Free Tax Filing Templates

Looking for a hassle-free way to file your taxes? Look no further! Our free tax filing service is designed to make the whole process easy and convenient for you. Whether you're a first-time filer or someone who has been filing taxes for years, our service has got you covered.

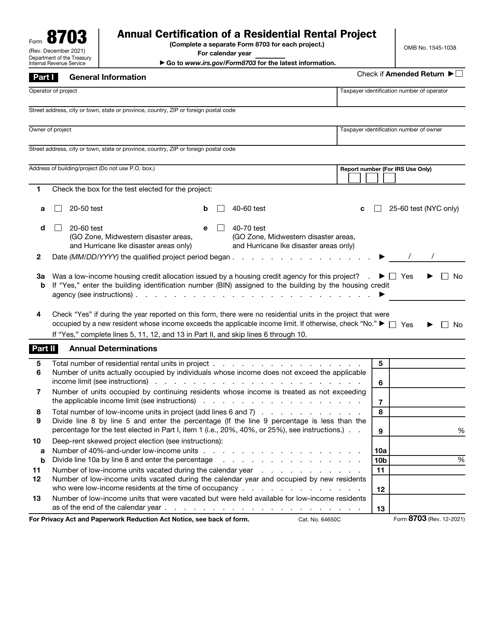

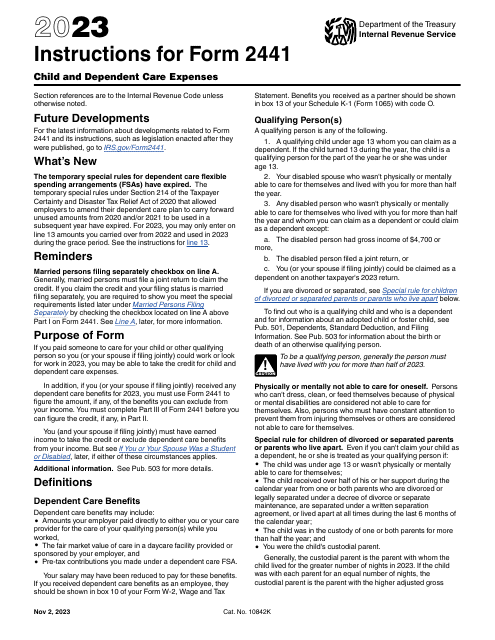

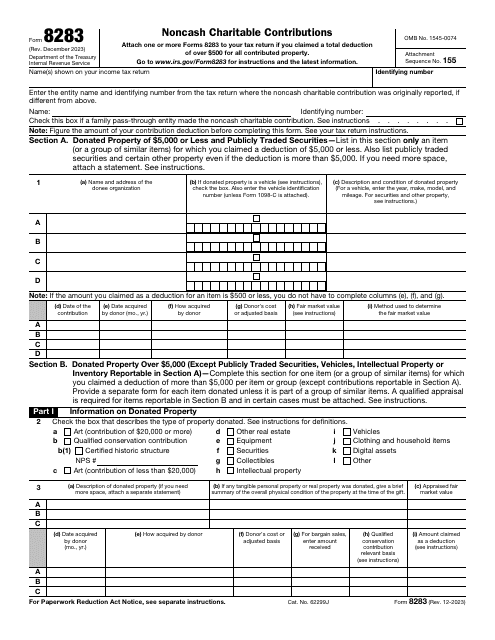

We understand that filing taxes can be overwhelming, which is why we provide a comprehensive range of tax filing forms and documents to ensure that you have everything you need to accurately file your taxes. Our collection includes a variety of tax forms, such as the Form IT-540 for Louisiana residents, the IRS Form 8862 for claiming certain credits after disallowance, and the IRS Form 1040-X for amended returns. No matter what your tax situation, we have the forms you need.

Our free tax filing service is available for individuals and businesses alike. We also offer specialized forms, such as the Resort Tax Return for the City of Miami Beach, Florida, and the Form DP-132 for claiming a net operating loss deduction in New Hampshire.

Say goodbye to the complexities of tax filing and say hello to convenience with our free tax filing service. With our user-friendly platform and extensive collection of tax filing forms and documents, you can file your taxes with confidence. Take advantage of our service today and experience the ease of filing your taxes for free.

Documents:

3000

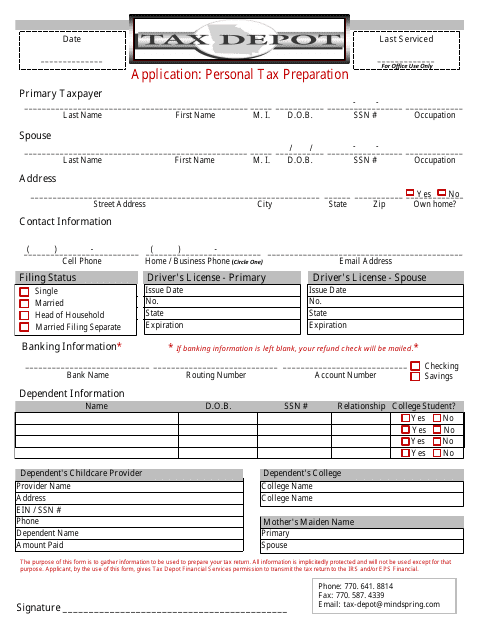

This Form is used for applying for a personal tax preparation application through Tax Depot.

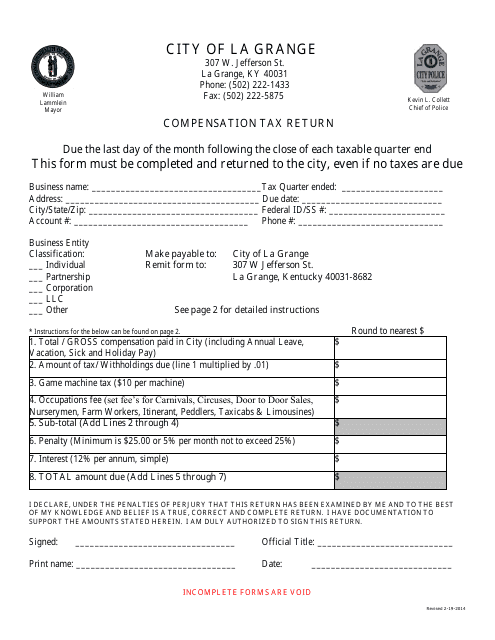

This document is used for reporting compensation tax returns to the City of La Grange, Kentucky.

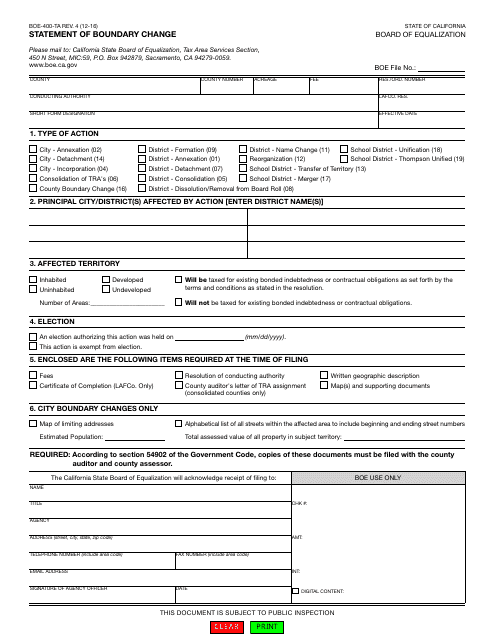

This form is used for reporting boundary changes in California.

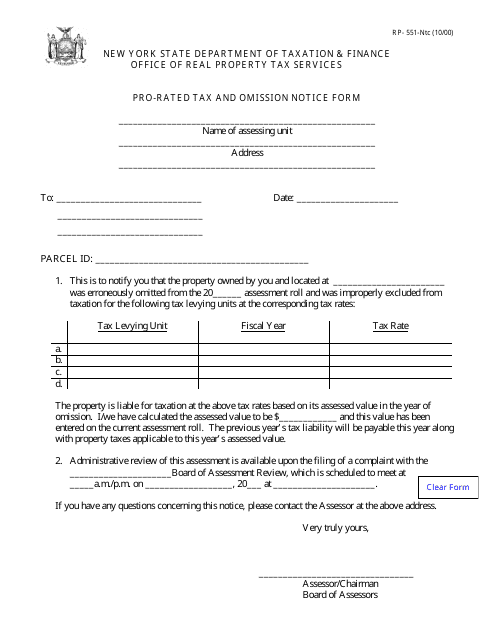

This form is used for notifying the New York State Department of Taxation and Finance about pro-rated taxes and omissions.

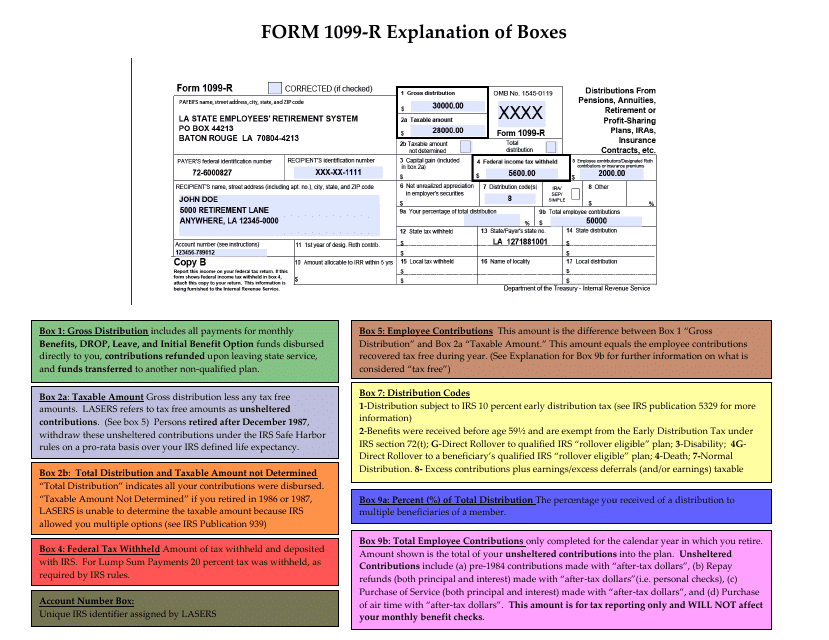

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.

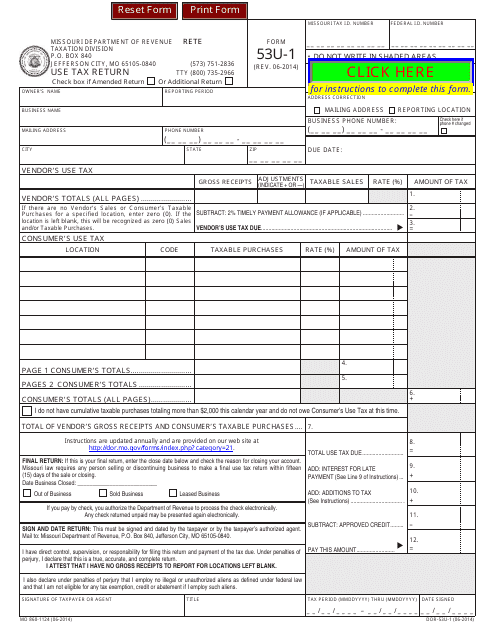

This Form is used for reporting and paying use tax in the state of Missouri. Use tax is owed on taxable items that were purchased tax-free and used in Missouri. The Form 53U-1 is used to calculate the use tax owed and submit it to the Missouri Department of Revenue.

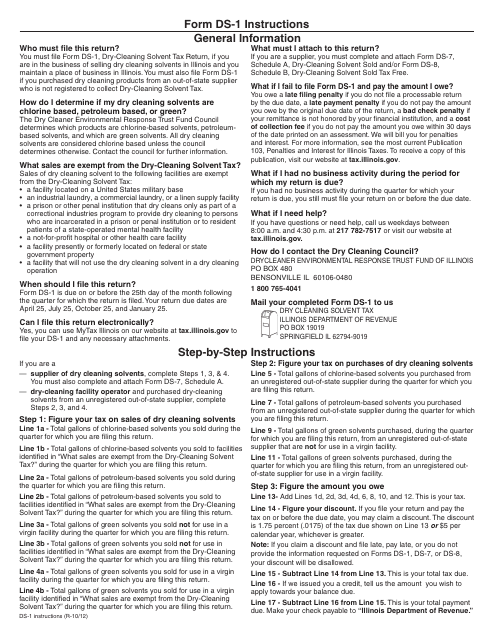

This Form is used for filing the Dry-Cleaning Solvent Tax Return in the state of Illinois. It provides instructions on how to report and pay the taxes on dry-cleaning solvents.

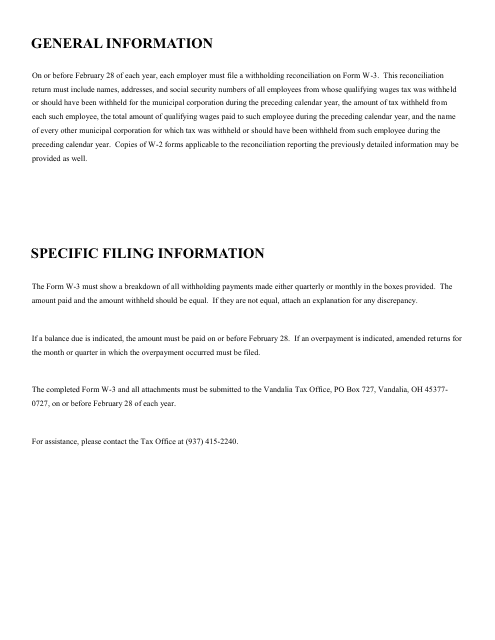

This Form is used for reconciling withholding taxes for the City of Vandalia, Ohio.

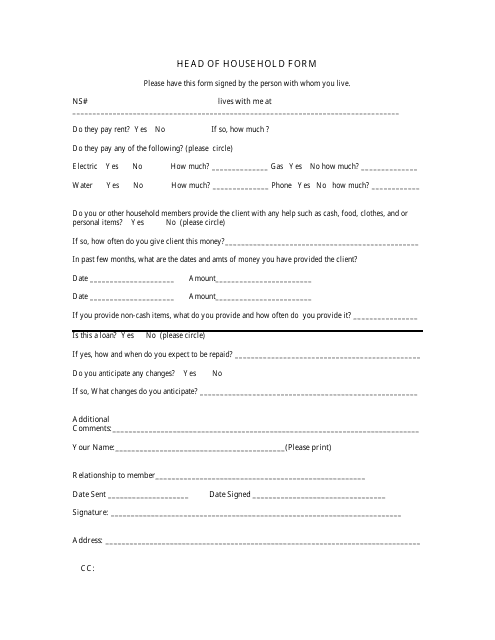

This form is used for individuals who qualify as a "head of household" for tax purposes. It helps determine your filing status and eligibility for certain tax credits and deductions.

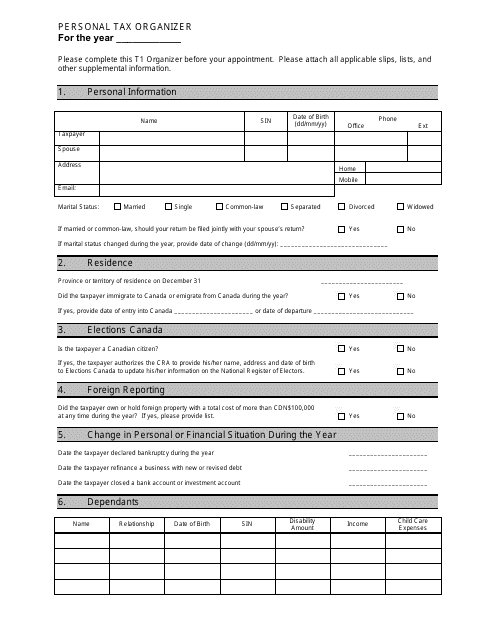

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

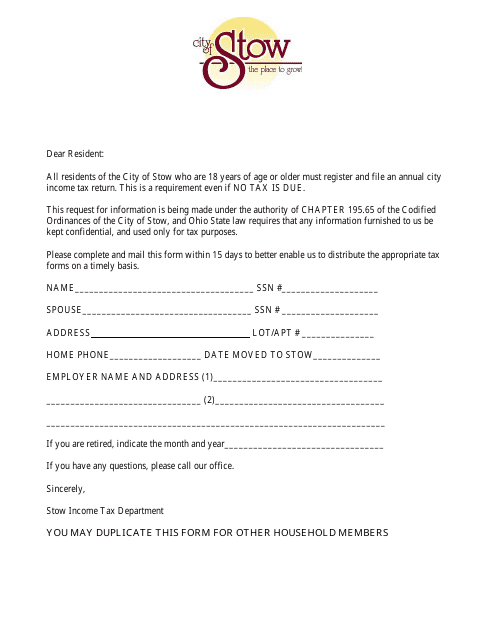

This Form is used for filing your income tax return in the City of Stow, Ohio.

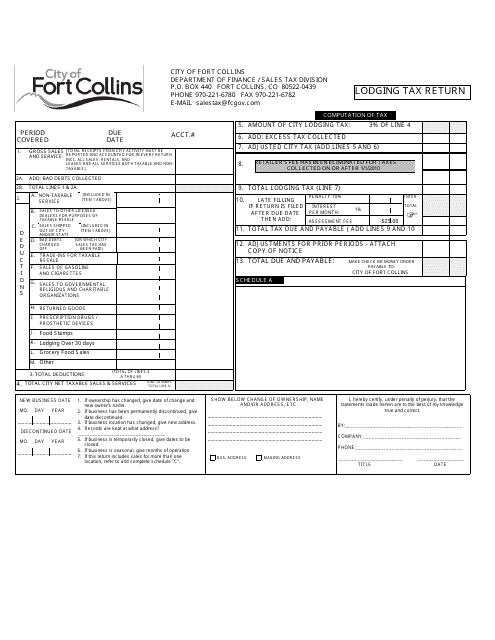

This document is used for filing a lodging tax return specifically for the city of Fort Collins, Colorado. It is required for individuals or businesses that provide lodging accommodations within the city and need to report and remit the applicable taxes.

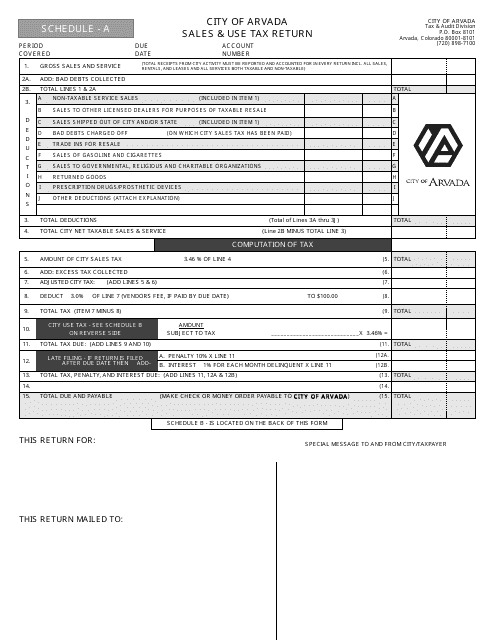

This document is used for filing Sales & Use Tax returns for businesses in the City of Arvada, Colorado.

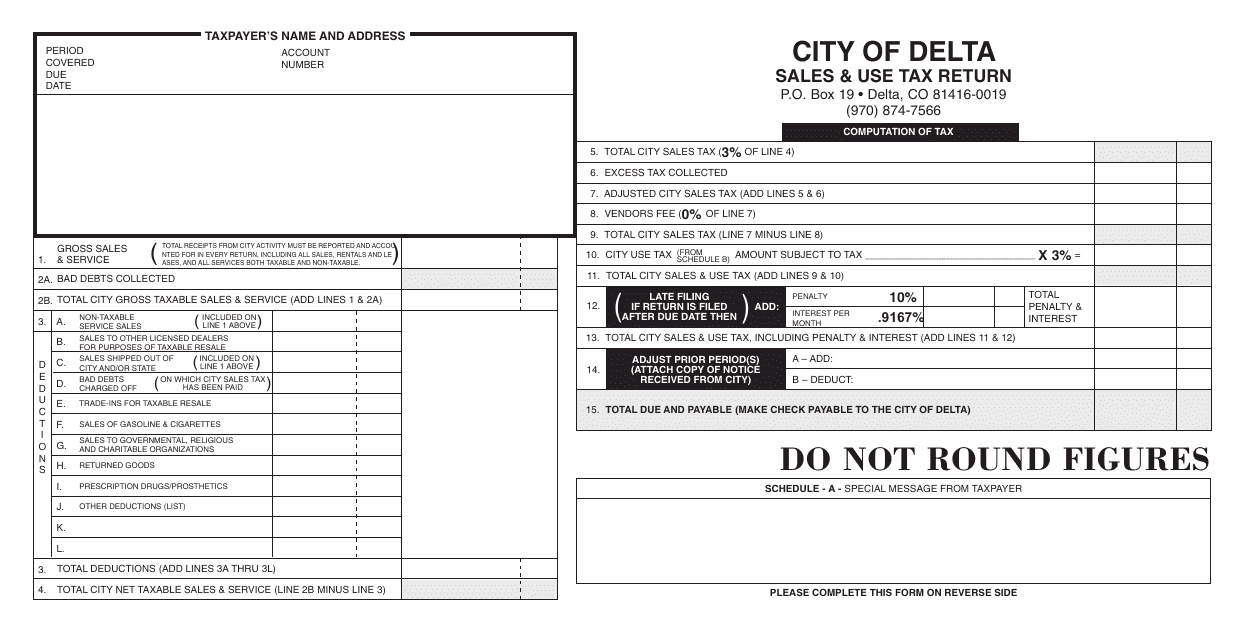

This form is used for reporting and submitting sales and use tax to the City of Delta, Colorado.

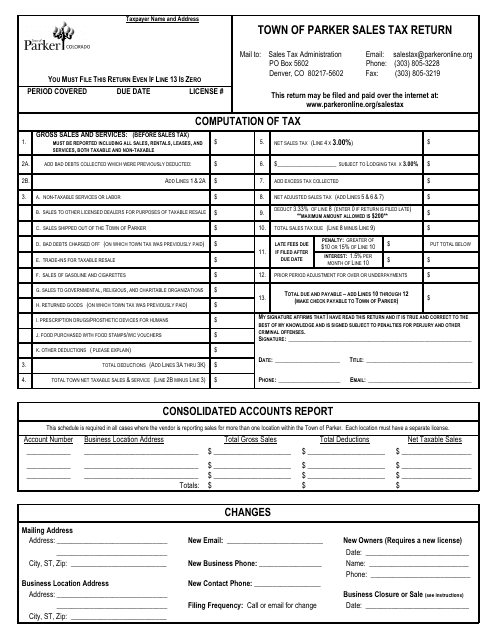

This form is used for filing sales tax returns in the Town of Parker, Colorado. It is used by businesses to report and remit the sales tax collected from their customers.

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

This form is used for reporting and remitting sales and use taxes to the City of Boulder, Colorado.

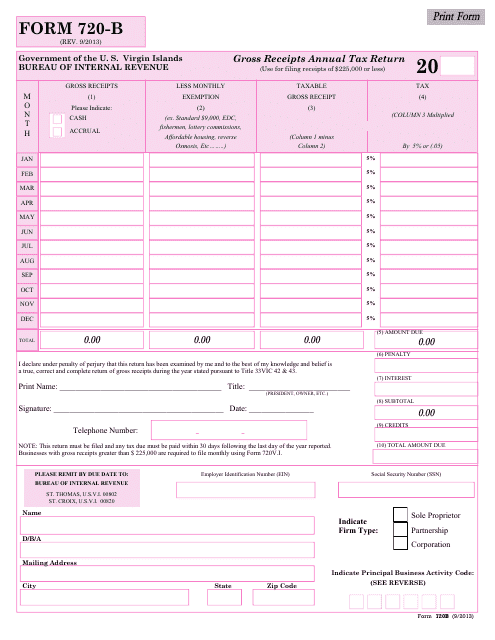

This Form is used for filing the Gross Receipts Annual Tax Return specifically for businesses operating in the Virgin Islands.

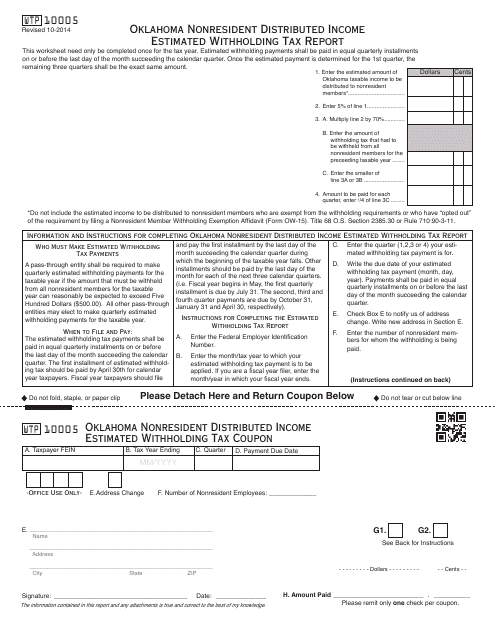

This form is used for reporting estimated withholding tax on distributed income for nonresidents in Oklahoma.

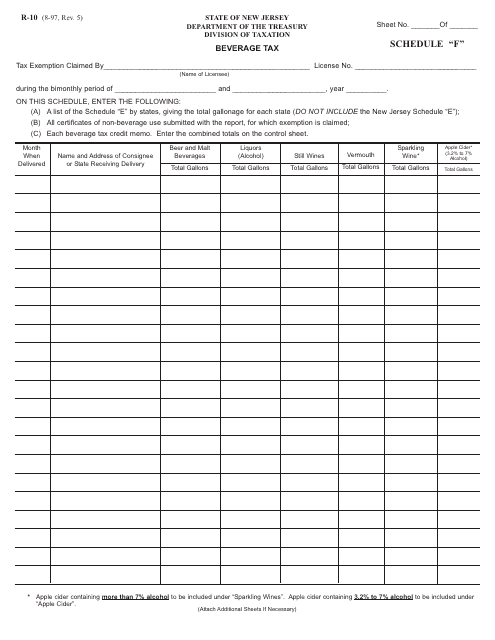

This form is used for reporting beverage taxes in New Jersey

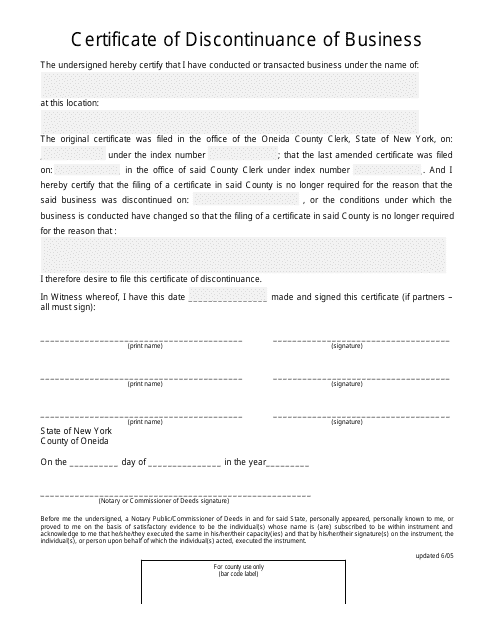

This document indicates that a business in Oneida County, New York has ceased its operations.

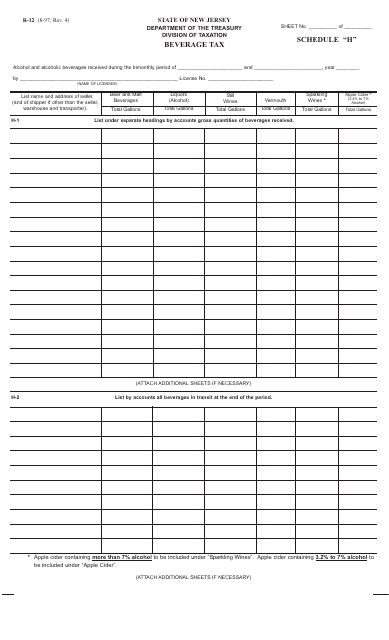

This form is used for reporting and paying beverage taxes in the state of New Jersey.

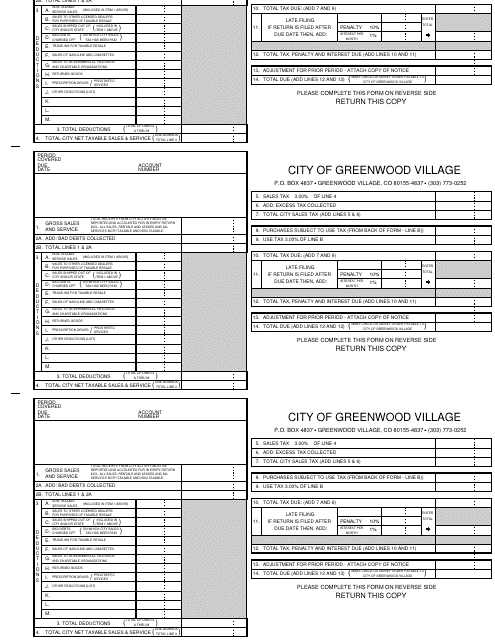

This form is used for reporting sales tax collected in the City of Greenwood Village, Colorado. It helps businesses comply with local tax regulations and submit the required payment to the city.

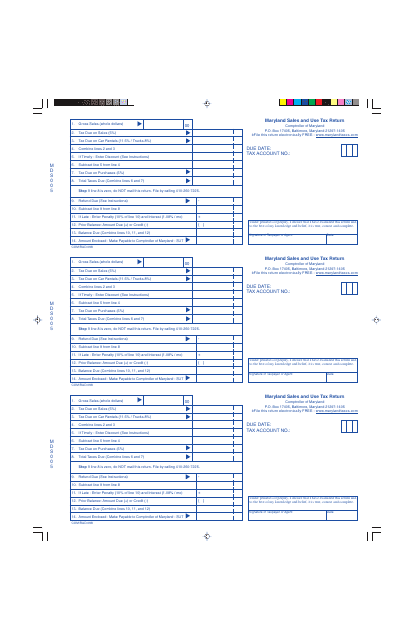

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

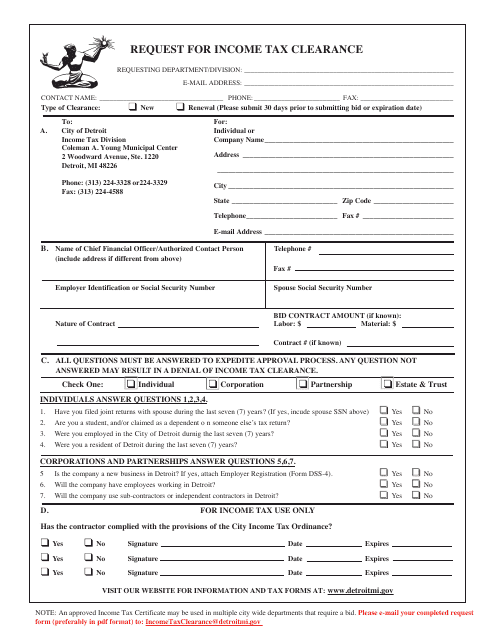

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

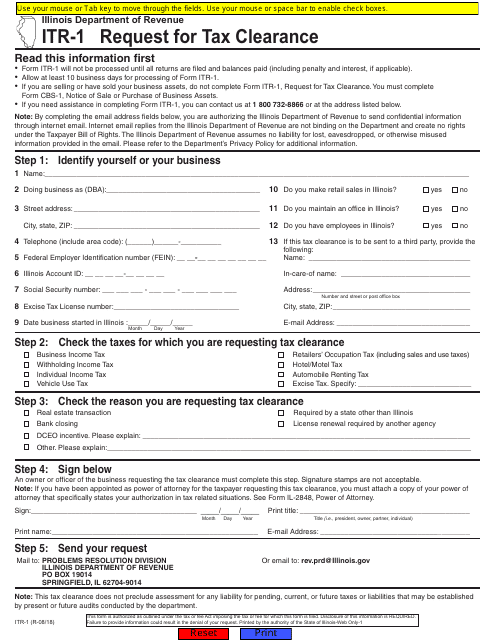

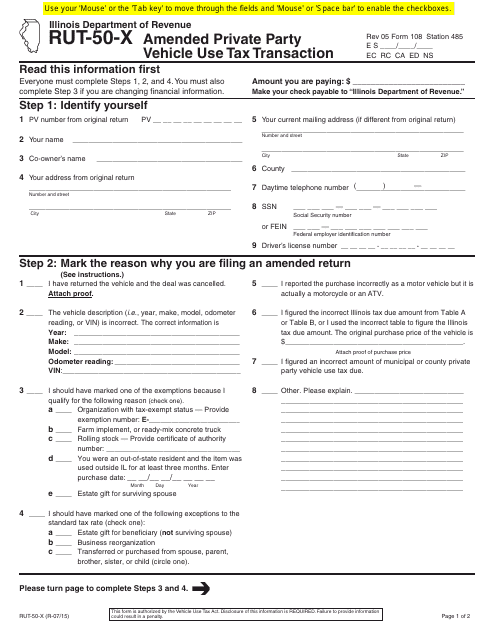

This form is used for reporting an amended private party vehicle use tax transaction in Illinois.

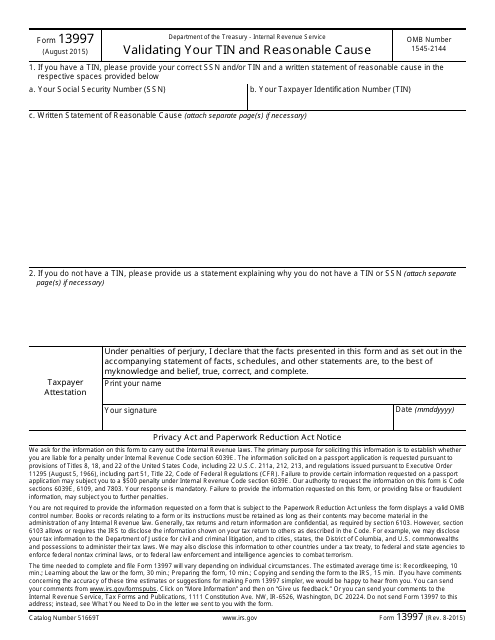

This Form is used for validating your Taxpayer Identification Number (TIN) and providing a reasonable cause explanation.

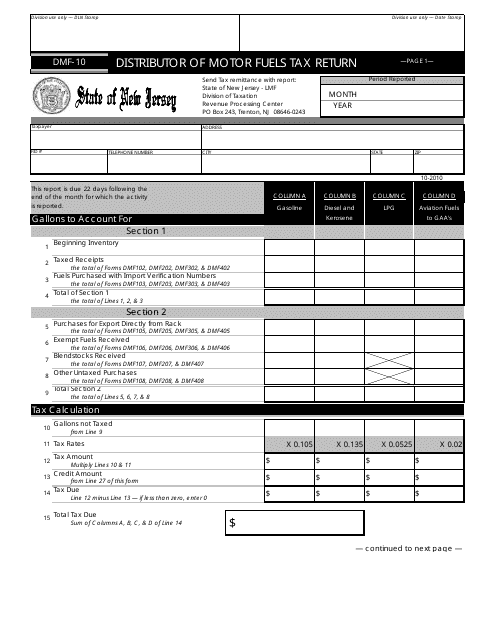

This form is used for filing the Motor Fuels Tax Return for distributors in the state of New Jersey.

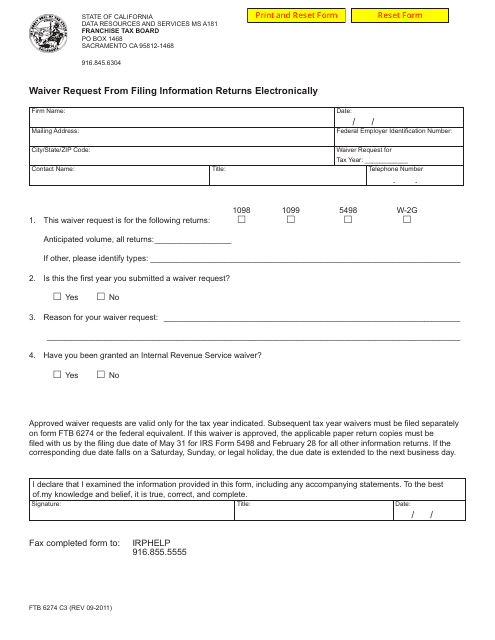

This form is used for requesting a waiver from filing information returns electronically in California.

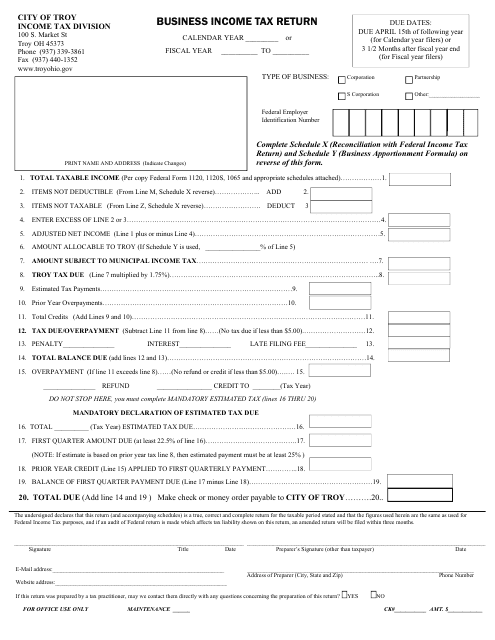

This document is used for filing your business income tax return specifically for the City of Troy, Ohio. It is required for businesses operating within the city to report their income and pay the appropriate taxes.

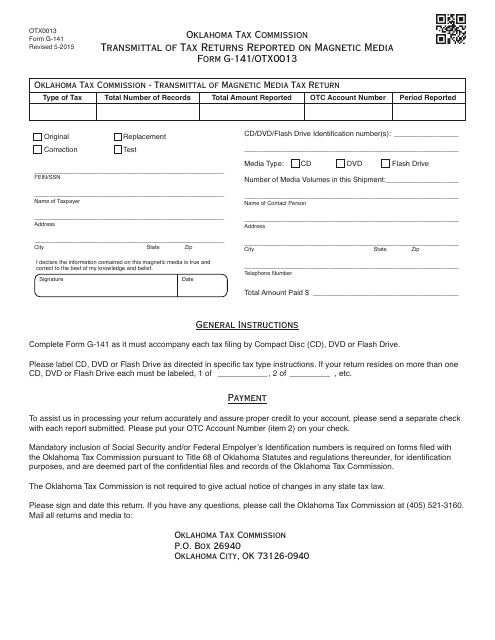

This document is used for transmitting tax returns reported on magnetic media to the Oklahoma Tax Commission (OTC).

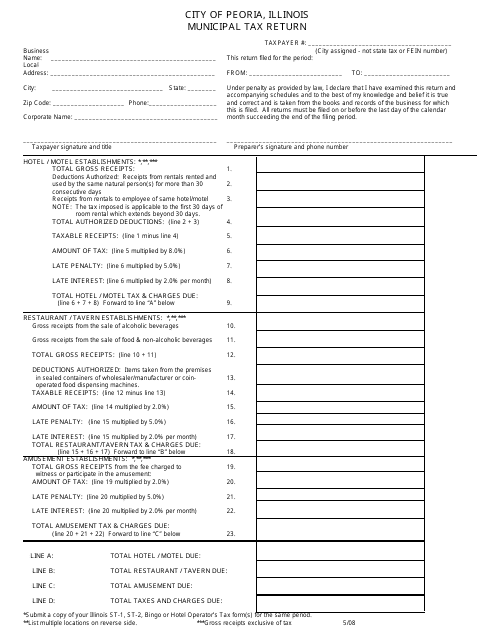

This type of document is used for reporting and filing municipal taxes for residents of Peoria, Illinois.

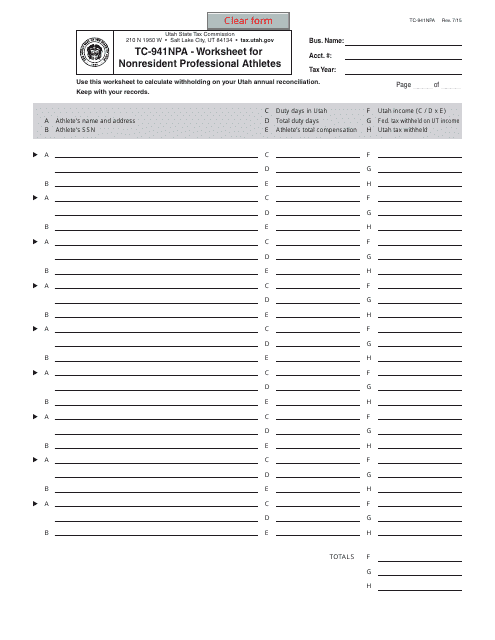

This form is used for nonresident professional athletes in Utah to calculate taxes owed.