Sales and Use Tax Form Templates

Are you looking for information on sales and use tax forms? Look no further! We have a comprehensive collection of documents and forms that are related to sales and use taxes. Our sales and use tax form collection includes a variety of forms that can help businesses and individuals fulfill their tax obligations.

Whether you are a business owner or an individual taxpayer, understanding the intricacies of sales and use taxes is crucial. Our sales and use tax form collection provides you with the necessary resources to navigate through the complexities of these taxes.

Our collection includes a wide range of forms such as the Form 10 Schedule II Nebraska and Local Sales and Use Tax Combined Return for Sales Transactions by Location in Nebraska. This form helps businesses report their taxable sales and calculate the appropriate tax amounts based on specific locations.

If you are in North Carolina, you may come across the Form E-589F Affidavit to Exempt Certain Purchases From the Additional 0.50%transit Sales and Use Tax. This form allows eligible individuals to claim exemptions for certain purchases from the transit sales and use tax.

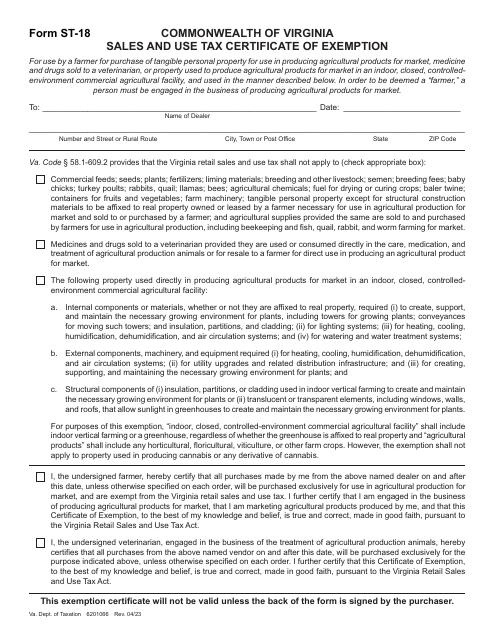

For those in the agricultural sector in South Carolina, the Instructions for Form ST-8F Agricultural Exemption Certificate for Sales and Use Tax will come in handy. This document provides guidance on how to apply for an exemption from sales and use tax for qualifying agricultural purchases.

Washington business owners can find Form REV81 1028 Manufacturer's Application for Sales and Use Tax Deferral for Lessor in our collection. This form enables manufacturers to request deferral of sales and use tax on tangible personal property that is leased.

Additionally, our collection includes the Instructions for Form ST-130 Business Purchaser's Report of Sales and Use Tax in New York. This document provides guidance on reporting and remitting sales and use taxes for businesses in the state.

These are just a few examples of the many resources available in our sales and use tax form collection. No matter where you are located or what your specific tax needs may be, our comprehensive collection is designed to help you meet your obligations. Explore our sales and use tax form collection today and ensure compliance with the tax laws in your area.

Documents:

168

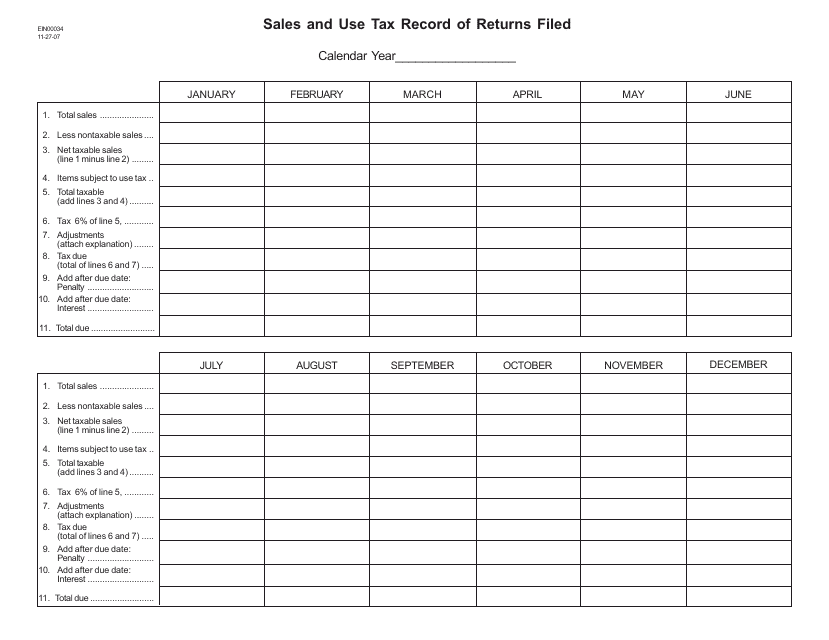

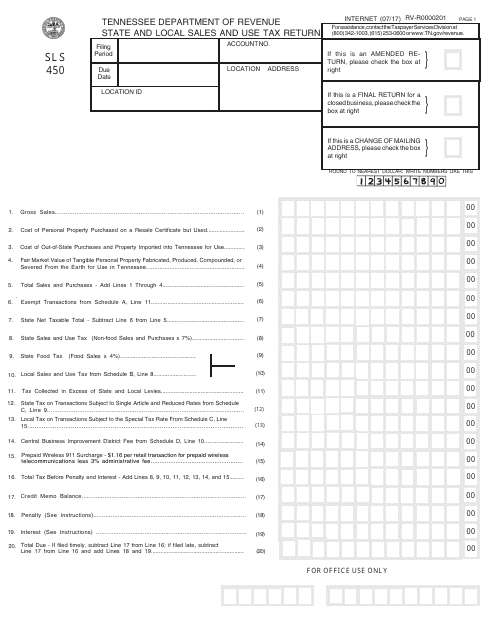

This form is used for recording sales and use tax returns filed in the state of Idaho.

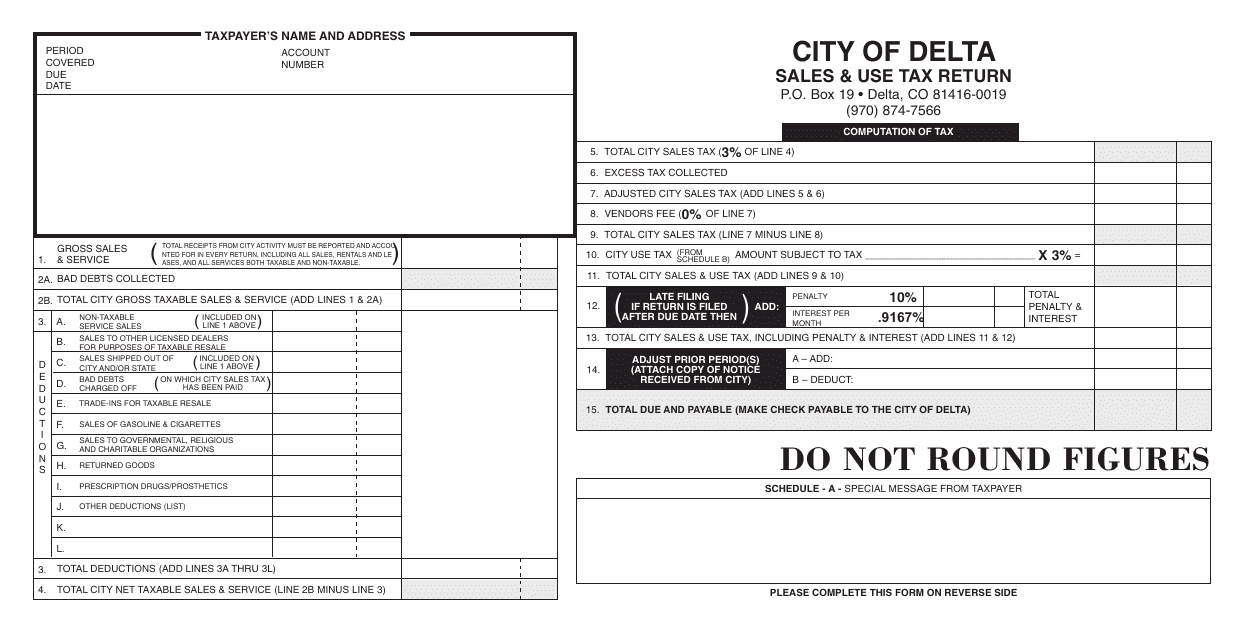

This form is used for reporting and submitting sales and use tax to the City of Delta, Colorado.

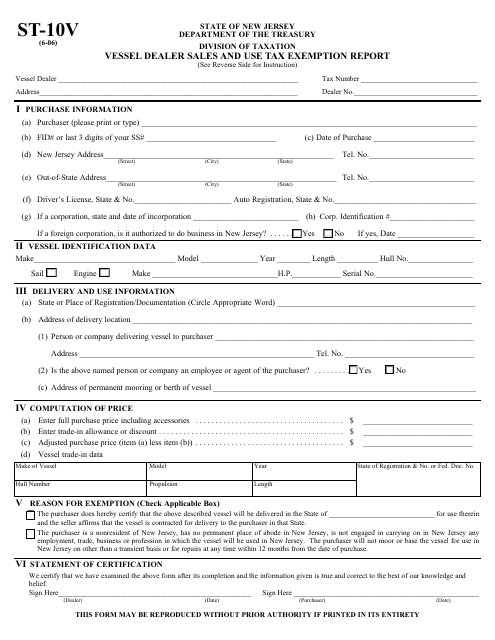

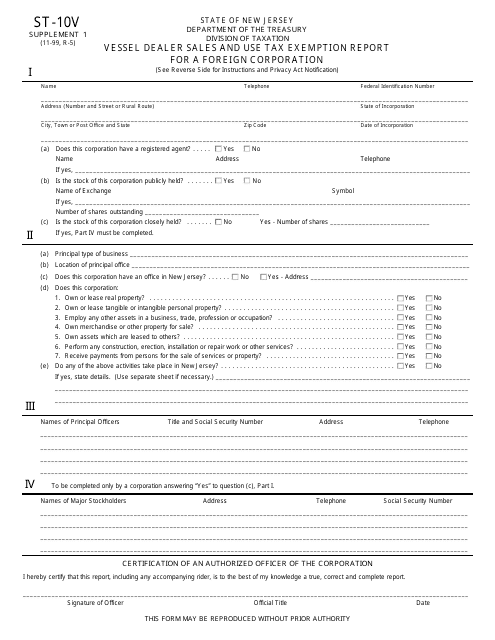

This Form is used for reporting sales and use tax exemptions for vessel dealers in New Jersey.

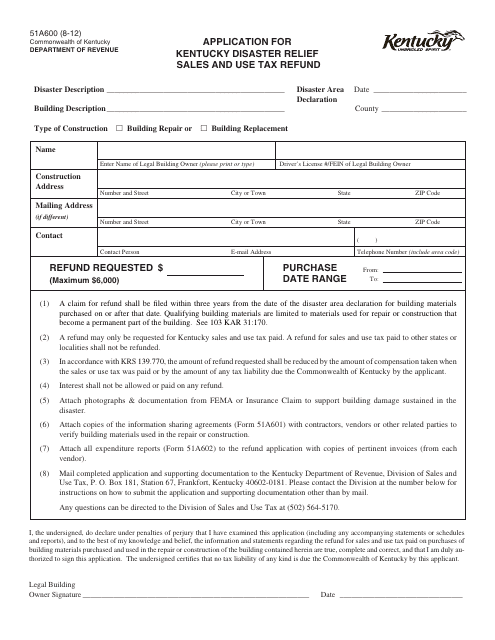

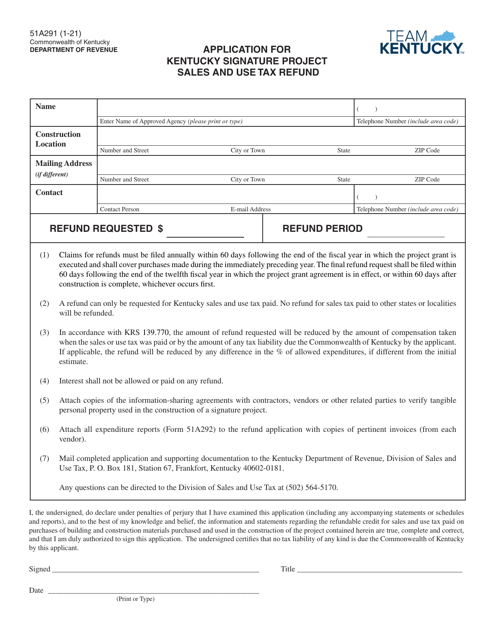

This Form is used for applying for Kentucky Disaster Relief Sales and Use Tax Refund in the state of Kentucky.

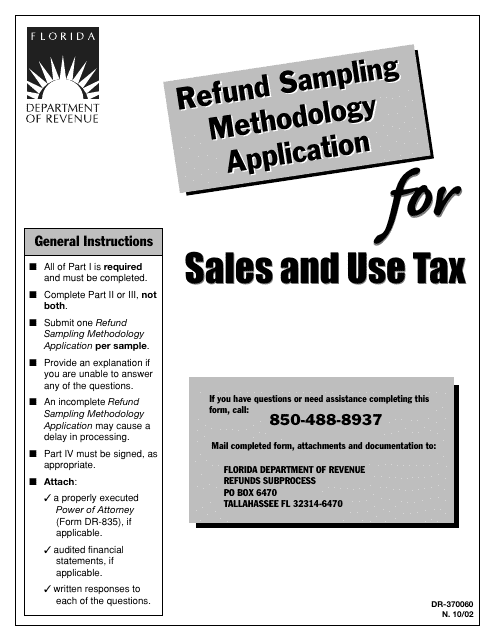

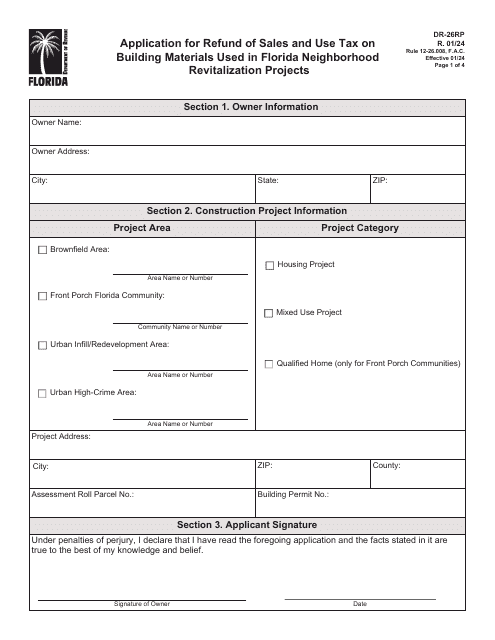

This Form is used for applying for a refund of sales and use tax in Florida. It specifically pertains to the sampling methodology that will be used to determine the amount of the refund.

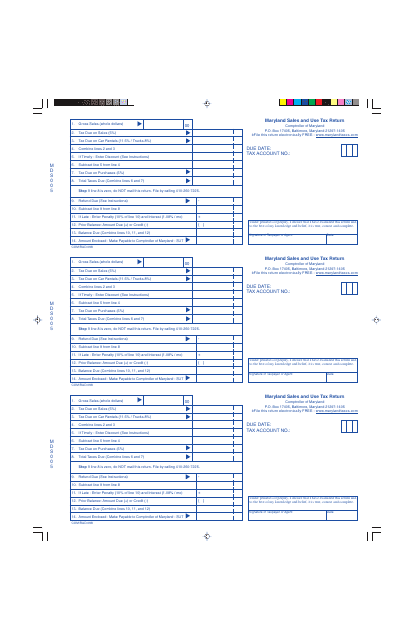

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

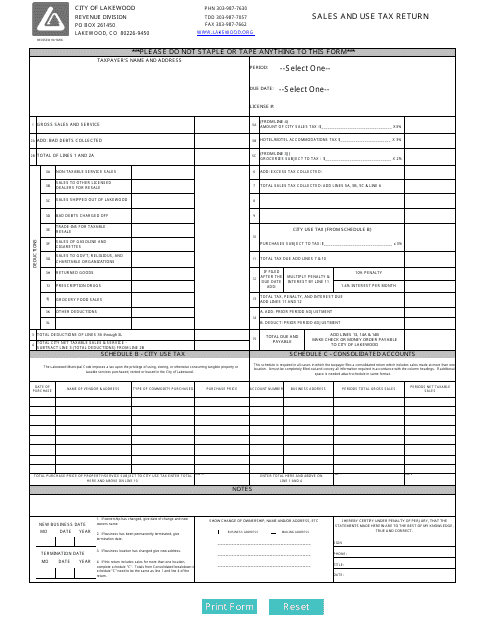

This Form is used for reporting and remitting sales and use tax to the City of Lakewood, Colorado.

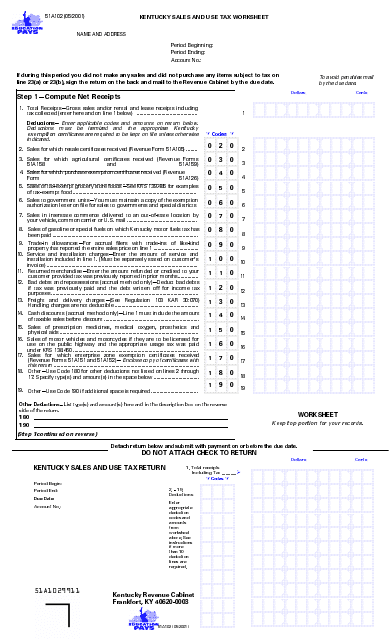

This Form is used for calculating sales and use tax in the state of Kentucky. It helps individuals and businesses determine the amount of tax owed based on their sales and use of taxable items.

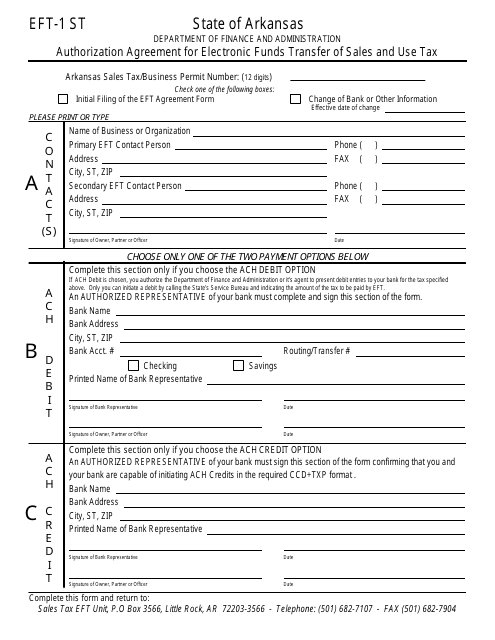

This form is used for authorizing the electronic funds transfer of sales and use tax in the state of Arkansas.

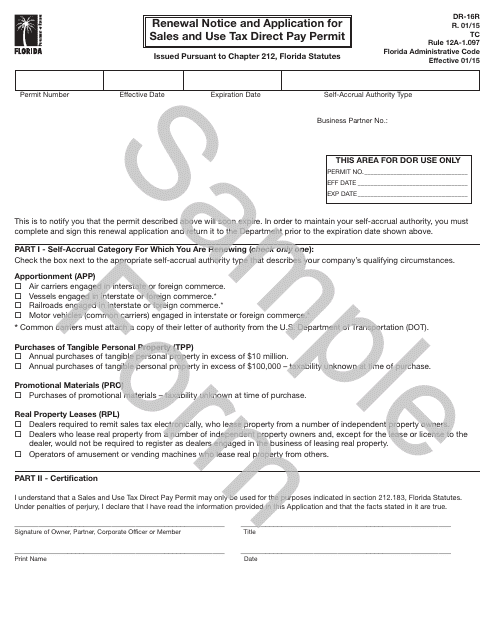

This Form is used for renewing and applying for a Sales and Use Tax Direct Pay Permit in Florida.

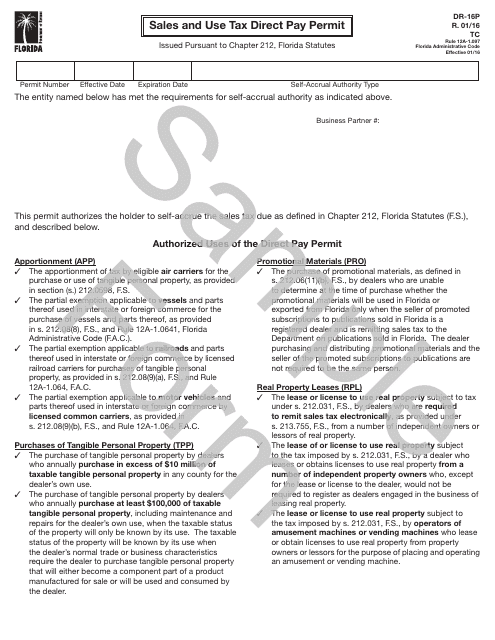

This Form is used for applying for a Sales and Use Tax Direct Pay Permit in the state of Florida. This permit allows businesses to pay sales and use tax directly to the Florida Department of Revenue instead of paying sales tax to their vendors.

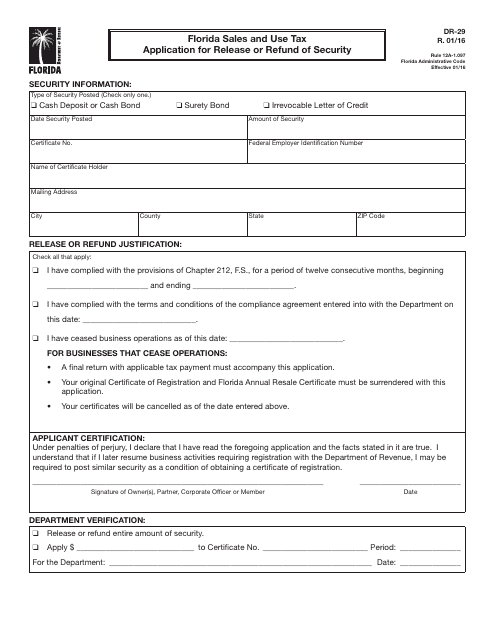

This form is used for applying for the release or refund of security for Florida sales and use tax.

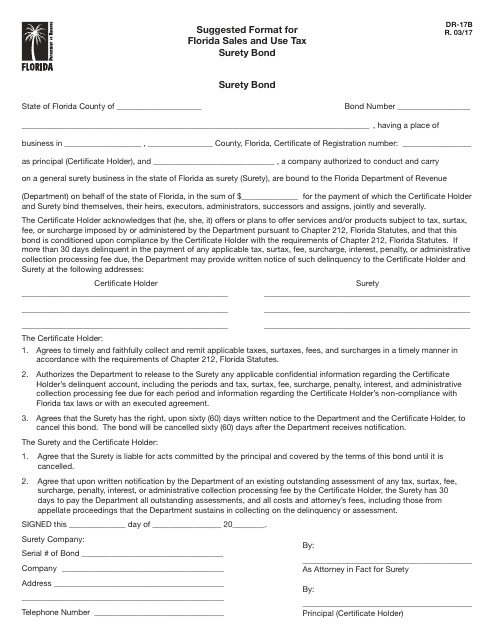

This form is used for obtaining a surety bond for Florida sales and use tax purposes. It provides a suggested format for the bond.

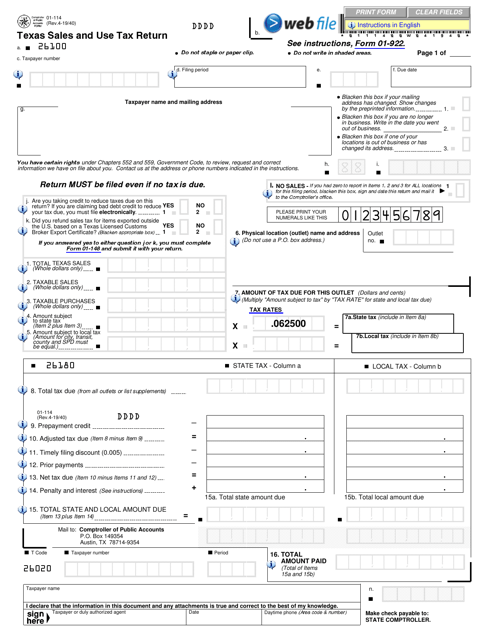

This is a form used in the state of Texas that is used by taxpayers when they want to report information related to the Sales and Use Tax they are supposed to pay.

This document is a Vessel Dealer Sales and Use Tax Exemption Report for a foreign corporation in New Jersey. It is used to report and claim exemption from sales and use tax on vessel purchases made by the foreign corporation.

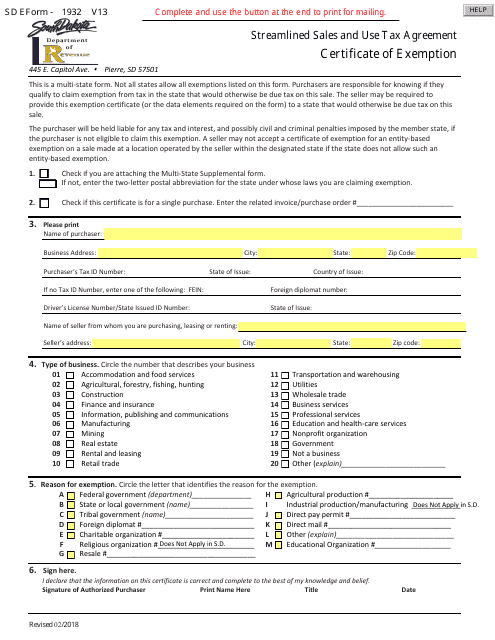

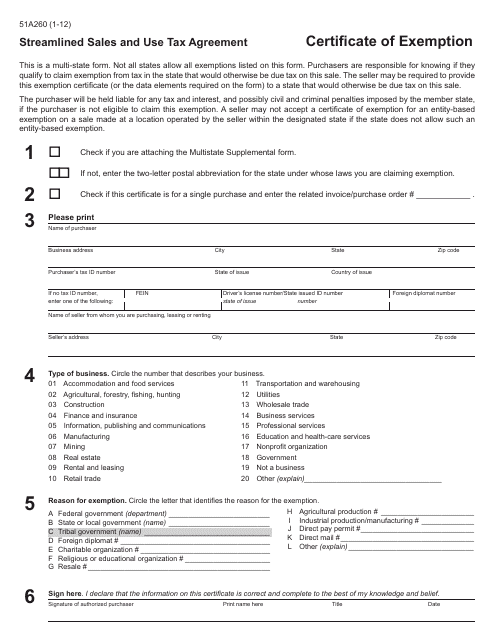

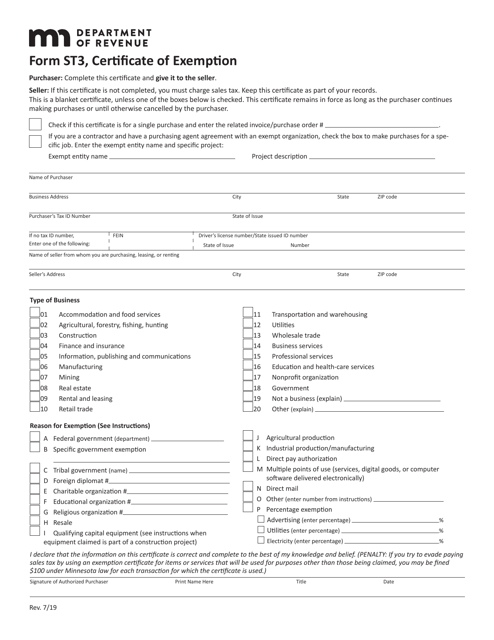

This form is used for claiming exemption from sales and use tax in Kentucky under the Streamlined Sales and Use Tax Agreement.

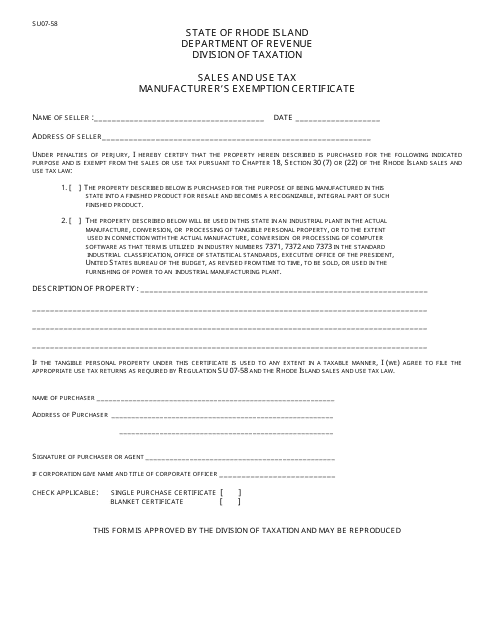

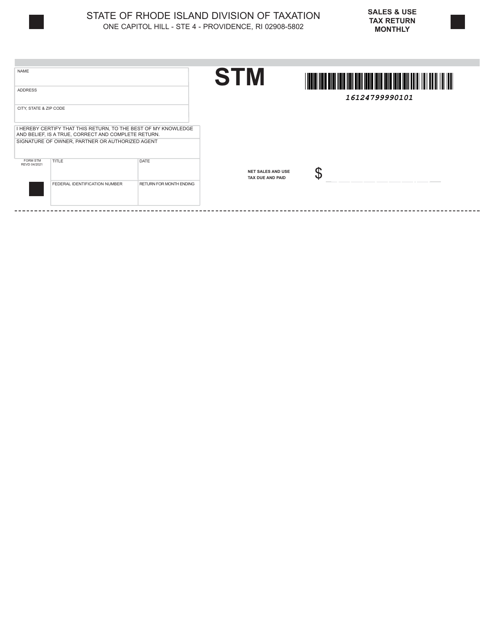

This form is used for obtaining a sales and use tax exemption for manufacturers in Rhode Island.

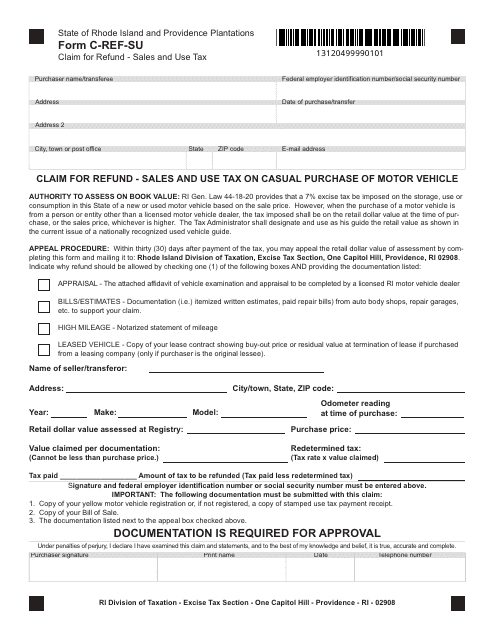

This Form is used for claiming a refund on sales and use tax paid for a casual purchase of a motor vehicle in Rhode Island.

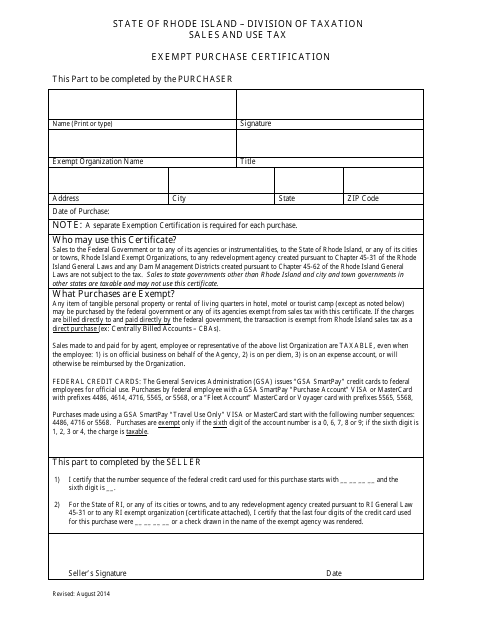

This form is used for certifying that a purchase is exempt from certain taxes in the state of Rhode Island.

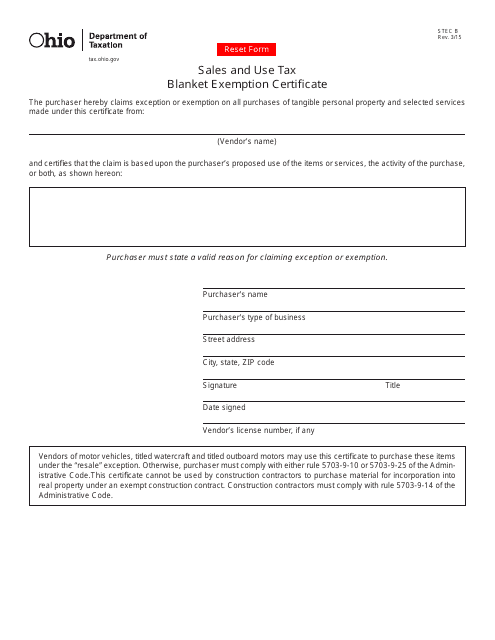

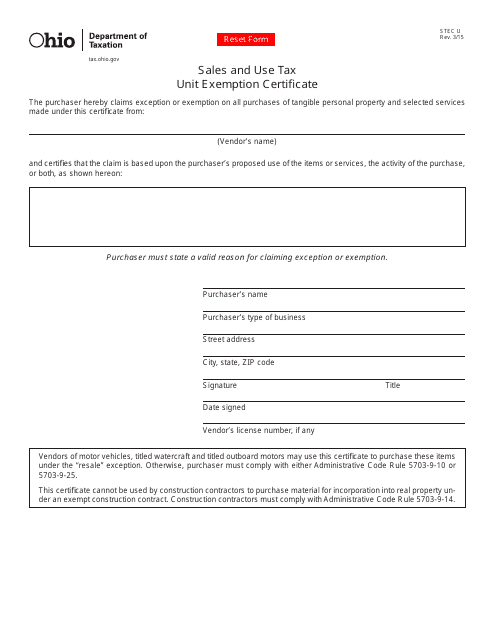

This form is used for applying for a sales and use tax exemption in Ohio for specific goods or services.

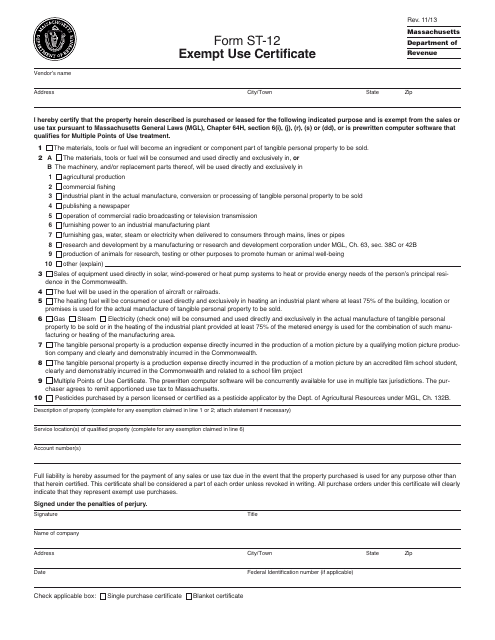

This document is a form used in Massachusetts for claiming exemption from certain taxes. It is known as the ST-12 Exempt Use Certificate.

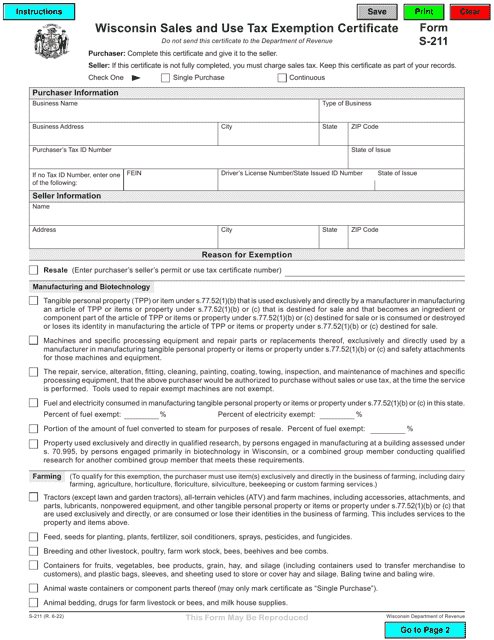

This is a legal document which is needed to gain tax exemption when buying merchandise to later resell in the state of Ohio.

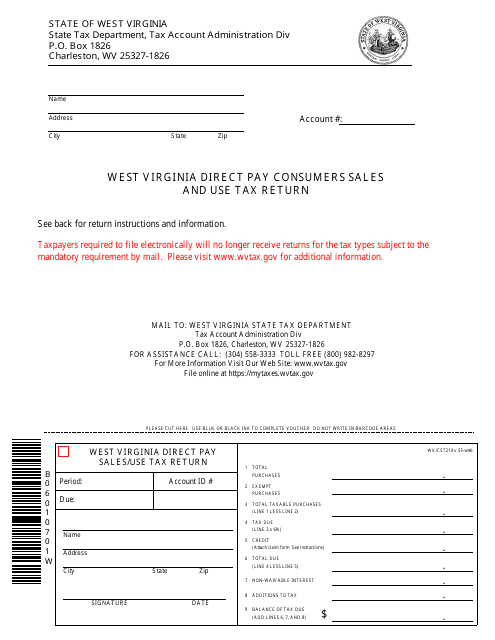

This document is used for filing the West Virginia Direct Pay Consumer Sales and Use Tax Return in the state of West Virginia. It is a form for individuals or businesses who have been granted direct payment authority to report and remit sales and use tax directly to the state. It allows for the reporting of taxable purchases and the calculation of tax due.

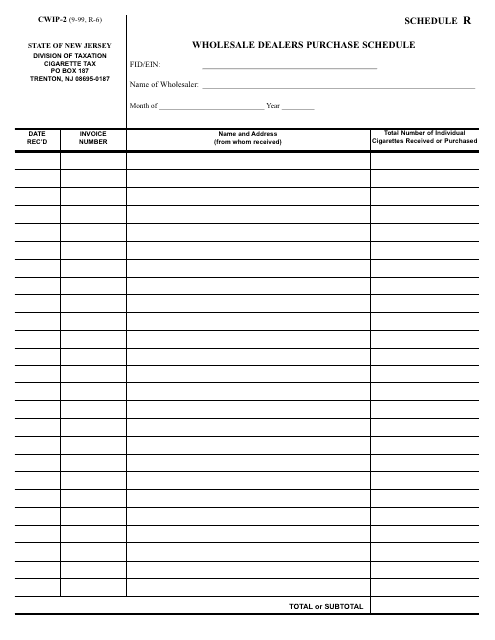

This form is used for reporting wholesale dealers' purchases in New Jersey. It is known as Schedule R and is part of the CWIP-2 form.

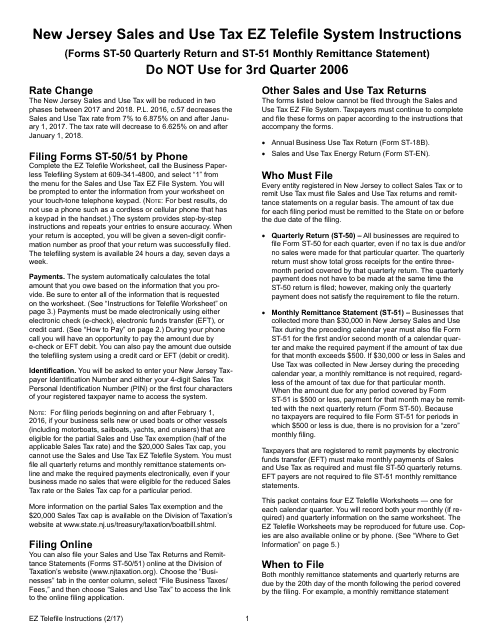

This Form is used for New Jersey sales and use tax reporting through the EZ Telefile System.

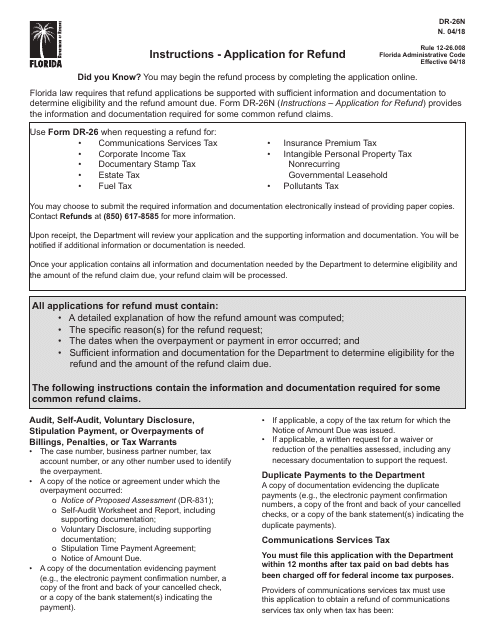

This Form is used for applying for a refund for all taxes in Florida, except Sales and Use Tax. It provides instructions on how to fill out and submit the DR-26 Application.

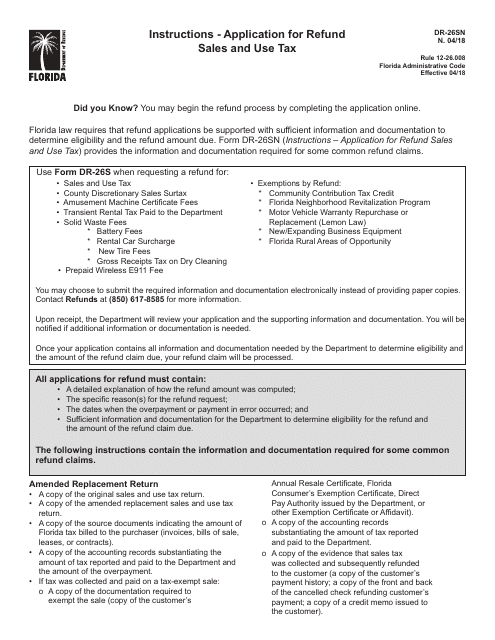

This document is used for applying for a refund of sales and use tax in the state of Florida. It provides instructions on how to fill out Form DR-26SN and Form DR-26S to request a refund.

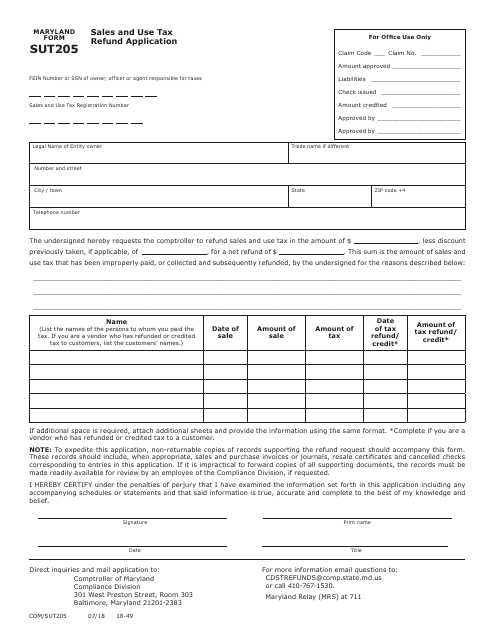

This form is used for applying for a refund of sales and use tax in the state of Maryland.

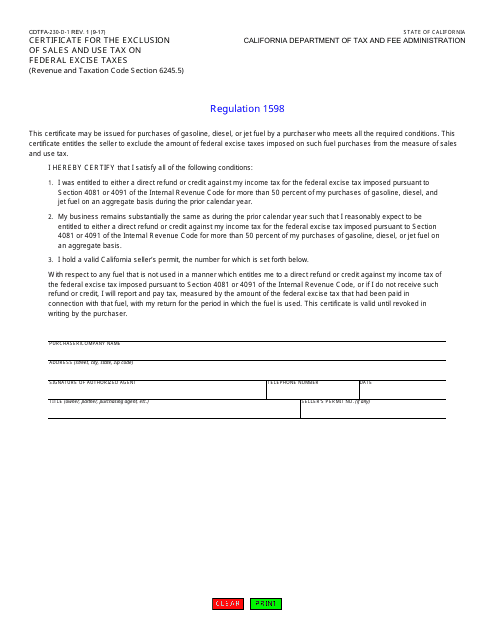

This form is used for requesting an exclusion of sales and use tax on federal excise taxes in the state of California.