Sales and Use Tax Form Templates

Documents:

168

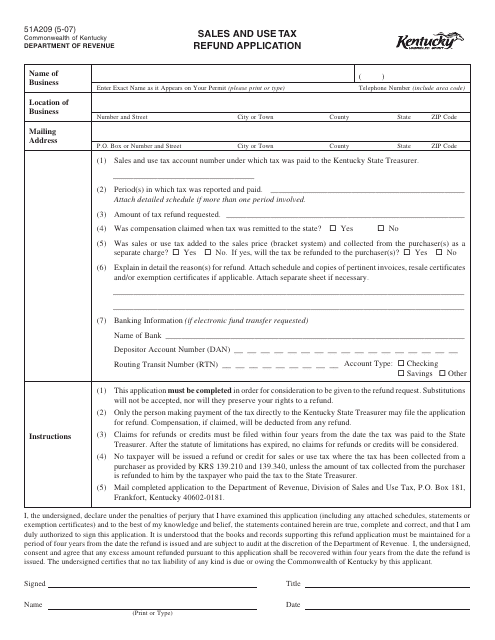

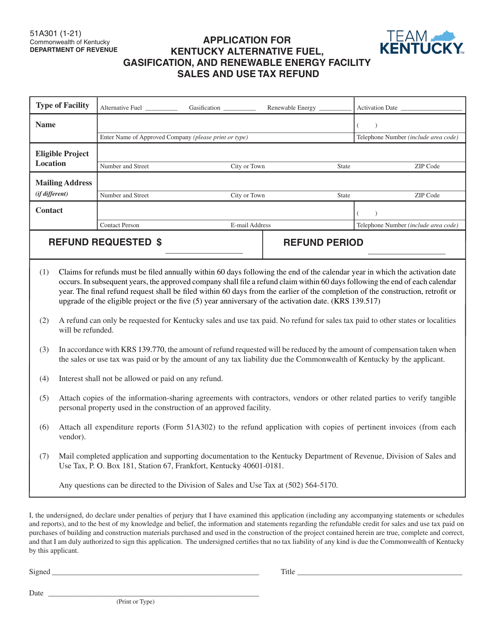

This document is used for applying for a sales and use tax refund in the state of Kentucky.

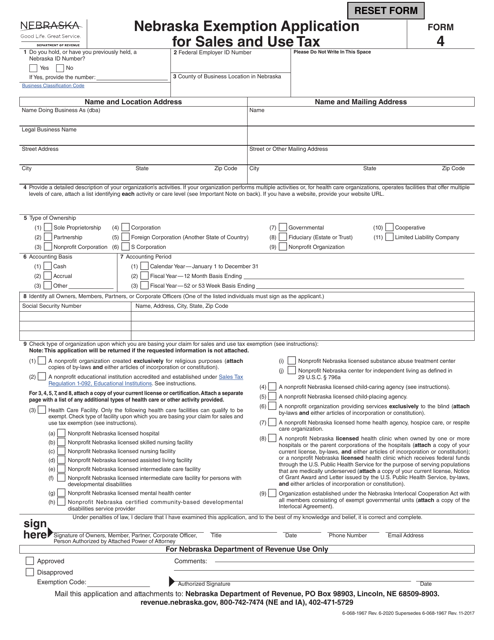

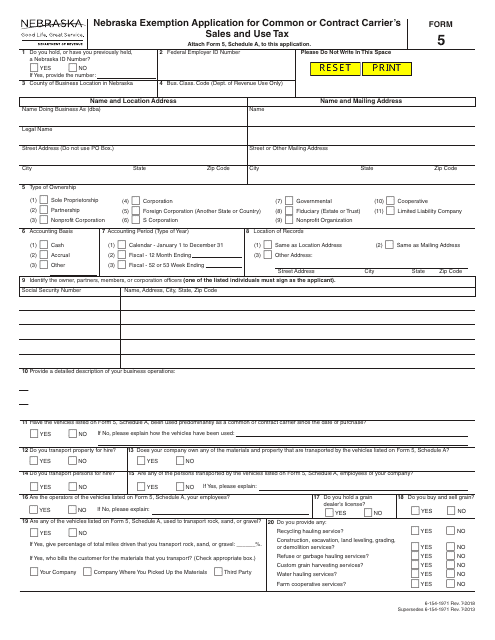

This form is used for exemption application for common or contract carrier's sales and use tax in Nebraska.

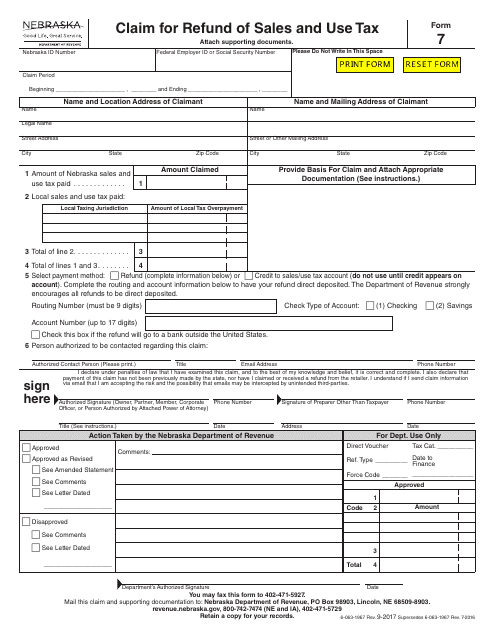

This Form is used for individuals and businesses in Nebraska to claim a refund of sales and use tax that was incorrectly paid or overpaid.

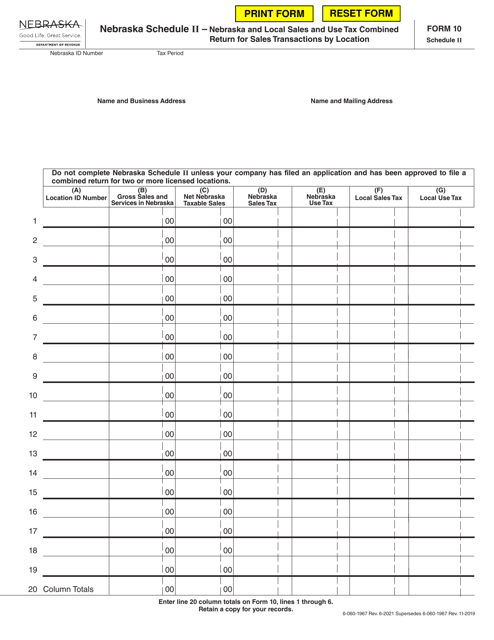

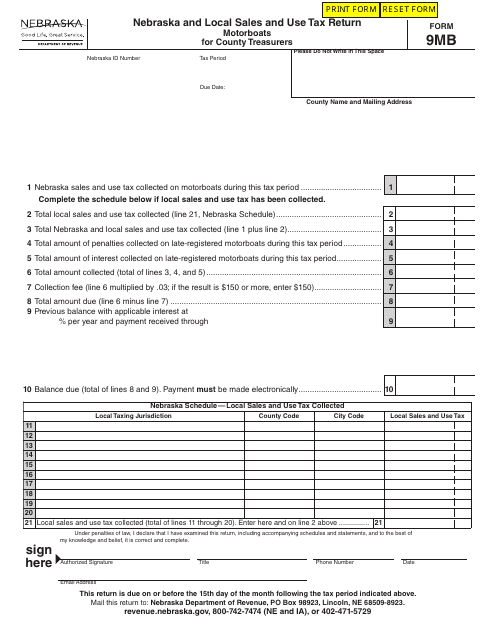

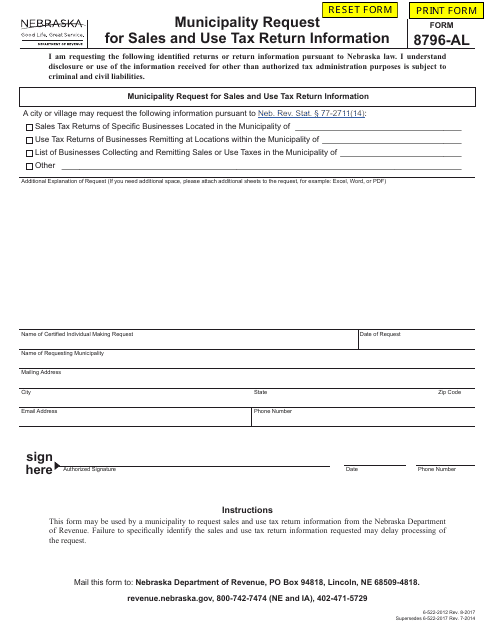

This type of document is used by municipalities in Nebraska to request sales and use tax return information.

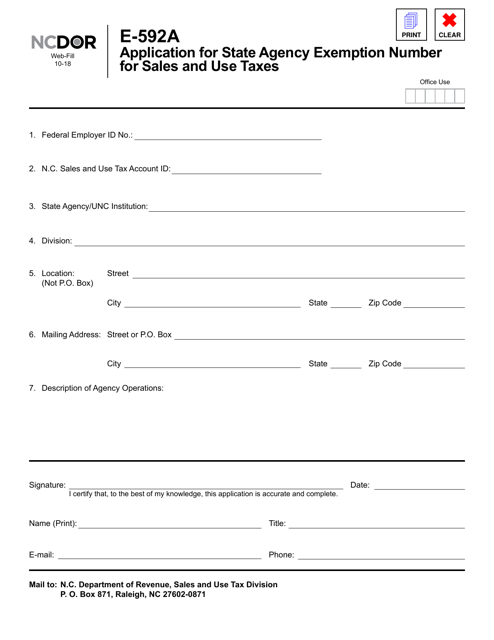

This form is used to apply for a State Agency Exemption Number for Sales and Use Taxes in North Carolina. It allows state agencies to be exempt from paying certain taxes when making purchases.

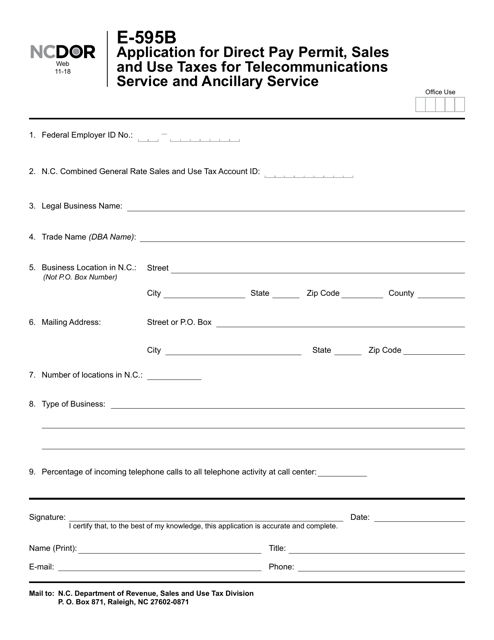

This Form is used for applying for a Direct Pay Permit for sales and use taxes related to telecommunications services and ancillary services in North Carolina.

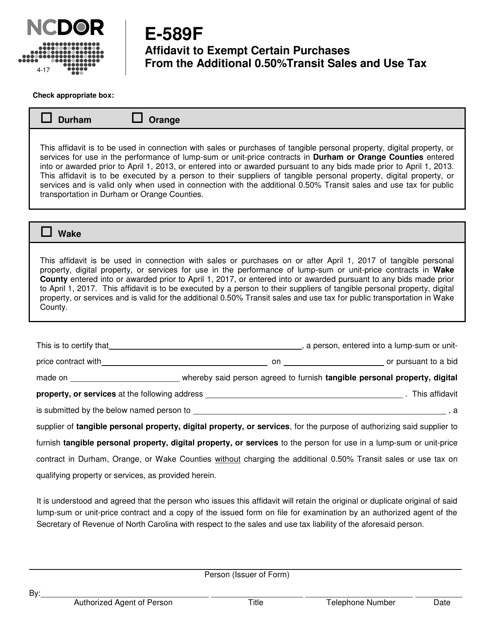

This form is used for requesting an exemption from the additional 0.50% transit sales and use tax on certain purchases in North Carolina.

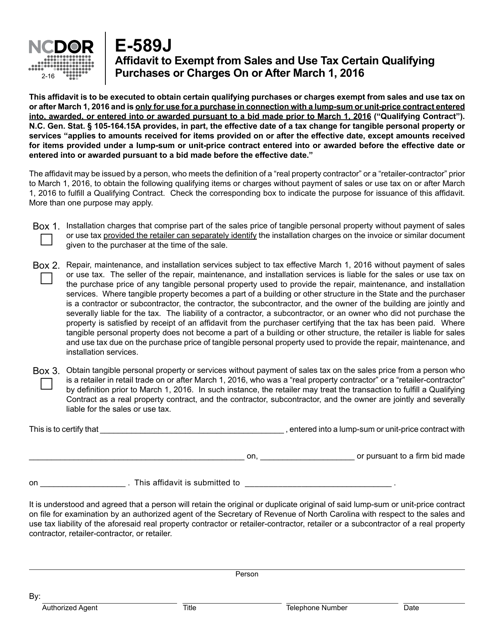

This form is used for individuals or businesses in North Carolina to claim an exemption from sales and use tax for certain qualifying purchases or charges made on or after March 1, 2016.

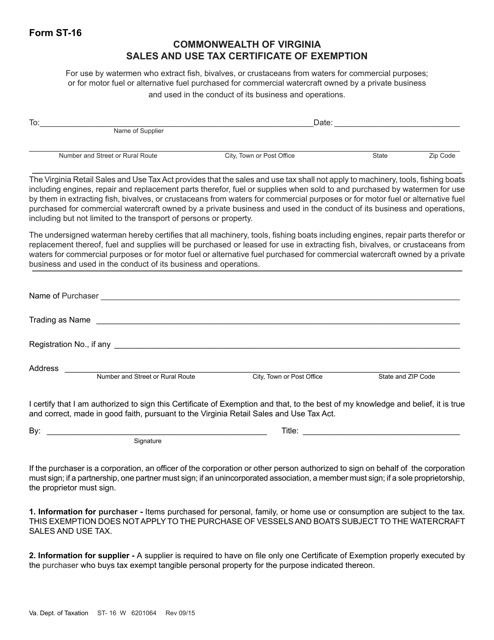

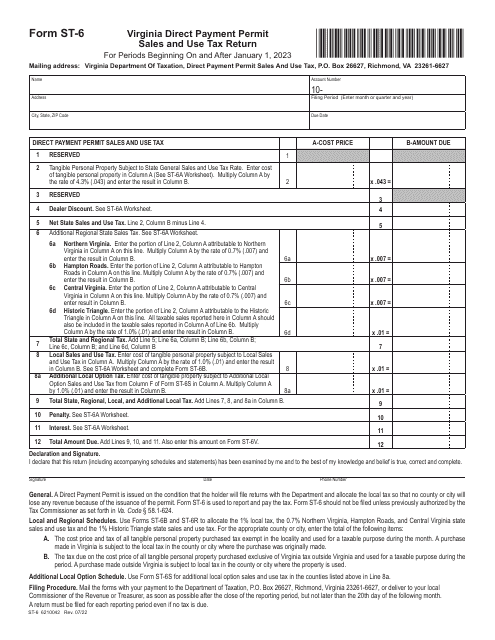

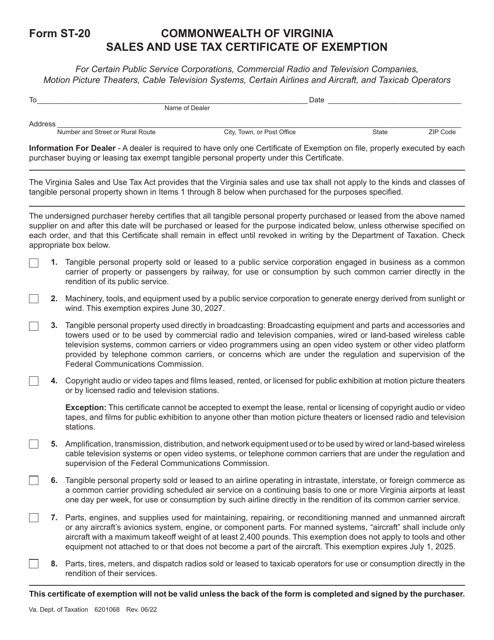

This form is used for the Sales and Use Tax Certificate of Exemption in Virginia.

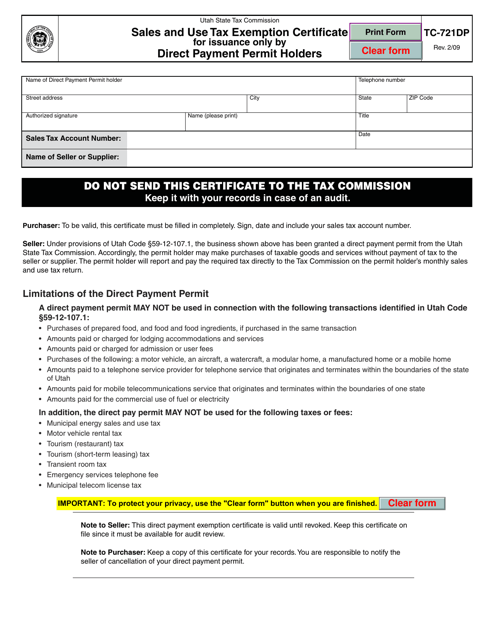

This document is a Sales and Use Tax Exemption Certificate specifically for Direct Payment Permit holders in the state of Utah. It allows these permit holders to claim exemption from paying sales and use taxes for certain transactions.

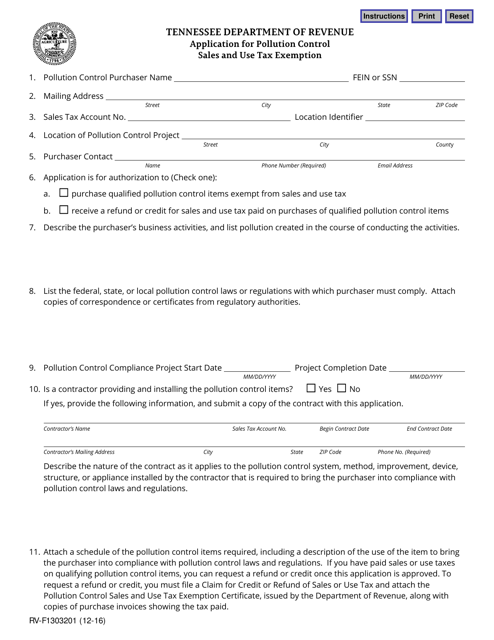

This form is used for applying for a sales and use tax exemption specifically for pollution control in the state of Tennessee.

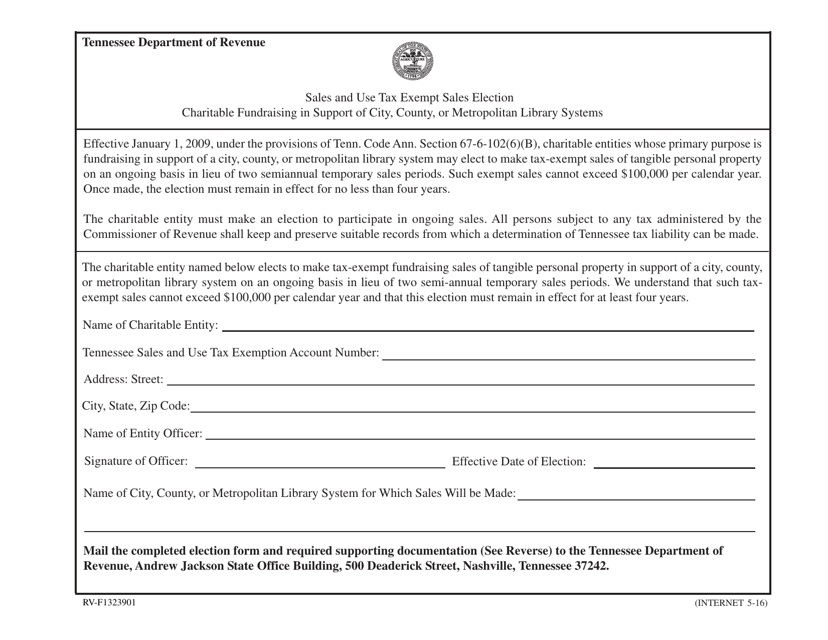

This form is used for making a sales tax exempt sales election for charitable fundraising to support library systems in Tennessee.

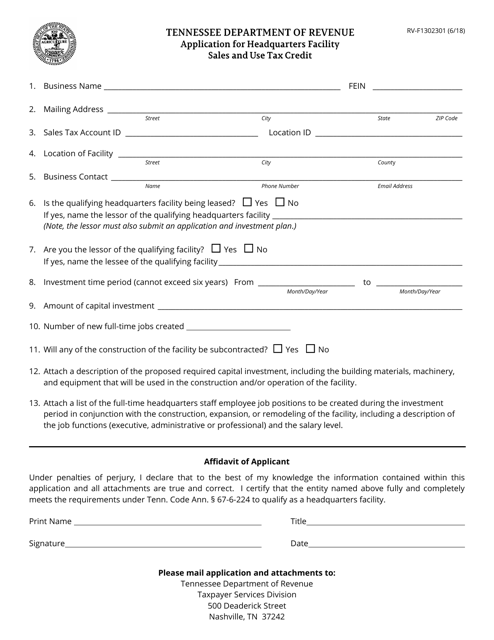

This Form is used for applying for the Headquarters Facility Sales and Use Tax Credit in Tennessee.

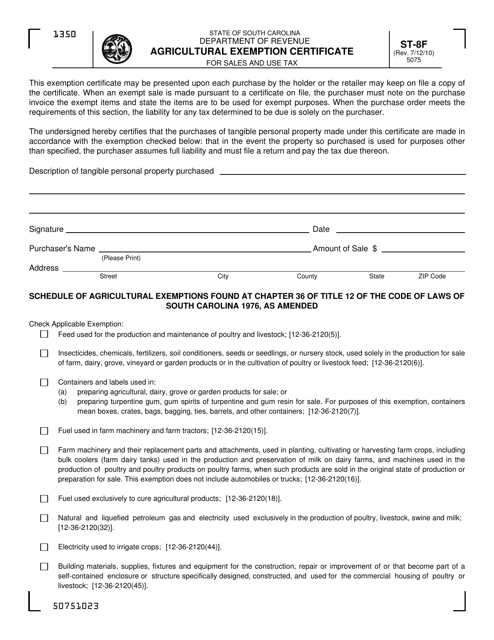

This form is used for claiming an exemption from sales and use tax on agricultural products in South Carolina. It provides instructions on how to properly fill out and submit the Form ST-8F Agricultural Exemption Certificate.

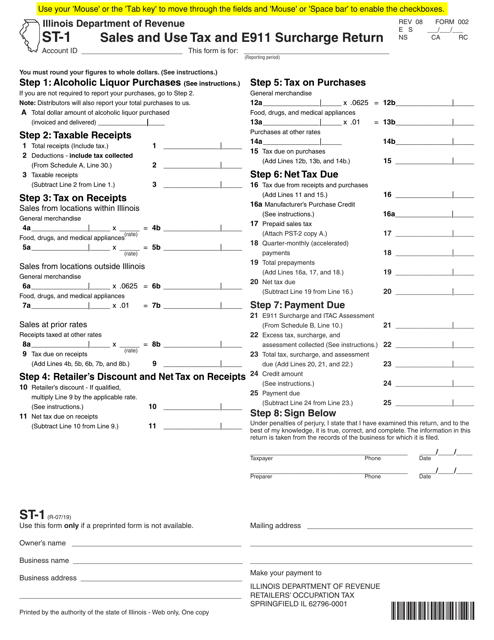

This form is used for filing sales and use tax, as well as E911 surcharge, in the state of Illinois.

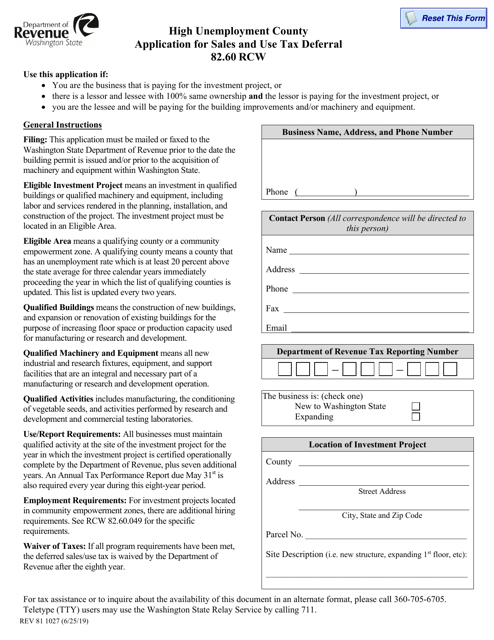

This Form is used for applying for a sales and use tax deferral in Washington for counties with high unemployment.

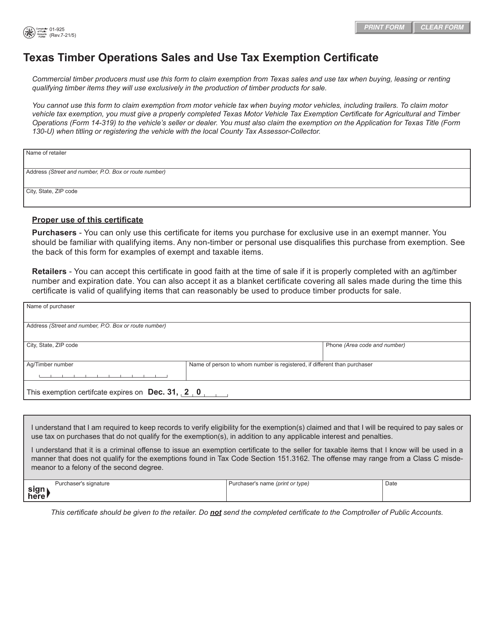

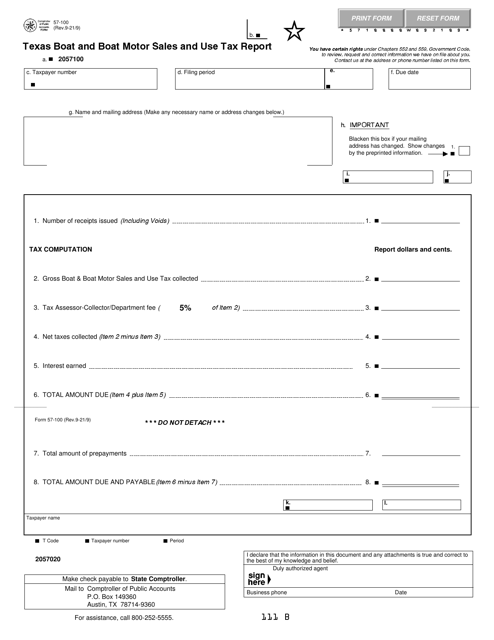

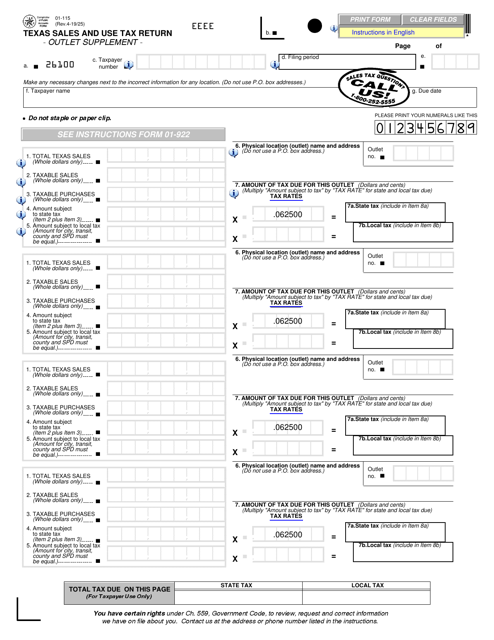

This form is used for reporting sales and use tax for outlets in the state of Texas.