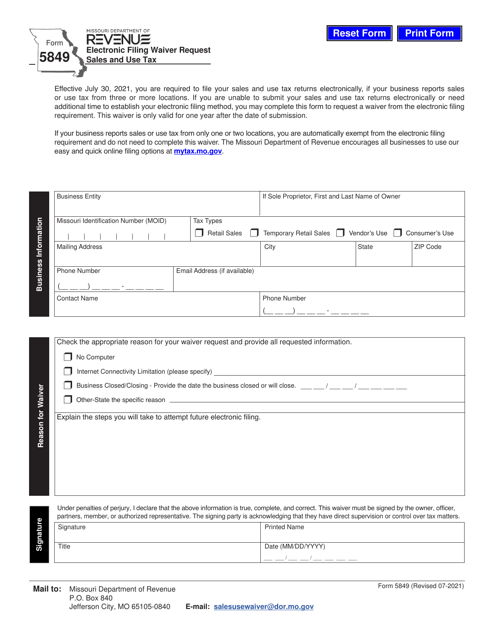

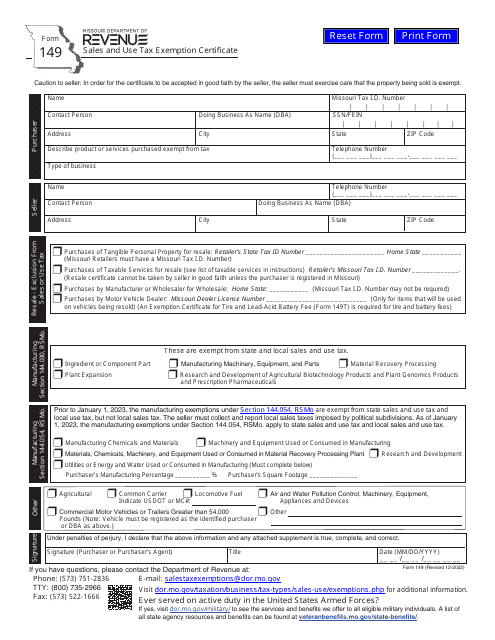

This form is used for requesting a waiver to electronically file sales and use tax returns in Missouri.

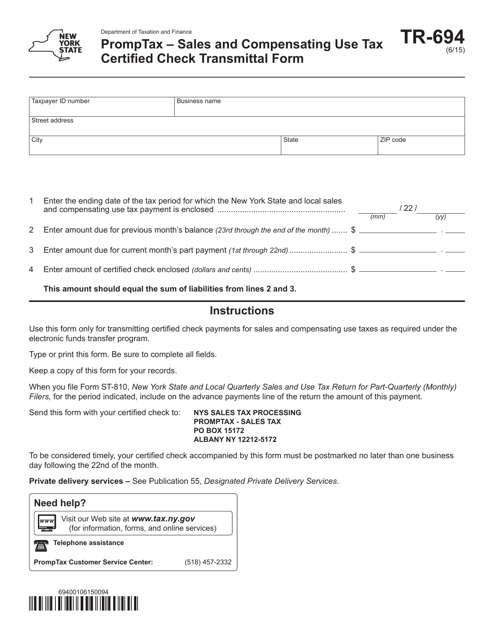

This form is used for transmitting certified checks for sales and compensating use tax in the state of New York.

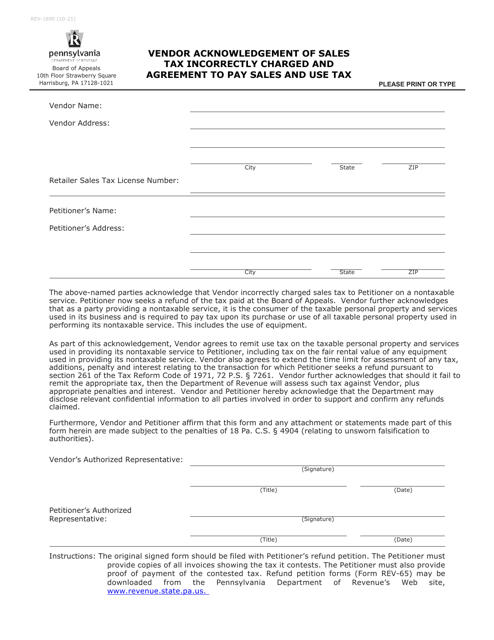

This form is used for vendors in Pennsylvania to acknowledge any incorrect sales tax charges that were made and agree to pay the correct sales and use tax.

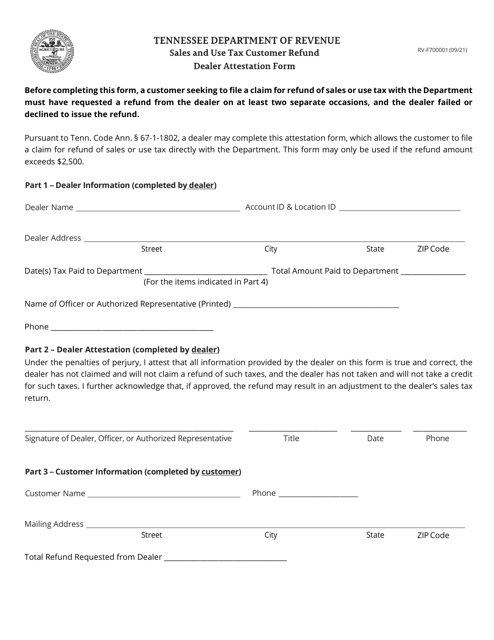

This form is used for dealers in Tennessee to attest to the accuracy of a sales and use tax customer refund.

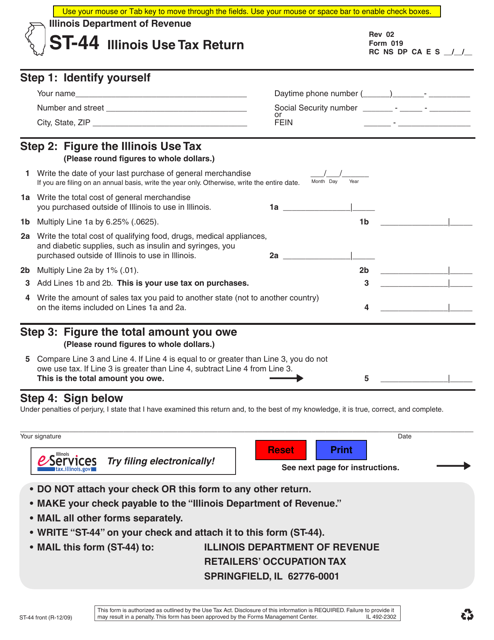

This document is the Use Tax Return Form (ST-44) for the state of Illinois. It is used to report and pay use tax on purchases made from out-of-state retailers when sales tax was not collected.

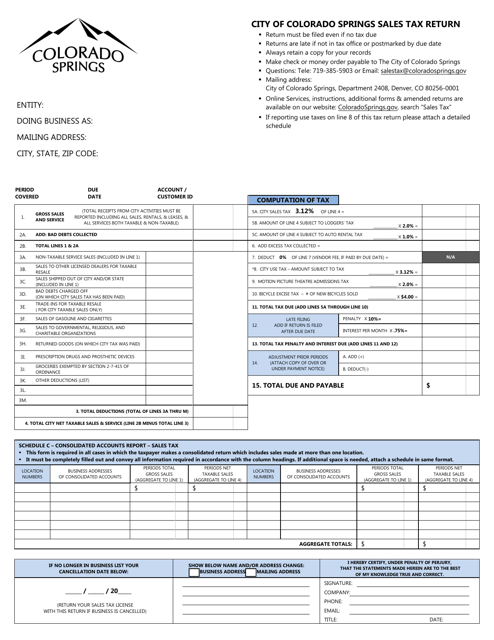

This sales and use tax return form is used by businesses in the City of Colorado Springs, Colorado to report and pay their sales and use tax at a rate of 3.12%.

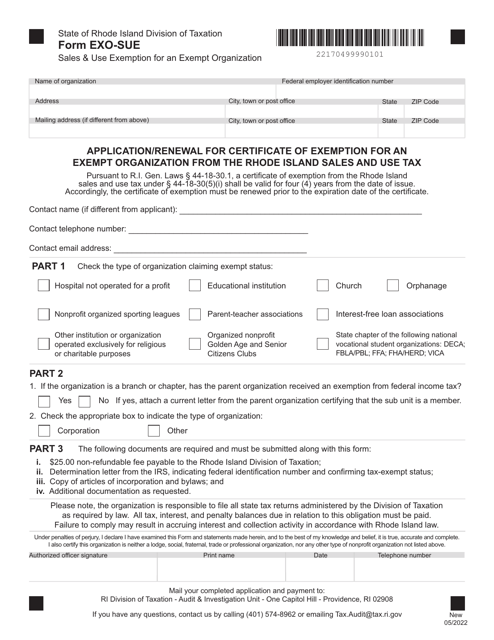

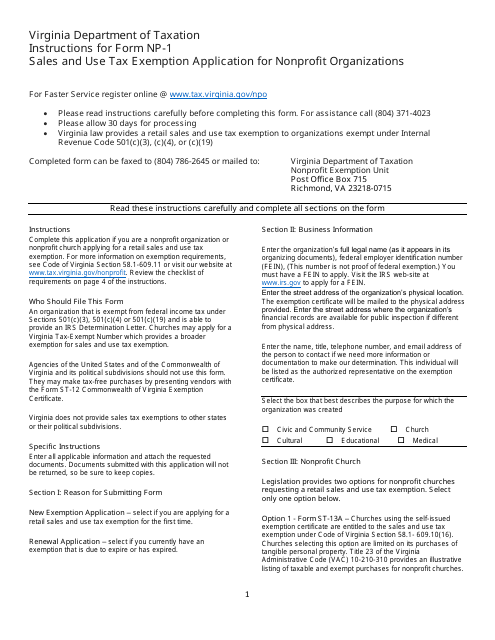

This form is used for applying or renewing a certificate of exemption for an exempt organization from the Rhode Island sales and use tax.

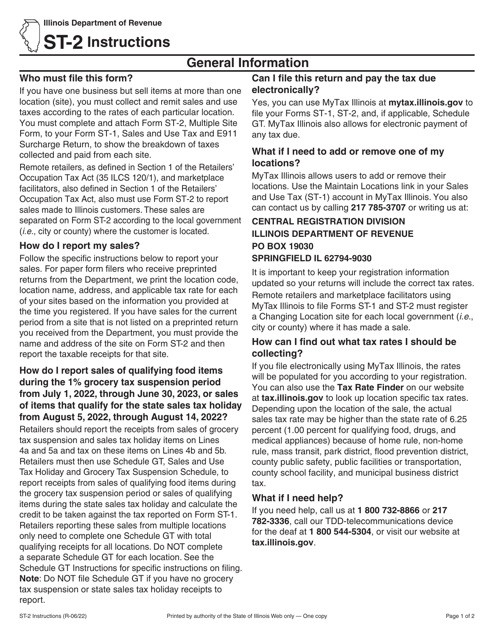

This Form is used for reporting multiple sites for sales and use tax purposes in the state of Illinois.

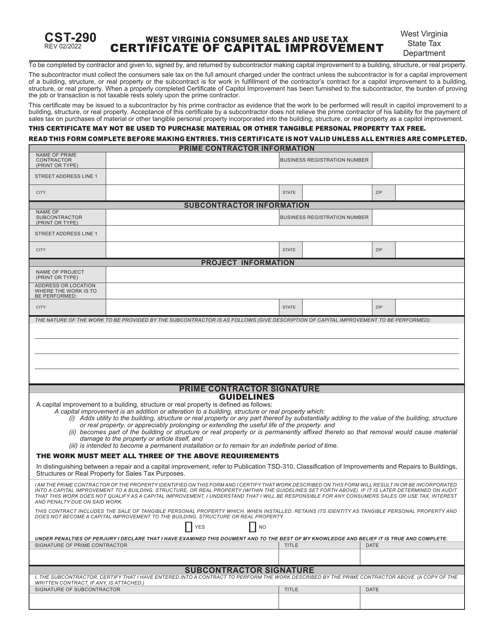

This form is used for obtaining a Consumer Sales and Use Tax Certificate of Capital Improvement in West Virginia. The certificate is required for businesses engaged in capital improvement projects to exempt certain purchases from sales and use tax.

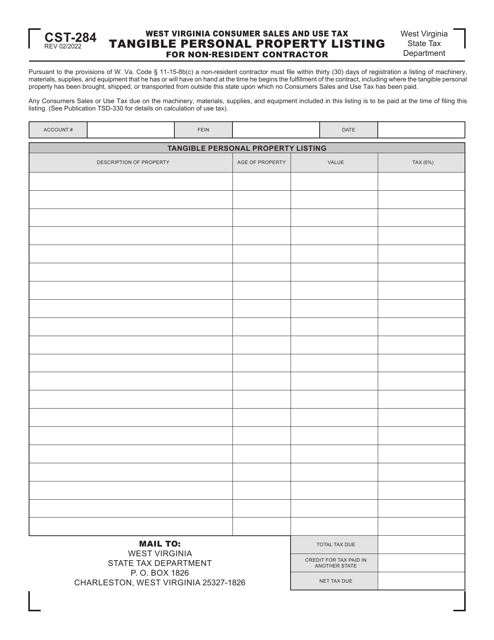

This form is used for Non-resident Contractors to list tangible personal property for sales and use tax purposes in West Virginia.

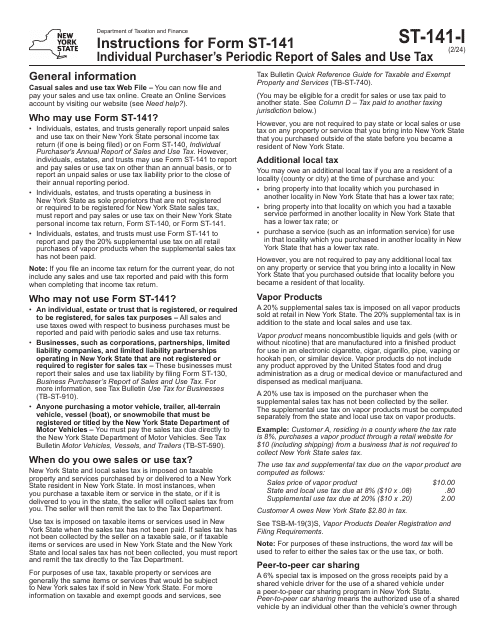

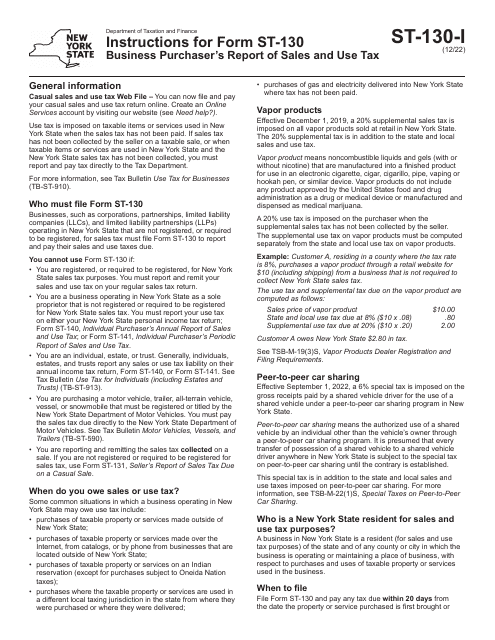

This Form is used for reporting annual sales and use tax by individuals in New York. It provides instructions on how to fill out and submit the Form ST-140.

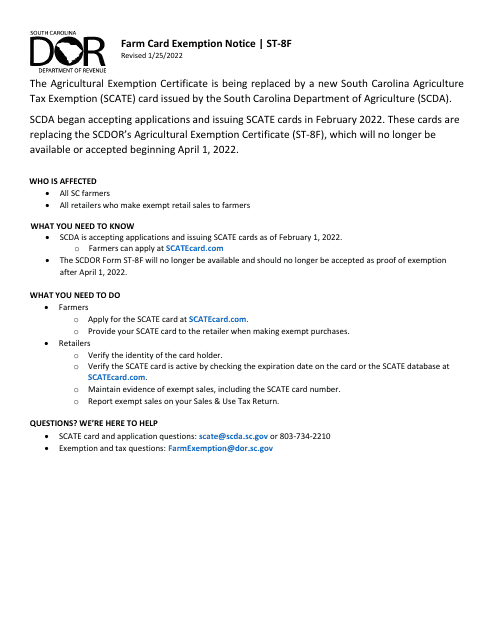

This form is used for claiming an exemption from sales and use tax on agricultural products in South Carolina. It is specifically for farmers and agricultural businesses.

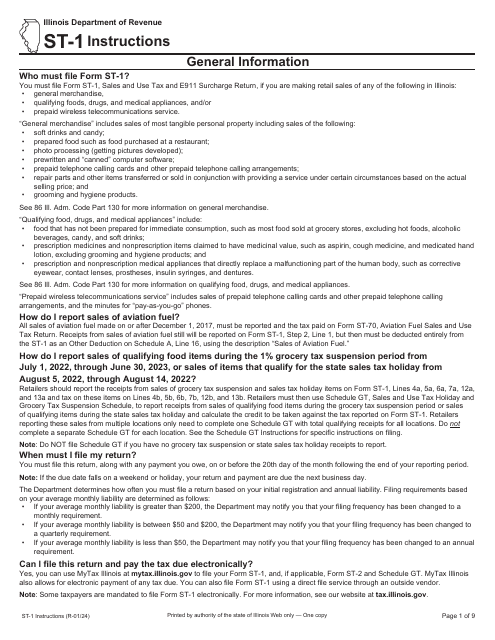

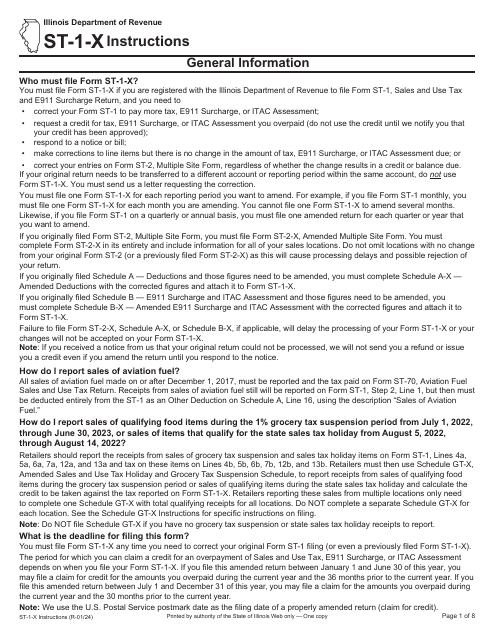

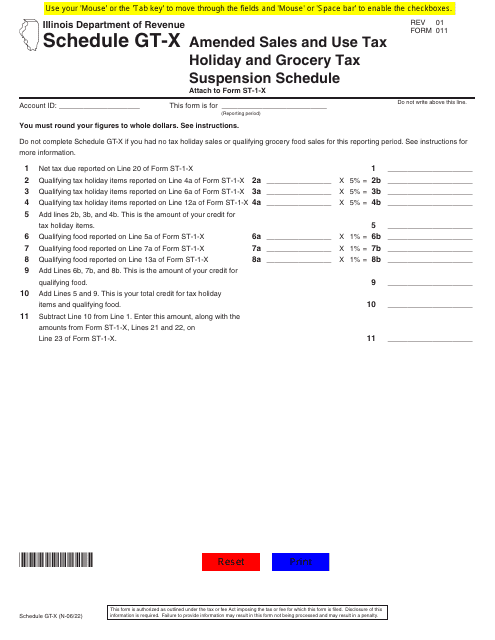

This form is used for reporting amendments to the Sales and Use Tax Holiday and Grocery Tax Suspension Schedule in the state of Illinois.

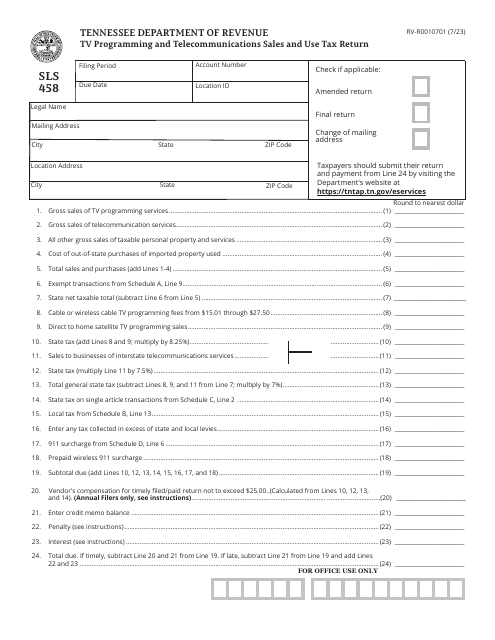

Form SLS458 (RV-R0010701) Tv Programming and Telecommunications Sales and Use Tax Return - Tennessee

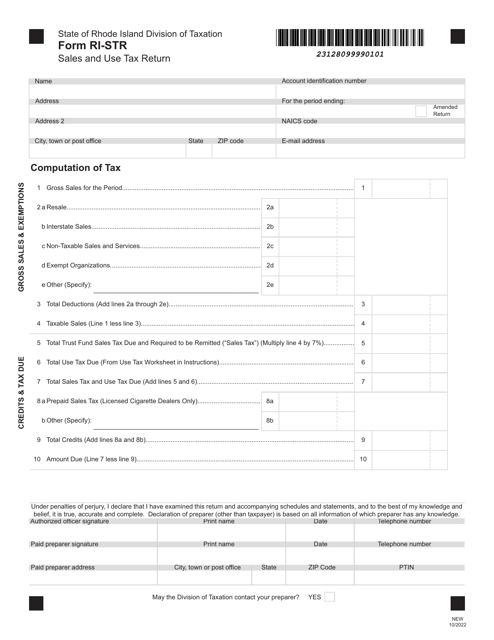

This form is used for filing sales and use tax returns in Rhode Island.

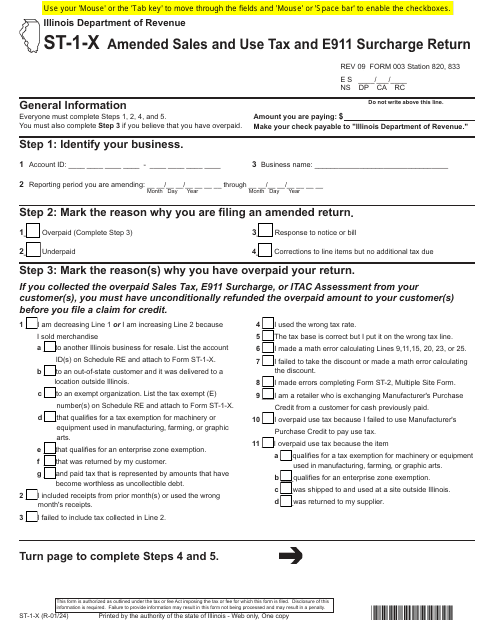

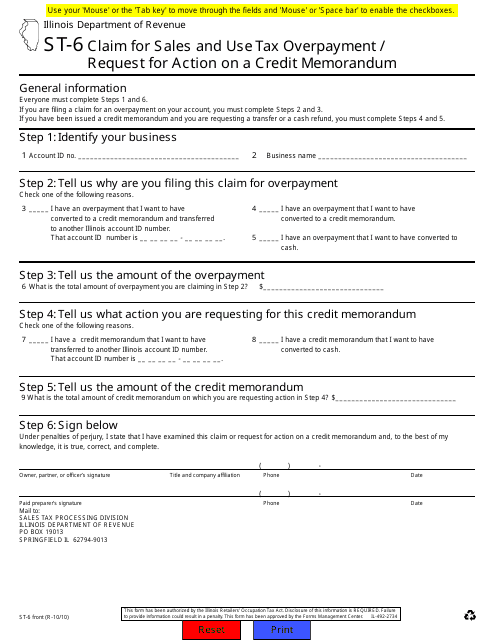

This form is used for claiming a sales and use tax overpayment and requesting action on a credit memorandum in the state of Illinois.

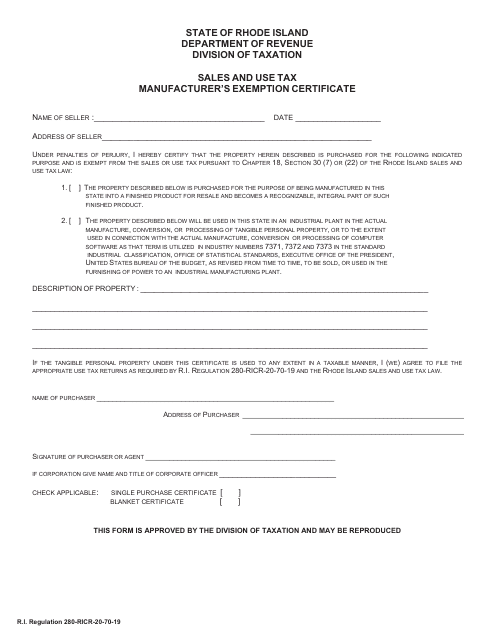

This document is used for claiming exemption from sales and use tax for manufacturers in Rhode Island.

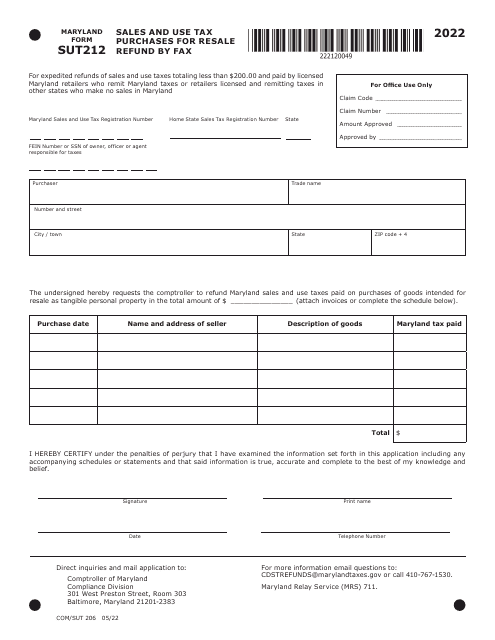

This Form is used for requesting a refund of sales and use tax for purchases made for resale in Maryland. The form can be submitted by fax.

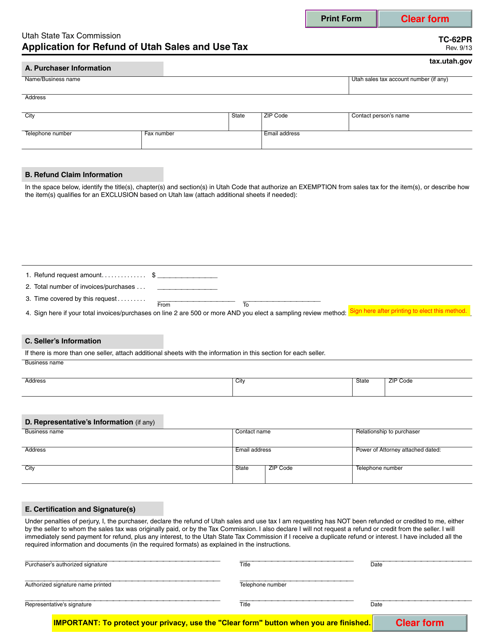

This form is used for applying for a refund of sales and use tax in the state of Utah.

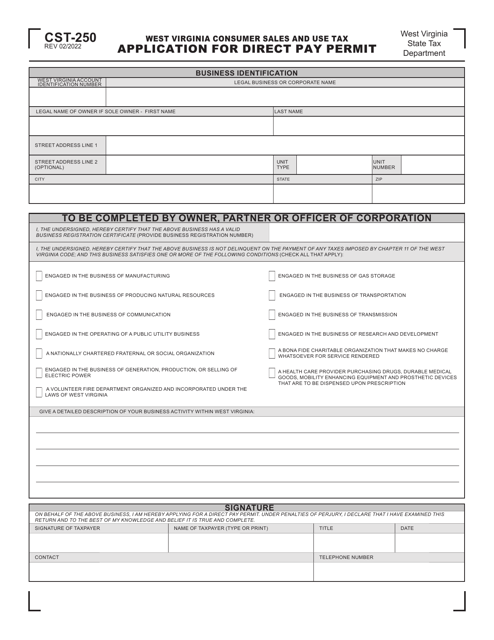

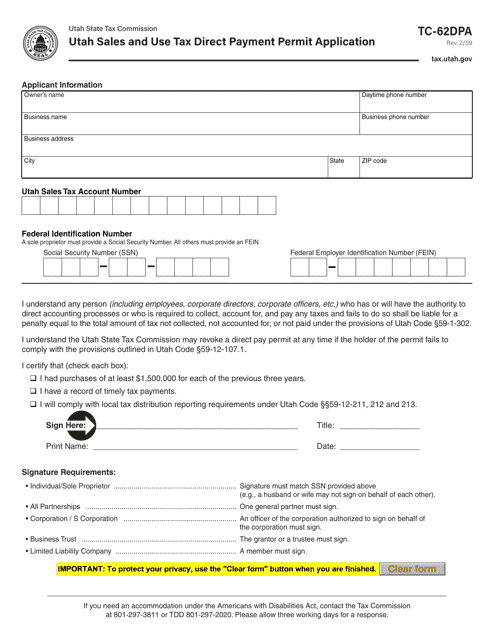

This form is used for applying for a Utah Sales and Use Tax Direct Payment Permit.